Bank failures don’t come much smaller than today’s closing of Pisgah Community Bank, Asheville, N.C. Total assets at Pisgah amounted to only $21.9 million, smaller than what many of the top executives take home in a year at the “too big to fail” banks.

Bank failures don’t come much smaller than today’s closing of Pisgah Community Bank, Asheville, N.C. Total assets at Pisgah amounted to only $21.9 million, smaller than what many of the top executives take home in a year at the “too big to fail” banks.

Pisgah Community Bank was established on May 15, 2008 on the eve of the largest banking collapse in U.S. history. By the end of 2009, the one branch Bank was effectively insolvent as loan defaults soared due to collapsing real estate values and a deep recession. In May 2010, Pisgah signed a Consent Order with regulators for engaging in unsafe and unsound banking practices.

The failure of Pisgah Community Bank would be a nonevent except for the fact that it is one of many banks owned by giant bank holding company Capitol Bancorp Ltd. At December 31, 2012, Capitol operated nine state chartered banks, one federal savings bank and one national bank that have combined total assets of $1.6 billion. All of the 11 banks controlled by Capitol Bancorp are on the unofficial Problem Bank List and eight are operating under Prompt Corrective Action notices. The banks controlled by Capitol Bancorp are listed below.

Arizona | |

|

|

Georgia | |

| |

Indiana | |

| |

Michigan | |

| |

Missouri | |

| |

|

Nevada | |

|

|

New Mexico | |

| |

|

North Carolina | |

| |

|

Ohio | |

| |

|

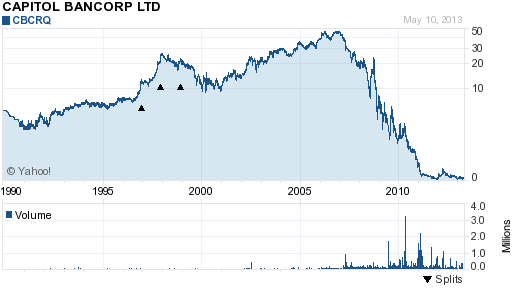

Capitol Bancorp has been attempting to either recapitalize or sell the various banks it controls without success. Given the seriously undercapitalized condition of the banks owned by Capitol Bancorp, buyers are hard to find. Serious buyers are more likely to wait until the banks are closed by regulators when FDIC assisted financing on favorable terms would be available. On August 9, 2012, Capitol Bancorp filed for reorganization under Chapter 11. Investors seem to be taking a dim view on a potential recovery by Capitol Bancorp and the stock has fallen from the $50 range in 2008 to a mere nine cents per share at today’s closing price.

courtesy: yahoo finance

In December, Capitol announced the planned sale and subsequent recapitalization of Sunrise Bank of Albuquerque but the transaction has been delayed due to the lack of regulatory approval. If regulators had closed the insolvent Sunrise Bank, it could have triggered a $10 million cross guaranty liability against the other banks owned by Capitol which could have lead to a complete collapse of the company. The FDIC has allowed Capitol Bancorp to stay in business by issuing 16 different waivers on cross guarantee liabilities on previous sales of banks controlled by Capitol.

The FDIC seems to have given Capitol Bancorp an extreme amount of latitude considering the dire financial condition that the company is in and the lack of success in disposing of its banking units. Unless Capitol Bancorp can pull off a miracle, it seems likely that regulators will eventually be forced to close the other banks owned by Capitol Bancorp as they did today with Pisgah Community Bank.

Late Note : Sunrise Bank, Valdosta, GA, owned by Capitol Bancorp, was closed by regulators after the closing of Pisgah Bank. Expect to see most of the other banks controlled by Capitol Bancorp to also wind up in the arms of the FDIC.

At December 31, 2012, Pisgah had total assets of $21.9 million and total deposits of $21.2 million.

The FDIC, acting as receiver sold Pisgah Community Bank to Capital Bank, N.A., Rockville, MD, which will assume all the deposits of the failed bank. In addition, Capital Bank will purchase $19.8 million of the failed bank’s assets with the remaining balance to be held by the FDIC for later disposition.

The cost to the FDIC for the failure of Pisgah Bank is $8.9 million, representing a very considerable 40% of the bank’s total assets. Pisgah Community Bank is the 11th banking failure of the year and the second in North Carolina.