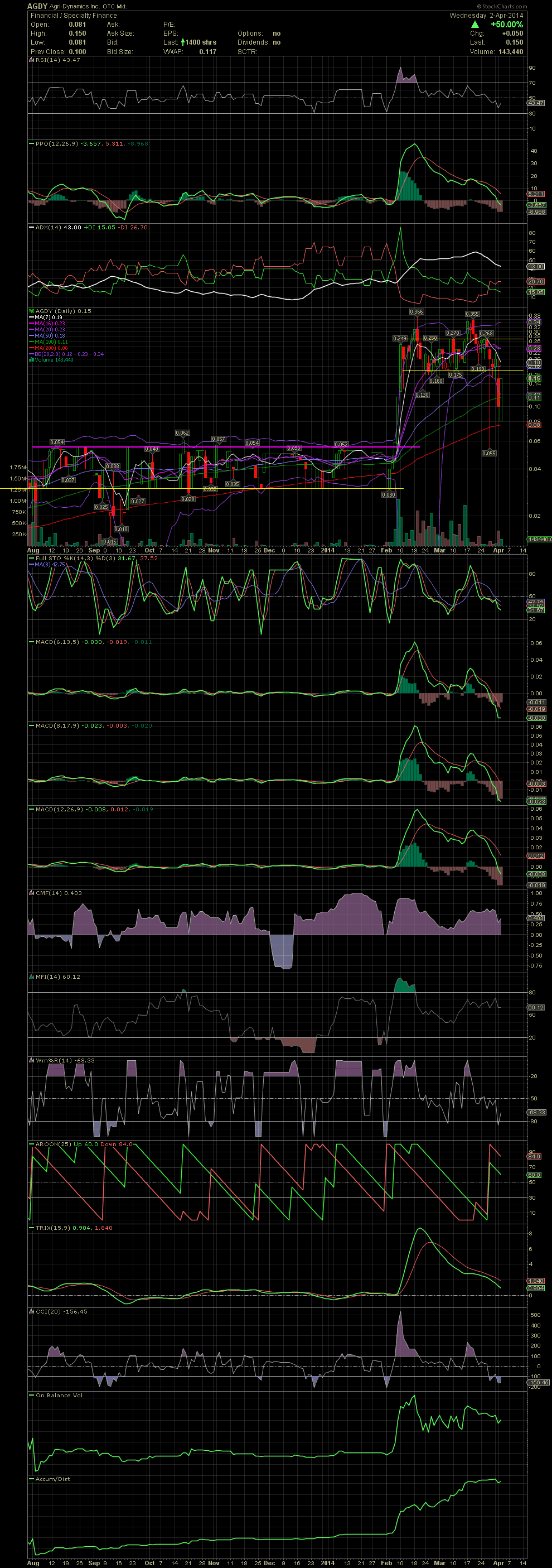

$AGDY Daily Chart ~ A Volatile Ride the Last Few D

Post# of 2561

I received quite a few inquiries as to "WTF is going on with the trading in AGDY". First of all, when you have a stock with a float of just 9.4 million shares, it can be very volatile in both directions. In early Feb, AGDY ran from .03 to the .24s in five days. Then came an intraday pullback into the .13s with a close at .19. That was followed by a four day move into the mid .30s. Last week saw the stock drop from .23 to .055 on only 9,000 shares and closing at .20. Yesterday saw a nervous and falsely informed shareholder sell his 164k shares at what appeared to be a market order. He knocked the stock down from .20 to the .11s. Next, we saw the churning of an additional 200k+ shares had the stock trading between .10 to .125. Smart investors were scooping up those shares being sold by those that were pooping their pants. I got a few of those .11s and .12s yesterday. Today, the stock opened with 1k at .081. No sure what kind of a fool would sell 1k into the opening bid, down 20% from the ask, but he did. I suppose he was raising lunch money for Saturday. A few other amateur hour sellers this morning, and the nervous holders were a thing of the past. AGDY then gradually moved higher to close at .15 for the day. I know of three friends who bought a few on the cheap. One of them got the only .08s traded today for himself. That was only 16k shares, but that's all that traded below .10. He wouldn't share any of those with me though. The nerve! Anyway, AGDY gained back 50% of yesterday's loss due to the inexperience or panic of only one trader. My thoughts are that nothing has changed with the fundamentals as we await major updates from the company. The technicals, FullSto and MACDs are still in decline. To those that swing traded out of AGDY in the high .20s/low .30s when the chart gave a sell signal, great move. That's what the charts and indicators are for. For others, who are holding fairly large positions, it is extremely difficult to move a million shares or more without killing the stock price. Even if they did so, with the intent of re-entering, there just isn't anyway that can happen with a stock where almost all of the 9.4 million float is held by a very small amount of investors. The volume today, just 143,440, was less than the amount sold by the individual who sold his position into the .11s yesterday. Had he attempted to buy back the same amount, 164,000, he wouldn't have been able to do so, as the bargain hunters stepped up the bids and buying. Just another 50k of buying at the ask today, would have resulted in AGDY moving back to .20. And those suckers that panic sold the additional 200k late yesterday are out of luck in buying those back between .10 and .12, where they sold. Anyone who added yesterday and this morning, a job well done! Now I'm hoping for some fundamental news next week that could take AGDY to new highs over the next couple of weeks. GLTA

(0)

(0) (0)

(0)