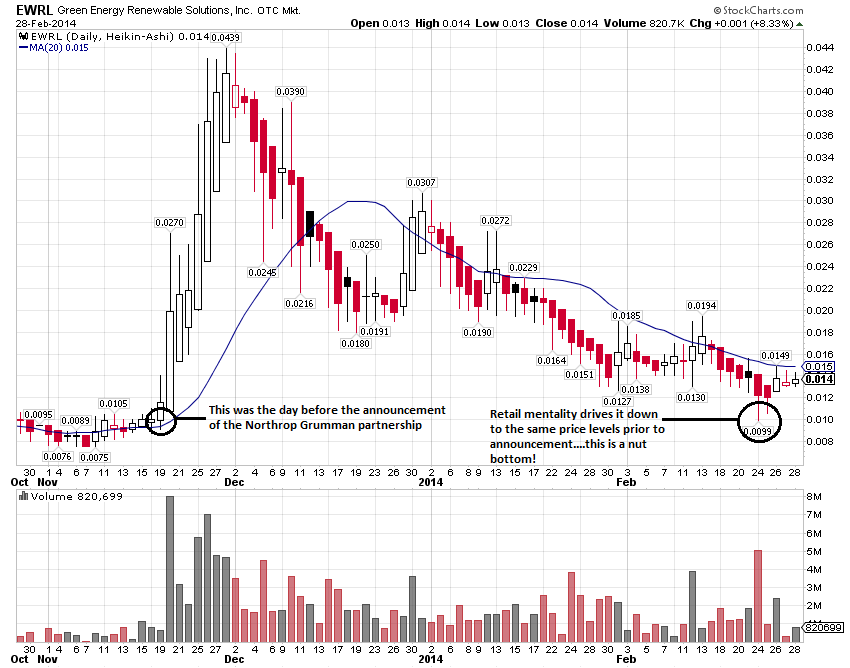

One of a few charts to post here(more later): Si

Post# of 1352

Since November 19th.....roughly 110 million shares traded. Of that, 23% was dilutive* from prior financing(which isn't used anymore). That leaves 77% of shares traded by retail hands. As I have pointed out many times over, dilution is really never the problem(for the most part)... the problem is retail . By applying the simplest math(5th grade level)....if 23% of retail purchased those dilutive shares...that leaves another 54% out there. You know them...hit and run for small profits or a loss, while others follow their trail....being..impatient and selling for a loss/small gain. Others build too much of a base and sell down some of their holdings to a safer level(a bit different...sometimes you have to). Also, lack of timing and no diligence to the study.

When will they learn?..... bottom is in........short term swing set @ six months..........or play longer....... or play both with a build on the til. I tend to play both with the really good ones(ie C...V...$...$). Enjoy this and chose your place wisely at all times.

* check filing

(0)

(0) (0)

(0)