(Total Views: 92)

Posted On: 09/26/2025 12:23:03 AM

Post# of 81

2) Spanish Mountain Gold - Operation Update ................................

======================================================

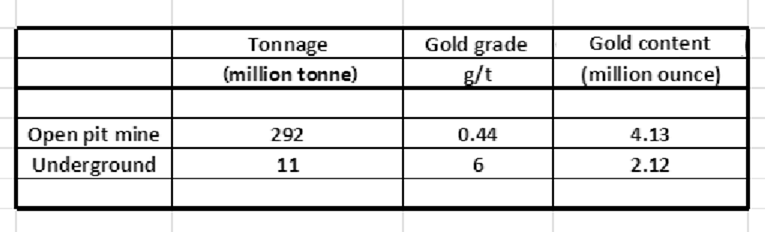

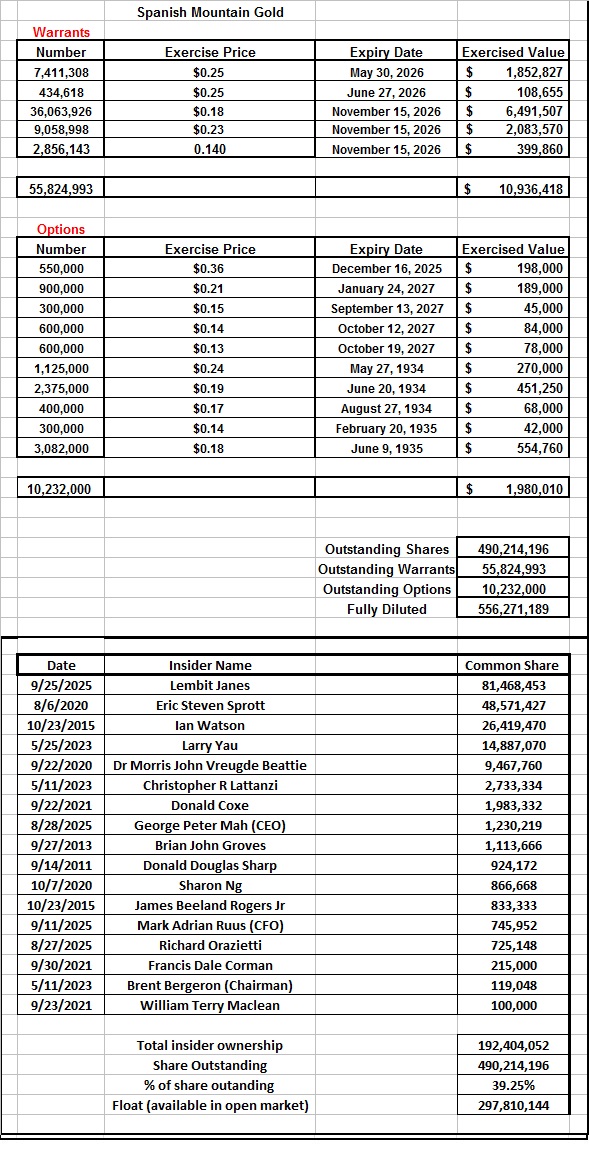

SPA.V monthly High, Low, Volume, Trade Value, Market Capitalization

======================================================

As of September 25

https://investorshangout.com/images/MYImages/...Sept25.png

Relentless selling can suppress share price but sellers do not have unlimited numbers of shares to sell. With increasing number of new investor entering the market and with selling drying up, "demands exceeding supplies" economic will drive up share price, thus increasing volume precedes rising share price. The daily chart pattern is very constructive and bullish, it indicates investors are expecting good news.

==============

Technical Analysis

==============

https://investorshangout.com/images/MYImages/...1yr-TA.png

Case history of bullish Head & Shoulder

https://investorshangout.com/images/MYImages/...istory.png

=================================

Charts - Gold, Silver, XAU, SPA.V, SPAUF

=================================

Gold Price

https://stockcharts.com/h-sc/ui?s=$GOLD&p...e_vignette

50-year gold price

https://mrci.com/pdf/gc.pdf

Silver Price

https://stockcharts.com/h-sc/ui?s=$SILVER&...e_vignette

50-year silver price (in cents)

https://mrci.com/pdf/si.pdf

Mining Index (XAU)

https://stockcharts.com/h-sc/ui?s=%24XAU&...9099899440

SPA.V weekly

https://stockcharts.com/h-sc/ui?s=SPA.V&p...e_vignette

SPA.V - daily

https://stockcharts.com/h-sc/ui?s=SPA.V&p...1572059125

SPA.V - News, trade data

https://www.stockwatch.com/Quote/Detail.aspx?C:SPA.V

SPAUF.OTCQB weekly chart

https://stockcharts.com/sc3/ui/?s=SPAUF&p...e_vignette

SPAUF.OTCQB daily

https://stockcharts.com/h-sc/ui?s=SPAUF&p...1572059125

SPAUF Level 2

https://www.otcmarkets.com/stock/SPAUF/overview

============================

Spanish Mountain Gold and its peers

============================

Blue Lagoon Resources - Dome Mountain Mine project, located about 400 Km northwest of Spanish Mountain Gold

https://www.google.ca/maps/place/Dome+Mountai...FQAw%3D%3D

Mineral Resource Estimate: https://bluelagoonresources.com/wp-content/up...slides.pdf

BLLG.CA weekly

https://stockcharts.com/h-sc/ui?s=BLLG.CA&...7291241482

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Banyan Gold - AurMac Project in Yukon

https://www.google.ca/maps/place/Banyan+Gold+...FQAw%3D%3D

Mineral Resource Estimate: https://banyangold.com/projects/aurmac/

https://stockcharts.com/h-sc/ui?s=BYN.V&p...7291241482

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1911 Gold - True North gold mine, Manitoba

https://www.google.ca/maps/place/True+North+G...FQAw%3D%3D

Mineral Resource Estimate: https://1911gold.com/news/press-releases/1911...ld-project

