(Total Views: 200)

Posted On: 09/19/2025 12:02:21 AM

Post# of 50

2) Spanish Mountain Gold - Operation Update ................................

The 2024 and 2025 exploration drill program identified opportunities to improve the average grade of the mineral resources and potentially grow the in-pit and near pit resources.

The Company’s current strategy remains focused on optimizing, de-risking and advancing its Spanish Mountain Gold Project towards a build decision before the end of 2027.

Preliminary Economic Assessment and NI-43-101 Technical Report has been published. The PEA envisions a conventional open pit mining and milling operation with a projected 24.5-year mine life producing 4 million ounces of gold.

$7,199,968 equity financing has been closed. The funds will be used for a 10,000 meter drill program to be commenced in the fall of 2025.

With the completion of the 2025 PEA, the Company anticipates beginning a new Pre-Feasibility Study (PFS) in 2025, or potentially advancing directly to a Feasibility Study (“FS”).

The company has engaged the services of Atrium Research Corporation, a leading company sponsored research firm. Atrium will produce a range of research services to the Company and present the Company’s investment case to potential investors. Atrium will also host video interviews with the Company’s management team to present the investment case in an interview format.

==============================

Recent drilling news and assays results

==============================

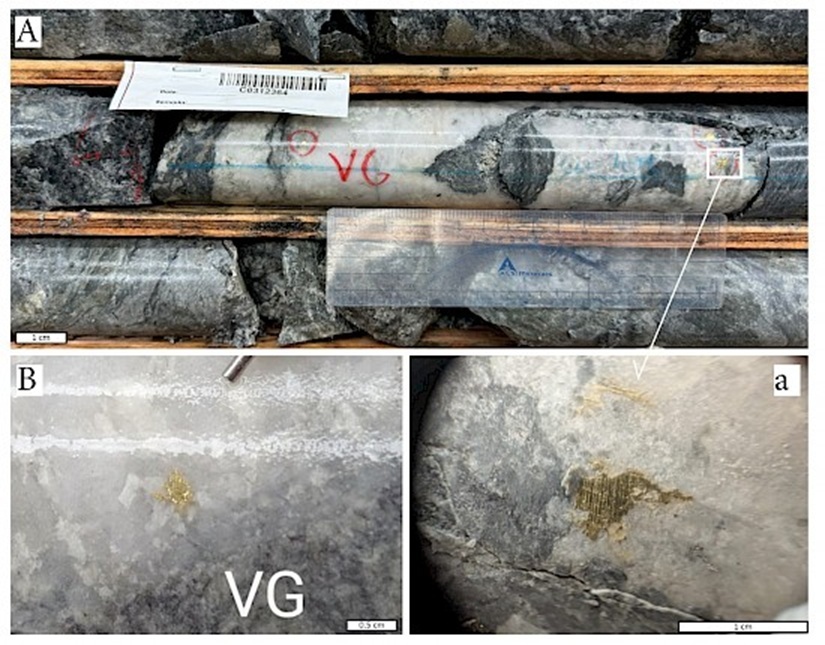

April 24, 2025 - Spanish Mountain Gold Reports Near Surface High Grade Gold Intercepts in the K - Zone

https://spanishmountaingold.com/news/2025/spa...he-k-zone/

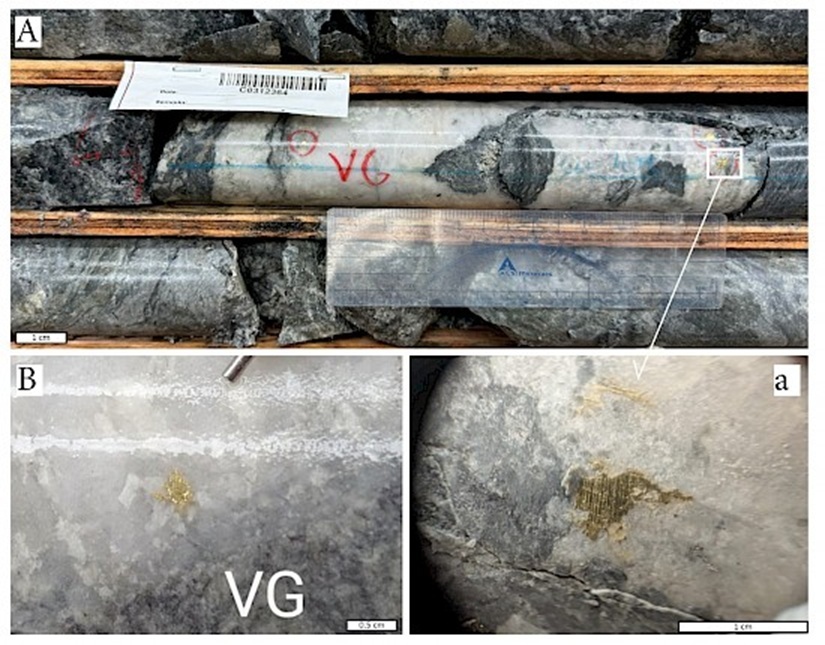

Visible gold is sighted in several drill holes, supporting the potential for significant new high-grade mineralization on the project.

Spanish Mountain Gold reports numerous high-grade gold assays from its 2025 drilling programs, particularly in the K Zone and at the new Phoenix Target, with notable results including:

Hole 25-DH-1286 (K Zone):

====================

719.26 g/t Au over 0.75 m

156.80 g/t Au over 3.50 m

4.18 g/t Au over 139.00 m from 56.00 m

Hole 25-CCR-062 (Phoenix Target):

==========================

17.28 g/t Au over 4.00 m

To follow up on the April 24 high grade result, the company will conduct a 10,000 meter program in the Fall of 2025

September 12, 2025 - Spanish Mountain Gold Announces 10,000 Meter Drill Program commencing in the Fall

https://spanishmountaingold.com/news/2025/spa...l-program/

==========================

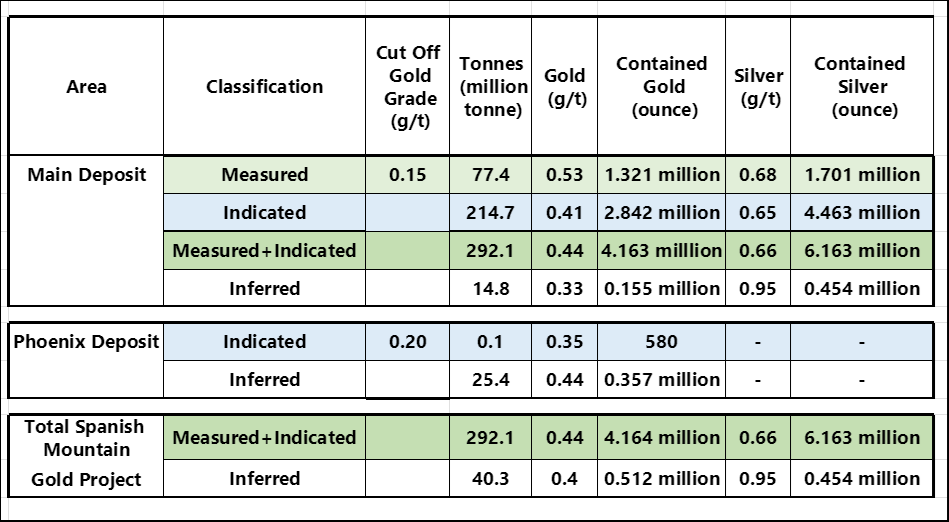

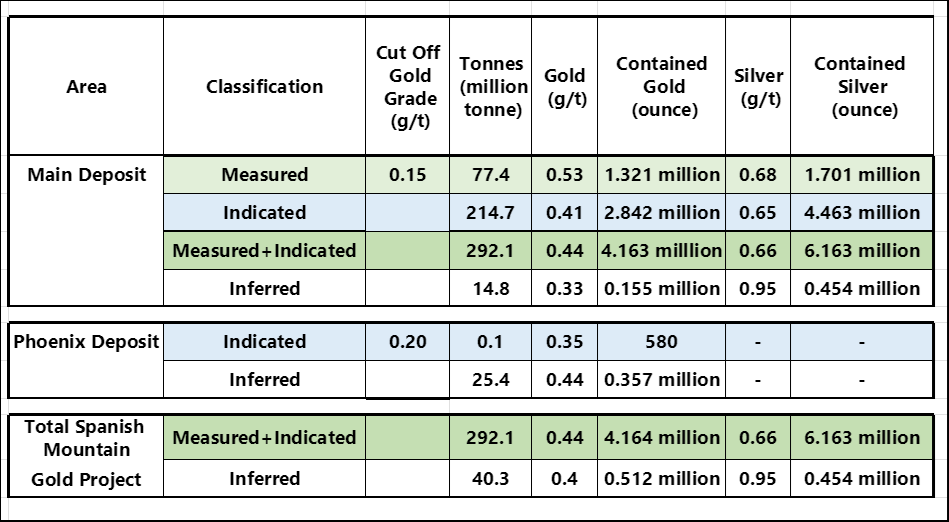

Mineral Resource Estimate (MRE)

==========================

https://investorshangout.com/images/MYImages/...timate.png

Drilling in 2025 shows long intervals of high grade gold, it could be a sign of existence of gold veins nearby which are the source of the low grade placer gold. The placer gold on the Spanish Mountain property originates from erosion of the parent lode gold deposit. After being weathered and broken loose, the dense gold was then eroded, transported, and deposited in placer deposits like those in the creeks on the southwest side of the property, such as Cedar Creek ( https://www.google.ca/maps/search/cedar+creek...FQAw%3D%3D ), where rich placer gold was discovered in the early 1900s. With skyrocketing gold price, placer gold mining has become highly profitable

.jpg)

Gold veins - How are they formed

Intense pressure and heat was generated between the collision of the world's tectonic plates 200 million years ago, caused buried, water-bearing rocks to release metamorphic fluids containing dissolved gold into the Earth's crust. These fluids migrate upwards through deep, fault-controlled fracture networks, depositing gold as quartz veins. As the Pacific plate submerged underneath the American plate (the phenomenon is called subduction), the west coast from British Columbia to South America was squeezed and pushed upward and skyward, forming the Rocky Mountain 8000 feet high as well as forming the Andes Mountain in South America, bringing along with it gold deposits and fossil of ancient sea creatures from the bottom of the ocean. That is why gold and fossil of sea creatures are found at high altitude of British Columbia and Nevada. On the other side of the world, the Indian tectonic plate is in a collision with the Eurasian plate, the collision caused land deformation and created the Himalayas Mountain and the Tibetan Plateau, but India will not completely disappear under Asia

============================

PEA and NI-43-101 Technical Report

============================

July 3, 2025 - Preliminary Economic Assessment (PEA)

https://spanishmountaingold.com/news/2025/spa...0-billion/

August 18, 2025 - NI-43-101 Technical Report

https://spanishmountaingold.com/site/assets/f...-final.pdf

=================================

Charts - Gold, Silver, XAU, SPA.V, SPAUF

=================================

Gold Price

https://stockcharts.com/h-sc/ui?s=$GOLD&p...e_vignette

https://mrci.com/pdf/gc.pdf

Silver Price

https://stockcharts.com/h-sc/ui?s=$SILVER&...e_vignette

Mining Index (XAU)

https://stockcharts.com/h-sc/ui?s=%24XAU&...9099899440

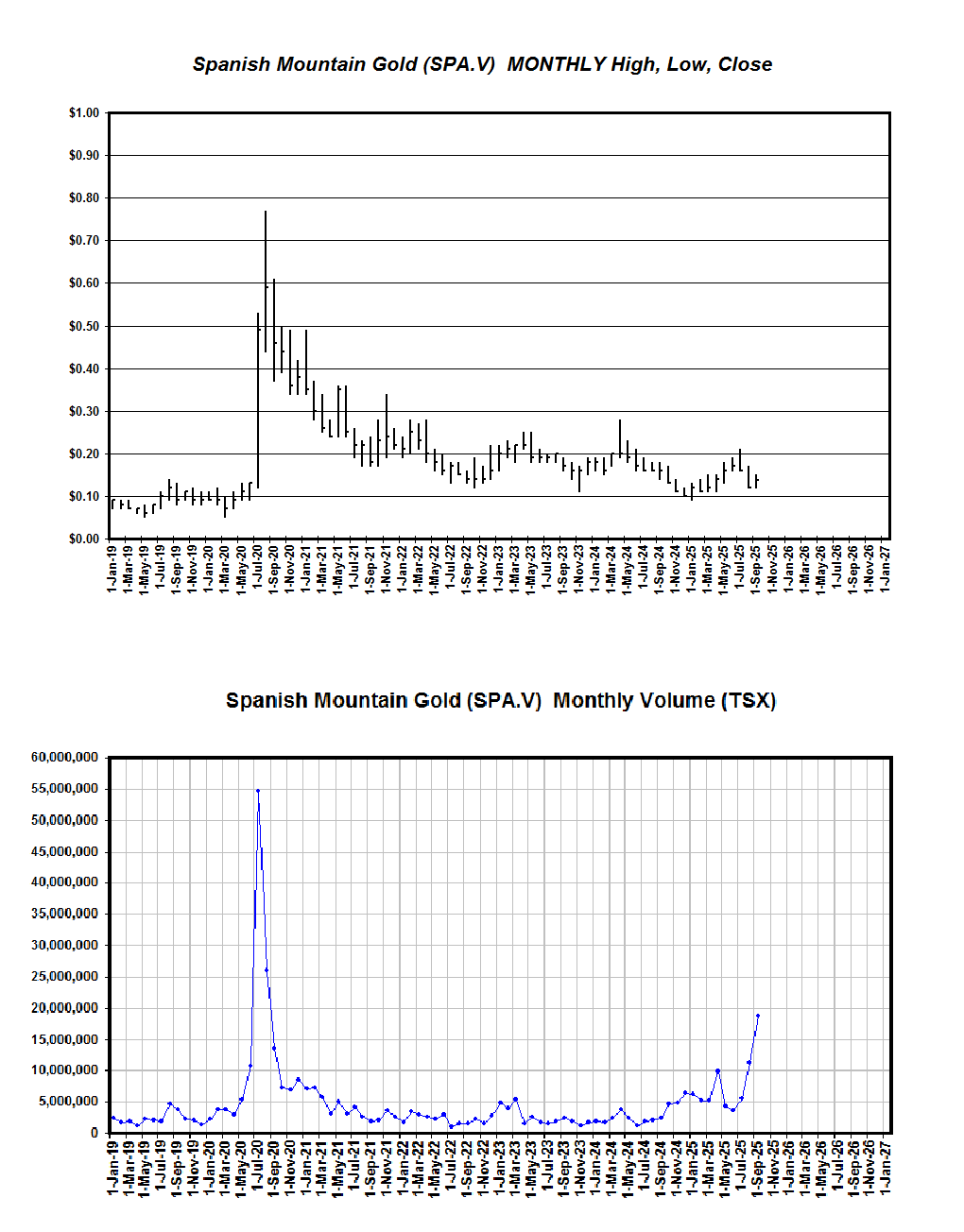

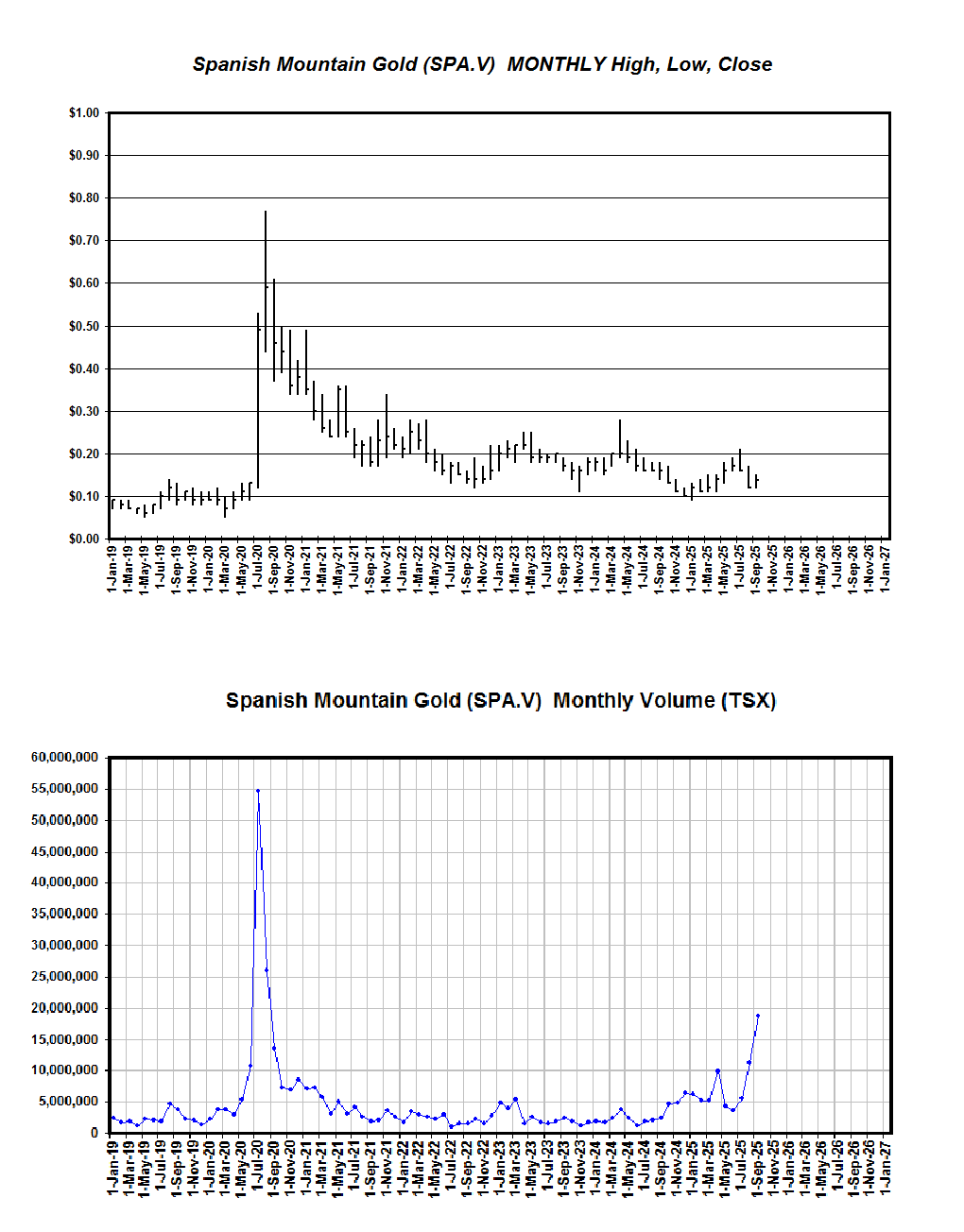

SPA.V monthly chart

Às of September 18, 2025

https://investorshangout.com/images/MYImages/...ychart.png

SPA.V weekly chart

https://stockcharts.com/h-sc/ui?s=SPA.V&p...e_vignette

SPA.V - News, trade data

https://www.stockwatch.com/Quote/Detail.aspx?C:SPA.V

SPAUF.OTCQB weekly chart

https://stockcharts.com/sc3/ui/?s=SPAUF&p...e_vignette

SPAUF Level 2

https://www.otcmarkets.com/stock/SPAUF/overview

===========================

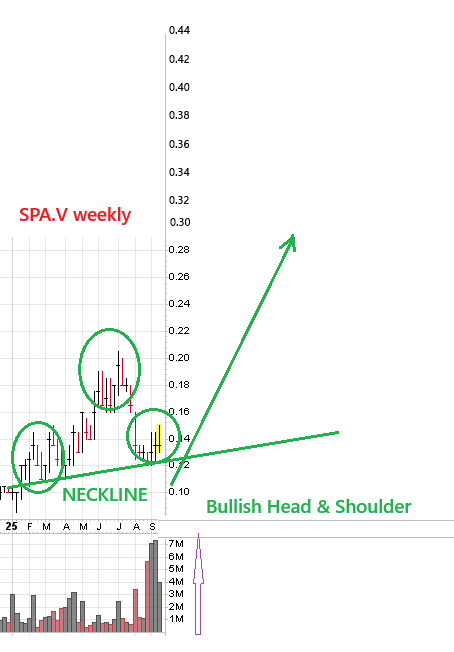

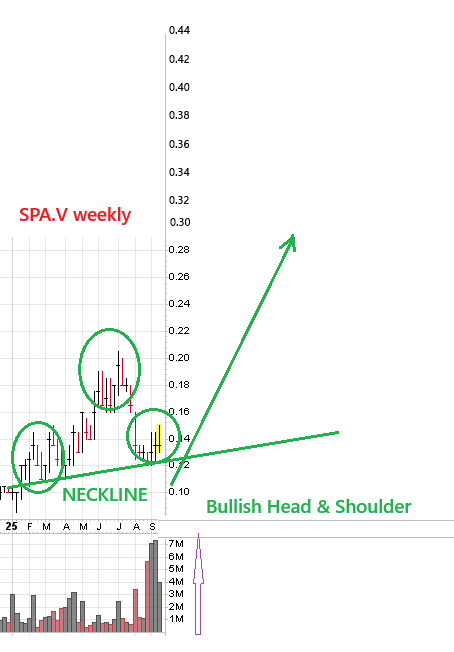

SPA.V weekly - Technical Analysis

==========================

https://investorshangout.com/images/MYImages/...3_SPAW.png

Historical cases of bullish Head & Shoulder

https://investorshangout.com/images/MYImages/...istory.png

======================

Potential future share price

======================

Excerpt from July 3, 2025 news release:

"Significant Production and Low Cost: 203,265 oz average annual gold production in the first 5 years at an all-in sustaining cost net of by-product credits (“AISC”) of US$1,024/oz and 122,041 oz average annual gold production over a 24.5-year life of mine at an AISC of US$1,338/oz".

With annual production of 203,265 ounces and at gold price of US$3200, annual sales will be US$650 million for the first 5 years. At All-In-Sustaining-Cost (AISC) of $1338 per ounce, profit will be US$1862 per ounce, it translates into net profit of US$7448 million (CAN$10427 million) over the 24 years of mine life, producing in excess of 4 million ounces of gold, before tax and other expenses, including loan payment. Future share price is projected to be CAN$10427 million / 600 million shares = CAN$17 per share, assuming future share outstanding will be at 600 million shares and gold price will remain constant at US$3200.

Since share price is forward looking and share price = P/E ratio x Earning per Share, with consistent positive earnings, especially increasing earnings, the P/E ratio can accelerate and share price could hit $17 long before the company's peak resource potential is achieved.

=================================

All-In-Sustaining-Cost of 25 gold producers

=================================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Cost (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

=============================

Spanish Mountain Gold - Governance

=============================

Spanish Mountain Gold Corp website

https://spanishmountaingold.com/

Spanish Mountain Gold - Corporate Presentation

https://spanishmountaingold.com/site/assets/f...dpated.pdf

News Release

https://spanishmountaingold.com/news/2025/

Financial Reports

https://spanishmountaingold.com/investors/fin...y-filings/

Preliminary Economic Assessment Economics

https://spanishmountaingold.com/project/preli...economics/

Top Management

https://spanishmountaingold.com/corporate/management/

Board of Directors

https://spanishmountaingold.com/corporate/boa...directors/

==============================

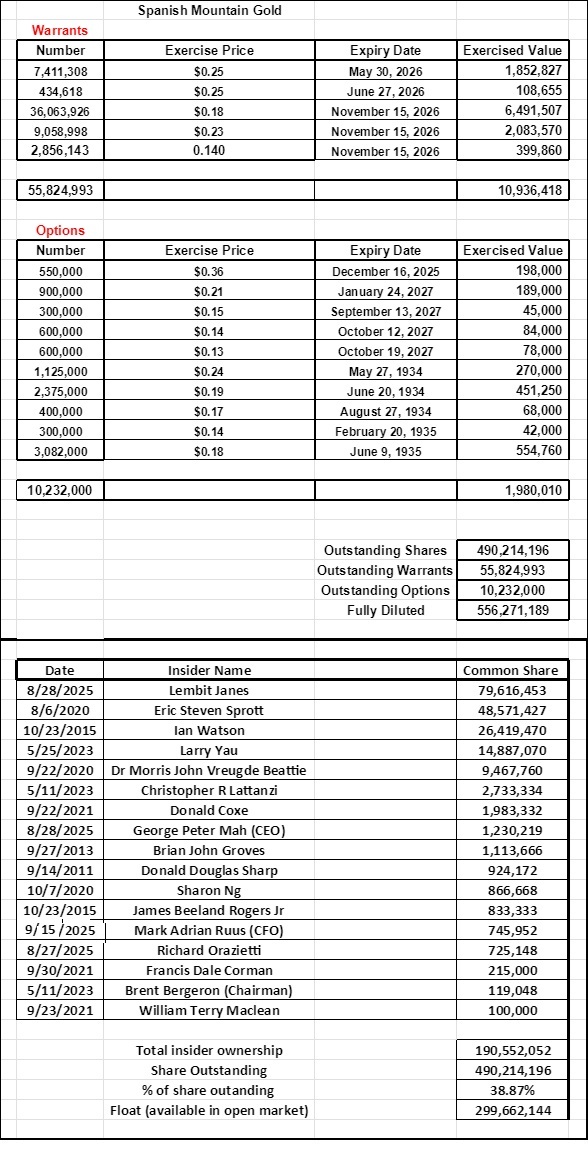

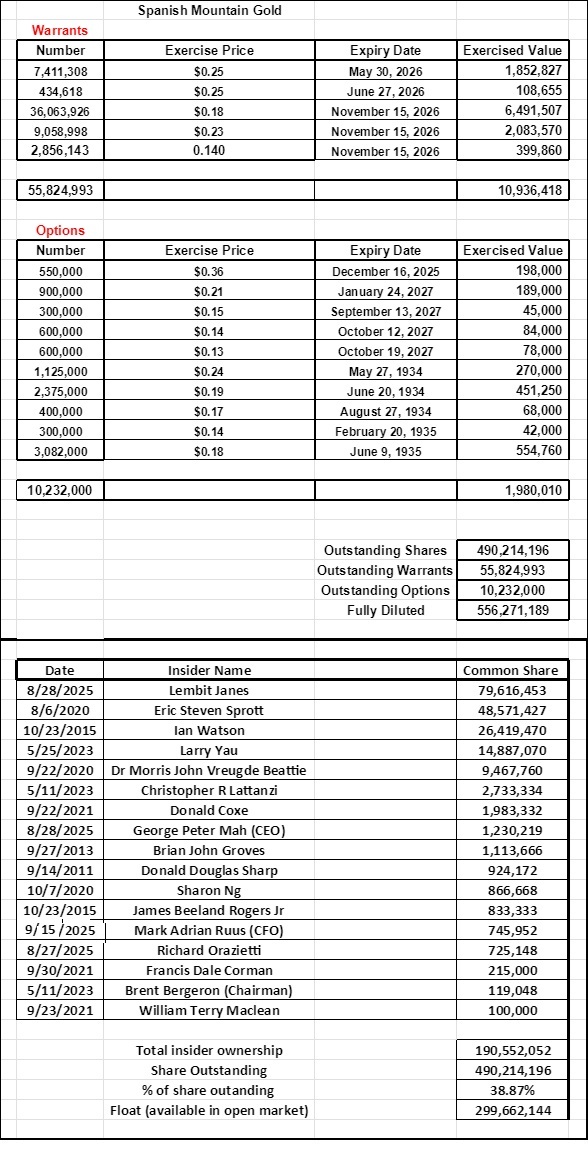

Warrants, Options, Major shareholders

==============================

https://investorshangout.com/images/MYImages/...ership.jpg

Insider trading transaction update

https://www.barchart.com/stocks/quotes/SPA.VN/insider-trades

=============

You tube videos

=============

Webinar replay July 2025

https://www.youtube.com/watch?v=wwTCeoLABlY&t=649s

Mining Investment Event in Quebec City July 2025

https://www.youtube.com/watch?v=9MDABJPTEFU&t=160s

===========

Social Media

===========

Government extending support for mineral exploration in Canada

https://www.canada.ca/en/department-finance/n...anada.html

Spanish Mountain Gold at LinkedIn.com

https://ca.linkedin.com/company/spanish-mountain-gold-ltd-

===============================

Other mines in the Cariboo Region of BC

===============================

Gibraltar Mines - Owned by Taseko Mines, located 50 kilometers west of Spanish Mountain Gold

The Gibraltar Mine is the second-largest open-pit copper-molybdenum mine in Canada, owned and operated by Taseko Mines. Its primary resource is low-grade porphyry copper-molybdenum deposit containing minerals chalcopyrite, molybdenite, bornite, and cuprite. As of December 31, 2024, the mine has 616 million tons of 0.26% copper and 0.008% molybdenum. ( https://www.youtube.com/watch?v=yJmanh1uQMQ )

Cariboo Gold Project - Owned by Osisko Development, located 30 kilometers northwest of Spanish Mountain Gold

The Cariboo Gold Project is 100%-owned by Osisko Development Corp. April 2025 feasibility study indicates a probable reserves of 16.7 million tonnes of 3.78 g/t gold containing 2.031 million ounces of gold. The company has secured US$450 million loan from Appian Capital Advisory to advance the development.

Polley Mines - Owned by Imperial Metals, located 10 kilometers west of Spanish Mountain Gold

2025 production targets are set for 25 to 27 million pounds of copper and 35,000 to 40,000 ounces of gold.

=======================

Spanish Mountain Gold's peer

=======================

Banyan Gold (BYN.V) is focused on earning a 100% stake in the AurMac Project in Yukon. Banyan Gold does not currently own or operate a mill. Banyan Gold's future plans include moving towards a Pre-Feasibility Study (PFS) in 2025, which will include further optimization studies for their Powerline project.

Share outstanding: 376,729,649

Market Capitalization: $282,547,237

Share price: CAN$0.78

Project Overview

https://banyangold.com/projects/overview/

June 25, 2005 - Banyan Intersects 3.95 g/t Gold Over 38.1 Metres at the Airstrip Deposit, AurMac Project, Yukon, Canada

https://banyangold.com/news-releases/2025/ban...on-canada/

July 8, 2025 - Banyan Announces First Indicated Mineral Resources and Identifies High Grade Continuous Zones at its’ AurMac Project, Yukon, Canada

https://banyangold.com/news-releases/2025/ban...on-canada/

BYN.V weekly chart

https://stockcharts.com/sc3/ui/?s=BYN.V&p...6610120538

======================================

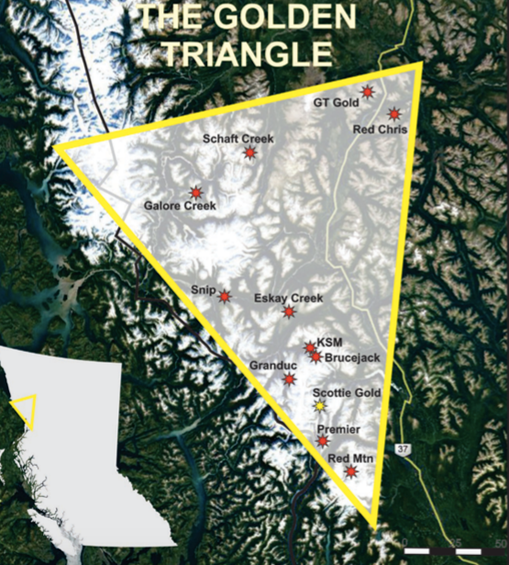

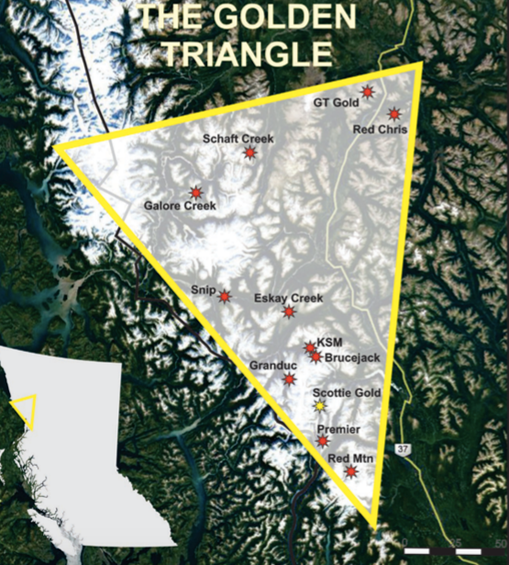

Historical buyout deals in the Golden Triangle, BC

======================================

https://thedeepdive.ca/wp-content/uploads/202...le-3-1.png

Placer Dome and International Corona acquired Stikine Resources at Can$67 per share

https://www.northernminer.com/news/placer-sta...000178407/

Imperial Metals acquired American Bullion Minerals Ltd. at Can$2.45 a share

https://imperialmetals.com/for-our-shareholde...an-bullion

Newmont acquired GT Gold at $3.25 per share in a Can$393 million deal

https://www.newmont.com/investors/news-releas...fault.aspx

Australian gold and copper producer Newcrest Mining acquired Pretium Resources in a Can$3.84 billion, $18.5 per share deal

https://magazine.cim.org/en/news/2021/newcres...e%20region

=============================

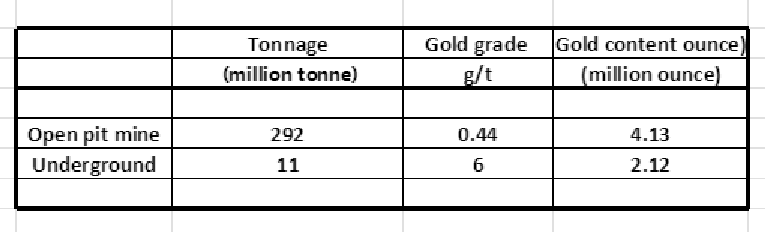

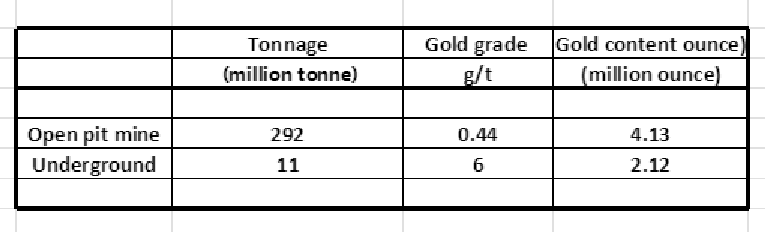

Open pit versus underground mining

=============================

Open-pit mining excavates minerals from a large, open surface pit, making it best for shallow, large deposits and generally cheaper, safer, and easier to operate with large equipment, but it causes significant surface disturbance and environmental impact. Underground mining is for deeper deposits, requiring expensive infrastructure like shafts or tunnels and complex ventilation/communication systems, but it offers higher recovery rates, less surface disturbance, and access to high-value deposits in sensitive areas

Open-pit mining is generally more profitable than underground mining because it has lower costs, higher productivity, and greater safety, making it the preferred choice for near-surface deposits of lower-value minerals. However, the profitability of either method ultimately depends on the specific orebody's characteristics, including the mineral's grade and depth, the overall deposit size, and economic factors like commodity prices and infrastructure costs.

Open pit mining usually involves high tonnage of low grade gold while underground mining involves low tonnage of high grade gold. All-In-Sustaining-Cost varies, depending on the company's operation.

The 2024 and 2025 exploration drill program identified opportunities to improve the average grade of the mineral resources and potentially grow the in-pit and near pit resources.

The Company’s current strategy remains focused on optimizing, de-risking and advancing its Spanish Mountain Gold Project towards a build decision before the end of 2027.

Preliminary Economic Assessment and NI-43-101 Technical Report has been published. The PEA envisions a conventional open pit mining and milling operation with a projected 24.5-year mine life producing 4 million ounces of gold.

$7,199,968 equity financing has been closed. The funds will be used for a 10,000 meter drill program to be commenced in the fall of 2025.

With the completion of the 2025 PEA, the Company anticipates beginning a new Pre-Feasibility Study (PFS) in 2025, or potentially advancing directly to a Feasibility Study (“FS”).

The company has engaged the services of Atrium Research Corporation, a leading company sponsored research firm. Atrium will produce a range of research services to the Company and present the Company’s investment case to potential investors. Atrium will also host video interviews with the Company’s management team to present the investment case in an interview format.

==============================

Recent drilling news and assays results

==============================

April 24, 2025 - Spanish Mountain Gold Reports Near Surface High Grade Gold Intercepts in the K - Zone

https://spanishmountaingold.com/news/2025/spa...he-k-zone/

Visible gold is sighted in several drill holes, supporting the potential for significant new high-grade mineralization on the project.

Spanish Mountain Gold reports numerous high-grade gold assays from its 2025 drilling programs, particularly in the K Zone and at the new Phoenix Target, with notable results including:

Hole 25-DH-1286 (K Zone):

====================

719.26 g/t Au over 0.75 m

156.80 g/t Au over 3.50 m

4.18 g/t Au over 139.00 m from 56.00 m

Hole 25-CCR-062 (Phoenix Target):

==========================

17.28 g/t Au over 4.00 m

To follow up on the April 24 high grade result, the company will conduct a 10,000 meter program in the Fall of 2025

September 12, 2025 - Spanish Mountain Gold Announces 10,000 Meter Drill Program commencing in the Fall

https://spanishmountaingold.com/news/2025/spa...l-program/

==========================

Mineral Resource Estimate (MRE)

==========================

https://investorshangout.com/images/MYImages/...timate.png

Drilling in 2025 shows long intervals of high grade gold, it could be a sign of existence of gold veins nearby which are the source of the low grade placer gold. The placer gold on the Spanish Mountain property originates from erosion of the parent lode gold deposit. After being weathered and broken loose, the dense gold was then eroded, transported, and deposited in placer deposits like those in the creeks on the southwest side of the property, such as Cedar Creek ( https://www.google.ca/maps/search/cedar+creek...FQAw%3D%3D ), where rich placer gold was discovered in the early 1900s. With skyrocketing gold price, placer gold mining has become highly profitable

.jpg)

Gold veins - How are they formed

Intense pressure and heat was generated between the collision of the world's tectonic plates 200 million years ago, caused buried, water-bearing rocks to release metamorphic fluids containing dissolved gold into the Earth's crust. These fluids migrate upwards through deep, fault-controlled fracture networks, depositing gold as quartz veins. As the Pacific plate submerged underneath the American plate (the phenomenon is called subduction), the west coast from British Columbia to South America was squeezed and pushed upward and skyward, forming the Rocky Mountain 8000 feet high as well as forming the Andes Mountain in South America, bringing along with it gold deposits and fossil of ancient sea creatures from the bottom of the ocean. That is why gold and fossil of sea creatures are found at high altitude of British Columbia and Nevada. On the other side of the world, the Indian tectonic plate is in a collision with the Eurasian plate, the collision caused land deformation and created the Himalayas Mountain and the Tibetan Plateau, but India will not completely disappear under Asia

============================

PEA and NI-43-101 Technical Report

============================

July 3, 2025 - Preliminary Economic Assessment (PEA)

https://spanishmountaingold.com/news/2025/spa...0-billion/

August 18, 2025 - NI-43-101 Technical Report

https://spanishmountaingold.com/site/assets/f...-final.pdf

=================================

Charts - Gold, Silver, XAU, SPA.V, SPAUF

=================================

Gold Price

https://stockcharts.com/h-sc/ui?s=$GOLD&p...e_vignette

https://mrci.com/pdf/gc.pdf

Silver Price

https://stockcharts.com/h-sc/ui?s=$SILVER&...e_vignette

Mining Index (XAU)

https://stockcharts.com/h-sc/ui?s=%24XAU&...9099899440

SPA.V monthly chart

Às of September 18, 2025

https://investorshangout.com/images/MYImages/...ychart.png

SPA.V weekly chart

https://stockcharts.com/h-sc/ui?s=SPA.V&p...e_vignette

SPA.V - News, trade data

https://www.stockwatch.com/Quote/Detail.aspx?C:SPA.V

SPAUF.OTCQB weekly chart

https://stockcharts.com/sc3/ui/?s=SPAUF&p...e_vignette

SPAUF Level 2

https://www.otcmarkets.com/stock/SPAUF/overview

===========================

SPA.V weekly - Technical Analysis

==========================

https://investorshangout.com/images/MYImages/...3_SPAW.png

Historical cases of bullish Head & Shoulder

https://investorshangout.com/images/MYImages/...istory.png

======================

Potential future share price

======================

Excerpt from July 3, 2025 news release:

"Significant Production and Low Cost: 203,265 oz average annual gold production in the first 5 years at an all-in sustaining cost net of by-product credits (“AISC”) of US$1,024/oz and 122,041 oz average annual gold production over a 24.5-year life of mine at an AISC of US$1,338/oz".

