Dear Jeffrey Benz, Esq., SK3 Group, Inc. Executive

Post# of 36729

As a large stockholder of SK3 Group, Inc. (SKTO) and ardent fan of Berkeley Bio in light of the singularly important work the GoldNApel team does, I bring to your attention issues of crucial interest in regard to Alternative Energy Partners, Inc. (AEGY).

The first issue is a questionable statement made by CEO Mario Barrera in an AEGY 8-K submitted to SEC re Michael Gelmon and Alberta Securities Commission's Cease Trade order. The second issue is unbridled if not reckless AEGY share dilution. The third is control issues at AEGY and apparent duplicity and sleight of hand in AEGY FL corporate filings.

Given the 03/14/2014 announcement of a contemplated merger of SKTO and AEGY, the state of the financial health and the integrity of AEGY are of obvious concerns vis a vis SKTO which boasts a positive balance sheet and superior prospects for growth.

It is therefore vital that an SEC examination of AEGY pursuant to a merger shows no serious defects in said firm lest not only the merger be denied but also the firm be jeopardized and taint SKTO. As you well know, the SEC has developed a lower tolerance for abuse of public trust and markets by OTC tickers. To add, FINRA issued a warning on the MMJ sector in August 2013. Therefore, prudence and circumspection must be the order of the day.

Share Dilution

According to recent AEGY SEC filings:

AEGY (the "Company") has an accumulated deficit of $10,247,626, and a working capital deficit of $1,761,077 as of Jan 31, 2014.

In the the six months ending January 31, 2014, the Company issued 1,339,318,962 common shares resulting in 2,164,853,983 outstanding shares as of January 31, 2014.

As of March 19, 2014, there were 3,549,927,718 shares of common stock outstanding.

These data also show that the pace of dilution from August 1, 2013 to March 19, 2014 was 363 million common stock issued per month.

Even more disturbingly, these data show AEGY issued 1.385 billion common shares in just 32 business days (not counting NYSE holiday) for an average of 43.3 million shares issued every business day from Feb 1 - March 19 inclusive.

Assuming the latter pace of dilution, an additional 476 million common shares of AEGY would have been issued by today's date April, 3, 2014.

Gelmon and Alberta Securities Commission Cease Trade

On 02/10/2014, AEGY presented to the SEC Form 8-K signed by AEGY CEO Mario Barrera. The purpose of the 8-K was to report and explain a material event, i.e., a "Cease Trade" order issued by the Alberta Securities Commission in Canada against AEGY.

In said 8-K, CEO Barrera protested the Cease Trade order and explained that, "The sole apparent basis for the Alberta action, whether or not enforceable against Registrant (i.e., AEGY), was that Michael Gelmon was a director of Registrant from January 2013 to early May, 2013. Mr. Gelmon resigned all positions with the Company as of early May, 2013, long before the 'cease trade order' was issued and is not now affiliated in any way with Registrant."

The aforesaid statement CEO Barrera made to the SEC is questionable in light of the following:

In the latest AEGY 10-Q filed 03/24/14 for period ending 01/31/14 and signed by Mario Barrera as CEO and John F. Burke as Consulting Principal Accounting Officer appear the following statements:

1) "We (i.e., AEGY) have entered into a consulting agreement effective December 31, 2012 with Novation Consulting Services, Inc., which remains in effect."

2) "Mario Barrera currently is our Chairman, President and CEO and sole officer. He is not an employee of the company and is not paid as an employee. Currently, we have no paid employees, full or part-time, and rely on paid consultants to provide necessary services."

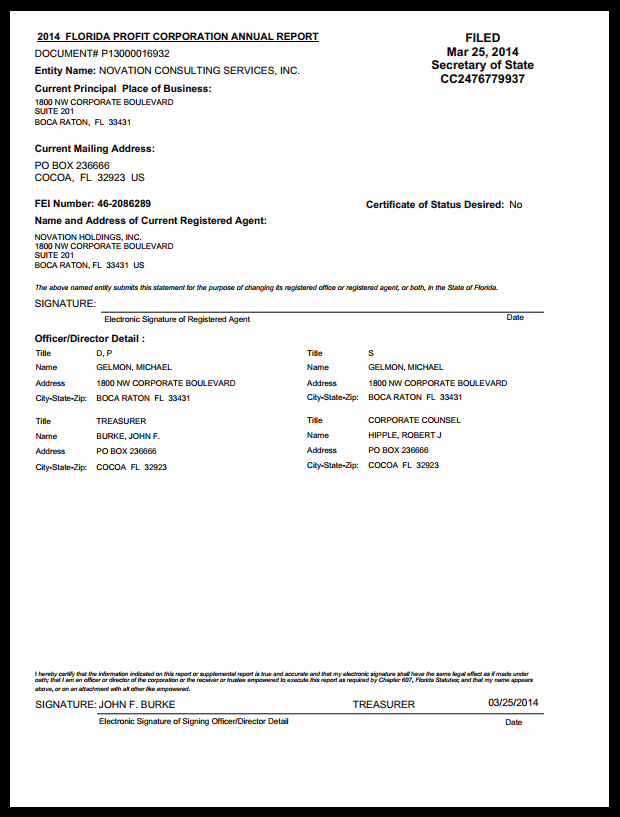

According to FL corporate filings, Novation Consulting Service is peopled by John F. Burke as Treasurer and Michael Gelmon as Director, President, and Secretary. See attachment #1.

