ARTICLE: Iron ore extending bull market as export

Post# of 8059

ARTICLE: Iron ore extending bull market as export gains at 11 year low - Clarkson

http://www.steelguru.com/raw_material_news/Ir...53714.html

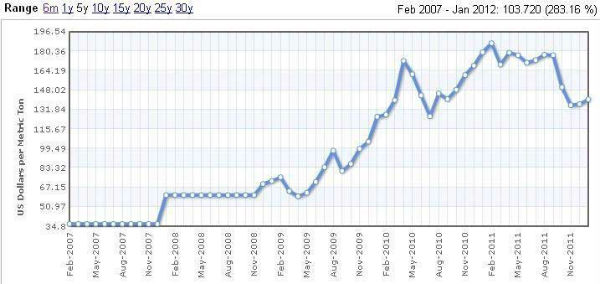

Iron ore, the world's second biggest commodity cargo after crude oil, is extending a bull market after rallying 22% from a 22 month low in October as the slowest expansion in exports in 11 years restricts supplies.

According to Clarkson Plc, the largest shipbroker, seaborne supply will advance 3.8% to 1.09 billion tonnes in 2012, the smallest gain since 2001. Prices in China, the biggest importer, may rise 10% to an average of USD 157.50 a tonne in the fourth quarter, the median of 11 analyst estimates compiled by Bloomberg shows. Shares of Vale SA, which ships more ore than any other company, will rise 19% to USD 30.42 in the next 12 months, the average of 16 estimates shows.

New mines and expansions of existing ones are being postponed by rising costs and licensing delays. Morgan Stanley cut its forecast for export supply by 9.6% since October 2011 and expects a 99 million tonnes deficit in the seaborne market this year, at least the ninth consecutive annual shortage. Vale will report its second biggest profit ever this year, the mean of 11 analyst estimates compiled by Bloomberg shows.

Mr Neil Gregson, who helps manages about USD 7.4 billion of commodity assets at JPMorgan Asset Management in London, said that "The wall of additional iron ore supply that investors have been fearing is going to be late. Iron ore remains a tight market."

According to The Steel Index Limited, which publishes steel, ore and scrap prices, ore with 62% metal content delivered to the Chinese port of Tianjin was at USD 143 a tonne, a fourth consecutive monthly gain. The commodity is measured in dry tons, or metric tons less moisture content.

Iron ore's 22% advance since October compares with a 7.2% gain in the Standard & Poor's GSCI gauge of 24 commodities and a 4.1% jump in the MSCI All Country World Index of equities. Treasuries returned 2.3%, a Bank of America Corporation index shows.

Prices that rose sevenfold in eight years spurred new products for investors. Deutsche Bank and Credit Suisse Group AG started swaps in 2008 and the Singapore Mercantile Exchange began futures in 2011. About USD 13 billion of swaps and options were traded in the past three years, with 95% linked to the Tianjin price. Fourth quarter swaps closed at USD 130.09 on February 28th 2012.

Mr Wu Rongqing, the chief engineer of the China Mining Association, said that rising prices may spur more production in China. Imports may drop as much as 14% in 2012. Its ore is typically about 25% iron as compared with 60% in Australia, increasing costs for mining companies. Inventories at ports are within 2.7% of the record 101 million tonnes reached February 3rd 2012.

Chinese steel consumption hasn't rebounded since a weeklong public holiday in January 2012 because of tighter credit and weaker construction, MEPS (International) Limited, a Sheffield, England based industry consultant, said in a report on February 27th 2012. The nation's economy, consuming about 65% of all seaborne ore, will expand 8.2% in 2012, the slowest growth since 1999.

According to the median of 25 economist estimates compiled by Bloomberg, demand for iron ore may also be curbed by the debt crisis in Europe, where mills produced about 12% of the world's steel in 2011. The economy in the 17 nation euro area will decline 0.4% this year, compared with growth of 1.5% in 2011.

Source - Bloomberg

(0)

(0) (0)

(0)