Good find. Thanks. This needs to be studied as to

Post# of 36729

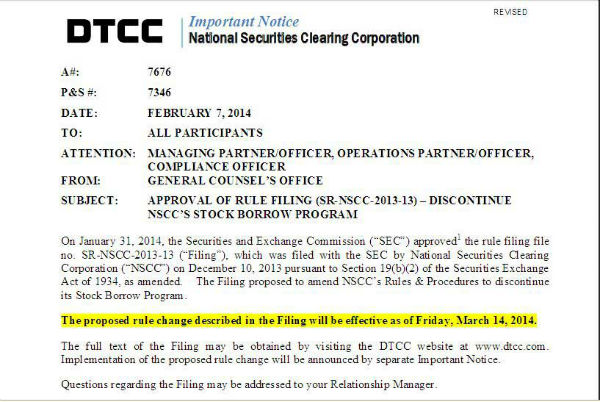

TO: ALL PARTICIPANTS

ATTENTION: MANAGING PARTNER/OFFICER, OPERATIONS PARTNER/OFFICER,

COMPLIANCE OFFICER

FROM: GENERAL COUNSEL’S OFFICE

SUBJECT: APPROVAL OF RULE FILING (SR-NSCC-2013-13) – DISCONTINUE

NSCC’S STOCK BORROW PROGRAM

On January 31, 2014, the Securities and Exchange Commission (“SEC”) approved the rule filing file no. SR-NSCC-2013-13 (“Filing”), which was filed with the SEC by National Securities Clearing Corporation (“NSCC”)on December 10, 2013 pursuant to Section 19(b)(2) of the Securities Exchange Act of 1934, as amended. The Filing proposed to amend NSCC’s Rules & Procedures to discontinue its Stock Borrow Program.

The proposed rule change described in the Filing will be effective as of Friday, March 14, 2014.

###

Definition of 'National Securities Clearing Corporation - NSCC

A subsidiary of the Depository Trust & Clearing Corporation (DTCC) that provides centralized clearing, risk management, information and settlement services to the financial industry. The NSCC offers multilateral netting so that brokers can offset buy and sell positions into a single payment obligation, thereby reducing financial exposure and capital requirements.

The National Securities Clearing Corporation was established in 1976 and is a registered clearing corporation regulated by the U.S. Securities and Exchange Commission (SEC). Before its inception, huge demand of paper stock certificates were a reality for stock brokerages, causing the stock exchanges to close once a week. To overcome this problem, multilateral netting was proposed, leading to the formation of the NSCC. The corporation serves as a seller for every buyer, and buyer for every seller for trades settled in U.S. markets.

The NSCC and DTC (another subsidiary of the DTCC) play a major part in the settlement and clearing of securities transactions. They are the largest providers of these services, worldwide.

###

(0)

(0) (0)

(0)