Less than half of copper projects needed to meet

Post# of 23232

Less than half of copper projects needed to meet demand

Frik Els | March 31, 2015

Less than half of copper projects needed to meet demand Las Bambas: 460,000 tonnes per year starting early 2016. Image: MMG

Less than half of copper projects needed to meet demand

Las Bambas: 460,000 tonnes per year starting early 2016. Image: MMG

The price of copper in New York fell on Tuesday with May futures trading on the Comex market giving up 1.5% to $2.74 a pound after optimism about economic stimulus from top consumer China began to fade.

Copper is down 9.7% compared to a year ago, but has recovered well from five-and-half-year lows struck in January. Most analysts expect copper to move into a surplus in excess of 200,000 tonnes this year after a mostly balanced 2014, but the copper industry has a long history of supply disruptions.

Typical disruptions associated with adverse weather (top producer Chile has swung from severe drought to worst floods in 80 years in 2015), technical problems, power shortages or labour activity coupled with falling grades and dirty concentrates at old mines make forecasting a tough proposition.

200,000 tonnes of potential copper mine output destined for markets this year have been lost

To these variables add more recent factors affecting future supply which includes the weak price which makes it difficult for miners to raise development finance (or raise wages for that matter). That leads to project deferrals, commissioning delays and downsizing of mine plans.

A new report by London-based CRU, an independent mining, metals and fertilizer researcher, estimates that some 200,000 tonnes of potential copper mine output destined for markets this year have been lost due to these factors.

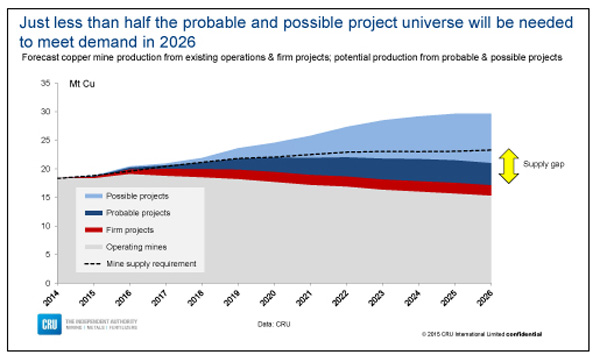

By 2021 that figure would've increased to close to 3 million tonnes which compares to global annual production of under 20 million tonnes. At the same time output at existing operations are expected to peak next year and from 2020 a "marked downtrend in committed production will set in" according to Christine Meilton, Principal Consultant at CRU.

All of which should be great news for the copper price. Not so fast says Meilton:

There is no shortage of potential resources available to fill this gap. CRU's portfolio of projects includes 231 "probable" and "possible" projects with total maximum potential output of 12.9M tonnes, while a further 6.6Mt is potentially available from earlier stage projects, those which CRU categorises as "prospects". In addition, despite difficult financial conditions, grassroots exploration continues.

As the graph shows that means according to CRU estimates just less than half of the probable and possible projects need to get off the ground to fill the supply gap.

Less than half copper projects needed to meet demand

Source: CRU

Click here for more from CRU.

8

inShare

Share on email

Share on print

Your email address

(0)

(0) (0)

(0)NASDAQ DIP and RIP

Here is the best word that describes what i do here.

Intuitive;

means having the ability to understand or know something without any direct evidence or reasoning process.

I was born with it, I'm truly blessed!

Alway's searching for winners'