(Total Views: 143)

Posted On: 08/31/2025 12:58:20 PM

Post# of 1032

1911 Gold - The tale of 2 emerging gold producers ................................

and the 1911 Gold potential.

It is the best of times, it is the worst of times. It is the best of times in delineating 2 million ounces of gold resources in underground drilling before production begins while gold price is in an eternal rise. It is the worst of times that some impatient 6-cents financiers are taking their profits while looking for other elusive overnight tenbaggers and in the process, hindering the upward momentum of share price. But they don't have unlimited number of shares to sell, when selling dries up, share price will accelerate upward as demands are strong. Somehow there is a silver lining in the selling, it increases liquidity and eliminates ugly bashing among late comers whose motive is to shake shares off the weak hands amid supply shortage. But when the selling is gone so will the buying opportunity for cheap shares.

In April, in response to my inquiry about the relentless selling by an anonymous seller at 20 cents level, hitting as low as 15 cents, Shaun Heinrich said: "There is something working against us, a fund manager has exercised his warrants, he never intends to hold the shares for long term investment, I will never do such financing again". Subsequently share price rose to 28 cents after the selling dried up but another exercising of warrant was mentioned in the 2025 Q2 financial report ( https://1911gold.com/investors/financial-reports/ ).

Excerpt from Page 18 of 2025 Q2 Management Discussion and Analysis with typo corrected:

https://1911gold.com/_resources/financials/19...f?v=083003

Issuance of common shares from the exercise of warrants

9,284,133 common shares from the exercise of share purchase warrants for a value of $928K.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1911 Gold - AUMB.V

.jpg)