AUMB.V weekly

https://stockcharts.com/h-sc/ui?s=AUMB.V&...2963243620

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

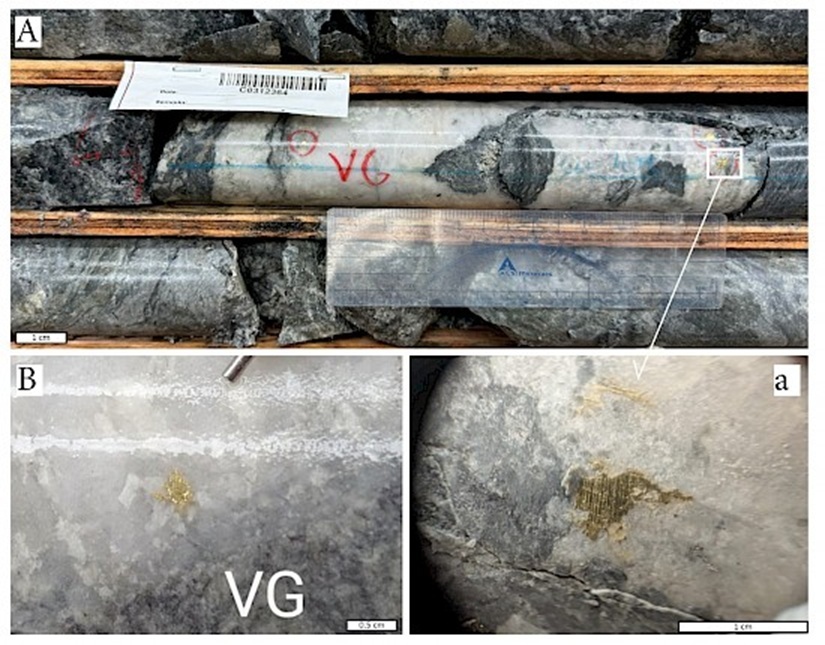

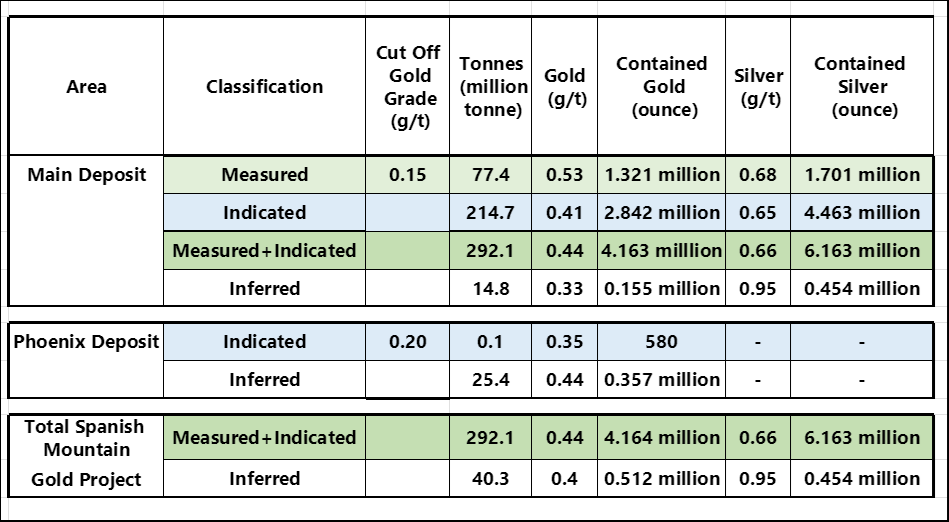

Spanish Mountain Gold

Mineral Resource Estimate: Page 12 of August 18 NI-43-101 Technical Report

https://spanishmountaingold.com/site/assets/f...-final.pdf

https://stockcharts.com/h-sc/ui?s=SPA.V&p...2963243620

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

==============

Operation Update

==============

The 2024 and 2025 exploration drill program identified opportunities to improve the average grade of the mineral resources and potentially grow the in-pit and near pit resources.

The Company’s current strategy remains focused on optimizing, de-risking and advancing its Spanish Mountain Gold Project towards a build decision before the end of 2027.

