ISBG Daily Chart ~ Down Big for the Week into the

Post# of 2561

As ISBG continues its transition from old management, with no production or execution, into the new team, led by Jeff Freiberger, who have done remarkably well to date, the stock has churned between the .005s to .0128 over the last month. Year end tax selling, impatient and nervous investors? Probably nothing more than that, as the company continues to execute thru their building of its two brands, Cavoda Vodka and Besado Tequila. Despite the constant misinformation on other stock message boards, ISBG has sold most of its first run of 10,000 cases of Cavoda and all of its initial 5,000 cases of Besado. The company is working on and repairing the many administrative and reporting issues that were neglected by the past management group. If you haven't yet, you should follow this emerging federal importer, licensor and marketer of alcoholic beverages. Already in sponsorship deals with MetLife Stadium, the NY Jets, and NY Giants, it appears a lot more is on the immediate horizon. My own opinion is that ISBG will succeed and become a great investment for those with a longer term mindset.

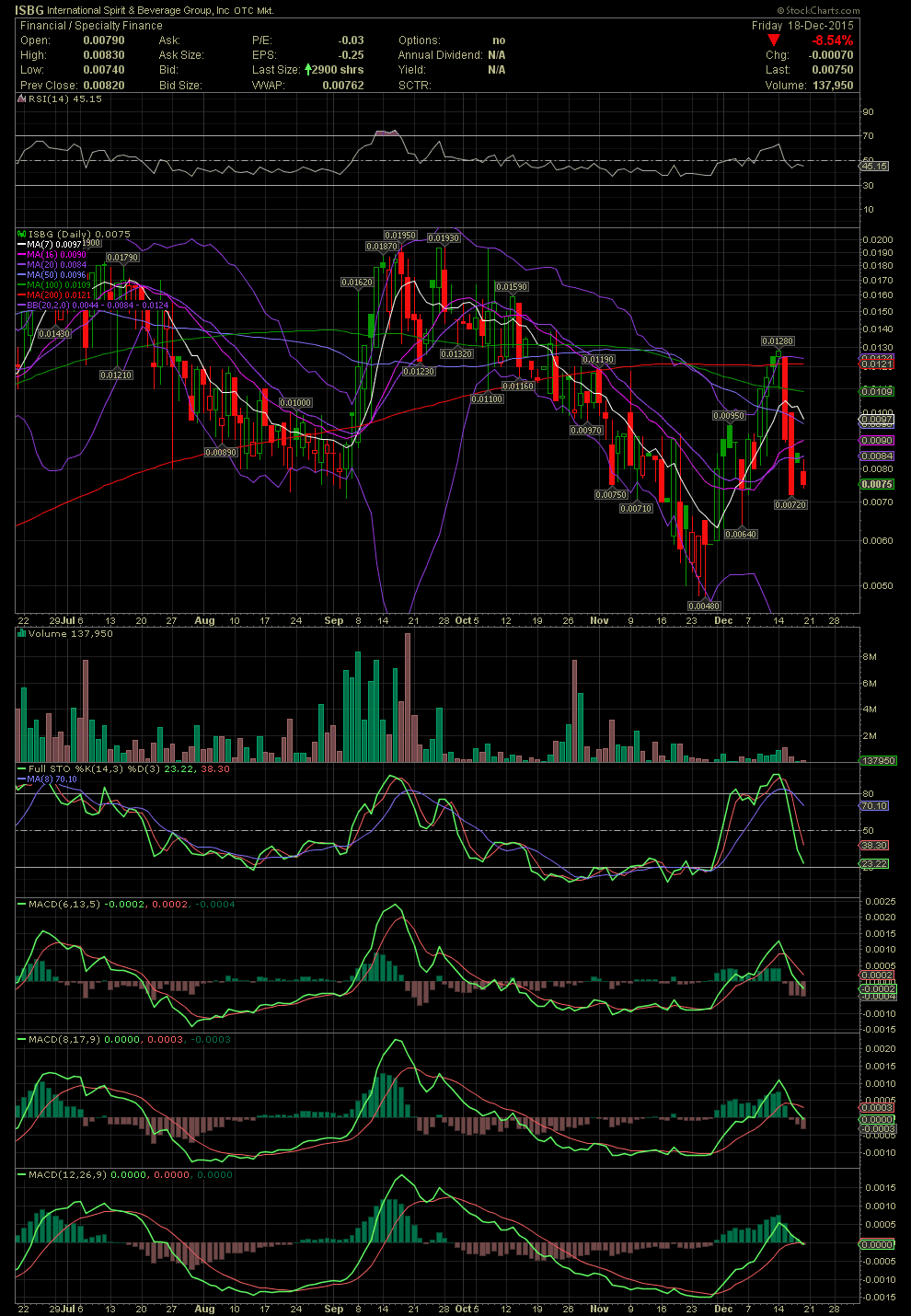

The short term technicals have called for a correction from the recent appreciation from .0048 to .0128 due to the trading of the share price outside the upper bollie band, the very overbought level of the FullSto and the negative crossovers of the two faster MACDs. The 20D MACDs is just barely beginning its crossover, but any movement to the upside will more than likely negate a full confirmation of a negative divergence.

(0)

(0) (0)

(0)