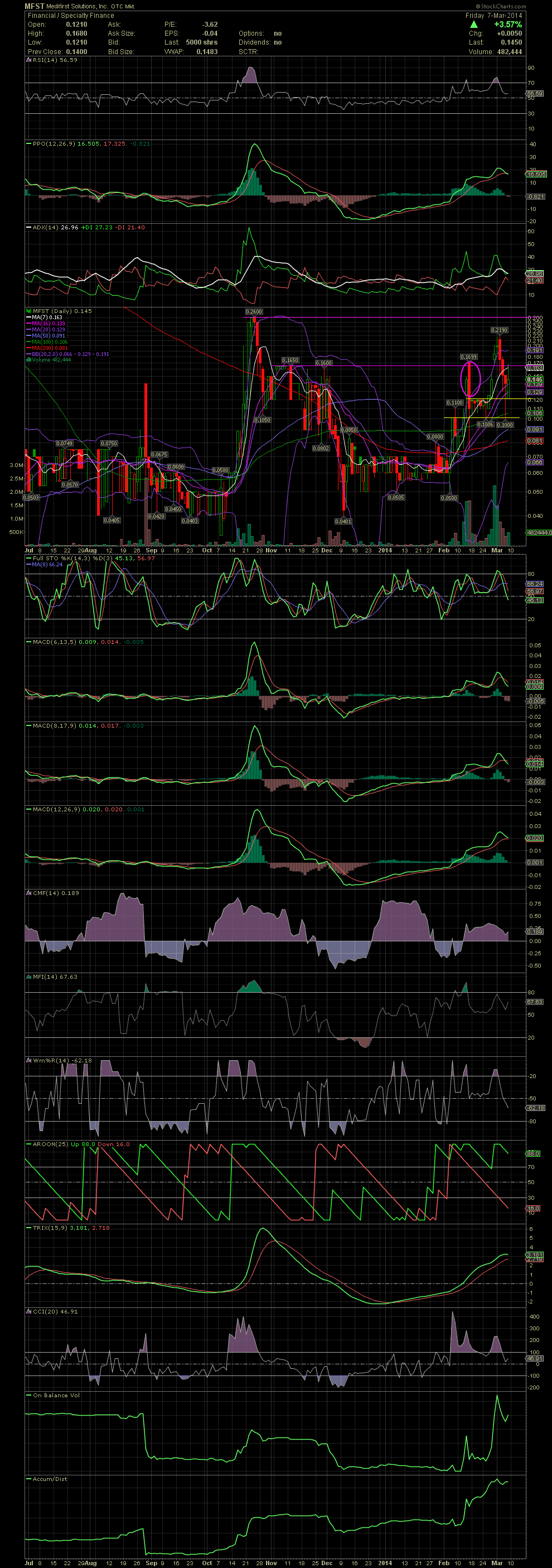

MFST Daily Chart ~ Thinly Traded Makes for Volatil

Post# of 2561

I bid all week for some more MFST from .10 to .135. Although the stock did trade down to .10, I didn't receive one share. I did add a few on Friday in the .14s, and those orders took almost the entire day to get executed. I've learned a bit more about MFST over the last week, so I won't be selling any unless we get a similar move outside the upper bollie during a run up. There's a real possibility of a multi bagger here in MFST should the execution of management continue. As for the technicals and chart, the selloff from being outside the upper bollie, to as high as .219, saw a decline on Thursday and Friday to two short term support lines, at .10 and .12. And yes, the FullSto and MACDs are curling to the downside, but as seen with the failure to get any shares, with orders sitting from .10 to .135, makes me believe that something else is happening. Rumors of strong news pending this week would turn the chart quickly because of the low float and sharp intraday moves. GLTA

| 03/07/14 | Bought | 10,000 of MFST @ $0.145 (Order #829) | -1,457.99 |

| 03/07/14 | Bought | 20,000 of MFST @ $0.142 (Order #822) | -2,847.99 |

(0)

(0) (0)

(0)