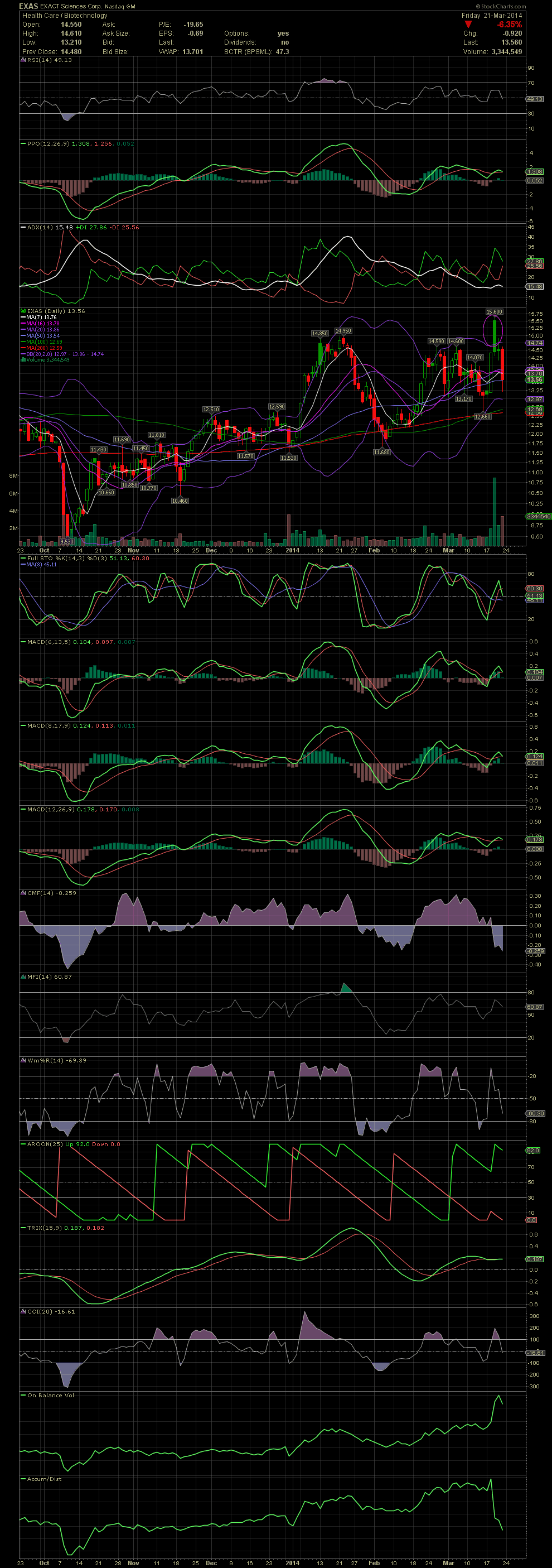

EXAS Daily Chart ~ Setting Up for Another $3 Leg?

Post# of 2561

EXAS has offered opportunities of $2.50/3.00 moves on four separate occasions since October. There's a lot of interest in EXAS over the last week, but a few did buy heavily into that gap and trap last Wednesday. I may not sell into every move outside the upper bollie, but one thing I have learned is to never buy into a gap up and move largely outside the upper bollie. Every once in a while that move might pay off, but in most cases, it's a recipe for an immediate loss. That was seen when EXAS opened at 15.51, hit 15.60 and closed at 14.45, just up .03 for that day. Since then, those that charged into that gap and trap on the news, have lost almost 2.00/share, while those that sold into that gap made a nice gain. I have EXAS on watch now as the drop on Friday was also helped along with the general weakness of the biotech sector. The stock closed on the MA50, so there might be a technical bounce. I'll keep an eye on the FullSto and MACDs for any signs of a momentum shift. If the MA50 fails as support, I would look for the 13.10 area as the next support level, and below that the MA200 at 12.59. The 200 has offered support since Dec. GLTA

(0)

(0) (0)

(0)