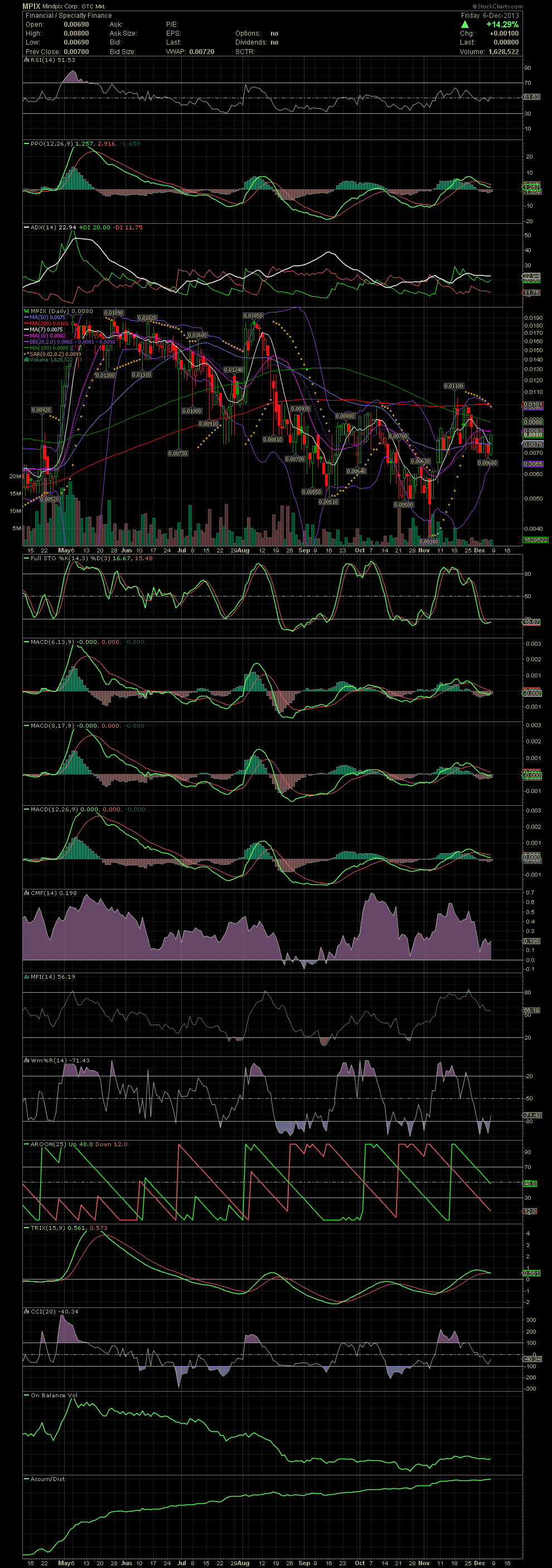

MPIX Daily Chart ~ Indicators Lining Up for the Ne

Post# of 5570

Good evening StuKiwi and all MPIXers. You are correct Stu in your thoughts of the chart. A lot of indicators are beginning to turn positive again after a three week decline in share price from .011 to the .006s. The RSI is holding near its 50 line. The PPO and ADX are turning up slightly. The FullSto is clearly at levels that lead to a sharp rally, and it is in a positive crossover. The MACDs are beginning to turn up and could be in the green within a couple of days. CMF is turning higher. MFI is holding above the 50 line. The Willy is coming out of oversold territory. The OBV is completely bottomed out, while the AD line continues to show massive accumulation over the months. A strong management team, a quality IR firm in place, OS down to 1.06 billion from almost 1.5 billion, audited financials being completed in Q4/early Jan, S-1 SEC Registration to be filed, an uplisting to the QB early in the year, and numerous revenue producing projects/events to be announced in short order. What's not to like? I'm hoping that this next leg, based on fundamentals and material developments, will take the stock over the .0185/.02 triple tops for good. GLTA

(0)

(0) (0)

(0)