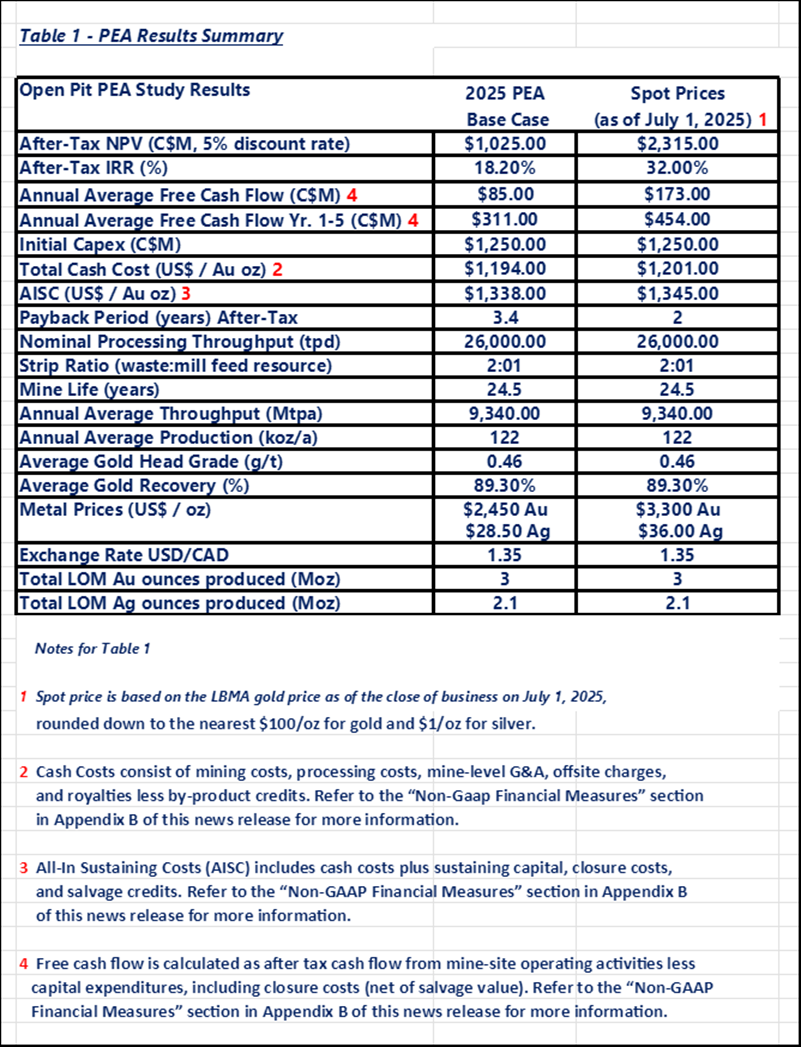

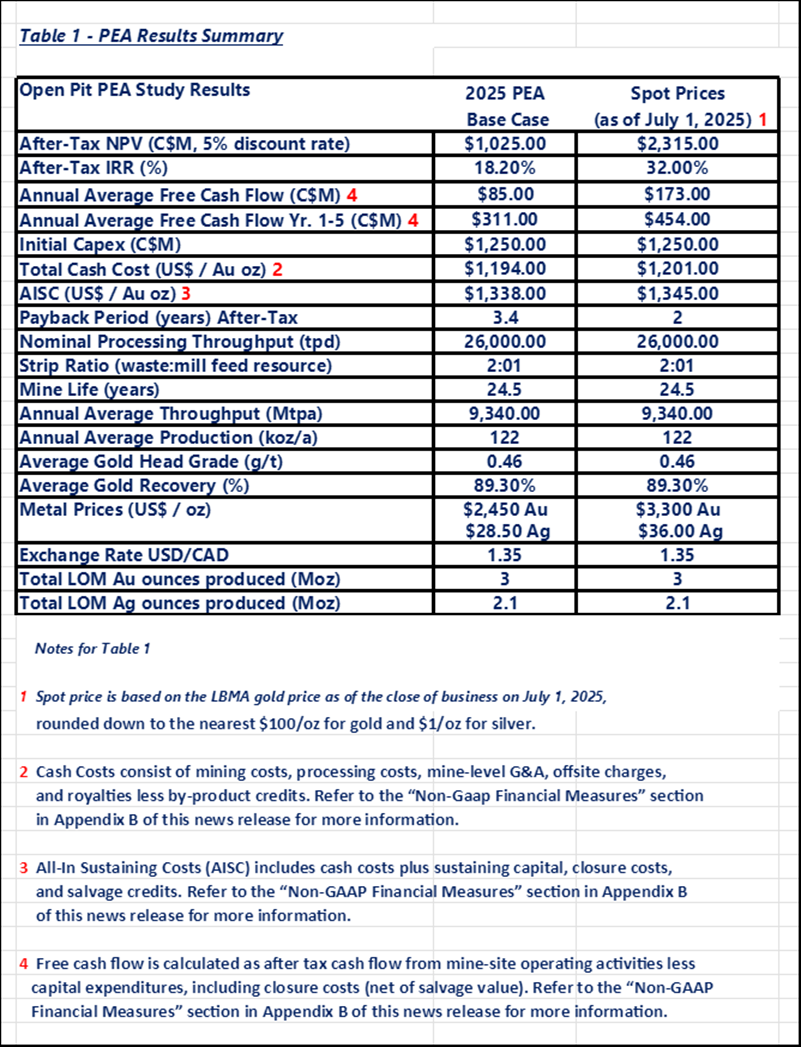

Preliminary Economic Assessment and NI-43-101 Technical Report has been published. The PEA envisions a conventional open pit mining and milling capacity of 26,000 tonnes per day with a projected 24.5-year mine life producing 4 million ounces of gold.

$7,199,968 equity financing has been closed. $4 million of the funds will be used for a 10,000 meter drill program to be commenced in the fall of 2025.

With the completion of the 2025 PEA, the Company anticipates beginning a new Pre-Feasibility Study (PFS) in 2025, or potentially advancing directly to a Feasibility Study (“FS”).

The company has engaged the services of Atrium Research Corporation, a leading company sponsored research firm. Atrium will produce a range of research services to the Company and present the Company’s investment case to potential investors. Atrium will also host video interviews with the Company’s management team to present the investment case in an interview format.

==============================

Recent drilling news and assays results

==============================

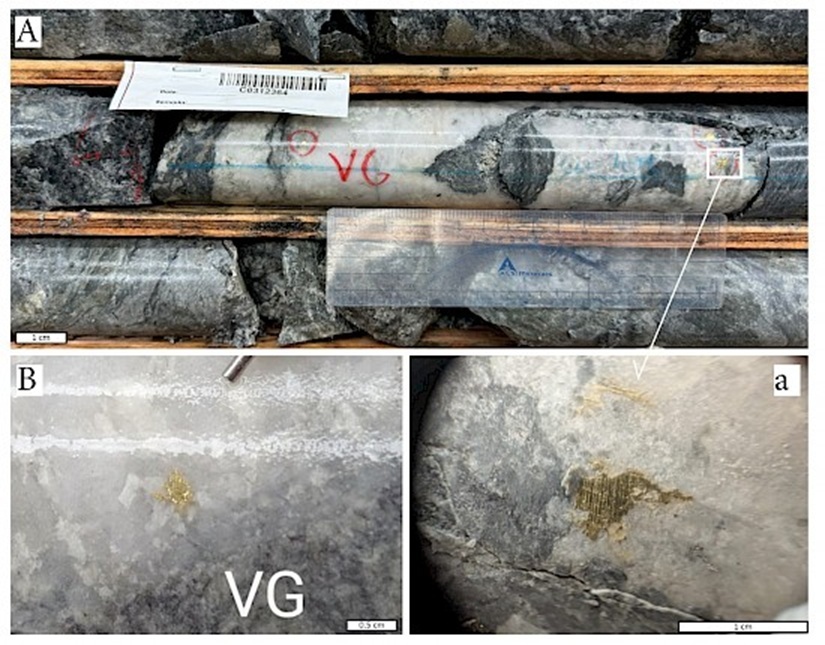

April 24, 2025 - Spanish Mountain Gold Reports Near Surface High Grade Gold Intercepts in the K - Zone

https://spanishmountaingold.com/news/2025/spa...he-k-zone/

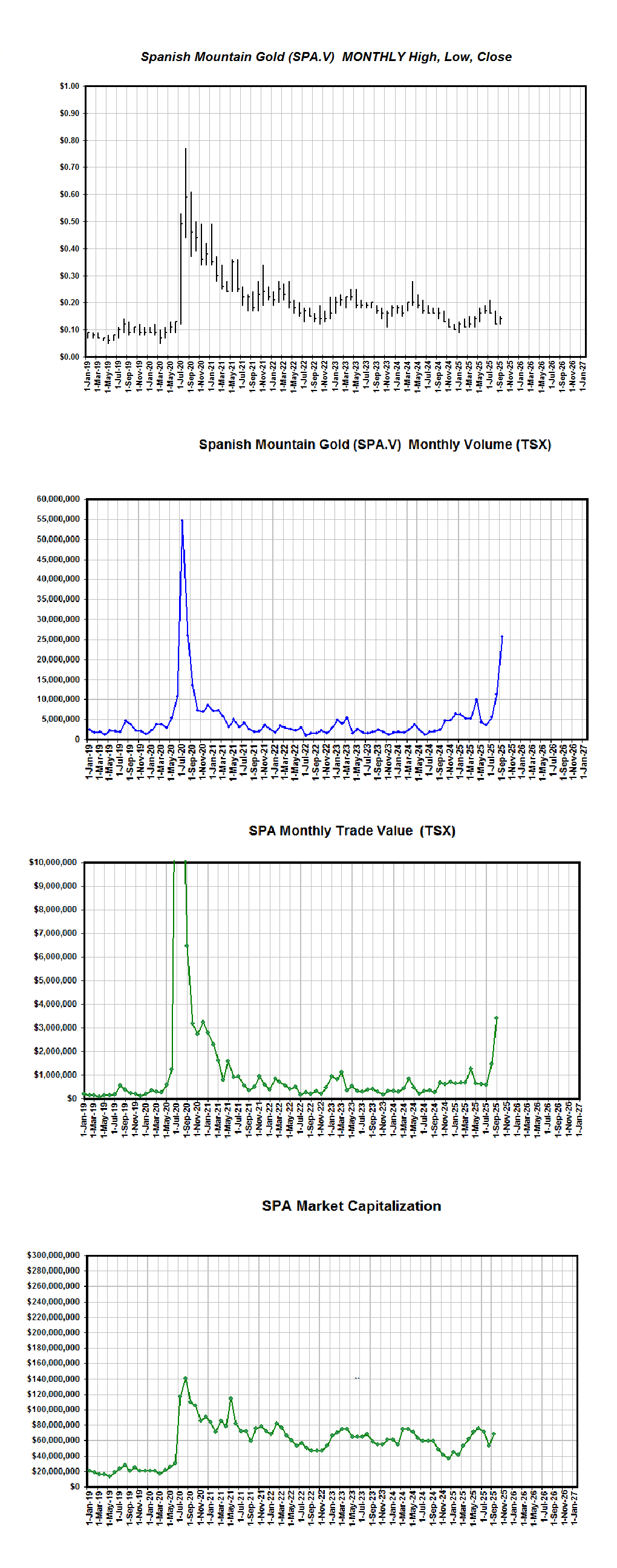

Visible gold is sighted in several drill holes, supporting the potential for significant new high-grade mineralization on the project.

