Acquisition action has captured Wall Street's atte

Post# of 63910

7 A.M.

Shares in DirecTV (DTV, Fortune 500) were surging by about 5% in premarket after AT&T said Sunday it had agreed to pay nearly $50 billion to acquire America's biggest satellite television provider.

Shares in AT&T (T, Fortune 500) were edging up by 0.5% ahead of the opening bell, while shares in competitor Verizon (VZ, Fortune 500) were under pressure.

AstraZeneca's (AZN) shares fell by roughly 14% in London after the board rejected yet another takeover bid from U.S. pharmaceutical giant, Pfizer (PFE, Fortune 500). Investors had pushed AstraZeneca stock higher as they hoped Pfizer would be able to woo the British firm, but the rejection of a fourth and "final" offer from Pfizer suggests the deal is dead in the water.

Shares in Pfizer were rising by about 2% in premarket trading.

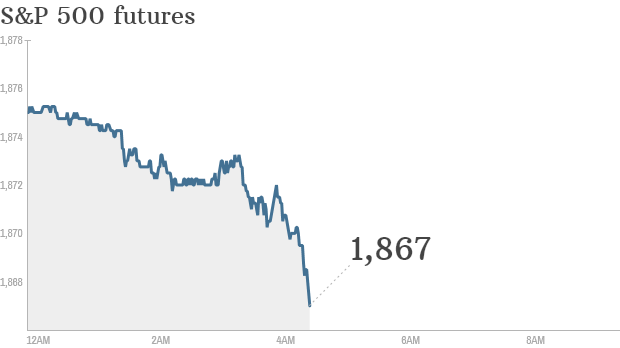

In broader terms, U.S. stock futures were declining Monday ahead of the opening bell.

The latest reading from the CNNMoney Fear & Greed index indicates investors are feeling fearful after stock markets hit fresh all-time highs last week.

Related: Retailers under the microscope

There's not much in terms of economic and earnings announcements on the docket Monday.

Campbell Soup (CPB, Fortune 500) will report earnings before the opening bell and Urban Outfitters (URBN) will report after the close.

Related: CNNMoney's Tech30

European markets were mostly declining in morning trading.

Banking stocks, including Deutsche Bank (DB) and Barclays (BCS), were under performing in Europe after Deutsche Bank announced it was raising roughly €8 billion ($11 billion) from investors to help give it a larger cash base to meet regulatory requirements.

Asian markets mostly ended with losses. However, the Mumbai Sensex index continued to rise as investors cheered the election of a new leader, Narendra Modi. Indian markets seem poised to set another all-time closing high. To top of page

(0)

(0) (0)

(0)