Mountain National Bank, Sevierville, TN was closed today by the Office of the Comptroller of the Currency. The FDIC, appointed as receiver, sold the failed bank to First Tennessee Bank, N.A., Memphis, TN, which will assume all deposits of Mountain National Bank.

Mountain National Bank, Sevierville, TN was closed today by the Office of the Comptroller of the Currency. The FDIC, appointed as receiver, sold the failed bank to First Tennessee Bank, N.A., Memphis, TN, which will assume all deposits of Mountain National Bank.

Originally founded in 1998, Mountain National Bank becomes the first bank failure of the year in Tennessee. The last bank failure in Tennessee occurred last June.

All 12 branches of Mountain National Bank will reopen as branches of First Tennessee Bank and all depositors will continue to have uninterrupted FDIC deposit insurance up to the applicable limits. Over the weekend customers of the failed bank can access their money through the use of checks, ATMs and debit cards.

At March 31, 2013, Mountain National Bank had total assets of $437.3 million and total deposits of $373.4 million. Besides assuming all deposits, First Tennessee Bank also agreed to purchase all of the failed bank’s assets.

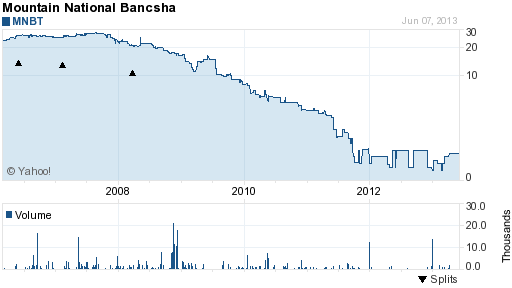

Mountain National Bank operates as a subsidiary of holding company Mountain National Bancshares, Inc. Shares of lightly traded Mountain National Bancshares closed today at $0.85, down from a high of almost $30 in 2007.

Courtesy: yahoo finance

The loss to the FDIC Deposit Insurance Fund (DIF) for the failure of Mountain National Bank is $33.5 million. Mountain National becomes the 16th banking failure of 2013 and the first bank failure of the year in Tennessee.

While the number of banking failures has steadily declined since 2010, the number of banks on the FDIC Problem Bank List remains elevated and includes almost 9% of all banks. At March 31, 2013 there were a total of 612 banks on the problem bank list with total assets of $213.3 billion.

The 16 banks that failed in 2013 had total assets of $1.9 billion and resulted in losses of $374.1 million for the FDIC. Since 2008 a total of 481 banks have failed.

Banking Failures Since 2008

Year Number of Bank Failures

2008 25

2009 140

2010 157

2011 92

2012 51

2013 16

Total 481