Spanish Mountain Gold reports numerous high-grade gold assays from its 2025 drilling programs, particularly in the K Zone and at the new Phoenix Target, with notable results including:

Hole 25-DH-1286 (K Zone):

====================

719.26 g/t Au over 0.75 m

156.80 g/t Au over 3.50 m

4.18 g/t Au over 139.00 m from 56.00 m

Hole 25-CCR-062 (Phoenix Target):

==========================

17.28 g/t Au over 4.00 m

To follow up on the April 24 high grade result, the company will conduct a 10,000 meter program in the Fall of 2025

September 12, 2025 - Spanish Mountain Gold Announces 10,000 Meter Drill Program commencing in the Fall

https://spanishmountaingold.com/news/2025/spa...l-program/

==========================

Mineral Resource Estimate (MRE)

==========================

https://investorshangout.com/images/MYImages/...timate.png

.jpg)

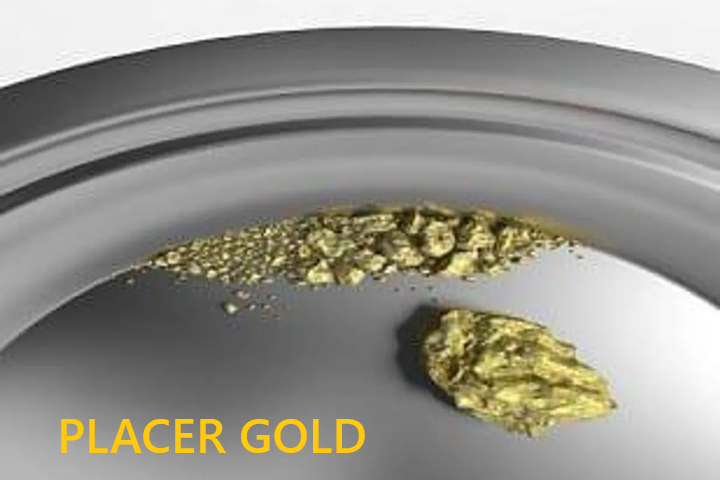

Where did placer gold come from: Placer gold is fine gold fragments that were broken from original gold veins in geological upheaval and eroded by weather over 200 million years. It is heavier then the surrounding materials and deposited in river gravels, floodplains, and hillsides. Placer gold can be in the form of dust, flakes, or nuggets which have been diluted from visible gold. Finding placer gold is a strong indicator that a source, most likely gold veins exist somewhere upstream or nearby.

The case of Aurelian Resources 2006: After years of exploration in Ecuador and discovering only insignificant gold mineralization, geologist Stephen Leary joined Aurelian Resources in 2024 and in 2026 he traced the placer gold in the stream up stream to a place called Fruta del Norte and drilled some holes there, by then the company was nearly out of money. But high grade gold emerged in the drill cores. Subsequent drilling turned into a bonanza discovery. After delineating 13.7 million ounces of gold Aurelian Resources was bought out by Kinross Gold for $1.2 billion. ( https://www.youtube.com/watch?v=4vLwL5sOl04 )

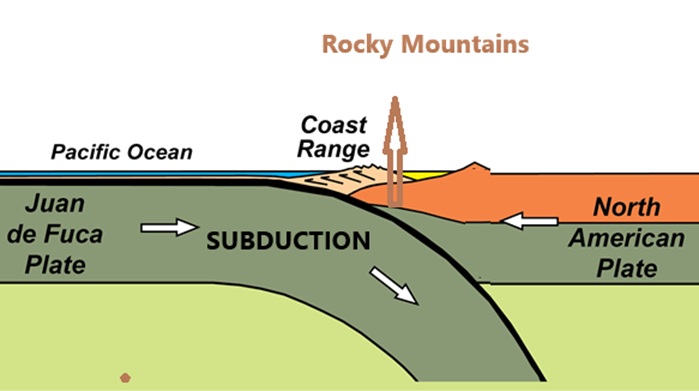

How gold veins are formed: 200 million years ago, during the collision of the world's tectonic plates, tremendous heat and pressure was generated, forcing metamorphic hydrothermal fluids containing dissolved gold and quartz to migrate upwards through fractured rocks and faults, forming channels. As the fluids cooled, gold and quartz was deposited in the rocks. Gold deposits formed this way is called orogenic gold, 75% of the gold mined in the world are orogenic gold, 25% are found in magma rocks.

Why gold is found in quartz veins: Quartz is a piezoelectric material, meaning it generates an electric charge when subjected to stress of high temperature and pressure, these electric charges act on the dissolved gold in the hydrothermal fluid, causing it to solidify onto gold grains, leading to the formation of large gold nuggets embedded in quartz veins as hydrothermal fluids cooled and precipitated gold and quartz in the rocks.

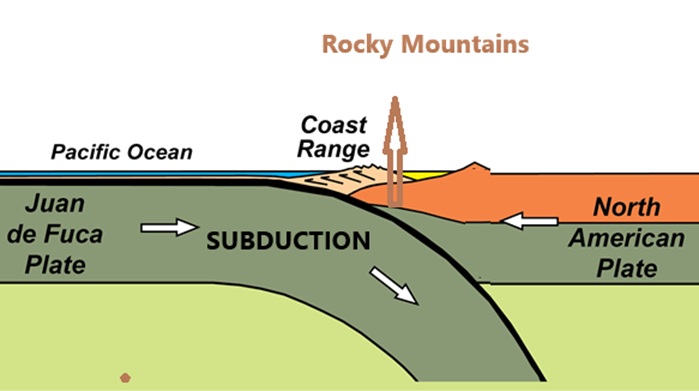

Why gold and fossil of marine life are found on top of the Rocky Mountain: In the collision between the Pacific tectonic plate and the American tectonic plate, the denser Pacific plate submerged beneath the less denser American plate and the west coast from British Columbia to Peru buckled and was pushed upward and skyward, forming the Rocky Mountain as high as 12,970 feet at Mount Robson and the Andes Mountain in South America as high as high as 6,961 feet, bringing along with it gold deposits and fossils of marine life from the bottom of the ocean. The geological process is called Subduction.

===================================================

Preliminary Economic Assessment and NI-43-101 Technical Report

===================================================

https://investorshangout.com/images/MYImages/...67_PEA.png

Preliminary Economic Assessment Economics

https://spanishmountaingold.com/project/preli...economics/

August 18, 2025 - NI-43-101 Technical Report

https://spanishmountaingold.com/site/assets/f...-final.pdf

============================

Unofficial Potential future share price

============================

Excerpt from July 3, 2025 news release:

"Significant Production and Low Cost: 203,265 oz average annual gold production in the first 5 years at an all-in sustaining cost net of by-product credits (“AISC”) of US$1,024/oz and 122,041 oz average annual gold production over a 24.5-year life of mine at an AISC of US$1,338/oz".

