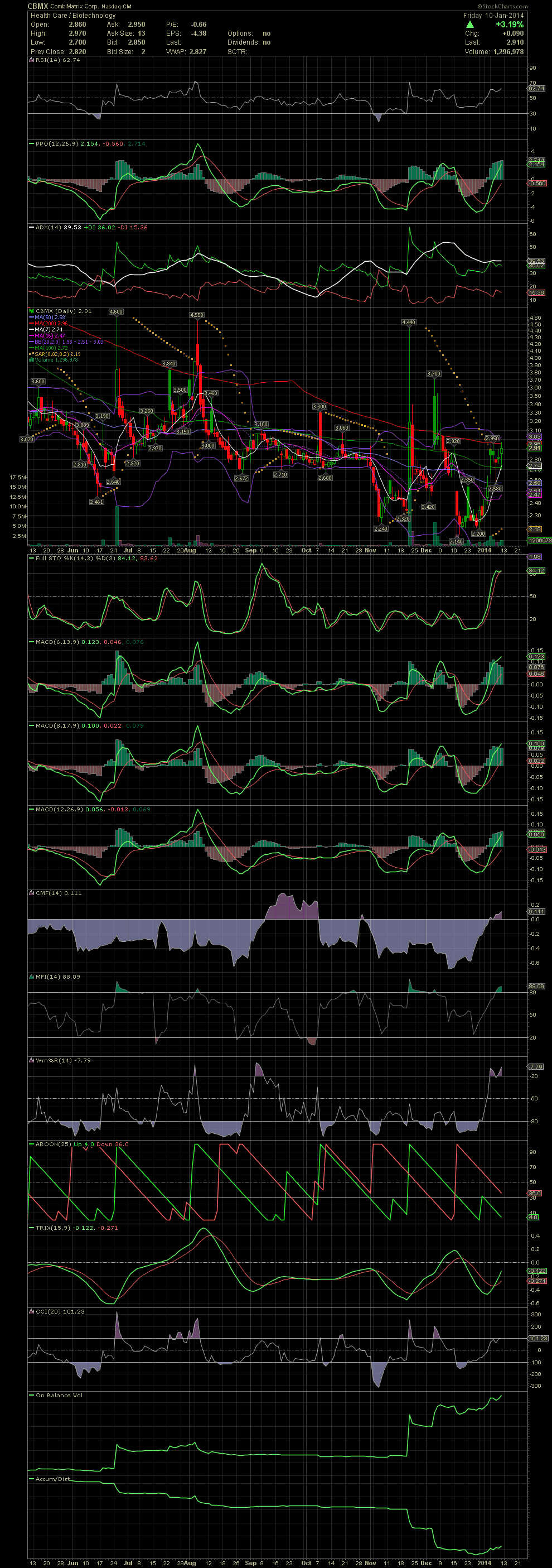

CBMX Daily Chart ~ Attempting to Clear the MA200

Post# of 2561

Friday saw another attempt at moving above the MA200. The stock appear to be consolidating some of the gains of this last week when it gapped from the 2.50s into the 2.80s. Closing at 2.91, the stock is barely above the previous closing highs of early December. Although the FullSto is already in the 80s, the MACDs are showing great divergence and have room to move. Fundamentally, CBMX seems to be inexpensive, so I added a few more on Friday in the 2.80s again. The key this coming week will be to see the volume pick up while closing over the MA200. I'll be looking for a close above the 3.10 previous high in Sept. All the other candles at higher prices were simply gap openings which obviously all failed to hold, therefore the solid candles (not a good thing to me). GLTA

(0)

(0) (0)

(0)