Johannesburg-based Harmony Gold Mining (NYSE:HMY) has outlined the potential of the Wafi-Golpu project, a 50-50 JV with Australia's Newcrest Mining in Papua New Guinea, saying in a presentation the deposit could support a $9.8 billion mine with peak annual production of 560,000 gold ounces and 335,000 tonnes of copper.

The mine with a 26-year mine life will cost $4.85 billion to bring to production with annual output at 490,000 ounces of gold and 290,000 tonnes of copper with start-up in 2019 followed by expansion.

The economics of the mainly underground mine located 80 km from the port of Lae is sweet – gold output will cost a negative $2,600 an ounce while copper would be extracted for just $0.54 a pound. Copper was trading at $3.76 in New York on Friday.

The market has been anticipating great things from Wafi-Golpu. Harmony's 2007 pre-feasibility study showed a 1.3 million oz gold and below 1 million tonnes of copper. This has now grown to contain roughly 12.4 million ounces of gold and 5.4 million tonnes of copper.

Harmony Gold says the site is highly prospective and will embark on a feasibility study next year with a focus on enhancing gold recovery which is pegged at 61% at the moment and a $400 million drilling program. Discussions with local landowners are also ongoing.

Harmony Gold's Australian partners Newcrest's (TSX:NM, ASX:NCM) Lihir gold mine in Papua New Guinea has run into trouble with landowners over compensation and the 600,000 gold oz per year mine had to be briefly shut in August.

The government of PNG has the option to take a 30% stake in the Wafi-Golpu mine at cost.

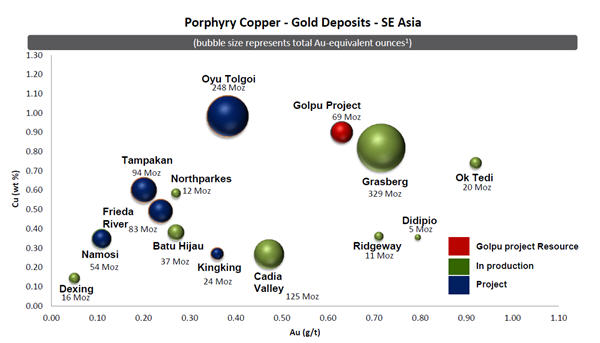

Chart is from Harmony Gold's presentation to analysts – click here for more on Wafi-Golpu.