Qualifying the merged entity for listing at Nasdaq

Post# of 36729

Nasdaq (Small) Capital Market Listing Requirements (min $2 or $3, depending on program)

As of Sept 2012: "Under the new NasdaqCM (Nasdaq Capital Market) requirements, a stock can qualify for listing if it closes at $3 or above for at least five consecutive business days prior to approval. The five-day requirement is in place to reduce the risk of price manipulation aimed at allowing a security to qualify for listing. In addition to the $3 share price requirement, the company must meet the following requirements:

Stockholders’ equity of at least $5 million

Market value of publicly held shares of at least $15 million

Two years of operating history

or:

Net income from continuing operations of $750,000 in the most recently completed fiscal year or in two of the three most recently completed fiscal years

Stockholders’ equity of at least $4 million

Market value of publicly held shares of at least $5 million.

Securities with a $2 minimum closing price for five consecutive business days prior to the approval can also qualify for listing on the NasdaqCM if they meet the Market Value of Listed Securities Standard, which requires a market value of listed securities of at least $50 million, stockholders’ equity of at least $4 million, and a market value of publicly held shares of at least $15 million

In addition, companies must demonstrate that they have more than $2 million in net tangible assets if they have been in continuous operation for at least three years, or more than $5 million if they’ve been in continuous operation for less than three years. A company must also have average revenue of at least $6 million for the past three years. All other requirements for listing on the Capital Market are the same or higher than those of the NYSE Amex."

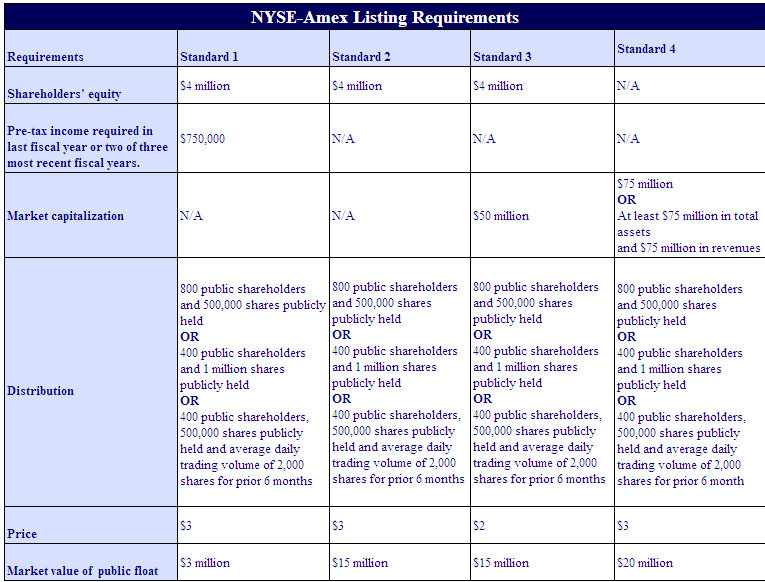

NYSE AMEX Listing Requirements ($3 minimum price)

(0)

(0) (0)

(0)