With annual production of 203,265 ounces and at gold price of US$3200, annual sales will be US$650 million for the first 5 years. At All-In-Sustaining-Cost (AISC) of $1338 per ounce, profit will be US$1862 per ounce, it translates into net profit of US$7448 million (CAN$10427 million) over the 24 years of mine life, producing in excess of 4 million ounces of gold, before tax and other expenses, including loan payment. Future share price is projected to be CAN$10427 million / 600 million shares = CAN$17 per share, assuming future share outstanding will be at 600 million shares and gold price will remain constant at US$3200.

Since share price is forward looking and share price = P/E ratio x Earning per Share, with consistent positive earnings, especially increasing earnings, the P/E ratio can accelerate and share price could hit $17 long before the company's peak resource potential is achieved.

=================================

All-In-Sustaining-Cost of 25 gold producers

=================================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

=============================

Spanish Mountain Gold - Governance

=============================

Spanish Mountain Gold Corp website

https://spanishmountaingold.com/

Spanish Mountain Gold - Corporate Presentation

https://spanishmountaingold.com/site/assets/f...dpated.pdf

News Release

https://spanishmountaingold.com/news/2025/

Financial Reports

https://spanishmountaingold.com/investors/fin...y-filings/

Top Management

https://spanishmountaingold.com/corporate/management/

Board of Directors

https://spanishmountaingold.com/corporate/boa...directors/

==============================

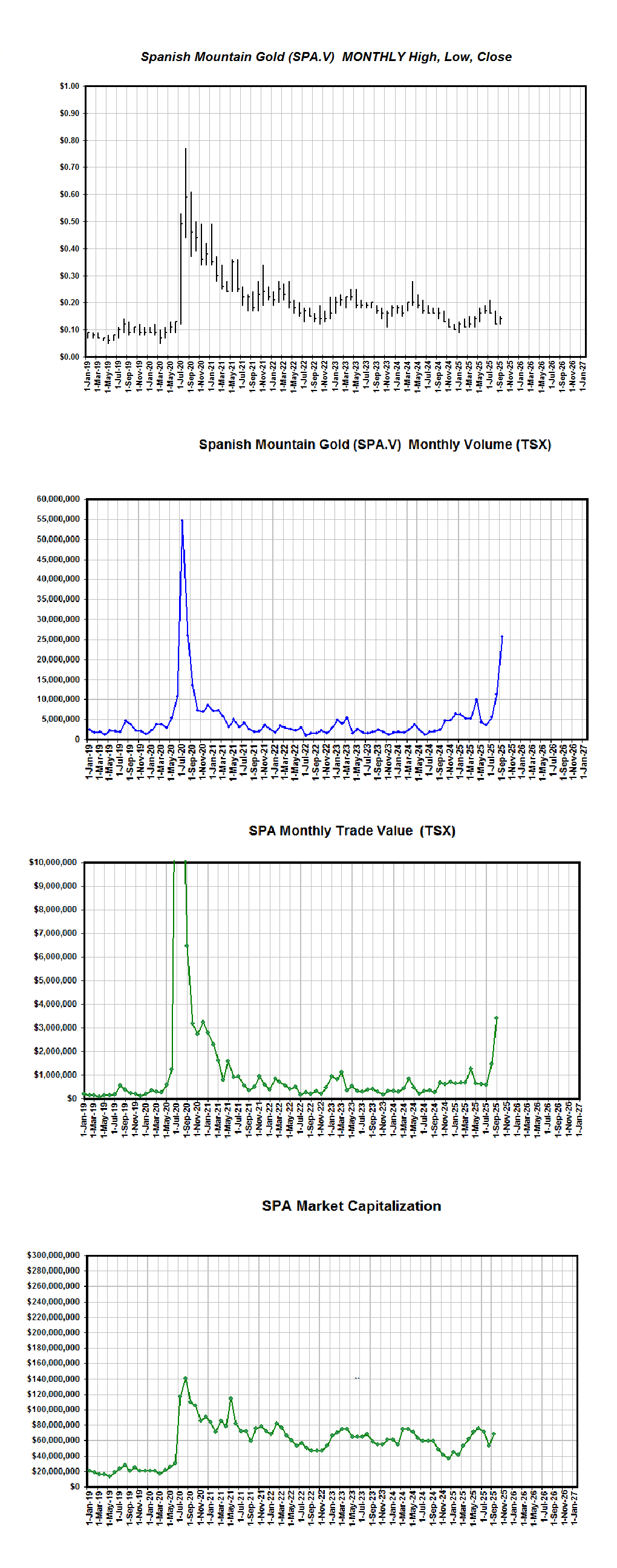

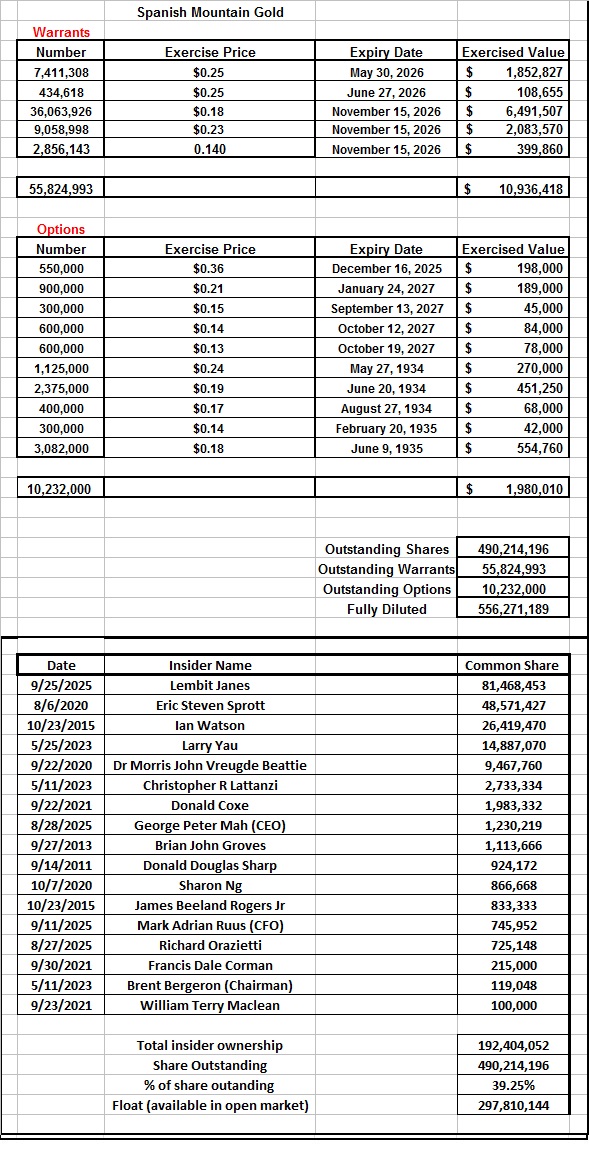

Warrants, Options, Major shareholders

==============================

https://investorshangout.com/images/MYImages/...ership.jpg

Insider trading transaction update

https://www.barchart.com/stocks/quotes/SPA.VN/insider-trades

=============

You tube videos

=============

Webinar replay July 2025

https://www.youtube.com/watch?v=wwTCeoLABlY&t=649s

Mining Investment Event in Quebec City July 2025

https://www.youtube.com/watch?v=9MDABJPTEFU&t=160s

===========

Social Media

===========

Government extending support for mineral exploration in Canada

https://www.canada.ca/en/department-finance/n...anada.html

Spanish Mountain Gold at LinkedIn.com

https://ca.linkedin.com/company/spanish-mountain-gold-ltd-

===============================

Other mines in the Cariboo Region of BC

===============================

Gibraltar Mines - Owned by Taseko Mines, located 50 kilometers west of Spanish Mountain Gold

