The price of gold is down 28% in 2013 and is set to break the 12-year bull run that took it from around $270 an ounce at the end of 2000 to a record high above $1,900 in September 2011.

Gold's $480 an ounce fall in 2013 is the worst performance since 1980, when the yellow metal hit $850 an ounce, in inflation adjusted terms still the all-time high.

Here are nine ways 2013 changed the nature of the gold market and pulled it into bear territory:

1. A collective loss of confidence

Gold bugs used to be able to roll with the punches and absorb price shocks. This year they had no fight left

When gold fell off a cliff ( or as many believe, was pushed off ) in April, the last bit of upward momentum in the price was lost. Market reaction was completely different after September 2011’s record price.

When gold fell off a cliff ( or as many believe, was pushed off ) in April, the last bit of upward momentum in the price was lost. Market reaction was completely different after September 2011’s record price.

The pullback from the all-time high was as dramatic as the April shocker, but that did not stop money from continuing to pour into gold assets: gold fell almost $300 over three weeks from the $1,900+ high, but over than same period more than 20 tonnes flowed INTO granddaddy GLD alone and the buying didn’t stop for another 15 months.

In 2013, gold’s Q2 $200 smack down over just two sessions, saw 80 tonnes flow OUT of GLD within 3 weeks and the selling hasn’t stopped.

2. €urotrash talk, EM mayhem and a Cypriot riot

A country named after a metal sparks a meltdown

In 2012 stories about the single currency turning into eurotrash, the breakup of the world’s largest economic bloc and the destruction of what was left of the international financial system after Lehman Brothers, kept markets entertained and the gold price humming.

In 2012 stories about the single currency turning into eurotrash, the breakup of the world’s largest economic bloc and the destruction of what was left of the international financial system after Lehman Brothers, kept markets entertained and the gold price humming.

In 2013, talk of a currency war between the developed world and emerging markets briefly perked up ears, but words like Spanic and Grexit were (thankfully) banished from the lexicon completely as old Europe faded from the headlines.

Except for one tiny island beloved by Russian oligarchs and other tax avoiders; its puny central bank and its miniscule gold reserves. Back in March Cyprus hinted it would sell 10.36 tonnes of gold, worth $500m at the time, to help fund its $13bn bailout. That’s not enough ounces to keep the ETF trade busy for a morning, but the damage was done and the issue that paralyzed the market for decades – central bank sales – was back on the table.

3. Fed up

The days of the Fed and the gold price being joined at the hip are over

When the US Federal Reserve unleashed its quantitative easing program on an unsuspecting gold market in December 2008 gold was hovering around $800. QE1 and August 2010's second round set off waves of buying, that turned gold into a one-way for the next three years culminating in September 2011 record high.

When the US Federal Reserve unleashed its quantitative easing program on an unsuspecting gold market in December 2008 gold was hovering around $800. QE1 and August 2010's second round set off waves of buying, that turned gold into a one-way for the next three years culminating in September 2011 record high.

By the end of that month gold was in danger of crashing through $1,600 – down almost $300 in less than a month – but once again the Fed stepped in with 'Operation Twist' lifting gold (briefly) back above $1,800 by November.

Just as the Fed’s easy money was losing its ability to boost anything about the US economy bar the stock market, the Feds actions and pronouncements were having less and less of an effect on gold.

During the most dramatic price action in 32 years – April’s $200 drop over a Friday and Monday – the Fed was nowhere in sight.

And last week’s surprise/no-surprise taper announcement did move the gold price, but the action was subdued, particularly considering the record number of short players present in the market. By the time the dust settled gold was back in a happy trading range.

4. Someone's using the h-word again

Hedging is safe, predictable and looks good on accounting paper. What’s not to love?

The vicious combination of central bank selling, lease rates of 1% or less and producer hedging during much of the Eighties and Nineties choked off any possibility of a serious rise in the gold price which ended the last in the mid-$200s. Major producers like Barrick Gold and Anglogold spent billions buying out hedge books and still made money on the deals as gold began its 12-year climb.

The vicious combination of central bank selling, lease rates of 1% or less and producer hedging during much of the Eighties and Nineties choked off any possibility of a serious rise in the gold price which ended the last in the mid-$200s. Major producers like Barrick Gold and Anglogold spent billions buying out hedge books and still made money on the deals as gold began its 12-year climb.

Now that the bull run is over and the windfall profits squandered on wildly overpriced takeovers and fanciful projects, suitably chastened producers are dusting off their hedge books. And are ready to spin stories about the win-win benefits of the strategy.

5. Portfolio pushers and yield chasers

After a 12-year bull run in gold, the metal’s portion of your average investment portfolio had become too outsized

A correction after gold's near 20-year bear market had a certain inevitability to it, but so does a pause after a dozen up years.

A correction after gold's near 20-year bear market had a certain inevitability to it, but so does a pause after a dozen up years.

With confidence in the global financial system slowly returning, 2013 became the year the ‘smart money’ decided to turn gold into just another asset class to rotate into – but mostly out of. While this rebalancing act at times looked and felt more like a run on a bank or a currency than a careful portfolio risk-adjustment, it had to be done.

