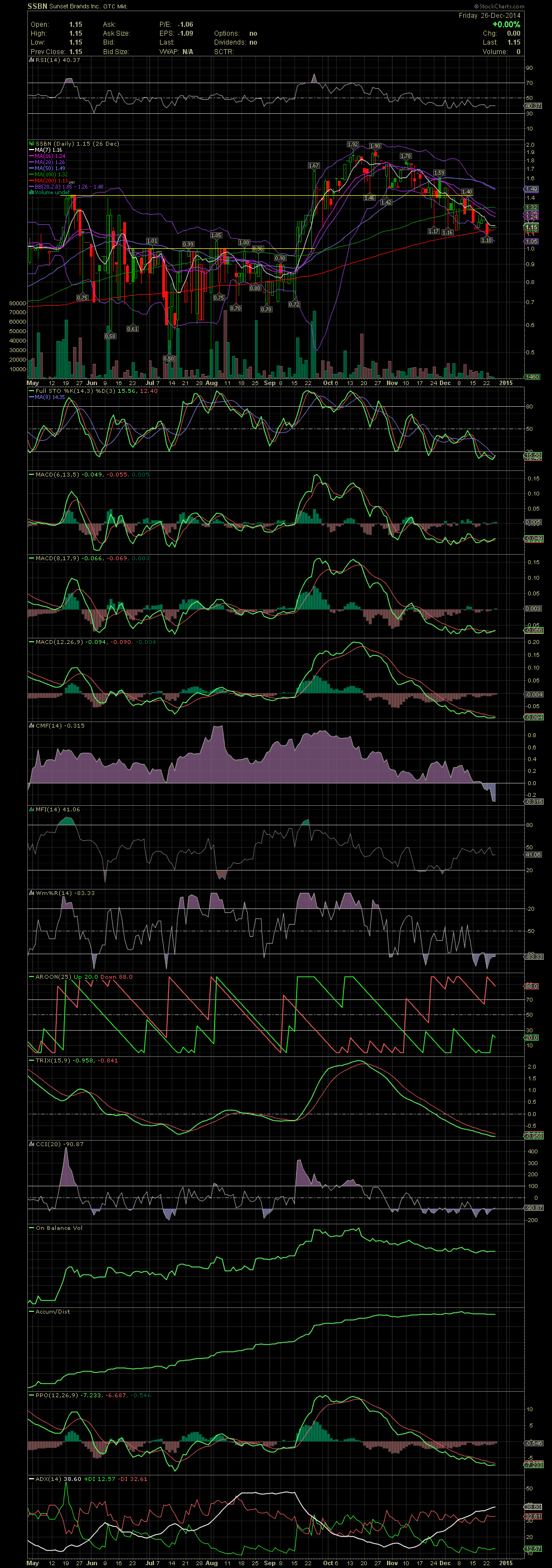

SSBN Daily Chart ~ Just About Reset After a Two Mo

Post# of 84

Not much to share yet about SSBN as shareholders await some major material events. Financials have been completed and audited. The company's assets have been appraised by a third party. Asset valuations appear to be ranging from $500MM to over $800MM, depending on the way the assets might be liquidated.

As the company begins to monetize those assets, they will be able to use them as collateral for acquiring or partnering with other profitable businesses. Should the company execute what they have talked about, shareholders should see a much higher stock price. I'm still thinking in the $10+ range near term with longer term targets much closer to the book value. As to the technicals, the trading volume has declined to very low levels as tax loss selling season ends for those who weren't around prior to the September breakout. Many are holding gains from the .50s and are getting close to long term gains in a few months. The daily chart is showing the FullSto and MACDs beginning a positive crossover to the upside. The stock is beginning to show support in the 1.10-1.20s while holding on to the MA200. A few of us have been accumulating the stock over the last few days, and it's getting harder to get filled on the bid. It looks like some aggressive buys at the ask of approx 5k-10k shares will take the stock back over $1.50 quickly. Looking for strong news in January. GLTA

(0)

(0) (0)

(0)