I think I know what you mean. By the way, my resea

Post# of 36729

http://articles.latimes.com/2014/feb/03/busin...s-20140203

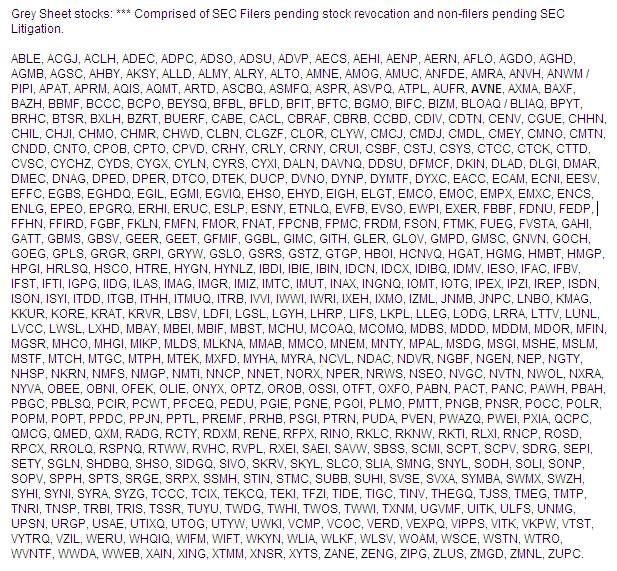

The US Securities and Exchange Commission (SEC) has suspended 255 shell companies from trading from 3 February through 14 February to prevent “pump and dump” fraud, and stocks will not be relisted if companies fail to prove they are operational.

The suspension took hold at the start of trading on 3 February and will end at 11:50 p.m. on Feb. 14. Suspended stocks can't be relisted unless the company can prove it is still operational, a requirement that the SEC said was "extremely rare."

The SEC suspension covers shell companies in 26 US states and two unnamed foreign countries, with the US regulator describing the targets as “ripe for abuse”.

These “pump and dump schemes” being targeted by the SEC generally occur when violators talk up a thinly traded microcap stock through false and misleading statements about the company to the market. The violators buy up the company’s shares cheaply and the pump up the stock price by creating the appearance of market activity and then dump the stock for a massive profit.

This activity was made famous through the 2014 Hollywood movie, The Wolf of Wall Street, which is based on the true story of former US stockbroker Jordan Ross Belfort, who served 22 months in prison for causing investors to lose $200 million through a pump and dump scheme.

The SEC moved to suspend 61 other shell companies in June last year, along with 379 shell companies in 2012. This is part of the SEC’s ongoing initiative dubbed “Operation Shell-Expel,” which was launched in 2012.

The suspension will end at 11:50 p.m. on 14 February, and according to the SEC, the “trading suspension essentially renders the shells worthless and useless to scam artists.”

Because these shells all too often are used by those looking to manipulate stock prices, we will continue to protect unwary investors by suspending trading in shells,” Andrew J. Ceresney, director of the SEC’s enforcement division, said in a statement.

###

###

SEC

FOR IMMEDIATE RELEASE

2014-21

Washington D.C., Feb. 3, 2014

The Securities and Exchange Commission today announced the latest actions in its microcap fraud-fighting initiative known as Operation Shell-Expel, suspending trading in 255 dormant shell companies ripe for abuse in the over-the-counter market.

Pump-and-dump schemes are among the most common types of fraud involving microcap companies. Perpetrators will tout a thinly-traded microcap stock through false and misleading statements about the company to the marketplace. After purchasing low and pumping the stock price higher by creating the appearance of market activity, they dump the stock to make huge profits by selling it into the market at the higher price.

Since Operation Shell-Expel began in 2012, the SEC Enforcement Division’s Office of Market Intelligence has been cleaning up the microcap marketplace by scrutinizing penny stocks nationwide and identifying clearly inactive companies. This has enabled the SEC to proactively suspend trading in several hundred dormant shell companies before fraudsters have an opportunity to manipulate them.

“A frequent element in pump-and-dump schemes has been the use of dormant shells,” said Andrew J. Ceresney, director of the SEC Enforcement Division. “Because these shells all too often are used by those looking to manipulate stock prices, we will continue to protect unwary investors by suspending trading in shells.”

Today’s massive trading suspension involves dormant shell companies uncovered in 26 states and two foreign countries. Once a stock has been suspended from trading, it cannot be relisted unless the company provides updated financial information to prove it is still operational. It is extremely rare for a company to fulfill this requirement, so the trading suspension essentially renders the shells worthless and useless to scam artists.

“Policing this sector of the markets can be a challenge,” said Margaret Cain, a microcap specialist in the Office of Market Intelligence. “There is often little or no reliable information about a microcap issuer, and the sheer number of these companies stretches law enforcement resources thin and makes this sector particularly dangerous for investors. The approach we take with Operation Shell-Expel is both economical and efficient as the SEC continues its commitment to preventing microcap fraud.”

###

(0)

(0) (0)

(0)