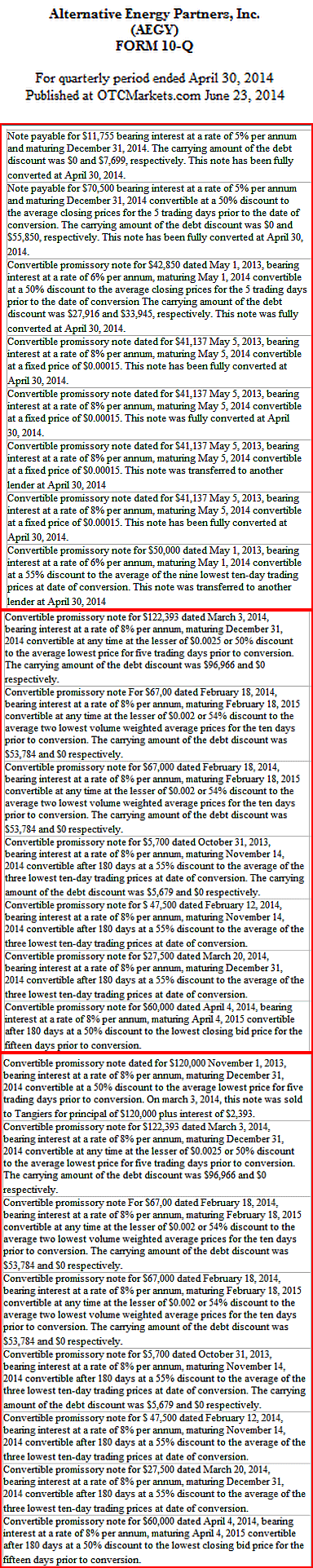

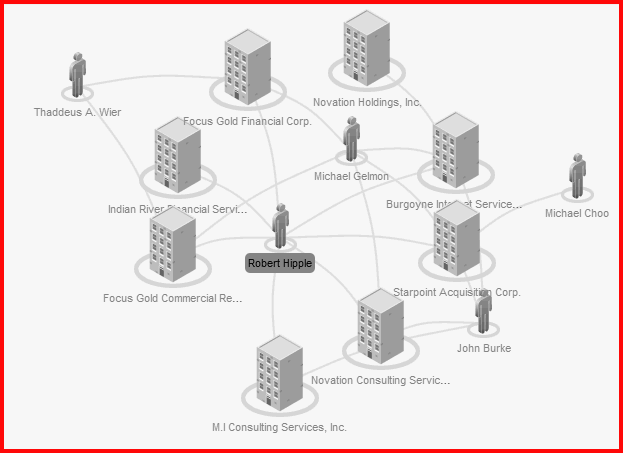

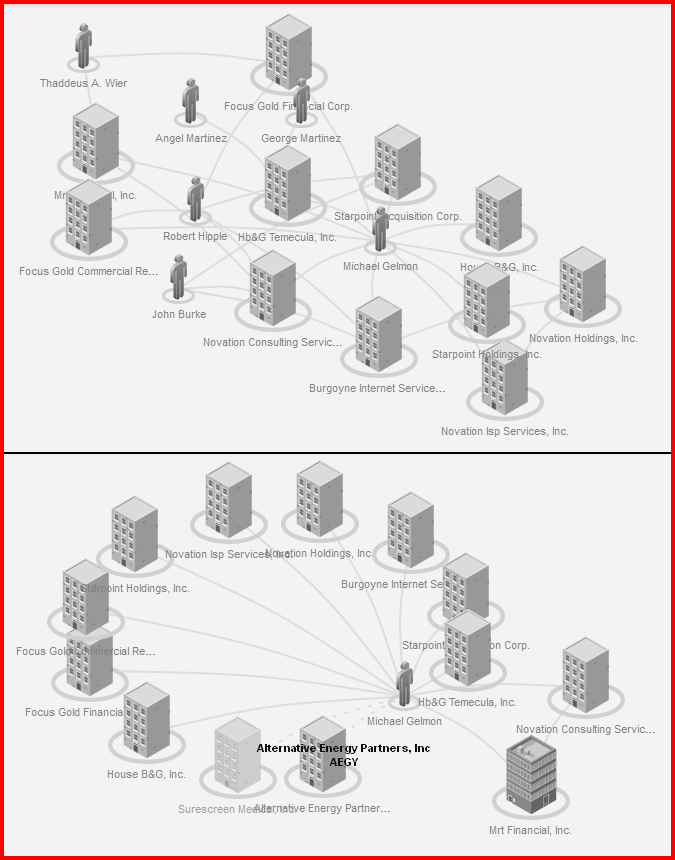

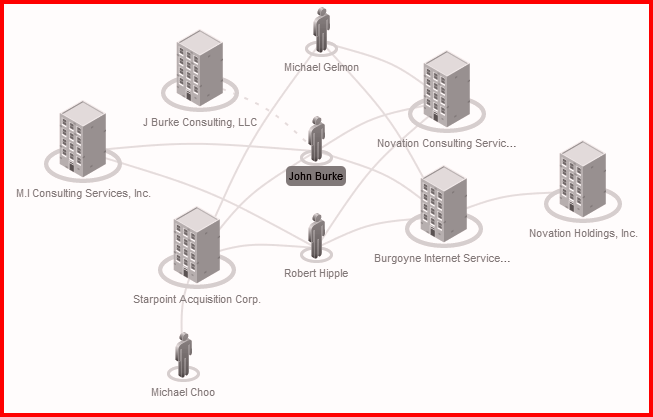

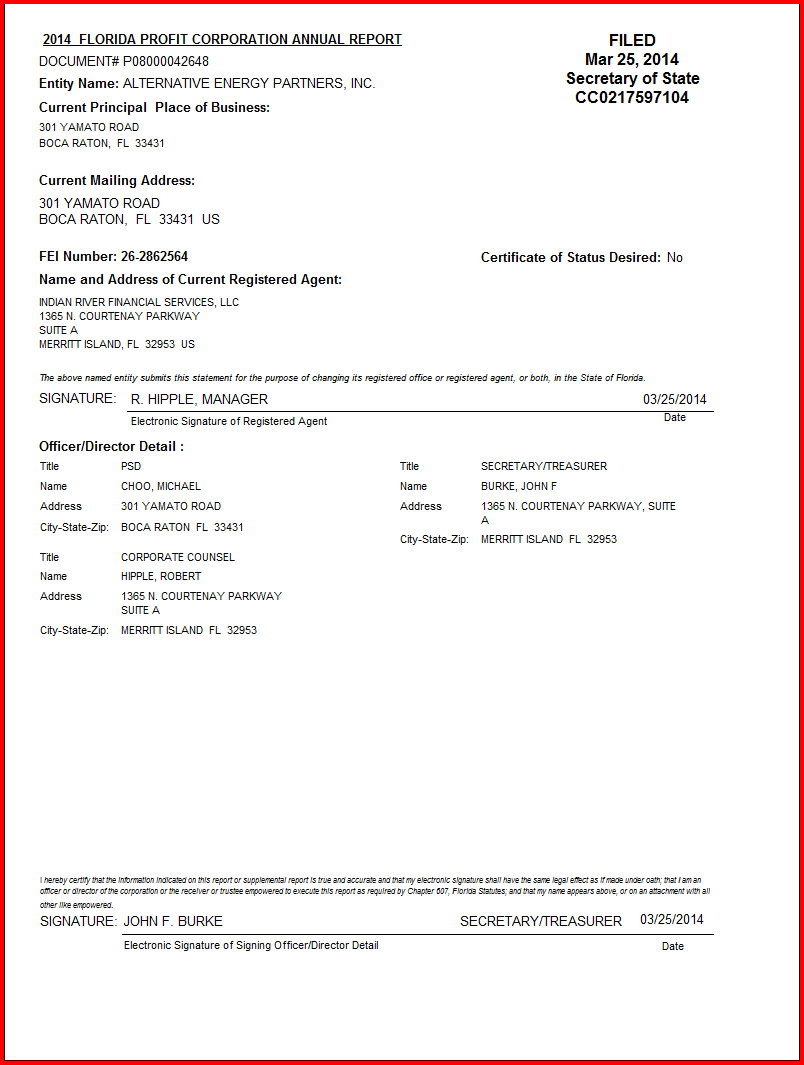

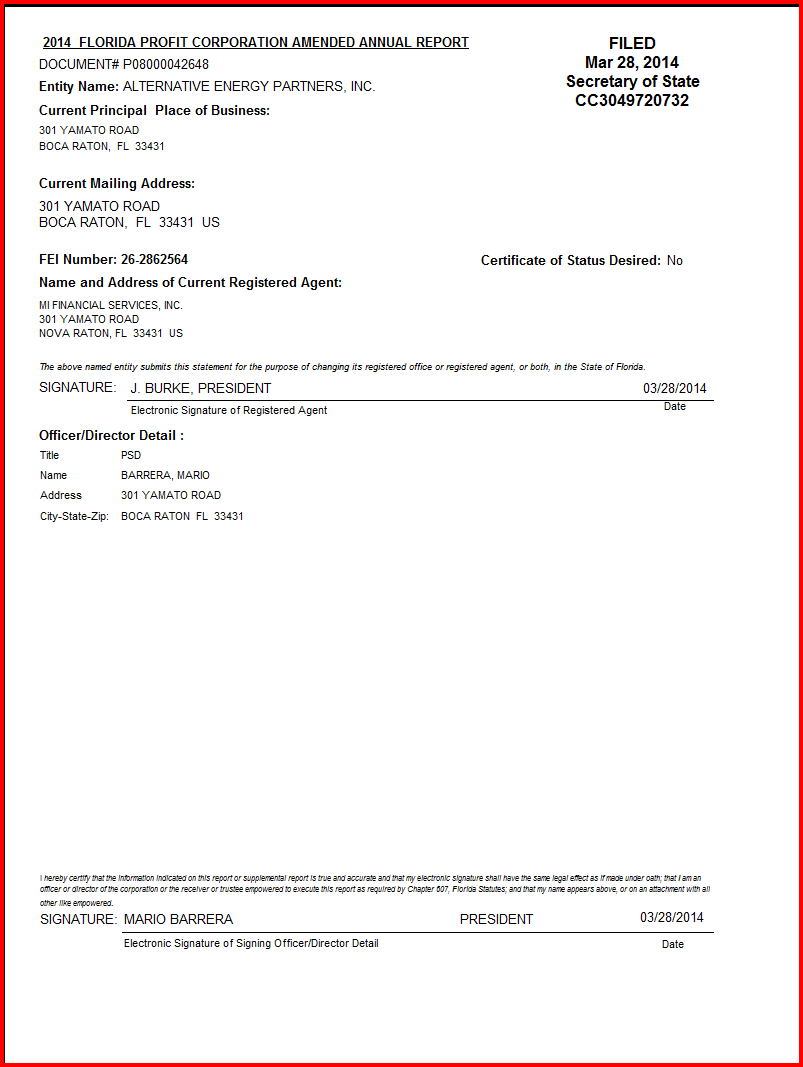

