CHART: Mining tide is turning Frik Els | October

Post# of 23222

Frik Els | October 11, 2015

CHART: Mining tide is turning The sun also rises

CHART: Mining tide is turning

The sun also rises

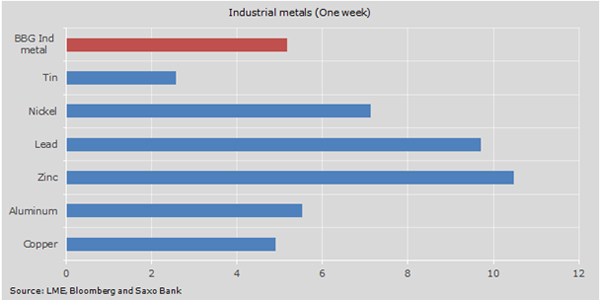

Over the past week crude oil prices have jumped 13%, platinum is up 8%, copper 4.8% and industrial metals 5.2% on average after double digit gains for zinc. Aluminum gained more than 5% over the week while benchmark iron ore price advanced by the same margin.

Even after including more modest advances for the agricultural sector (cocoa is the sole commodity that lost value) it's been the best week for commodities (as per the Bloomberg Commodity Index) since July 2012.

The change in sentiment was also in evidence on stock markets, with the sector's heavyweights rallying across the board. The world's number one miner BHP Billiton which also has significant exposure to oil markets jumped more than 14% for the week. Iron ore's top producers Rio Tinto and Vale soared with the Brazilian company adding one fifth to its value.

The raft of negative media headlines and the capitulation of some of the few remaining perma-bulls among the investment banks has now been followed up by dire warnings from the IMF and central bank regulators

A new note by Capital Economics argues that the "turn for commodities is nigh (if it hasn't already happened)".

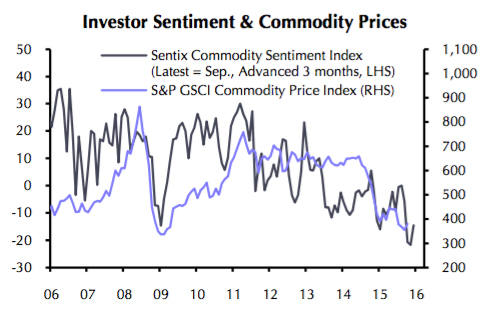

Apart from supply cuts and expectations of a soft landing in China boosting prices in the sector, Julian Jessop, head of commodities research, believes investor "sentiment toward commodities had become too pessimistic and may now be bottoming out":

"Indeed, the raft of negative media headlines and the capitulation of some of the few remaining perma-bulls among the investment banks has now been followed up by dire warnings from the IMF and central bank regulators, which a cynic would say is a sure sign that the things are about to get better!"

CHART: Commodity tide is turning

Source: Capital Economics, Sentix, Bloomberg

Danish bank Saxo also sees a turnaround but warns in its Quarterly Outlook that investors should not expect a quick recovery in the sector:

"Prices tend to recover much more slowly from a supply-driven downturn than from a demand-induced drop as producers often try to make up for the shortfall in revenue by increasing production wherever possible."

CHART: Commodity tide is turning

Source: Saxo Bank

Prices tend to recover much more slowly from a supply-driven downturn than from a demand-induced drop

While many analysts including those working for Goldman Sachs, UBS and others remain pessimistic about the outlook for metals and mining, Morgan Stanley last week made a definite switch to the bull camp.

The investment bank believes the worst may be over mining stocks that have seen valuations drop dramatically since the start of the year:

[Morgan Stanley analysts] see commodity prices rising 19% by 2017, adding this “would be a sharp reversal from the experience in the last 18 months.” Equities exposed to the sector, they said, will likely outperform.

“Emerging markets and China in particular remain key to commodities demand. In the next few months we expect the perception around this demand to improve. In particular the acceleration of financial and administrative stimulus policies in China in recent weeks should start to feed through in both actual activity levels and equity market expectations,” they wrote.

(0)

(0) (0)

(0)NASDAQ DIP and RIP

Here is the best word that describes what i do here.

Intuitive;

means having the ability to understand or know something without any direct evidence or reasoning process.

I was born with it, I'm truly blessed!

Alway's searching for winners'