The Gibraltar Mine is the second-largest open-pit copper-molybdenum mine in Canada, owned and operated by Taseko Mines. Its primary resource is low-grade porphyry copper-molybdenum deposit containing minerals chalcopyrite, molybdenite, bornite, and cuprite. As of December 31, 2024, the mine has 616 million tons of 0.26% copper and 0.008% molybdenum. ( https://www.youtube.com/watch?v=yJmanh1uQMQ )

Cariboo Gold Project - Owned by Osisko Development, located 30 kilometers northwest of Spanish Mountain Gold

The Cariboo Gold Project is 100%-owned by Osisko Development Corp. April 2025 feasibility study indicates a probable reserves of 16.7 million tonnes of 3.78 g/t gold containing 2.031 million ounces of gold. The company has secured US$450 million loan from Appian Capital Advisory to advance the development.

Mount Polley Mine - Owned by Imperial Metals, located 10 kilometers west of Spanish Mountain Gold

2025 production targets are set for 25 to 27 million pounds of copper and 35,000 to 40,000 ounces of gold.

Aerial view of Mount Polley Mine

https://www.google.ca/maps/place/Mount+Polley...FQAw%3D%3D

======================================

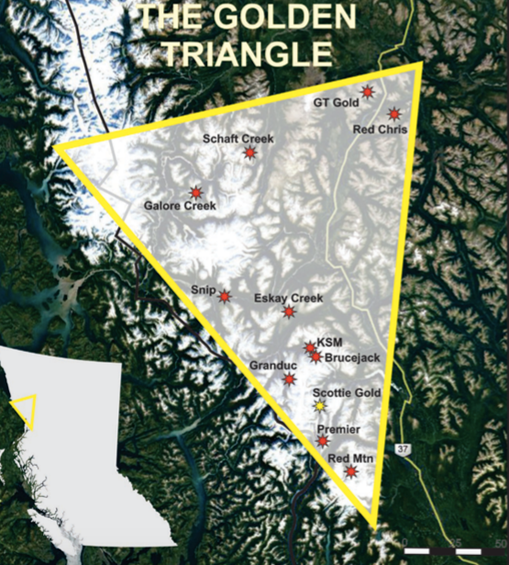

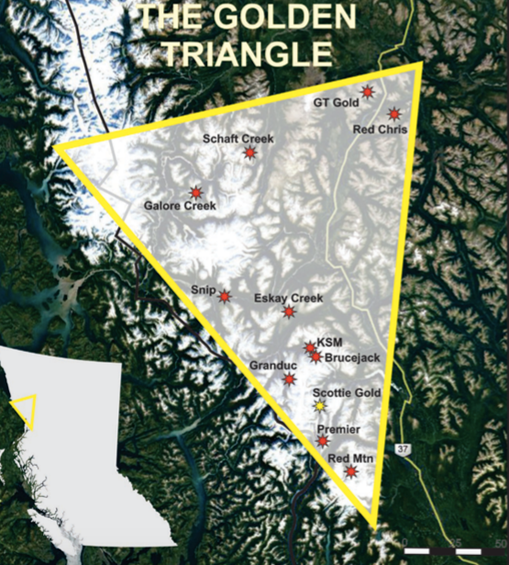

Historical buyout deals in the Golden Triangle, BC

======================================

https://thedeepdive.ca/wp-content/uploads/202...le-3-1.png

Placer Dome and International Corona acquired Stikine Resources at Can$67 per share

https://www.northernminer.com/news/placer-sta...000178407/

Imperial Metals acquired American Bullion Minerals Ltd. at Can$2.45 a share

https://imperialmetals.com/for-our-shareholde...an-bullion

Newmont acquired GT Gold at $3.25 per share in a Can$393 million deal

https://www.newmont.com/investors/news-releas...fault.aspx

Australian gold and copper producer Newcrest Mining acquired Pretium Resources in a Can$3.84 billion, $18.5 per share deal

https://magazine.cim.org/en/news/2021/newcres...e%20region

=============================

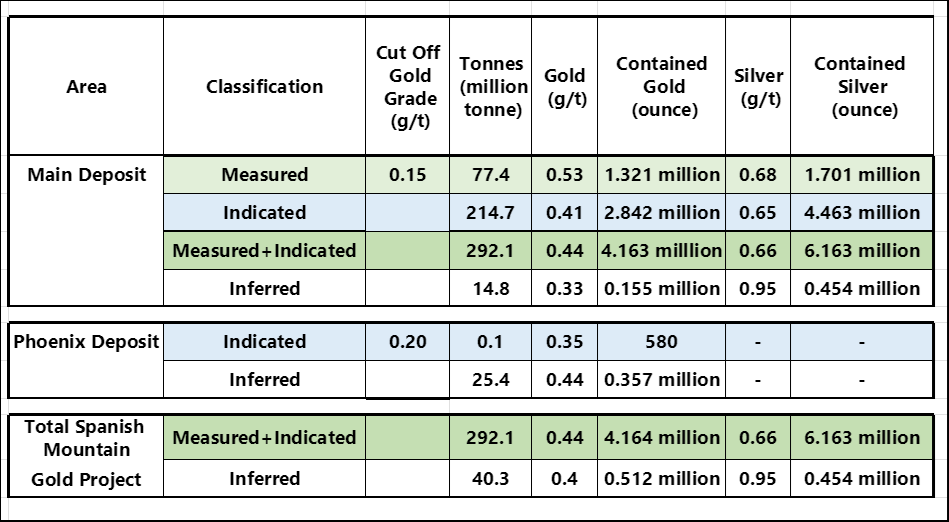

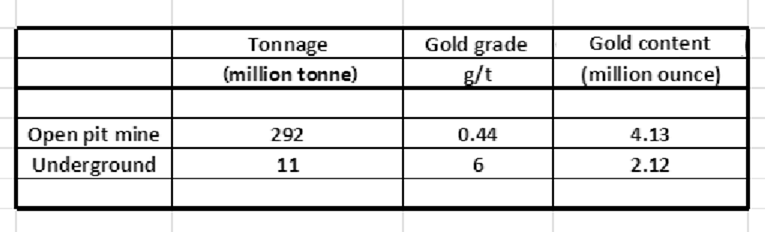

Open pit versus underground mining

=============================

Open-pit mining excavates minerals from a large, open surface pit, making it best for shallow, large deposits and generally cheaper, safer, and easier to operate with large equipment, but it causes significant surface disturbance and environmental impact. Underground mining is for deeper deposits, requiring expensive infrastructure like shafts or tunnels and complex ventilation/communication systems, but it offers higher recovery rates, less surface disturbance, and access to high-value deposits in sensitive areas

Open-pit mining is generally more profitable than underground mining because it has lower costs, higher productivity, and greater safety, making it the preferred choice for near-surface deposits of lower-value minerals. However, the profitability of either method ultimately depends on the specific orebody's characteristics, including the mineral's grade and depth, the overall deposit size, and economic factors like commodity prices and infrastructure costs, with underground mining becoming necessary to access deeper or higher-grade deposits.

