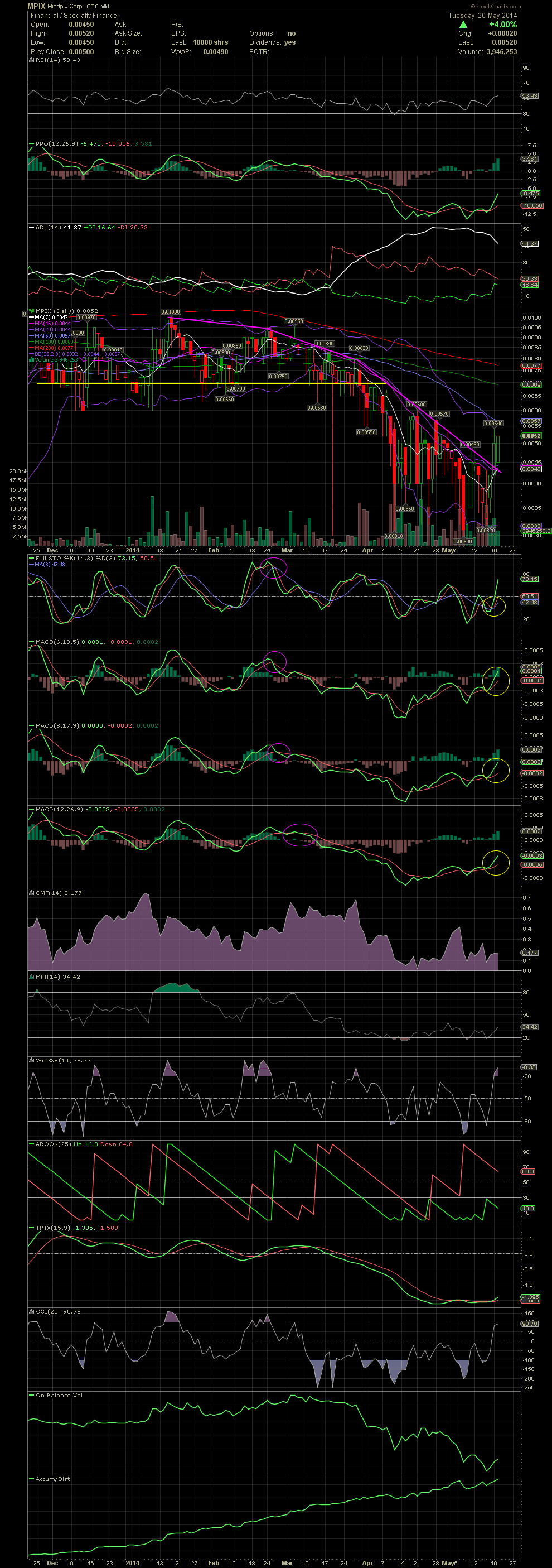

$MPIX Daily Chart ~ First Signs of Green in Ten We

Post# of 2561

After almost 10 weeks of downside from .01 to a low of .0032, MPIX has finally seen a few days of green. When the stock broke the multi month support line at the .007 level, it was followed by a lot of selling into the .004s/.003s. Obviously someone sold a lot of stock, but someone also absorbed all those shares. Hopefully most of them fell into longer term investors' hands. The FullSto crossed over a few days ago, while the MACDs did the same from extremely oversold levels. Also, please note the 'pinch' form with the PPO/ADX which began to open nicely last week before the stock reversed from the .003s. It's always important to follow all indicators for signs of a reversal from both the lows and highs on a chart. The stock ran into the upper bollie on Monday at .0054 before pulling back. The next bit of resistance could be the MA50 at .0057. Should that target be taken out, next up would be the MA100 and 200 at .0069 and .0077. The previous horizontal support line at .007 might also offer some resistance simply because the amount of time the stock held at that level. Today saw a slight continuation to the upside which I'm sure was welcome to many weary shareholders who have been beaten over the head for weeks with the non-stop selling. We knew eventually the selling would let up, and we've now seen a move of almost 70% from the lows set on Thursday. How would you like to be the fool who sold almost 10 million shares last week from .0034 to .0037, lol. For those that bought when you saw blood in the streets, congrats are in order. Now it's time for management to deliver to allow a stronger group of shareholders to see the share price rise to .01 and beyond. Our first project is the Golden Trailer Awards on May 30 followed by the Spring Festival in June. Let's hope MPIX can see a few revenues from those two events followed by larger projects in the near future. GLTA

(0)

(0) (0)

(0)