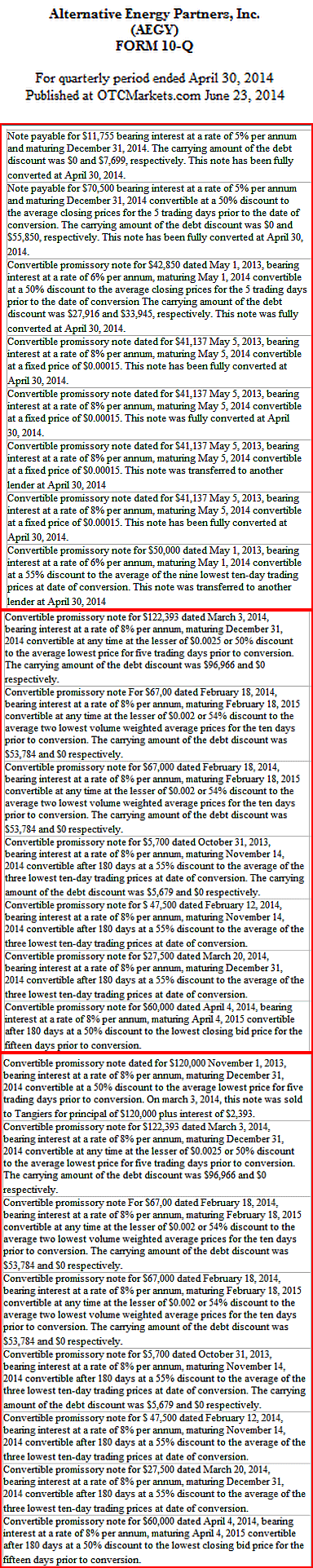

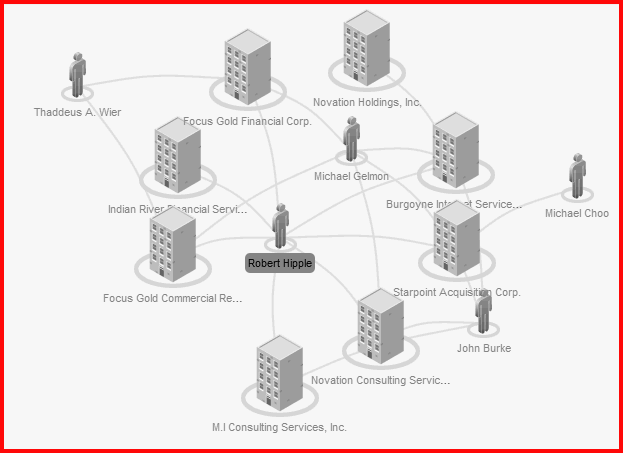

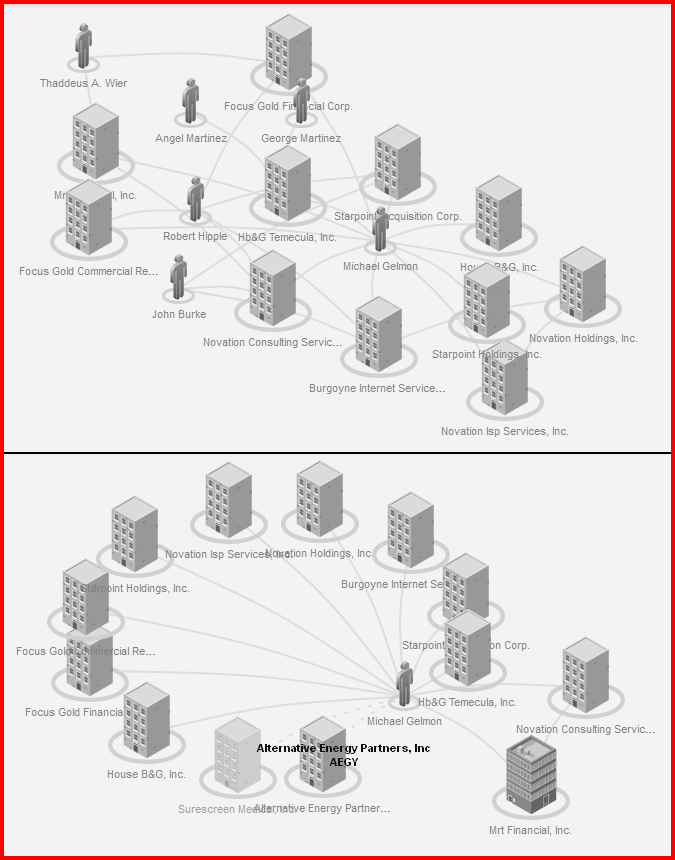

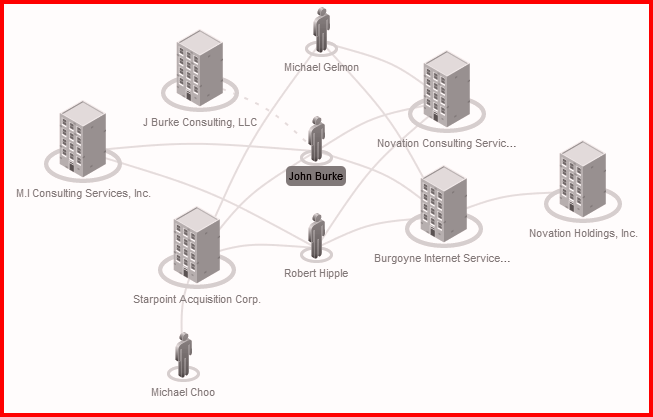

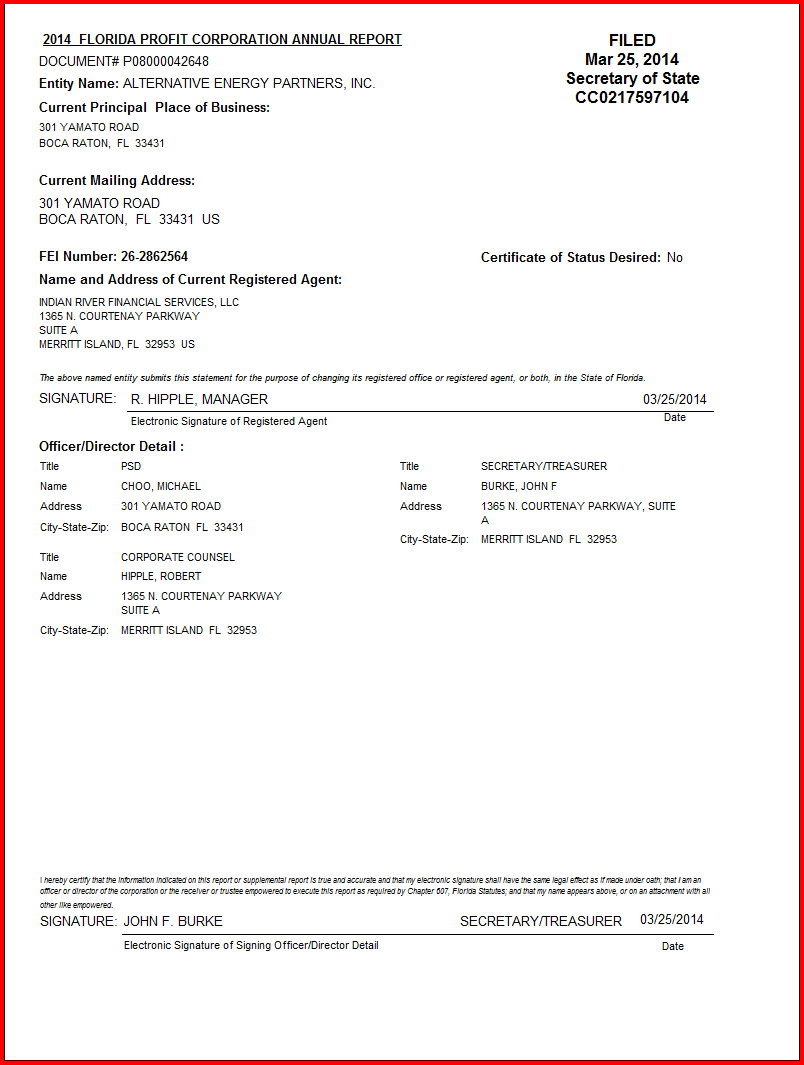

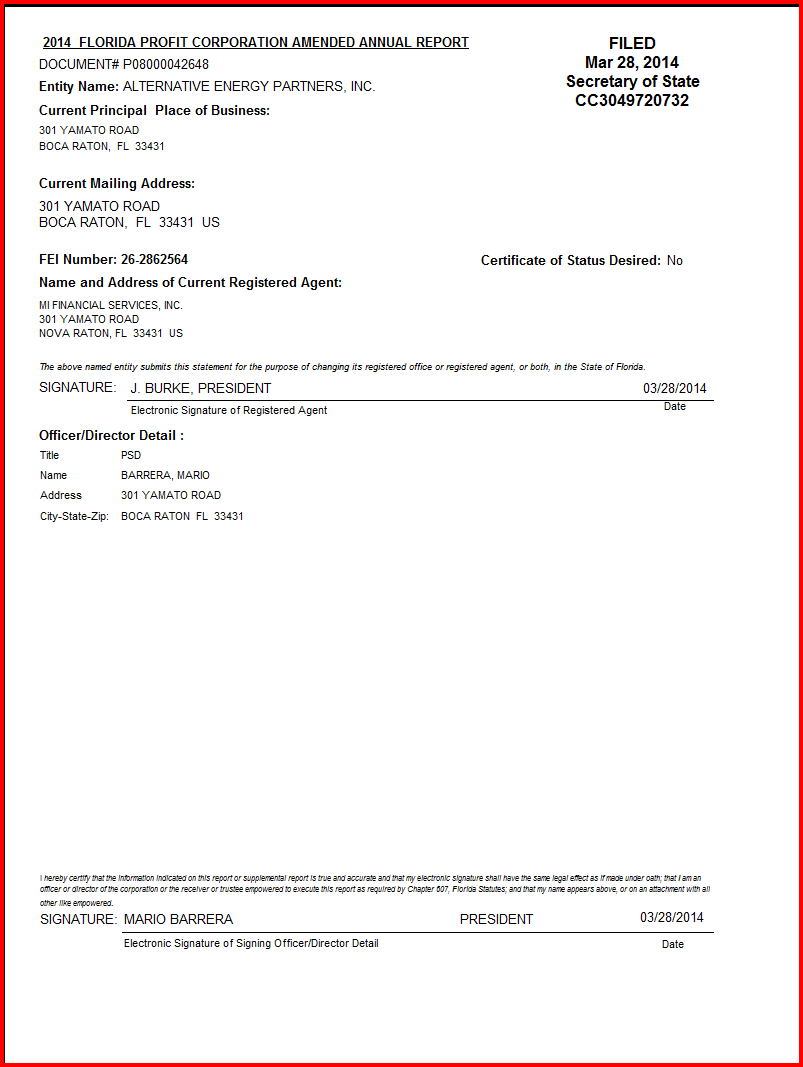

