I think it's great news that iequity doesn't own S

Post# of 36729

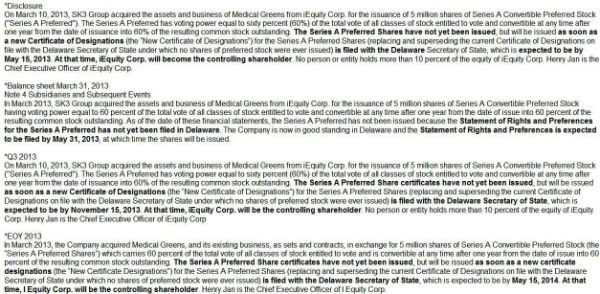

iequity had a deal with SKTO for consulting fees.* But it's obvious iequity doesn't want those authorized preferred shares issued to them for some reason. See attachment to support that argument. Issuance would give iequity total, not shared, control (60%) of a publicly traded company, and that would invite scrutiny from the regulators -- the last thing those guys would want. Can you imagine looking into that can of worms?

The planned merger is a way of shifting those 5m authorized unissued shares, which served their purpose by fostering the illusion of control, to a different entity for consideration without ever having iequity's name attached to them. A nifty, clean, clever scheme, eh?

It's like buying a car from someone; leaving the new owner-name field blank; never retitling; using the car; and then selling it to somebody else under the previous owner's name.

*"Effective May 1, 2012, the Company entered into a Consulting Agreement with iEquity Corp. under which iEquity Corp. agreed to undertake the research and business development necessary to implement the new business of the Company already under development. The Consulting Agreement provides for a monthly fee of $50,000 and a total of $450,000 in fees had accrued as of December 31, 2012. The accrued amount was converted into a promissory note in the same amount on December 31, 2012 convertible into common stock at the election of the holder."

(0)

(0) (0)

(0)