Open pit mining usually involves high tonnage of low grade gold while underground mining involves low tonnage of high grade gold. All-In-Sustaining-Cost varies, depending on the company's operation.

Comparison between Spanish Mountain Gold's open pit mine and an emerging underground gold mining producer:

======================================================

SPA.V monthly High, Low, Volume, Trade Value, Market Capitalization

======================================================

As of September 25

https://investorshangout.com/images/MYImages/...Sept25.png

Relentless selling can suppress share price but sellers do not have unlimited numbers of shares to sell. With increasing number of new investor entering the market and with selling drying up, "demands exceeding supplies" economic will drive up share price, thus increasing volume precedes rising share price. The daily chart pattern is very constructive and bullish, it indicates investors are expecting good news.

==============

Technical Analysis

==============

https://investorshangout.com/images/MYImages/...1yr-TA.png

Case history of bullish Head & Shoulder

https://investorshangout.com/images/MYImages/...istory.png

=================================

Charts - Gold, Silver, XAU, SPA.V, SPAUF

=================================

Gold Price

https://stockcharts.com/h-sc/ui?s=$GOLD&p...e_vignette

50-year gold price

https://mrci.com/pdf/gc.pdf

Silver Price

https://stockcharts.com/h-sc/ui?s=$SILVER&...e_vignette

50-year silver price (in cents)

https://mrci.com/pdf/si.pdf

Mining Index (XAU)

https://stockcharts.com/h-sc/ui?s=%24XAU&...9099899440

SPA.V weekly

https://stockcharts.com/h-sc/ui?s=SPA.V&p...e_vignette

SPA.V - daily

https://stockcharts.com/h-sc/ui?s=SPA.V&p...1572059125

SPA.V - News, trade data

https://www.stockwatch.com/Quote/Detail.aspx?C:SPA.V

SPAUF.OTCQB weekly chart

https://stockcharts.com/sc3/ui/?s=SPAUF&p...e_vignette

SPAUF.OTCQB daily

https://stockcharts.com/h-sc/ui?s=SPAUF&p...1572059125

SPAUF Level 2

https://www.otcmarkets.com/stock/SPAUF/overview

============================

Spanish Mountain Gold and its peers

============================

Blue Lagoon Resources - Dome Mountain Mine project, located about 400 Km northwest of Spanish Mountain Gold

https://www.google.ca/maps/place/Dome+Mountai...FQAw%3D%3D

Mineral Resource Estimate: https://bluelagoonresources.com/wp-content/up...slides.pdf

BLLG.CA weekly

https://stockcharts.com/h-sc/ui?s=BLLG.CA&...7291241482

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Banyan Gold - AurMac Project in Yukon

https://www.google.ca/maps/place/Banyan+Gold+...FQAw%3D%3D

Mineral Resource Estimate: https://banyangold.com/projects/aurmac/

https://stockcharts.com/h-sc/ui?s=BYN.V&p...7291241482

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1911 Gold - True North gold mine, Manitoba

https://www.google.ca/maps/place/True+North+G...FQAw%3D%3D

Mineral Resource Estimate: https://1911gold.com/news/press-releases/1911...ld-project

AUMB.V weekly

https://stockcharts.com/h-sc/ui?s=AUMB.V&...2963243620

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Spanish Mountain Gold

Mineral Resource Estimate: Page 12 of August 18 NI-43-101 Technical Report

https://spanishmountaingold.com/site/assets/f...-final.pdf

https://stockcharts.com/h-sc/ui?s=SPA.V&p...2963243620

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

==============

Operation Update

==============

The 2024 and 2025 exploration drill program identified opportunities to improve the average grade of the mineral resources and potentially grow the in-pit and near pit resources.

The Company’s current strategy remains focused on optimizing, de-risking and advancing its Spanish Mountain Gold Project towards a build decision before the end of 2027.

Preliminary Economic Assessment and NI-43-101 Technical Report has been published. The PEA envisions a conventional open pit mining and milling capacity of 26,000 tonnes per day with a projected 24.5-year mine life producing 4 million ounces of gold.

$7,199,968 equity financing has been closed. $4 million of the funds will be used for a 10,000 meter drill program to be commenced in the fall of 2025.

With the completion of the 2025 PEA, the Company anticipates beginning a new Pre-Feasibility Study (PFS) in 2025, or potentially advancing directly to a Feasibility Study (“FS”).

The company has engaged the services of Atrium Research Corporation, a leading company sponsored research firm. Atrium will produce a range of research services to the Company and present the Company’s investment case to potential investors. Atrium will also host video interviews with the Company’s management team to present the investment case in an interview format.

==============================

Recent drilling news and assays results

==============================

April 24, 2025 - Spanish Mountain Gold Reports Near Surface High Grade Gold Intercepts in the K - Zone

https://spanishmountaingold.com/news/2025/spa...he-k-zone/

Visible gold is sighted in several drill holes, supporting the potential for significant new high-grade mineralization on the project.

Spanish Mountain Gold reports numerous high-grade gold assays from its 2025 drilling programs, particularly in the K Zone and at the new Phoenix Target, with notable results including:

Hole 25-DH-1286 (K Zone):

====================

719.26 g/t Au over 0.75 m

156.80 g/t Au over 3.50 m

4.18 g/t Au over 139.00 m from 56.00 m

Hole 25-CCR-062 (Phoenix Target):

==========================

17.28 g/t Au over 4.00 m

To follow up on the April 24 high grade result, the company will conduct a 10,000 meter program in the Fall of 2025

September 12, 2025 - Spanish Mountain Gold Announces 10,000 Meter Drill Program commencing in the Fall

https://spanishmountaingold.com/news/2025/spa...l-program/

==========================

Mineral Resource Estimate (MRE)

==========================

https://investorshangout.com/images/MYImages/...timate.png

.jpg)

Where did placer gold come from: Placer gold is fine gold fragments that were broken from original gold veins in geological upheaval and eroded by weather over 200 million years. It is heavier then the surrounding materials and deposited in river gravels, floodplains, and hillsides. Placer gold can be in the form of dust, flakes, or nuggets which have been diluted from visible gold. Finding placer gold is a strong indicator that a source, most likely gold veins exist somewhere upstream or nearby.

The case of Aurelian Resources 2006: After years of exploration in Ecuador and discovering only insignificant gold mineralization, geologist Stephen Leary joined Aurelian Resources in 2024 and in 2026 he traced the placer gold in the stream up stream to a place called Fruta del Norte and drilled some holes there, by then the company was nearly out of money. But high grade gold emerged in the drill cores. Subsequent drilling turned into a bonanza discovery. After delineating 13.7 million ounces of gold Aurelian Resources was bought out by Kinross Gold for $1.2 billion. ( https://www.youtube.com/watch?v=4vLwL5sOl04 )

How gold veins are formed: 200 million years ago, during the collision of the world's tectonic plates, tremendous heat and pressure was generated, forcing metamorphic hydrothermal fluids containing dissolved gold and quartz to migrate upwards through fractured rocks and faults, forming channels. As the fluids cooled, gold and quartz was deposited in the rocks. Gold deposits formed this way is called orogenic gold, 75% of the gold mined in the world are orogenic gold, 25% are found in magma rocks.