With annual production of 203,265 ounces and at gold price of US$3200, annual sales will be US$650 million for the first 5 years. At All-In-Sustaining-Cost (AISC) of $1338 per ounce, profit will be US$1862 per ounce, it translates into net profit of US$7448 million (CAN$10427 million) over the 24 years of mine life, producing in excess of 4 million ounces of gold, before tax and other expenses, including loan payment. Future share price is projected to be CAN$10427 million / 600 million shares = CAN$17 per share, assuming future share outstanding will be at 600 million shares and gold price will remain constant at US$3200.

Since share price is forward looking and share price = P/E ratio x Earning per Share, with consistent positive earnings, especially increasing earnings, the P/E ratio can accelerate and share price could hit $17 long before the company's peak resource potential is achieved.

=================================

All-In-Sustaining-Cost of 25 gold producers

=================================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Cost (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

=============================

Spanish Mountain Gold - Governance

=============================

Spanish Mountain Gold Corp website

https://spanishmountaingold.com/

Spanish Mountain Gold - Corporate Presentation

https://spanishmountaingold.com/site/assets/f...dpated.pdf

News Release

https://spanishmountaingold.com/news/2025/

Financial Reports

https://spanishmountaingold.com/investors/fin...y-filings/

Preliminary Economic Assessment Economics

https://spanishmountaingold.com/project/preli...economics/

Top Management

https://spanishmountaingold.com/corporate/management/

Board of Directors

https://spanishmountaingold.com/corporate/boa...directors/

==============================

Warrants, Options, Major shareholders

==============================

https://investorshangout.com/images/MYImages/...ership.jpg

Insider trading transaction update

https://www.barchart.com/stocks/quotes/SPA.VN/insider-trades

=============

You tube videos

=============

Webinar replay July 2025

https://www.youtube.com/watch?v=wwTCeoLABlY&t=649s

Mining Investment Event in Quebec City July 2025

https://www.youtube.com/watch?v=9MDABJPTEFU&t=160s

===========

Social Media

===========

Government extending support for mineral exploration in Canada

https://www.canada.ca/en/department-finance/n...anada.html

Spanish Mountain Gold at LinkedIn.com

https://ca.linkedin.com/company/spanish-mountain-gold-ltd-

===============================

Other mines in the Cariboo Region of BC

===============================

Gibraltar Mines - Owned by Taseko Mines, located 50 kilometers west of Spanish Mountain Gold

The Gibraltar Mine is the second-largest open-pit copper-molybdenum mine in Canada, owned and operated by Taseko Mines. Its primary resource is low-grade porphyry copper-molybdenum deposit containing minerals chalcopyrite, molybdenite, bornite, and cuprite. As of December 31, 2024, the mine has 616 million tons of 0.26% copper and 0.008% molybdenum. ( https://www.youtube.com/watch?v=yJmanh1uQMQ )

Cariboo Gold Project - Owned by Osisko Development, located 30 kilometers northwest of Spanish Mountain Gold

The Cariboo Gold Project is 100%-owned by Osisko Development Corp. April 2025 feasibility study indicates a probable reserves of 16.7 million tonnes of 3.78 g/t gold containing 2.031 million ounces of gold. The company has secured US$450 million loan from Appian Capital Advisory to advance the development.

Polley Mines - Owned by Imperial Metals, located 10 kilometers west of Spanish Mountain Gold

2025 production targets are set for 25 to 27 million pounds of copper and 35,000 to 40,000 ounces of gold.

=======================

Spanish Mountain Gold's peer

=======================

Banyan Gold (BYN.V) is focused on earning a 100% stake in the AurMac Project in Yukon. Banyan Gold does not currently own or operate a mill. Banyan Gold's future plans include moving towards a Pre-Feasibility Study (PFS) in 2025, which will include further optimization studies for their Powerline project.

Share outstanding: 376,729,649

Market Capitalization: $282,547,237

Share price: CAN$0.78

Project Overview

https://banyangold.com/projects/overview/

June 25, 2005 - Banyan Intersects 3.95 g/t Gold Over 38.1 Metres at the Airstrip Deposit, AurMac Project, Yukon, Canada

https://banyangold.com/news-releases/2025/ban...on-canada/

July 8, 2025 - Banyan Announces First Indicated Mineral Resources and Identifies High Grade Continuous Zones at its’ AurMac Project, Yukon, Canada

https://banyangold.com/news-releases/2025/ban...on-canada/

BYN.V weekly chart

https://stockcharts.com/sc3/ui/?s=BYN.V&p...6610120538

======================================

Historical buyout deals in the Golden Triangle, BC

======================================

https://thedeepdive.ca/wp-content/uploads/202...le-3-1.png

Placer Dome and International Corona acquired Stikine Resources at Can$67 per share

https://www.northernminer.com/news/placer-sta...000178407/

Imperial Metals acquired American Bullion Minerals Ltd. at Can$2.45 a share

https://imperialmetals.com/for-our-shareholde...an-bullion

Newmont acquired GT Gold at $3.25 per share in a Can$393 million deal

https://www.newmont.com/investors/news-releas...fault.aspx

Australian gold and copper producer Newcrest Mining acquired Pretium Resources in a Can$3.84 billion, $18.5 per share deal

https://magazine.cim.org/en/news/2021/newcres...e%20region

=============================

Open pit versus underground mining

=============================

Open-pit mining excavates minerals from a large, open surface pit, making it best for shallow, large deposits and generally cheaper, safer, and easier to operate with large equipment, but it causes significant surface disturbance and environmental impact. Underground mining is for deeper deposits, requiring expensive infrastructure like shafts or tunnels and complex ventilation/communication systems, but it offers higher recovery rates, less surface disturbance, and access to high-value deposits in sensitive areas

Open-pit mining is generally more profitable than underground mining because it has lower costs, higher productivity, and greater safety, making it the preferred choice for near-surface deposits of lower-value minerals. However, the profitability of either method ultimately depends on the specific orebody's characteristics, including the mineral's grade and depth, the overall deposit size, and economic factors like commodity prices and infrastructure costs.

Open pit mining usually involves high tonnage of low grade gold while underground mining involves low tonnage of high grade gold. All-In-Sustaining-Cost varies, depending on the company's operation.