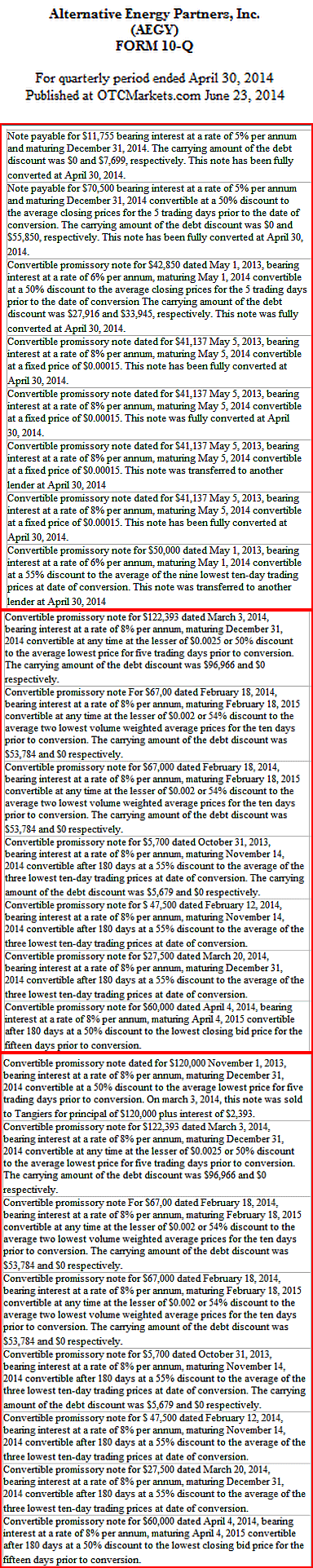

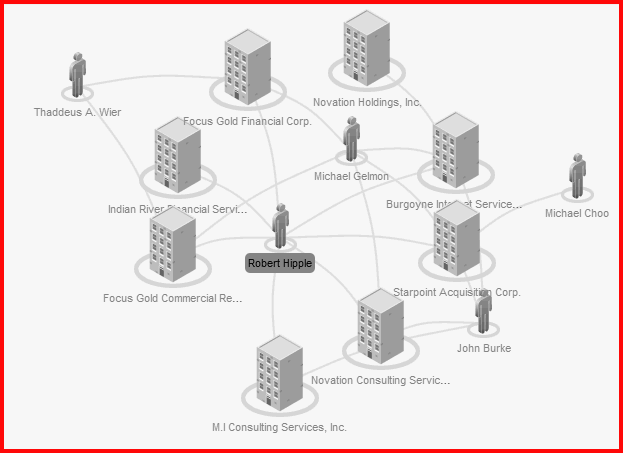

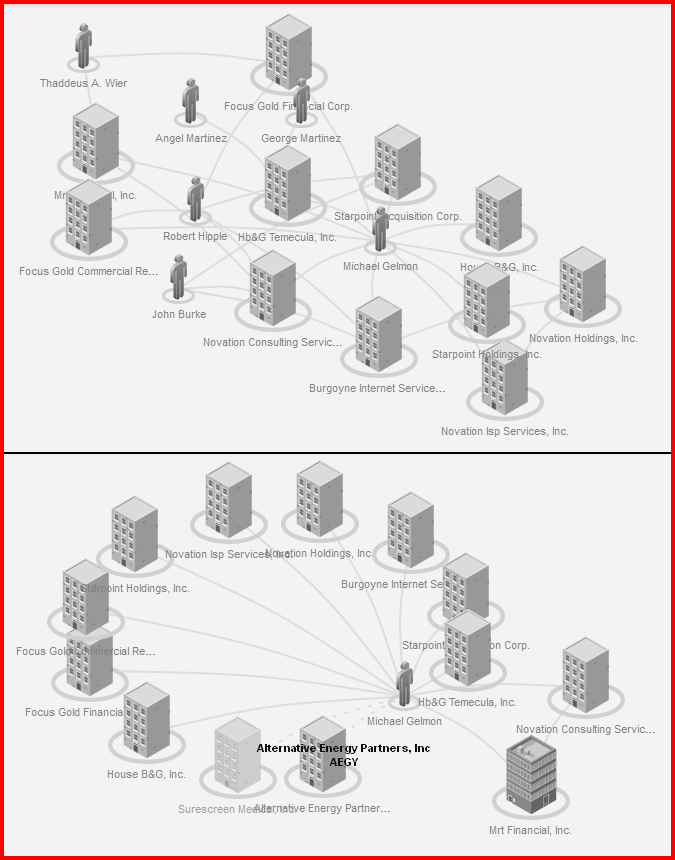

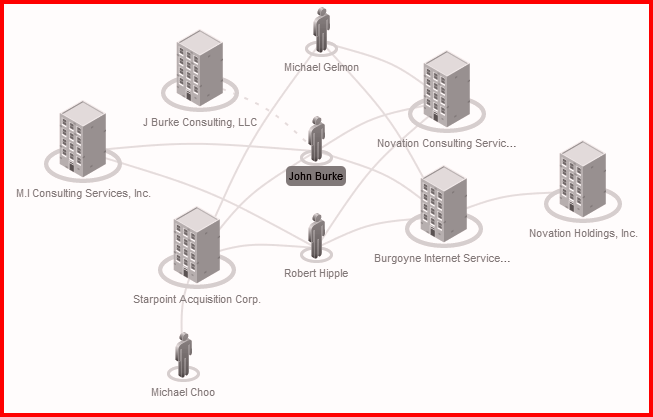

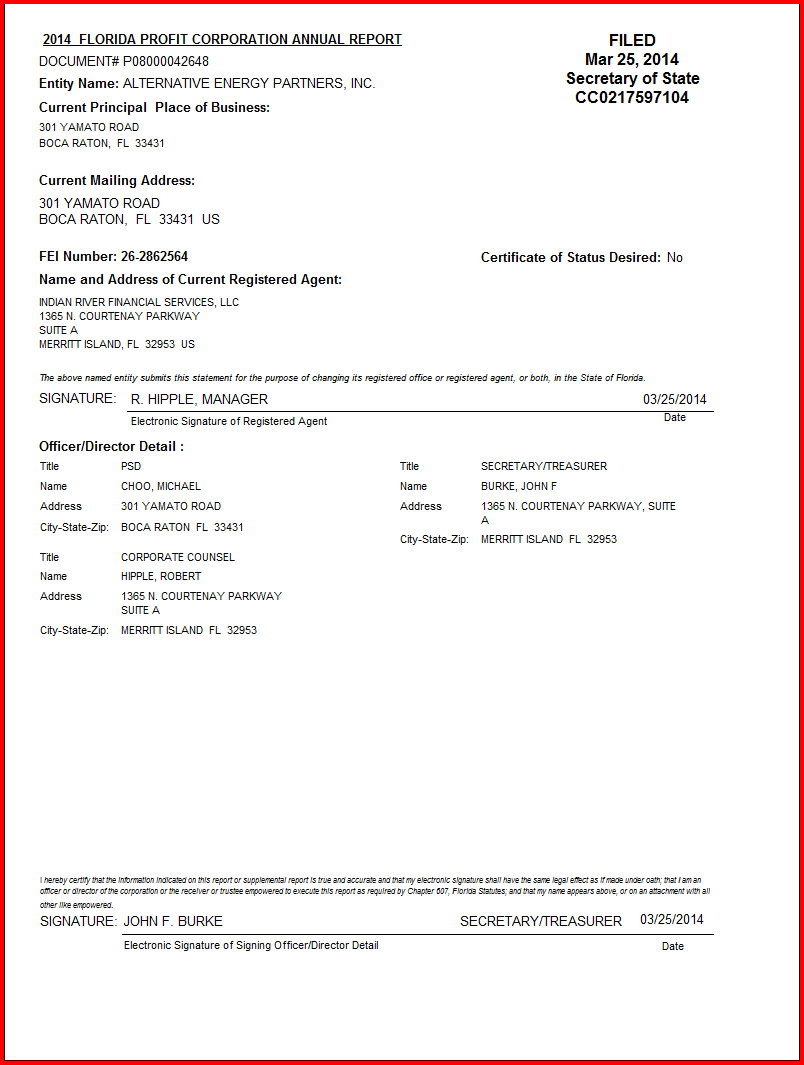

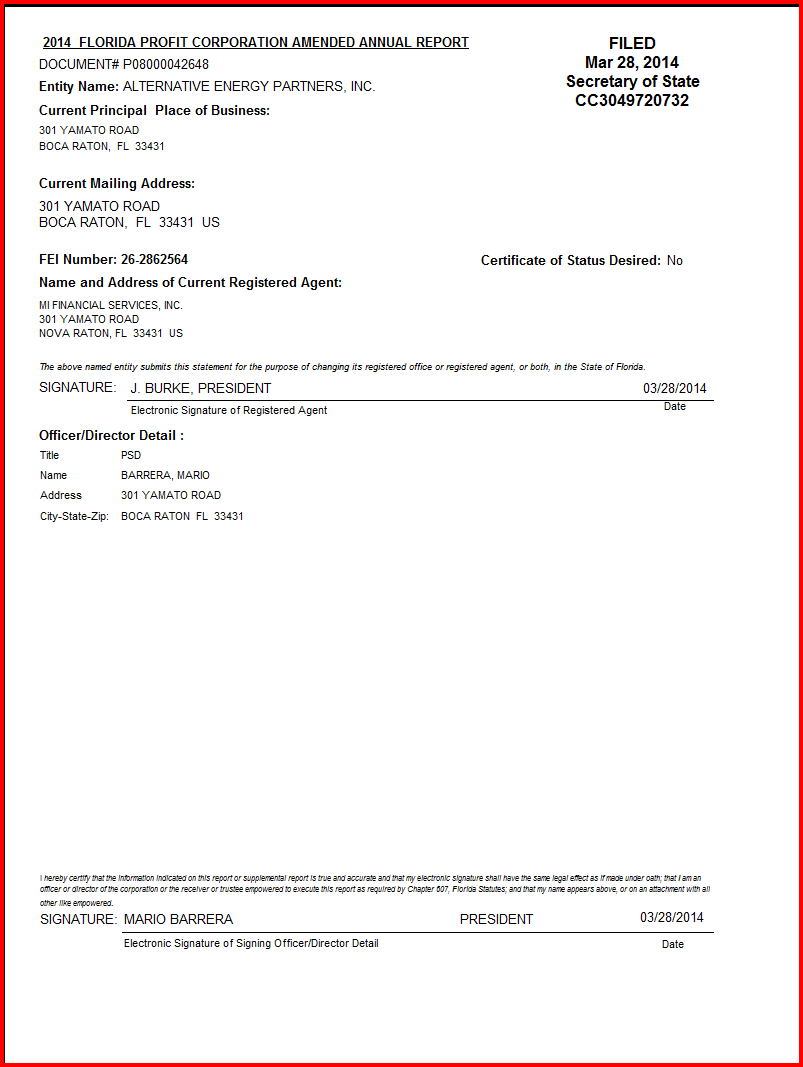

The lenders must be fed. Convertible promissories are where the big money is made. They control numerous vehicles to mask the true originators and paper trail from inquisitive eyes as can be seen below. Also, as can be seen below, there are billions of shares in the queue for selling, but where are the suckers to buy them with volume drying up? For example, shares they acquire at 0.00015 and sell at 0.00050 profit them with a 233% gain. But they need volume. That's where PR bait comes in handy for the hook. Why was this PR published at PJ website and not through legitimate business wire channels as were other PRs? Is it a desperate ploy to dump shares by sneaking it past FINRA and SEC? The two public companies (SKTO/AEGY) are material to this group only insofar as they can use them as vehicles for convertible promissories and for generating interest through forward statements, that rarely if ever materialize, in order to unload insider shares. Knowing their long and seedy history of failed companies, SEC censure, massively ballooning share structures, empty promises, and veiled insider enrichment at public expense, why would you trust these guys with the time of day much less give them more of your money and/or pump it to the unwary?

(0)

(0) (0)

(0)

(0)

(0) (0)

(0)