Value Play

Post# of 41

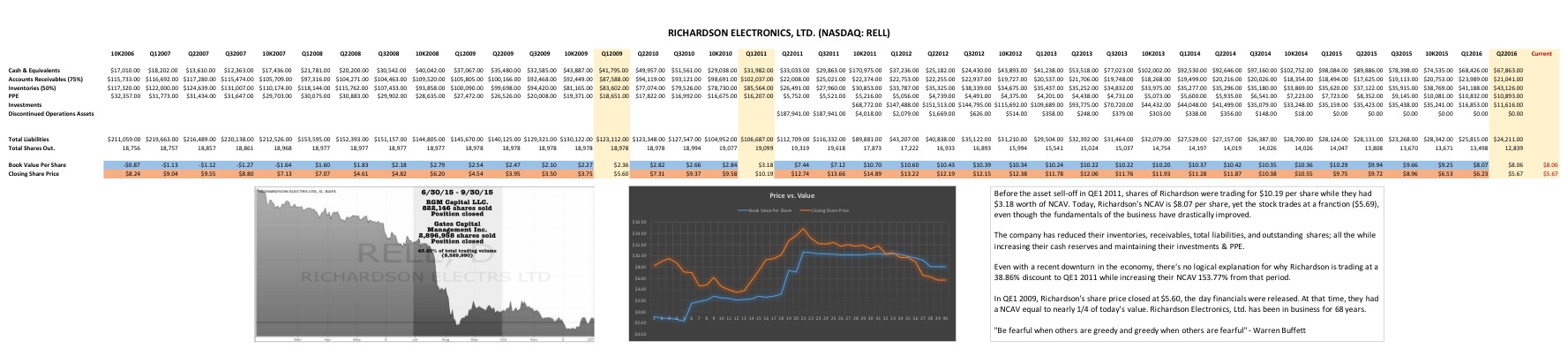

Here is a spreadsheet I converted to .pdf for anyone that has interest in reading:

It shows that, contrary to previous investors sentiments, RELL has only now become a buying opportunity. It outlines how RELL has been focused on increasing the tangible value of their assets while they increase their scope on organic growth to build long term cash flow for the business.

RELL has experienced unexpected situations lately, and there's no denying that, but what they've done by increasing their net worth from a negative NCAV value in 2009 to over $8 per share today is quite remarkable. Unfortunately for many investors, stock purchases were made too early before an opportunity had arisen.

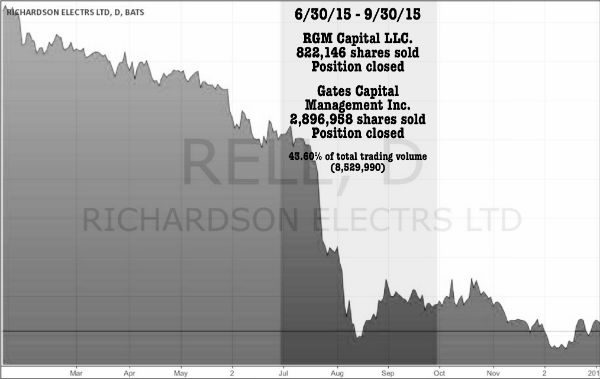

For example: both RGM Captial, llc. & Gates capital Management, Inc., both adhering to the value principles of investing, made their purchases above $11 per share when a value opportunity clearly was not present. I was asked to analyze RELL back in 2010 when I was approached by a value practitioner and I quickly realized that no opportunity was present at the time.

Here is a visual that shows the large sell-off from 6/3015 - 9/30/15:

Not until recently, within the last few months, has there been an opportunity for entry at a point where the share price is trading for less than a growing NCAV value.

I look forward to sharing ideas and perspectives about this business.

(0)

(0) (0)

(0)