Idaho state banking regulators closed Syringa Bank, Boise, Idaho, and appointed the FDIC as receiver for the failed bank. The FDIC sold Syringa Bank to Sunwest Bank, Irvine, CA, which will assume all deposits of the failed bank.

Idaho state banking regulators closed Syringa Bank, Boise, Idaho, and appointed the FDIC as receiver for the failed bank. The FDIC sold Syringa Bank to Sunwest Bank, Irvine, CA, which will assume all deposits of the failed bank.

Syringa Bank, founded in 1997, had total assets of $153.4 million and total deposits of $145.1 million as of September 30, 2013. All six branches of the failed bank will reopen as branches of Sunwest Bank and all depositors will continue to be covered by FDIC deposit insurance up to the applicable limits. Over the weekend, depositors of Syringa Bank will have access to their money through the use of ATMs, checking accounts and debit cards.

Although the risk of major bank collapses appears to be a thing of the past, there are hundreds of smaller banks that have been unable to recover from large loan losses. The FDIC still classified 7.4% or 515 banks as “problem banks” as of September 30, 2013. The inability to raise additional capital, slow economic growth, and weak capital structures will continue to plague smaller banks. In the previous banking crisis involving mainly savings and loans, the Feds relentlessly closed weaker banks. Prior to the banking crisis of 2008 only a handful of banks appeared on the Problem Bank List compared to over five hundred today.

Sunwest Bank agreed to purchase all of the assets of Syringa Bank and the FDIC extracted a premium of 0.75 percent on the deposits assumed by Sunwest.

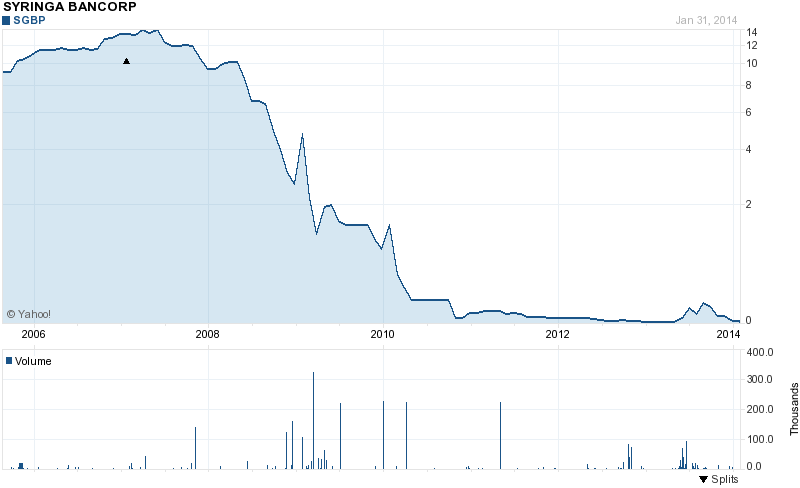

The shareholders of Syringa Bancorp, the holding company for Syringa Bank, wind up with worthless shares after trading as high as $14 per share in 2007. Shares of Syringa Bancorp closed at a mere 2 cents per share in Friday’s trading.

Courtesy: yahoo finance

The cost to the FDIC deposit insurance fund for the failure of Syringa Bank is $4.5 million. Syringa Bank is the third banking failure of the year and the first bank failure in Idaho since April 2009. Since the start of the banking crisis in 2008 there have been a total of 492 banking failures.