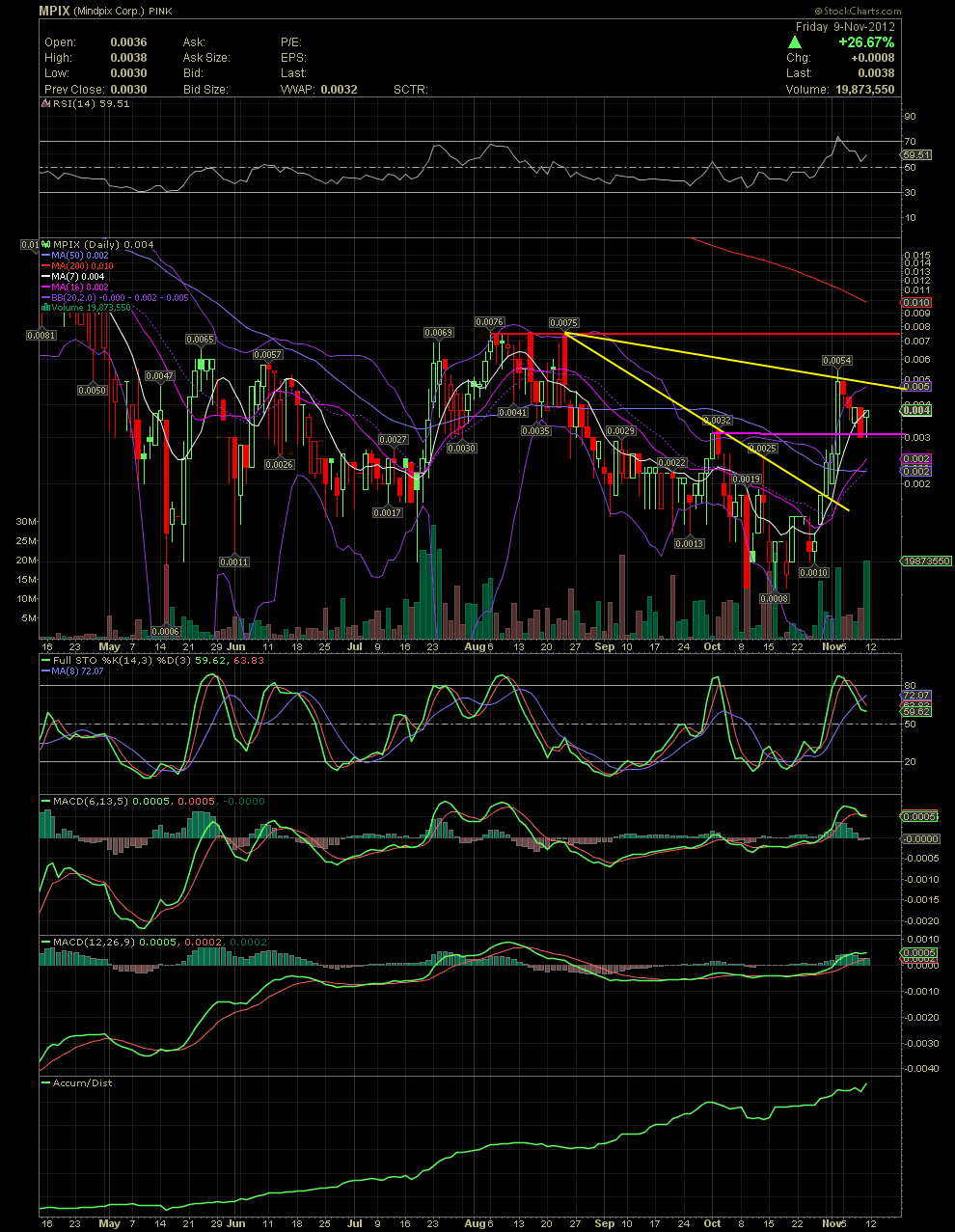

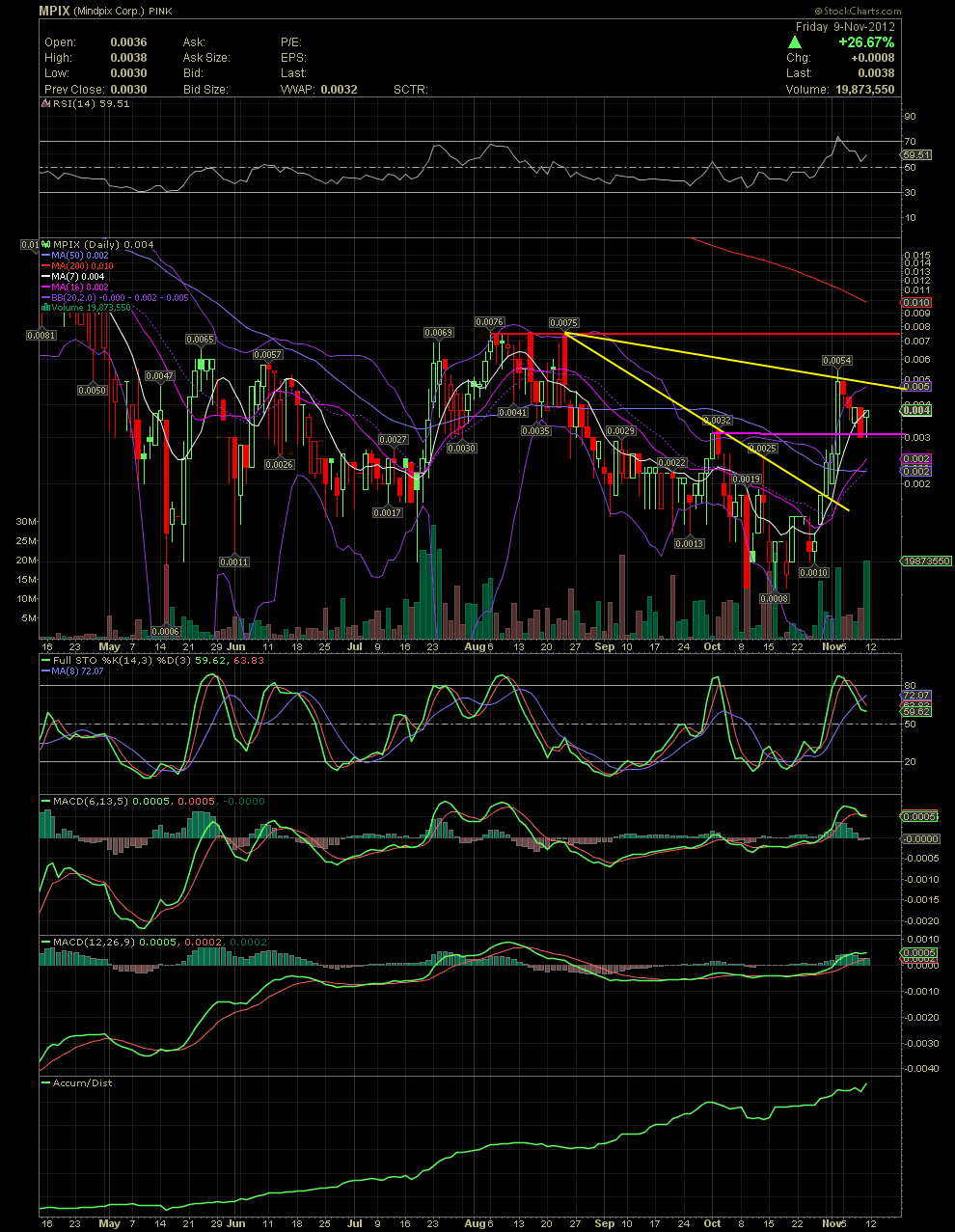

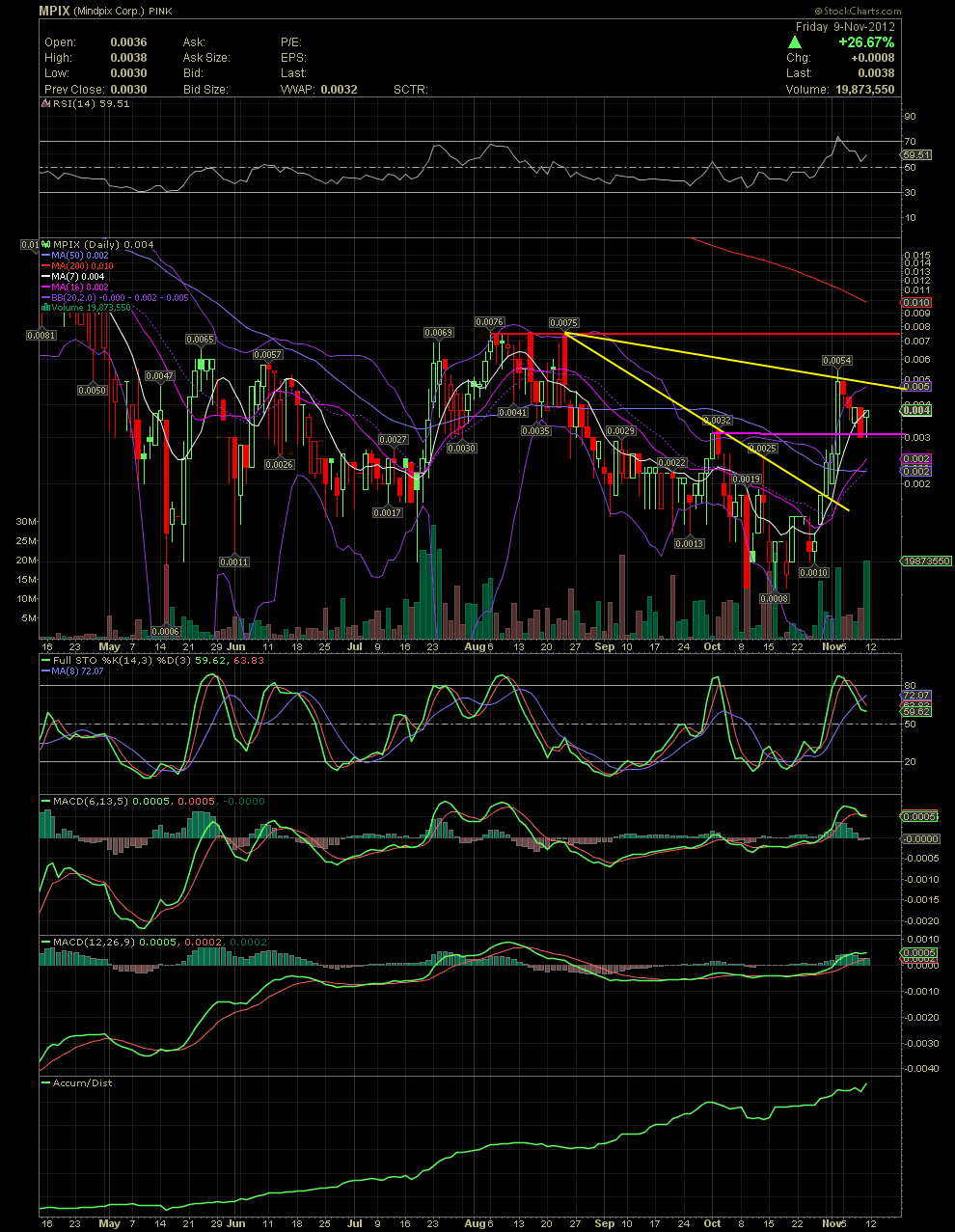

MPIX Daily Chart............ Hope everyone is having a good weekend.

As most of the technicals traders already know, a share price on any chart will trade within the bollie bands approx 85% of the time. Friday, of one week ago, saw a sharp move from under .003 to as high as .0054. If one reviews that chart, you can see that the candle was way outside the upper bollie. What goes outside the bollie, always comes back in. So the obvious move to have been expected earlier this week was to see a pullback into the bollies again. So the question that should arise is where will the stock find a bottom prior to the next leg up? One should look for previous resistance points or top that might offer support as a share price retraces. In the case of this last week, an obvious area should have been the .0031/.0032 top of late Sept/early Oct which I've drawn with a horizontal pink line. Although not a guarantee or an exact science, the stock price held at .003 before settling at a close for the week of .0038. Since the share price ran up a week ago Friday, leaving the MAs behind, most traders know that the MAs need to 'catch up' with the share price either thru a consolidation or pullback. Strong accumulation, though, continues as can be seen on the A/D line. The RSI and FullSto have come down from overbought territory while the shorter term MACD level out the last two days, and the longer term MACD continued a little higher. The green volume seen yesterday was the highest volume day since the July 20/23 period with the exception of one day.

For the coming week, it wouldn't surprise me to see a continuation of Friday's move. The upper bollie is still rising. A move above .0054 would be a strong indication that the .0076 tops of August will be tested. Should those highs be taken out, my next target would be the MA200 which is sitting at .01. Looking at Friday's candle, that's a nice green hammer there people. And with the constant selling pressure being absorbed by the longs, imo Friday was a great day with the volume of almost 20 million shares or almost $70,000.

GO MPIX - GLTA

(0)

(0) (0)

(0)

(0)

(0) (0)

(0)