Chinese copper imports surge Frik Els | October 1

Post# of 23215

Frik Els | October 13, 2015

PeopleMine

Chinese copper imports surge Fast boat to China

Chinese copper imports surge Fast boat to China In New York trade on Wednesday copper for delivery in December failed to capitalize on customs data from top consumer China showing a huge jump in imports of the red metal.

Copper changed hands for $2.3895 per pound or around $5,297 a tonne in lunchtime trade on Tuesday, down some 1% from yesterday's close with the positive news out of China being offset by an announcement by top exporter Chile that it's keeping to output targets.

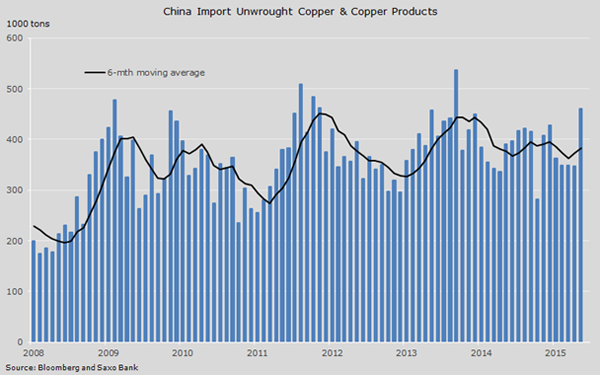

China is responsible for more than 45% of copper demand and imports of refined and semi-finished copper products surged by more than 30% in September compared to the previous month and 18% in the same month last year.

At 450,000 tonnes it was the highest monthly shipment total since January 2014 and the first rise since June last year. Year to date imports are still lagging last year's however, falling 5.5% to 3.4 million tonnes.

September imports of concentrate fell 6.2% in September compared to the same month last year, but the disappointing figure follows a nearly 20% year on year jump in August. Year to date concentrate imports are up 9.3% to 9.33 million tonnes.

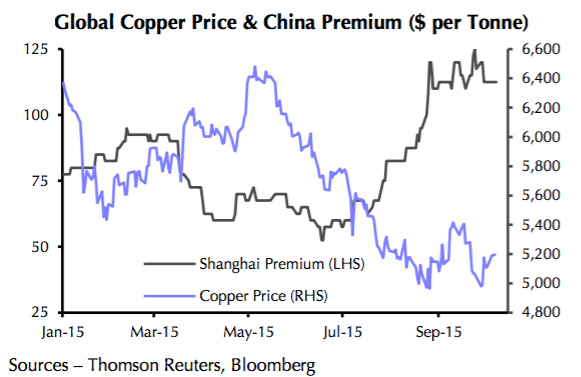

Increased demand for the metal in the world's second largest economy is also evidenced by rising premiums for physical delivery which according to Reuters jumped to a one-year high of $130 a tonne this week as warehouse stocks in Shanghai fall to 400,000 tonnes from 570,000 tonnes in early August.

Chinese copper imports surge

Source: Saxo Bank

Copper has recovered strongly from six-year lows struck late August after major producers including Freeport McMoRan and Glencore announced supply cuts and disruptions plagued top producer Chile.

The International Copper Study Group (ICSG) released its biannual forecasts for mine and refined output.

The latest estimates by the Lisbon-based researcher paint a very different picture from the previous forecast made in April. The market is now expected to be broadly in balance this year and to fall into a deficit of 130,000 tonnes in 2016. This compares with April’s forecasts of surpluses of 364,000 and 228,000 tonnes respectively.

According to ICSG World mine production, after adjusting for expected disruptions, is expected to increase by around 1.2% in 2015 to 18.8 million tonnes. 2014 recorded similar growth rates.

The expected market shortfall in 2016 will be against a backdrop of higher mine output of around 4% expected next year as additional supply is expected to arise from expansions at existing operations, ramp-up in production from mines that have recently come on stream and output from a few new mine projects.

Growth in 2015 and 2016 is expected to be in the form of copper in concentrate as SX-EW production is envisaged to decline mainly due to the announced production cuts being almost

entirely at SX-EW mines according to the report.

Chinese copper imports surge

Source: Capital Economics

(0)

(0) (0)

(0)NASDAQ DIP and RIP

Here is the best word that describes what i do here.

Intuitive;

means having the ability to understand or know something without any direct evidence or reasoning process.

I was born with it, I'm truly blessed!

Alway's searching for winners'