QUES Daily Chart ~ Near the HOY QUES had a ni

Post# of 2561

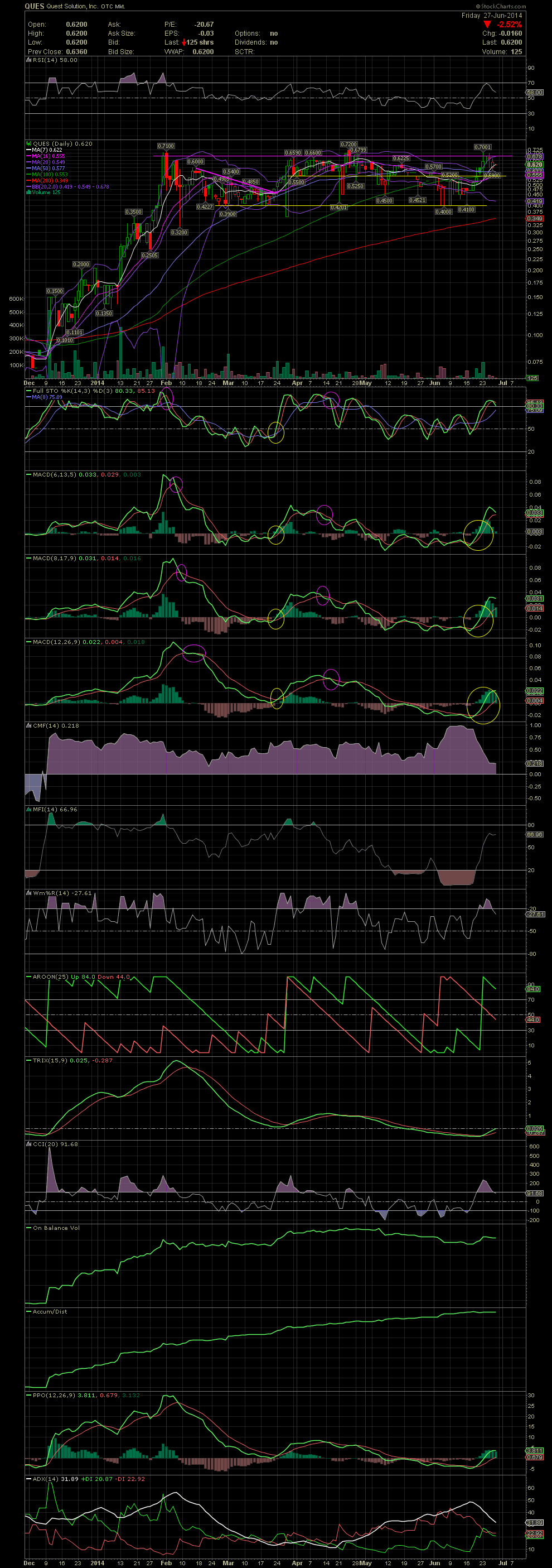

QUES had a nice move from .41 to .7001 in five days before pulling back and allowing longs to absorb a few sellers. You can see the low volume decline to Friday's close at .62. Friday's volume was just 125 shares, so the stock lost 2.52% for the day due to someone's need for McDonalds weekend lunch money. I'm looking at the positioning of all indicators, but especially the TRIX as compared to where it was back on Dec 10 just before the stock began climbing from .08 to .71 in just eight weeks. Not saying we'll see an 8 fold move over the next two months, but I do believe the chart is setting up for at least a double over the next quarter. Excellent for those who have been holding since our initial entries at .07/.08. As I've said all along, QUES is going to be a $4-$5 stock by the end of this year. Six months down and six to go. The hardest part was going from .08 to .70 and holding this high and this long until the penny players were weeded out. From .70 to $4 or $5 shouldn't be anywhere near as hard or long as the institutional types are now beginning to notice Quest Solutions. Just review that last few releases for your conclusions as to why QUES has done what it has so far in 2014. GLTA

(0)

(0) (0)

(0)