REITs That Drive For Show And Putt For Dough

Post# of 36634

In golf, winning is about consistency. Not just chipping and putting but also being able to utilize all of the golf clubs in a repeatable fashion. By maintaining a high level of consistency, a golfer can address the ball with confidence that results in an enduring measure of success applied repeatedly. As legendary golfer Bobby Jones once said,Consistency in golf depends directly upon form, an unsound swing may work well enough on occasion, but soundness of method is the only key to reliable performance.

In golf there are a wide range of options for addressing the ball and picking the right club results in an outcome of success or failure. Conversely, picking the right investment alternative can make or break a well-balanced portfolio strategy aimed towards consistency and reliability. Likewise, investing is measured by consistency and the most intelligent investors have developed habit forming patterns of owning shares in companies that demonstrate extraordinary consistency.

Picking the Right Club

In terms of attractive yields, they count for nothing if the dividend behind them is not sustainable. Historically REIT dividends have been reasonably secure, owing to the contractual nature of their leases. Equity REITs derive the majority of their income from leases that, depending on their duration and credit of the tenant, provide REITs with a more bond-like return than most non-REIT companies can offer.

The relative stability and visibility of these underlying cash flows are among the main reasons why investors view real estate and REITs as defensive assets, and why REIT dividend yields historically have been relatively safe. A simple way to think about how risky a REIT's cash flows may be is to consider the length of leases typically used to lease space. Shorter leases translate into more volatile future earnings while longer term leases, in contrast, provide more stability and consistency.

By contrast, triple-net REITs lease properties to tenants for 15 years or longer. During times of economic expansion, the triple-net landlord is not able to mark existing leases to market, and misses out on potential windfalls. However, during tough economic times, those leases produce steady, highly visible lease revenue - provided the tenants do not go bankrupt.

As in golf, REITs offer a broad range of investment options and these various choices represent a unique range of risk and return. Like a driver and a putter, there are two distinctly different REIT alternatives and the risk profiles are distinguished by one simple word: consistency .

REITs That Drive For Show

The driver is certainly the most powerful club in a golfer's arsenal and it is also his most unreliable . The power of the driver is measured in distance but the inaccuracy is best explained by long distance champion John Daly,

It's fun to be able to hit driver and you can score well if you hit it straight.

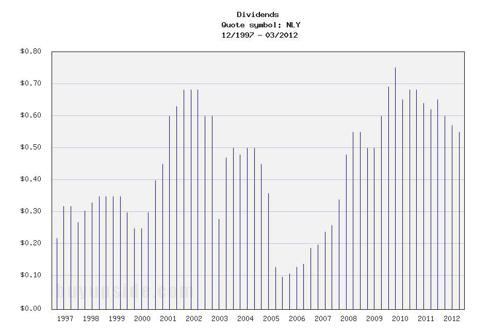

Mortgage REITs are also known for their volatility and higher risk composition. Unlike other types of dividend-paying companies which pay the same dividend each quarter, the dividends paid by mortgage REITs are very unstable and are cut often -- sometimes drastically -- when interest rates and/or mortgage defaults rise.

Many mortgage REITs, including Annaly Capital Management ( NLY ), Chimera Investments ( CIM ), American Capital Agency Corp. ( AGNC ), and Armour Residential REIT ( ARR ) are connected to debt-laden deals. That increases the leverage, which in turn adds a high volatility component to a REIT's earnings and dividends. Moreover, since mortgage REITs do not own or control property, judging its financial prospects is more of a guessing game.

Mortgage REITs that engage in leverage (i.e., borrowing money to magnify returns) also benefit from a steepening of the yield curve which can increase profit margins by widening the spread between the interest cost of borrowings and the interest income from the mortgages themselves. Interest rates are typically much more volatile than real estate prices, so mortgage REIT investors experience a bumpier ride than equity REIT investors.

REITs That Putt For Dough

Perhaps the putter is the most consistent club in a golfer's bag and also the safest. The putting stroke is smooth and flowing and the consistency is the differentiator for success and failure.

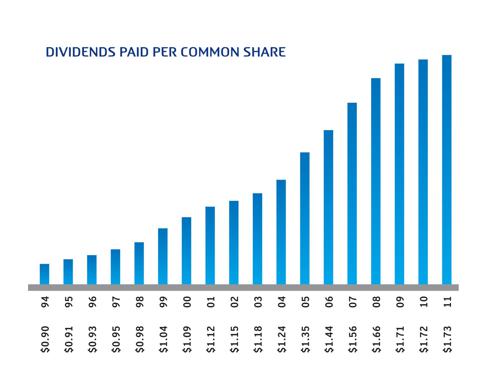

The triple net REITs are considered the most reliable of all other property sectors and accordingly these defensive alternatives are utilized often as alternative fixed-income stocks. As a general rule, REITs that own commercial properties with shorter initial leases tend to trade with more volatility than REITs than own properties with longer lease lengths. So generally REITs that focus on different property types rank in terms of trading volatility, which is a proxy for risk.

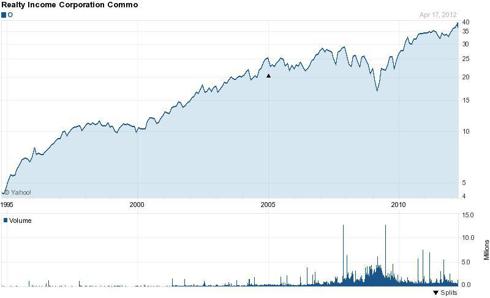

Realty Income ( O ) and National Retail Properties ( NNN ) are considered extremely reliable REITs. Both have demonstrated exceptional operating fundamentals with extraordinary dividend safety. These well-balanced platforms provide for a unique income alternative that are closely aligned to bond replacement alternatives. Realty Income is currently paying a 4.7 percent dividend and National Retail is currently paying a 5.8 percent dividend.

REITs that Drive for Show and Putt for Dough

As Gary Player has said, "greatness is talent applied consistently." The legendary golfer must have also been referring to the sound operating fundamentals of these highly regarded REITs known as Realty Income and National Retail. For these reliable REITs have been paying consistent and increased dividends for a combined forty years.

The essence of the triple net investment strategy is best described by Sam Chandan, Chief Economist at Chandan Economics and Adjunct Professor of Real Estate at the Wharton School:

The uncertain retail environment and property investors' limited appetite for risk-taking lend themselves to stronger demand for net lease assets with credit tenancy. The risk-mitigating features are fairly clear: a long-term lease with a high quality tenant limits exposure to market. Tenant quality is crucial since the tenancy risk is concentrated in a single counter-party. An unexpected bankruptcy can devastate cash flow.

Triple net REITs and mortgage REITs are two distinctly opposite business models - one built on durable dividends and the other built on unsustainable income and volatility. In time, consistency always wins and the triple net REITs have proven that they can weather the storms in good times and bad.

Realty Income has a current market cap of $5.1 billion and the current stock price is $38.23 (4.7 percent dividend yield). National Retail has a current market cap of $2.86 billion and the current stock price is $27.08 (5.8 percent dividend).

(0)

(0) (0)

(0)