juniors usually have lower costs than big boys due to lower overhead usually closer to port etc- Wuhan iron co bought a 40-60% stake in a N Labrador iron mine and planned on spending 2.5 billion just to build a railroad hundreds of km just o get to port as posted from an article before

Bob was always very cost conscious and got most equipment at very good deals-e.g got cat 375 ex and rebuilt themselves-would be 1 million new grajekk says-saved over 1/2 milion on that alone Mex is very low cost cf to USA/Canada etc so from everything I know cwrn pro cost is less than12/ton-and with fert/sinter byproduct sales will be NEGATIVE cost

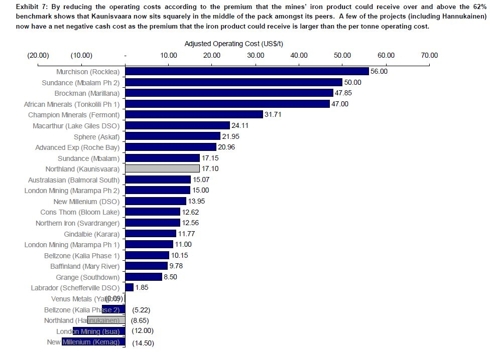

4-5co's on this chart have neg cost due to prem ore alone without fert