That gold unlike stocks, bonds and property, offers no yield is not news to anyone and thanks to a 350% appreciation since 2000, no-one cared. But this year portfolio managers judged the opportunity cost of holding gold to be simply too high – especially considering a full percentage point in real returns on risk free investments became available as US inflation fell to 1.2% and the yield on 10-Year Treasurys approached 3%.

6. Paper beats rock

Indian brides and Chinese housewives maxing out on gold don’t stand a chance against New York futures and options traders

India’s finance ministry did everything it could this year to suppress Indians’ lust for gold. What seemed like sensible measures to shore up the falling rupee and correct balance of payments problems, in no time succumbed to the laws of unintended consequences. Higher import duties begat more smuggling, more smuggling begat ludicrous premiums (only the father of new bride would shell out $140/oz over London fix and there are 10 million weddings a year in India), ludicrous premiums begat a parallel trading market and so on. In short nothing will quench India’s thirst for physical for gold.

India’s finance ministry did everything it could this year to suppress Indians’ lust for gold. What seemed like sensible measures to shore up the falling rupee and correct balance of payments problems, in no time succumbed to the laws of unintended consequences. Higher import duties begat more smuggling, more smuggling begat ludicrous premiums (only the father of new bride would shell out $140/oz over London fix and there are 10 million weddings a year in India), ludicrous premiums begat a parallel trading market and so on. In short nothing will quench India’s thirst for physical for gold.

Likewise China. The cultural significance of gold in China is routinely underestimated compared to their neighbours to the southwest, but on top of the social uses, the Chinese aunts and housewives (at least according to common lore) who are buying up all the tonnes the West is selling do so for very practical reasons.

It’s the only real investment option available to households with stack of unconvertible renminbi who shun the local stock market for obvious reasons (it’s an unregulated mess), can only buy so many apartments in so many ghost towns and haven’t figured out the Macau round-tripping trick yet. While premiums in Shanghai topped out at $37, even better for the demand picture is the ban on exports making Chinese the ultimate buy and hold investors.

This scenario may be great for physical gold long term, but amounts to a slow day in the highly-leveraged paper trade. Two years ago already the DAILY trade in gold futures and options was worth $240 billion, more than on the S&P 500 or Dow Jones. 50 billion ounces changed ounces in 2011. This is where the pricing action is in gold. In the time US sold gold go via London to smelters in Switzerland through customs in Hong Kong to an apartment in Tianjin light years have passed in the world of high-frequency trading.

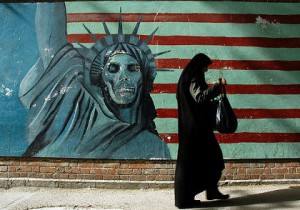

7. Not playing it safe anymore

The contrasting reaction in the gold market to turmoil in the Middle East today and 33 years ago is striking and spells the end of gold’s status as a safe haven

In January 1980 the hostage drama in Iran and the Soviet invasion of Afghanistan propelled gold 52% higher to $850 in a matter of weeks. In inflation adjusted terms that’s still the all-time high for gold (roughly $2,400).

In January 1980 the hostage drama in Iran and the Soviet invasion of Afghanistan propelled gold 52% higher to $850 in a matter of weeks. In inflation adjusted terms that’s still the all-time high for gold (roughly $2,400).

In 2013 Syria became the crucible of the Middle-East, drawing in petrodollars and arms from all the major powers in the region and pitting Russia and China against the US.

Not the threat of US military action or the continuing spillover effects could meaningfully lift the gold price – or oil for that matter – and flights to gold’s safe harbour proved small-scale and short-lived.

8. Fundamentals are for fools

The situation on the ground and underground matters little

In any sane market fundamental short and long term changes to the supply picture would play out in price discovery. Not so gold, especially not in 2013 when industry-wide strikes in South Africa, shutdowns in Indonesia and delayed projects all around the world hardly registered with gold traders.

In any sane market fundamental short and long term changes to the supply picture would play out in price discovery. Not so gold, especially not in 2013 when industry-wide strikes in South Africa, shutdowns in Indonesia and delayed projects all around the world hardly registered with gold traders.

All evidence of mounting extraction costs, a dearth of new discoveries, the drying up of money to develop mines and the disappearance of skills to operate them are now being ignored when gold prices are set.

Focusing only on one side of the supply-demand equation is a bit like the sound of one hand clapping. Which is what gold bugs were greeted with this year.

9. Doomsday postponed

They are coming for your guns and your gold, just not yet

Inflation expectations and/or reality and paper currency debasement remain the most convincing argument to buy gold.

Inflation expectations and/or reality and paper currency debasement remain the most convincing argument to buy gold.

But this year the United States did not become the Weimar Republic, Japan does not resemble Zimbabwe, the UK hasn’t ditched the pound for bitcoins and ECB euros still has enough value to bail out Mediterranean Europe.

Despite the $9 trillion and counting monetary expansion undertaken by central banks hyperinflation is a distant prospect and CPI rates are in abeyance in most developed and emerging economies and near record lows in the US.

On top of that the correlation of the gold price to the rate of paper money printing broke down early this year, long before taper became the word of the year.

Image of Tehran mural by Image by -john- | Image of Limassol Carnival in Cyprus by ruzanna | Image of gold winged shoes in Hong Kong by pondspider | Image of gold street performer smoking by mattneale