October 2, 2013: It's come to our attention that BLUF will once again become the subject of a Pump & Dump scheme tomorrow. We think it is time to review this very important expose.

---

He pulls up to his business meetings in a Bentley, wearing fancy clothes and slicked back hair, the standard attire/facade of the confidence man. When casually asked by acquaintances, family and friends he claims to be an investment banker or an oil man. In truth, Jim Can is Calgary's King of Penny Stock fraud and he has stolen millions from the public with his various schemes.

Known as the headquarters for several major energy companies thanks to Alberta's vast oil reserves, Calgary, is a western Canadian boom town turned big city. A bland, cultureless home to about one million people mostly living in cookie-cutter houses, Calgary is the residence of oil executives and wannabes alike. As home of the now defunct Alberta Stock Exchange, Calgary was also a bastion of fraudulent energy and mineral plays listed on the Alberta and Vancouver Stock Exchanges, perhaps none more prevalent than the infamous Bre-X Minerals scandal, which resulted in the merging of the two exchanges into the TSX-Venture Exchange, and significantly tighter regulations and reporting requirements. With the noose tightened around shysters who would pick the pockets of unsuspecting investors with "fool's gold" plays, these snake oil salesman packed up their salted mines, and other phony baloney get-rich-quick schemes, and looked to the US OTC markets as a safe haven to conduct "business". In an environment where FINRA often looks the other way and the SEC is impotent, penny stock fraud is rampant, and there are plenty of suckers and believers in fairy tales susceptible to the romance of untold and untrue riches offered by wooers like Jim Can.

In the past, Can openly acknowledged pulling the strings on Budget Waste, Inc. ( BDGW ), a scheme where he did everything he could to support promotions including the announcements of: phony deals consisting of phony funding and acquisitions of pretend assets; execute forward splits and stock dividends; and arrange for a reverse takeover in another OTC shell ( BWIH ), which in effect was an attempt to wash away the grime left behind by all the deceit.

BDGW shareholders received share of BWIH as a dividend on a reduced basis, which was effectively nothing more than a reverse split. Then, after issuing a bunch more phony baloney shares to himself and his compatriots, Can ran his magic on that ticker, running up the share price, watching it crash, and reverse splitting out the bag holders, as is his custom. The last word from BWIH was an announcement of marvelous financials which claimed earnings of 5 cents a share of revenues of almost $8 million. Then strangely (not really), 15 months of silence after which BWIH briefly becomes Aquasil International, Inc. ( AQUS ), a pretend silver water distributor.

But wait! What happened to Budget Waste? Well it turns out that Can had put the company into bankruptcy . What doesn't add up is that the bankruptcy filing pre-dated the announcement of the marvelous financials by over a year! Huh?

Moving on, the AQUS scheme lasted an entire three days, just long enough to conduct its own Pump & Dump campaign, and after which the scheme goes quiet. Seven months later, AQUS then announces plans to become Oveldi Worldwide Shipping Group, fodder for yet another Pump & Dump campaign. Those plans survived for about seven weeks before the perpetually empty shell, which never did execute the name change, goes quiet again and in conjunction with a one for 1,000 reverse split to eliminate the freshly minted bag holders. At that point, BWIH / AQUS morphed into Multi-Corp International ( MULI ). The Pump & Dump campaign on MULI is ongoing and at one time was head up be nefarious promoter, Best Damn Penny Stocks, who incidentally, and without coincidence, is the lead promoter on Can's current ripoff, Bluforest, Inc. ( BLUF ).

By the time the MULI scam was underway, Jim Can has already acquired control of two additional shells, Aura Bio Corp. ( AUBC ), which becomes Global Resource Energy, Inc. ( GBEN ) and Greenwood Gold Resources, Inc. ( GGRI ), which, as we detailed back then , was the subject of one of the bigger Pump & Dump scams of 2011, estimated to have cost investors in excess of $10 million. AUBC was headed up by another Calgary resident, Harry Lappa who, after transferring control to Jim Can's disciples, went on to become the head of North Springs Resources Corp. ( NSRS ), the subject of one of Awesome Penny Stocks most notorious Pump & Dump schemes ever. NSRS is now defunct.

Control of GBEN was acquired by Jim Can through his good friend and nominee shareholder, Harry James , a fellow Calgary resident. James was also registered as Can's playmate in the BWIH scheme.

Eventually, Jim Can's buddy, nominee shareholder and yet another Calgary resident, Robert Baker, who is nothing more than a common plumber, becomes President and CEO of GBEN . On August 1, 2011, Baker was paid in advance for his services to the tune of $40,000 in the form of 40,000,000 shares of GBEN , just days after the company executed a one for 1,000 reverse split. This valued GBEN stock at $.001 per share. Within a matter of months, those shares were trading at $.50 each, making his compensation worth $20,000,000. Not bad considering that he served in office for a period of only 18 months. Are you starting to get the picture?

GBEN eventually and purportedly made a deal to acquire the distribution rights a a Chinese manufacture's LED lighting products. The rights were acquired from a non-existent California corporation, Patedma Group Corp., which received 1,000,000 shares of GBEN for its trouble. Since the corporation does not exist, it is not hard to imagine that those shares went into the pocket of pretend President, James Brooks.

Of course the Patedma agreement isn't worth the paper it was written on. Eighteen months into the distribution agreement and according to its own financials, GBEN has not rung the register with a single penny of revenue.

In desperate need of an asset to legitimize its Pump & Dump campaigns, on November 12, 2012, GBEN makes a deal with its Poppa, Jim Can, and its sister fraud, BLUF , to acquire carbon credits in exchange for $660,000, which it paid by turning on the printing presses and issuing BLUF 3,000,000 intrinsically worthless shares of GBEN . For some reason, Can values these shares at 22,000% more than the shares issued to his lackey, Robert Baker, just a year earlier, even though the company hadn't done a damn thing other than acquire a worthless assignment of distribution rights from a non-existent company.

The GGRI shell was acquired by Jim Can from yet another resident of Calgary, the perpetrator of the GGRI scheme, President Branislav Jovanovic. In this transaction, Can used a recently introduced lackey, Charles Miller, in a reverse takeover of Oceanview Real Estate Ltd., a purported Canadian entity for which we cannot seem to find registry records. Miller, who was named the new President of GGRI , had already owned the lease rights to the Ecuadorian property holding the fantasy $700 million in carbon credits and was introduced to Jim Can through a third party.

The GGRI reverse merger was managed through a one for 500 reverse split of GGRI stock and followed by the issuance of 75,000,000 new shares to Oceanview. The acquisition agreement included the following covenant:

" In further accordance with the terms and provision s of the Acquisition Agreement, the Company shall enter into a three year consultant agreement (the “Mainland Consultant Agreement”) with Mainland Investment Ltd. (“Mainland”). The Mainland Consultant Agreement shall provide that Mainland will provide to the Company financial, advisory, marketing and investor relation services and the Company shall pay to Mainland an annual compensation of $1,000,000 and grant 1,000,000 stock options exercisable at $1.00 per share. "

Mainland Investment Ltd., is controlled by Jim Can. The covenant was clearly added in order to enable Can to accrue debt for future conversion to shares, in order to maintain control as he sold of his holdings in the course of a Pump & Dump campaign.

The 75,000,000 shares was later transferred to Jim Can's Belize entity, Global Environmental Investments Limited (GEIL) in a transaction documented here . Earlier, Charles Miller had vended in the aforementioned rights to the Ecuadorian property to GEIL in a private arrangement with Can designed to enrich them both. It was in this way that GGRI / BLUF would lay claim to the carbon credits with the bloated valuation.

A key component of the acquisition of the GGRI shell, was the issuance of stock and cash to former shell controller and President, Branislav Jovanovic, as memorialized in the another covenant of the acquisition agreement:

"Lastly, the Company shall: (i) cause the settlement of debt in the approximate amount of $60,000 due and owing to that certain creditor (the “Creditor”), as reflected on the financial statements of the Company as of September 30, 2011 (the “$60,000 Debt”) to be settled by issuance to the Creditor and/or his designee an aggregate of 25,000,000 shares of common stock; and (ii) within ninety days, the Company shall cause the debt in the approximate amount of $112,000 due and owing to Branislav Jovanovic, as reflected on the financial statements of GGRI as of September 30, 2011, to be settled by payment to Mr. Jovanovic."

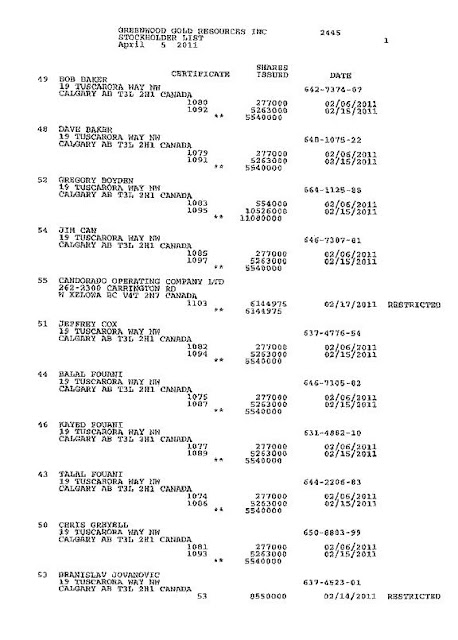

Now Jim Can has no problem explaining to potential business associates about his tendency to always protect his controlling interests by maintaining blocks of stock in nominees' names. He brags that in conjunction with the goal of maintaining control, he has no problem reverse splitting shareholders out of stock. That is evidenced in the two reverse splits that were executed since there came to be an agreement for Can to acquire the GGRI shell and the one for 1,000 reverse split of GBEN . Can also has a reputation for stiffing business associates and acting in bad faith, as evidenced by Jovanovic's lawsuit against Bluforest for the unpaid cash payment consideration of the shell acquisition. Now we really don't care how this litigation was adjudicated as it is merely a bunch of fraud artists litigating against themselves, but what we found interesting was a GGRI shareholder list that was submitted as an exhibit in a pleading, a portion of which we show you below:

|

Snippet of GGRI Shareholder List

|

Notice that Jim Can and his lackey, GBEN President Robert (Bob) Baker, are on the list with sizable holdings. Also notice that all the individual shareholders on this snippet share the same address, including then President GGRI Branislav Jovanovich, who appears to own 19 Tuscarora Way NW, Calgary, Alberta, a home in the northwest quadrant of Calgary.

In fact, if you were to view the the shareholder list in its entirety, you would find that all 12 out of the identified individual shareholders use this residence as the registration address for their stock, . Many of them are found on Jim Can's Facebook friend list. It seems that maybe, just maybe, Can was already in control of this shell when it was Greenwood Gold Resources and that the reverse merger was a facade.

Next, we'll look at the actual value of carbon credit and show you why BLUF has nothing even close to $700 million in assets.

Author's Note: This advisory was based upon (a) information voluntarily brought to us after our previous advisory on Bluforest, Inc., from by several sources with confirmed ties to Jim Can, and who may have had a legitimate axe to grind; and, (b) our own research instigated by these sources.

(0)

(0) (0)

(0)