Why gold is found in quartz veins: Quartz is a piezoelectric material, meaning it generates an electric charge when subjected to stress of high temperature and pressure, these electric charges act on the dissolved gold in the hydrothermal fluid, causing it to solidify onto gold grains, leading to the formation of large gold nuggets embedded in quartz veins as hydrothermal fluids cooled and precipitated gold and quartz in the rocks.

Why gold and fossil of marine life are found on top of the Rocky Mountain: In the collision between the Pacific tectonic plate and the American tectonic plate, the denser Pacific plate submerged beneath the less denser American plate and the west coast from British Columbia to Peru buckled and was pushed upward and skyward, forming the Rocky Mountain as high as 12,970 feet at Mount Robson and the Andes Mountain in South America as high as high as 6,961 feet, bringing along with it gold deposits and fossils of marine life from the bottom of the ocean. The geological process is called Subduction.

===================================================

Preliminary Economic Assessment and NI-43-101 Technical Report

===================================================

https://investorshangout.com/images/MYImages/...67_PEA.png

Preliminary Economic Assessment Economics

https://spanishmountaingold.com/project/preli...economics/

August 18, 2025 - NI-43-101 Technical Report

https://spanishmountaingold.com/site/assets/f...-final.pdf

============================

Unofficial Potential future share price

============================

Excerpt from July 3, 2025 news release:

"Significant Production and Low Cost: 203,265 oz average annual gold production in the first 5 years at an all-in sustaining cost net of by-product credits (“AISC”) of US$1,024/oz and 122,041 oz average annual gold production over a 24.5-year life of mine at an AISC of US$1,338/oz".

With annual production of 203,265 ounces and at gold price of US$3200, annual sales will be US$650 million for the first 5 years. At All-In-Sustaining-Cost (AISC) of $1338 per ounce, profit will be US$1862 per ounce, it translates into net profit of US$7448 million (CAN$10427 million) over the 24 years of mine life, producing in excess of 4 million ounces of gold, before tax and other expenses, including loan payment. Future share price is projected to be CAN$10427 million / 600 million shares = CAN$17 per share, assuming future share outstanding will be at 600 million shares and gold price will remain constant at US$3200.

Since share price is forward looking and share price = P/E ratio x Earning per Share, with consistent positive earnings, especially increasing earnings, the P/E ratio can accelerate and share price could hit $17 long before the company's peak resource potential is achieved.

=================================

All-In-Sustaining-Cost of 25 gold producers

=================================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

=============================

Spanish Mountain Gold - Governance

=============================

Spanish Mountain Gold Corp website

https://spanishmountaingold.com/

Spanish Mountain Gold - Corporate Presentation

https://spanishmountaingold.com/site/assets/f...dpated.pdf

News Release

https://spanishmountaingold.com/news/2025/

Financial Reports

https://spanishmountaingold.com/investors/fin...y-filings/

Top Management

https://spanishmountaingold.com/corporate/management/

Board of Directors

https://spanishmountaingold.com/corporate/boa...directors/

==============================

Warrants, Options, Major shareholders

==============================

https://investorshangout.com/images/MYImages/...ership.jpg

Insider trading transaction update

https://www.barchart.com/stocks/quotes/SPA.VN/insider-trades

=============

You tube videos

=============

Webinar replay July 2025

https://www.youtube.com/watch?v=wwTCeoLABlY&t=649s

Mining Investment Event in Quebec City July 2025

https://www.youtube.com/watch?v=9MDABJPTEFU&t=160s

===========

Social Media

===========

Government extending support for mineral exploration in Canada

https://www.canada.ca/en/department-finance/n...anada.html

Spanish Mountain Gold at LinkedIn.com

https://ca.linkedin.com/company/spanish-mountain-gold-ltd-

===============================

Other mines in the Cariboo Region of BC

===============================

Gibraltar Mines - Owned by Taseko Mines, located 50 kilometers west of Spanish Mountain Gold

The Gibraltar Mine is the second-largest open-pit copper-molybdenum mine in Canada, owned and operated by Taseko Mines. Its primary resource is low-grade porphyry copper-molybdenum deposit containing minerals chalcopyrite, molybdenite, bornite, and cuprite. As of December 31, 2024, the mine has 616 million tons of 0.26% copper and 0.008% molybdenum. ( https://www.youtube.com/watch?v=yJmanh1uQMQ )

Cariboo Gold Project - Owned by Osisko Development, located 30 kilometers northwest of Spanish Mountain Gold

The Cariboo Gold Project is 100%-owned by Osisko Development Corp. April 2025 feasibility study indicates a probable reserves of 16.7 million tonnes of 3.78 g/t gold containing 2.031 million ounces of gold. The company has secured US$450 million loan from Appian Capital Advisory to advance the development.

Mount Polley Mine - Owned by Imperial Metals, located 10 kilometers west of Spanish Mountain Gold

2025 production targets are set for 25 to 27 million pounds of copper and 35,000 to 40,000 ounces of gold.

Aerial view of Mount Polley Mine

https://www.google.ca/maps/place/Mount+Polley...FQAw%3D%3D

======================================

Historical buyout deals in the Golden Triangle, BC

======================================

https://thedeepdive.ca/wp-content/uploads/202...le-3-1.png

Placer Dome and International Corona acquired Stikine Resources at Can$67 per share

https://www.northernminer.com/news/placer-sta...000178407/

Imperial Metals acquired American Bullion Minerals Ltd. at Can$2.45 a share

https://imperialmetals.com/for-our-shareholde...an-bullion

Newmont acquired GT Gold at $3.25 per share in a Can$393 million deal

https://www.newmont.com/investors/news-releas...fault.aspx

Australian gold and copper producer Newcrest Mining acquired Pretium Resources in a Can$3.84 billion, $18.5 per share deal

https://magazine.cim.org/en/news/2021/newcres...e%20region

=============================

Open pit versus underground mining

=============================

Open-pit mining excavates minerals from a large, open surface pit, making it best for shallow, large deposits and generally cheaper, safer, and easier to operate with large equipment, but it causes significant surface disturbance and environmental impact. Underground mining is for deeper deposits, requiring expensive infrastructure like shafts or tunnels and complex ventilation/communication systems, but it offers higher recovery rates, less surface disturbance, and access to high-value deposits in sensitive areas

Open-pit mining is generally more profitable than underground mining because it has lower costs, higher productivity, and greater safety, making it the preferred choice for near-surface deposits of lower-value minerals. However, the profitability of either method ultimately depends on the specific orebody's characteristics, including the mineral's grade and depth, the overall deposit size, and economic factors like commodity prices and infrastructure costs, with underground mining becoming necessary to access deeper or higher-grade deposits.

Open pit mining usually involves high tonnage of low grade gold while underground mining involves low tonnage of high grade gold. All-In-Sustaining-Cost varies, depending on the company's operation.

Comparison between Spanish Mountain Gold's open pit mine and an emerging underground gold mining producer: