This article is a good read. It talks about the cu

Post# of 72451

Six ways to profit from Hillary Clinton’s $132 billion tweet

If you missed out on the enormous run in biotechnology stocks this past year, Hillary Clinton just gave you a second chance.

Take it.

Since Clinton’s infamous Sept. 21 tweet attacking drug companies for “price gouging,” biotech investors have lost an astonishing $132 billion. I’m pretty sure I know what they think of Hillary.

Many biotech stocks fell 20% to 35% or more in a few trading days, as selling turned panicky Monday. The iShares Nasdaq Biotechnology ETF has declined to where it traded last November.

“I haven’t seen it this bad in years,” says Ron Garren, a medical doctor and oncologist who writes the biotech stock letter Biotech Insight.

“It’s outright fear and panic,” says BioShares Funds portfolio manager Paul Yook, who provided the sector loss estimate cited above. “I have been on the phone all morning with panicked investors. Everyone is asking, ‘How much lower can it go? Do we bail?’ ”

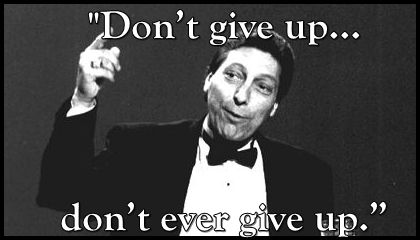

The answers: No one knows how much lower it can go. But don’t bail. This is a better time to buy than sell, say several biotech experts.

The bottom line here is that while drug pricing will hang around as a presidential campaign issue, any Washington, D.C., reform that hurts biotech companies will be far off, if it happens at all. And that is unlikely. So while the issue will create more volatility, it will also devolve into background noise.

Here’s why. If politicians are logical (which, granted, is debatable), their wrath will be focused more on the likes of Martin Shkreli at Turing Pharmaceuticals — meaning investors who buy the rights to drugs and then jack up the prices for a quick profit. Shkreli earned the reputation as “the most hated man on the Internet” last week and helped spark the biotech carnage when he announced a 5,000% price increase for a drug called Daraprim, used to treat parasitic infection.

Politicians need to focus on the real price gougers like Turing, because research-intensive biotech companies actually need robust pricing to fund drug development, which we all want. And they don’t necessarily make outsized profits in the process, once you factor in all their costs, like expensive drug trials.

Robert W. Baird analyst Brian Skorney estimates that the return on investment for drug development companies is only 15%. Why so low? Drug development takes years and it is extremely expensive. Plus, many drugs fail, and you need to factor in those costs. “If we want to continue to innovate great therapies, there has to be the promise of some profitability,” says Skorney.

“If you kill the prices on these drugs, nobody is going to develop them. Somebody has to make a profit and pay for all the trials that fail,” says Garren, an oncologist who regularly witnesses the effectiveness of cutting-edge cancer drugs that work well, in part, because biotech companies have figured out how to make them target the vulnerabilities of tumors. “Politicians will realize they can’t kill the golden goose.”

A 2014 Tufts University study concluded that developing a prescription medicine often takes longer than a decade and costs $2.6 billion on average, says John McCamant, editor of the Medical Technology Stock Letter. “Who is going to spend $2.6 billion without having some incentive?” he says. “Do we believe we are going to have innovation and research and development without sufficient incentives?”

The answer is pretty obvious, hopefully even to politicians.

Nonetheless, drug pricing is here to stay as a campaign issue. But it won’t cast a permanent shadow over the biotech sector for the following reasons.

1. There’s not much chance that Washington, D.C., will make big changes.

Connor Browne, co-manager of Thornburg Value Fund which owns biotech stocks, agrees that we may see legislation that makes it harder for outright drug-price gougers — like the most hated man on the Internet at Turing. “But I have a hard time understanding the path to significant reform that affects the sector broadly, and, boy, is the sector trading like this is the end.”

Here’s his logic. Back in the early days of the Obama administration, Democrats had a filibuster-proof Senate and a majority in the House. Nevertheless, “the government wasn’t able to put together legislation to control drug pricing,” says Browne. If not then, when? “The Democrats will never have as good an opportunity for significant health-care reform,” he says.

In fact, no one even knows if Clinton will be nominated. The general election is still a toss-up. And there is a “reasonable chance that Republicans will still control either the House or the Senate or both following the 2016 election,” says Goldman Sachs analyst Alec Phillips. All reasons why the current Hillary-induced biotech panic seems a bit overdone.

Browne predicts the tone of the drug-pricing debate will get less strident once the primaries are over and politicians shift from appealing to extreme elements in their base to winning over more moderate voters.

Besides, any serious debate on health-care costs has to look way beyond drug costs, since they only account for around 10% of overall health-care spending, says Yook at BioShares Funds, which manages the BioShares Biotechnology Products and BioShares Biotechnology Clinical Trials exchange traded funds.

Mainly because so many drugs are now coming off patent, overall drug costs are rising moderately, compared with the mega-increases of the mid-1990s — the last time Hillary Clinton sent shock waves through the health-care sector by proposing reforms. “Certain drugs are very high-priced, but the overall spend is not running rampant,” says Yook. “Drug prices as a whole are under control.”

If politicians have any sense, they will realize all of this and back off the attacks that crush biotech stocks — and threaten drug development that we all want.

2. More M&A will reignite interest in the group.

Buyouts at hefty premiums have attracted lots of investor interest in the group over the past few years. Now that biotech stocks have fallen so much, acquirers are no doubt hunting even harder, says J.P. Morgan analyst Cory Kasimov. A few big buyout announcements will put a bid under the whole sector.

3. The hits will keep coming.

In biotech, the rubber hits the road with blockbuster product approvals and research milestones. That won’t change. “As long as we have positive clinical data and meaningful improvements to people’s lives, that will continue to outweigh the concerns about drug pricing,” says Skorney at Robert W. Baird. Product approvals and research results can be announced at any time. But several biotech-research conferences between now and the end of the year will bring out bullish news, says McCamant at the Medical Technology Stock Letter.

4. Biotech companies are flush with cash.

Many biotech companies raised lots of funds in the past year, says Garren. So they don’t have to go into a weak market to raise dilutive capital. This can be a risk to a sector in a downturn, especially one like biotech that needs lots of funds to support drug development.

Stocks to buy

No one knows when the current carnage will end, of course. But the damage has been so extensive, a bottom may be near. “After today’s shake-out, I don’t see it going much lower than this,” says Garren. “Biotech is looking pretty cheap to me.”

McCamant, at the Medical Technology Stock Letter, thinks the sector may turn around this week.

In the current weakness, Thornburg Value Fund’s Browne favors Gilead Sciences and Seattle Genetics, two companies the fund owns. McCamant suggests Incyte and Ziopharm Oncology. Garren, who follows small-cap companies, likes Oncothyreon and Array BioPharma.

If you buy biotech stocks now, just remember what all seasoned biotech investors already know: The group is notoriously volatile. So have a long-term perspective. And be ready for gut-wrenching moves. It comes with the territory. “Repeatedly, we see that any sort of sector headwind can have an outsized impact,” says Skorney at Robert W. Baird.

You can say the same about Hillary.

http://www.marketwatch.com/story/six-ways-to-...-29?page=2

(0)

(0) (0)

(0)Innovation Pharmaceuticals Inc (IPIX) Stock Research Links