NYBD Daily Chart ~ Setting Up for a Potential Larg

Post# of 2561

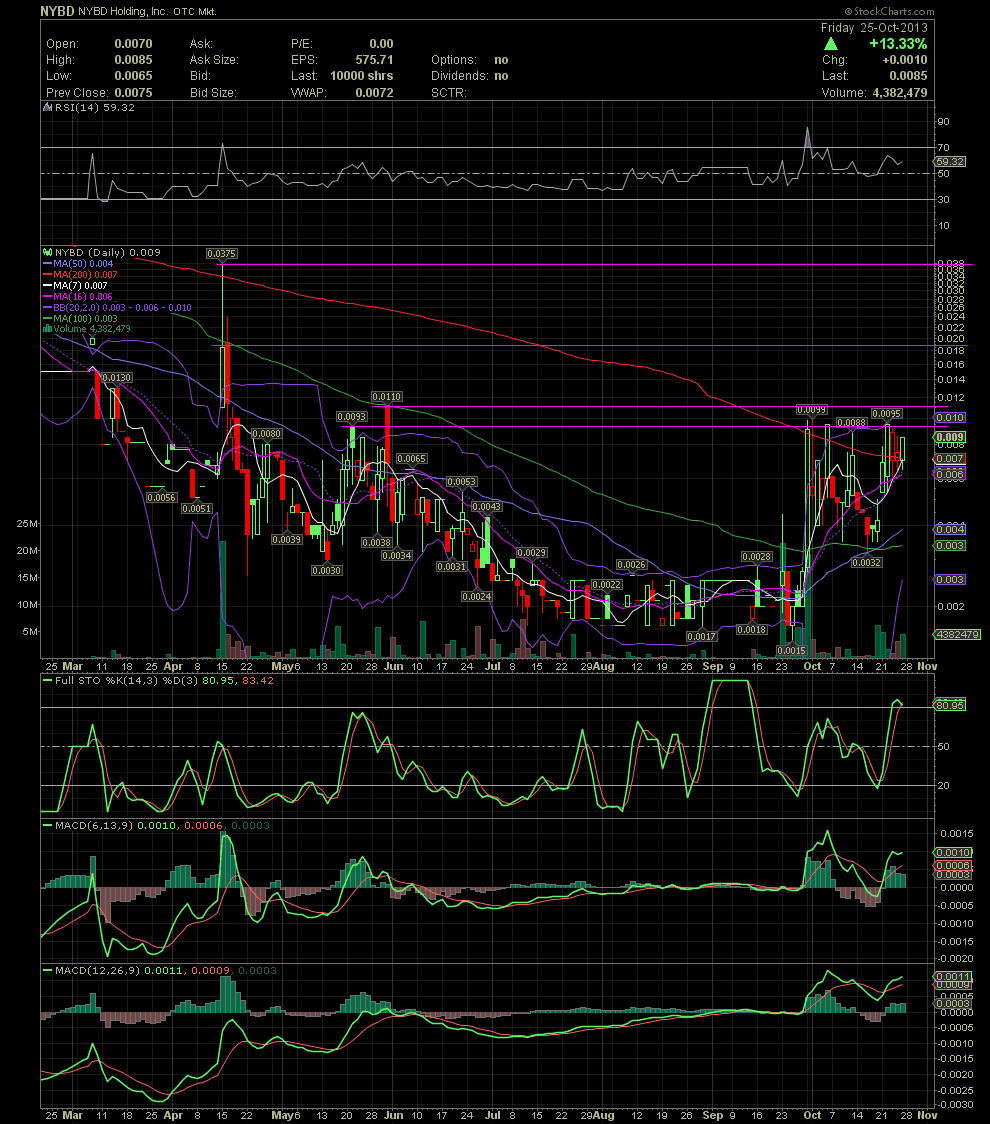

Those of you following along or already invested since late Sept, saw NYBD take a sharp move from the .002s to a high of .0099. Since then, the stock has been trading to as low as .0032 to .0095 as a few investors are accumulating shares. The new CEO is positioning NYBD for the rollout of Pleasant Kids. I like the business model and see an excellent opportunity for big gains with a mid-term hold. As always, just my opinion, but I'll continue accumulating with friends and bid for more as older shareholders continue to take the recent strength as their opportunities to sell what they are holding.

The technicals here are easy to understand. After basing and channeling between the mid .001s to the .0026/.002s for just over two months, the stock broke out in late Sept as it became obvious that the new CEO actually has a very interesting and exciting business plan. The initial push to .0099 continues to serve as the horizontal resistance on this chart although there was only 1,000 shares traded there. I chose to drawn in the resistance at .0093 as there was more volume at that level that the two trades at .0095 and .0099. After selling off from the high in late Sept, the stock received support from the MA50 and MA100 near the low .003s. Since then, the stock has been gradually moving back up with higher lows and testing the high .008s and .009s while shareholders await the news flow from management. A few of us will continue to accumulate while bidding near .007 in the hopes that another few million shares find their way into our hands. A break above .0099/.01 over the next couple of weeks would probably see a move into the .02s to the high .03s. The longer term potential will be seen in the Weekly Chart that I'll post next.

(0)

(0) (0)

(0)