I think it's time for SK shareholders to become mo

Post# of 36729

The Emperor (iequity) has no clothes.

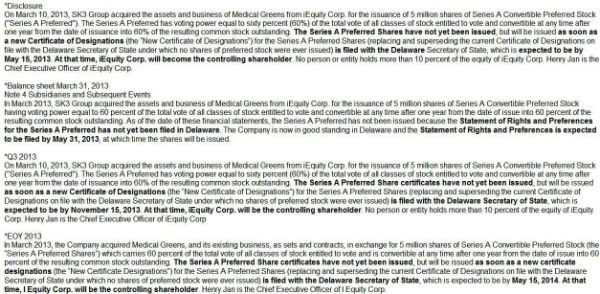

We have been falsely led to believe by management that iequity controls 60% of the voting interest in SKTO. This illusion has allowed them to roll the shareholders into submission and acquiescence. After all, "whatever iequity wants, iequity will get because it controls 60% of the firm." The fact is iequity controls nothing. Nada. It doesn't have one exercisable vote in this firm. All of its preferred shares are unissued. Only issued shares are allow a vote or votes.

iequity perpetuates the illusion of control. That "expected" date of issuance, jumps farther ahead in every filing. See attachment. It's obvious iequity doesn't want those preferred shares issued. It amounts to 60% control of a public company which would open them up to SEC scrutiny, the last thing they would wish. Rather, iequity corp can stay out safely out of range yet still foster the illusion of control to common shareholders who just accept their false dominance.

Action: 500m to the A/S from 750m to 1.25b on 01/01/2014. We common shareholders may be able to roll that back.

Title 8 Delaware regulations are clear that, in order to raise the A/S, a Delaware incorporated firm's B.O.D. must call a shareholder meeting and shareholders affected adversely by the change are entitled to vote on this measure. (1 common share = 1 vote)

From Title 8 of Del. code:

" (a) (3) To increase or decrease its authorized capital stock or to reclassify the same, by changing the number, par value, designations, preferences ..."

(b) Every amendment authorized by subsection (a) of this section shall be made and effected in the following manner:

1) If the corporation has capital stock, its board of directors shall adopt a resolution setting forth the amendment proposed, declaring its advisability, and either calling a special meeting of the stockholders entitled to vote in respect thereof for the consideration of such amendment or directing that the amendment proposed be considered at the next annual meeting of the stockholders.

2) The holders of the outstanding shares of a class shall be entitled to vote as a class upon a proposed amendment, whether or not entitled to vote thereon by the certificate of incorporation, if the amendment would increase or decrease the aggregate number of authorized shares of such class, increase or decrease the par value of the shares of such class, or alter or change the powers, preferences, or special rights of the shares of such class so as to affect them adversely.

####

(0)

(0) (0)

(0)