John F. Burke is an officer of said Novation Consulting Services, Inc. Burke is also an officer of AEGY and co-signs the AEGY SEC filings as "Consulting Principal Accounting Officer," obviously a remunerated consultant.

However, according to AEGY CEO Mario Barrera in the 8-K: "Mr. Gelmon resigned all positions with the Company as of early May, 2013, long before the 'cease trade order' was issued and is not now affiliated in any way with Registrant (AEGY)."

One can see the problem here:

In brief, Michael Gelmon is President, Director, and Secretary of the same Novation Consulting Services, Inc. that "provide necessary services" to AEGY. And, yet, AEGY CEO Mario Barrera has signed before the SEC in an 8-K that Michael Gelmon is not affiliated in any way with AEGY.

Control Issues and Apparent Duplicity

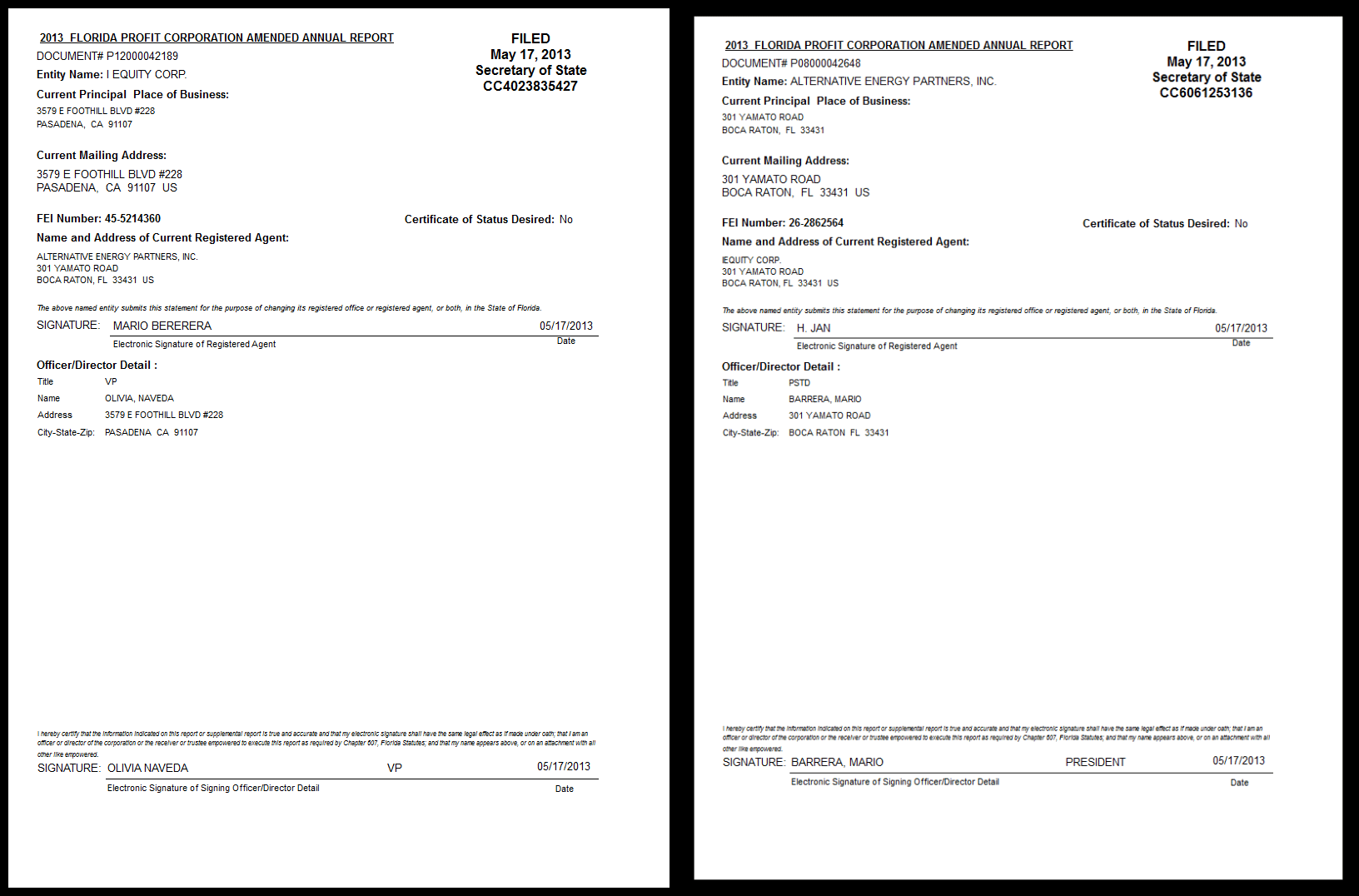

The attachments (no. 2 & 3) speak for themselves. Compare March 25, 2014 with March 28, 2014 filings. Who really runs AEGY? The SEC will ask those hard questions in light of these filings when it inspects them pursuant to a merger application. Please note that Robert Hipple is listed as an AEGY officer in the 03/25/2014 filing despite a five year O&D bar by SEC still in force.

There is also the issue that John F. Burke's firm "MI Financial Services" of Florida-- registered agent of AEGY -- doesn't exist in the FL online corporate data base, sunbiz.org

Thank you for your close attention in these matters.

Attachment #1

Attachment #2

Attachment #3

(0)

(0) (0)

(0)