Nicholas J. Johnson, an executive vice president at PIMCO, the world's largest money manager with an eye-watering $2 trillion in assets across its various funds, is also the company's portfolio manager focusing on commodities.

In one of the giant financial company's latest missives, Johnson makes a compelling attempt to demystify the gold price ; s omething some of the smartest people in the financial world are more than willing to admit they cannot explain or understand.

Billionaire investor Warren Buffet famously eschews investment in the metal and positing that aliens from Mars would only scratch their head when they see humans dig it out of a hole in the ground, melt it down, put it back in the hole and then pay people to look after it.

Those steering the finances of the free world also plead ignorance about gold, despite that fact that gold is one of the most liquid assets in the world with daily trade exceeding $240 billion – more than US equity markets combined.

Current chair of the US Federal Reserve Janet Yellen said last year: "I don’t think anybody has a very good model of what makes gold prices go up or down,” while her predecessor showed equal befuddlement over the price of gold when he answered a question by saying: ""Nobody really understands gold prices and I don't pretend to understand them either."

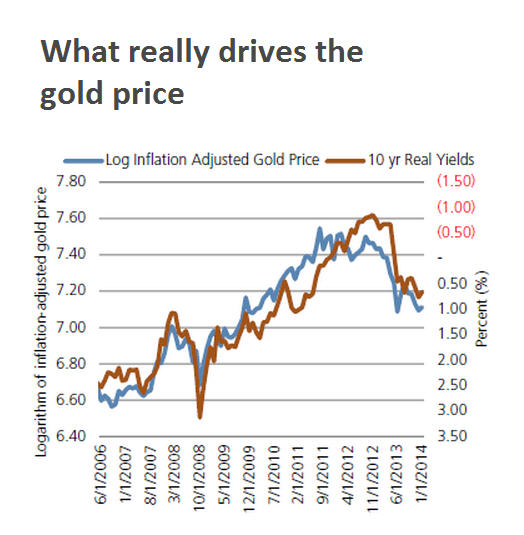

PIMCO makes a convincing case that above any other consideration including the growth of gold-backed ETFs, central bank purchases or government actions like India's import curbs, the number one factor influencing the price of gold is the real yield on 10-year US Treasurys:

"Based on our study, the regression shows that, all else equal, a 100-basis-point increase in 10-year real yields has historically led to a decline of 26.8% in the inflation-adjusted price of gold."

Johnson goes on to say that the correlation is so strong that the gold price can be used as a predictor of interest rates:

"Using this framework, consider the 15% price drop in gold in mid-April following talk of Fed tapering. This move predated the sharp move higher in yields in the fixed income market by two weeks. Over the month of May, 10-year real yields rose 57 bps. Even though the markets moved at different times, the size of their moves over this period was remarkably consistent with the historically observed 27-year real duration. In hindsight, we believe the move in gold gave an excellent early warning of both the direction and magnitude of the move in rates."

Johnson does give credence to the influence on prices of the perception of gold as a safe haven asset, but argues it is also subordinate to the 10-year yield correlation:

"During the credit crisis and the bankruptcy of Lehman Brothers, many market participants expected gold to do very well. Yet gold prices actually declined during the second half of 2008 as the credit crisis intensified. Why? During the credit crisis we saw a spike in the level of real yields, which puts downward pressure on gold prices. But the real-yield adjusted gold price actually rose sharply following the Lehman Bankruptcy. This shows us that while there was a flight-to-quality bid that increased the real-yield-adjusted gold price, the impact of higher real yields was larger."

Johnson sums up by saying "as gold increasingly becomes a financial asset, when real yields rise, gold prices should fall if they are to maintain a given level of financial demand relative to investors’ other opportunities. Similarly, when real yields fall, we expect the price of gold to rise":

"Looking ahead, we expect the Federal Reserve to move very gradually in reducing accommodative policy and for 10-year U.S. real yields over the next several months to be relatively steady around current levels, which would be neutral for nominal gold prices."

Continue reading at PIMCO Viewpoints .