Weekly chart

https://stockcharts.com/h-sc/ui?s=AUMB.V&...2963243620

News Release

https://1911gold.com/news/press-releases/

Daily Trading

https://www.stockwatch.com/Quote/Detail.aspx?C:AUMB.V

Statistics

https://ca.finance.yahoo.com/quote/AUMB.V/key-statistics/

Share Outstanding as of August 29: 257,122,285

Market Capitalization as of August 29: $75,851,075

~~~~~~~~~~~~~~~~~~

Blue Lagoon Resources - BLLG.CA

Weekly chart ( This will happen when gold production is imminent )

https://stockcharts.com/h-sc/ui?s=BLLG.CA&...5028404030

News Release

https://bluelagoonresources.com/

Daily Trading

https://www.stockwatch.com/Quote/Detail.aspx?C:BLLG

Statistics

https://ca.finance.yahoo.com/quote/BLLG.CN/key-statistics/

Share Outstanding as of August 29: 117,585,244

Market Capitalization as of August 29: $81,133,819

But AUMB is more superior in having its own ore processing mill having a replacement value of $300 million. With high grade gold in the assays, with multi-million ounces of historical gold production, with potential of more gold discoveries in many unexplored areas in the immense 630 square kilometers property, 1911 Gold's future growth potential is limited only by imagination, especially when the company "steps out of the regional footprint for accretive acquisition in North America" as pledged by the management.

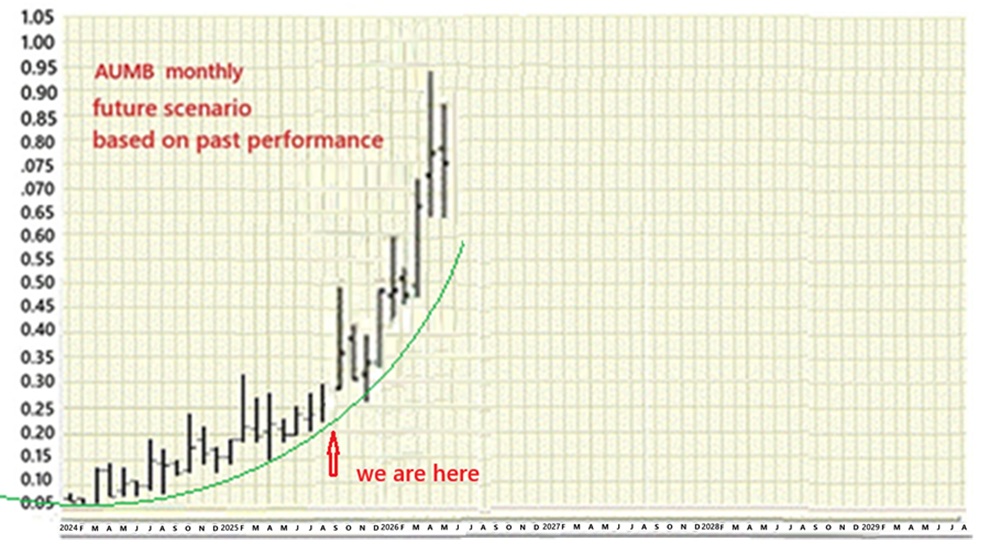

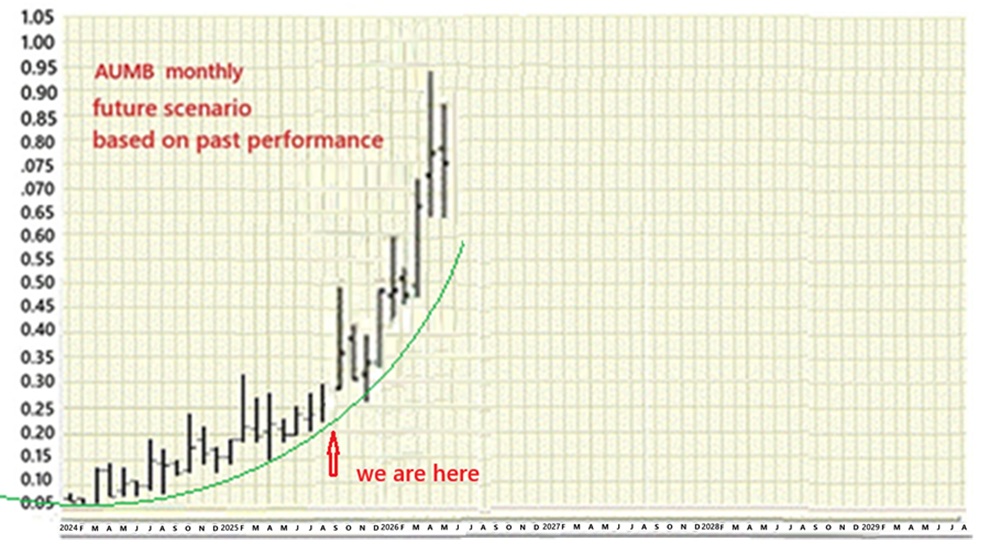

AUMB.V monthly - future scenario

https://investorshangout.com/images/MYImages/...enario.jpg

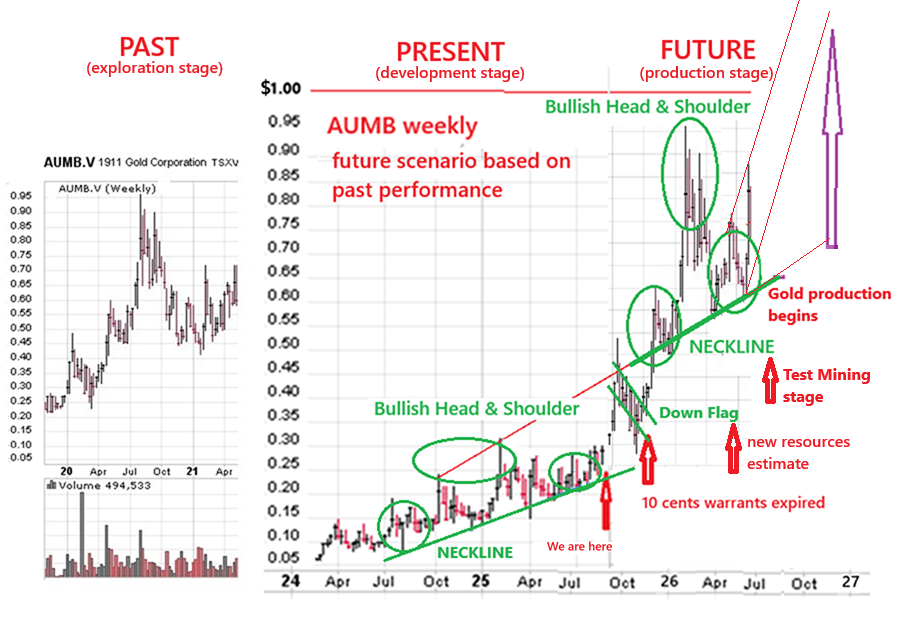

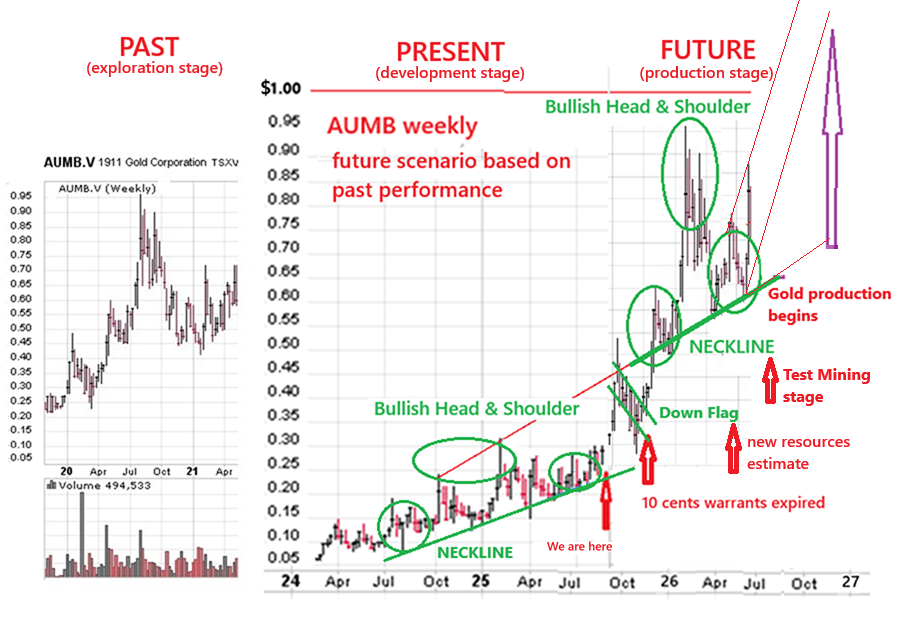

AUMB.V weekly - future scenario

https://investorshangout.com/images/MYImages/...enario.png

BLLG.CA weekly - Technical Analysis

https://investorshangout.com/images/MYImages/...3yr-TA.png

Do you know that it takes only 2 tenbaggers to turn $10K investment into $1 million? The first one turns $10K into $100K, the second one turns the $100K into $1 million. But if you are married to deadwood stocks, your $10K investment will turn into $0.00000001 So do your own diligent stoical research first before committing your hard earned money.

=================================================

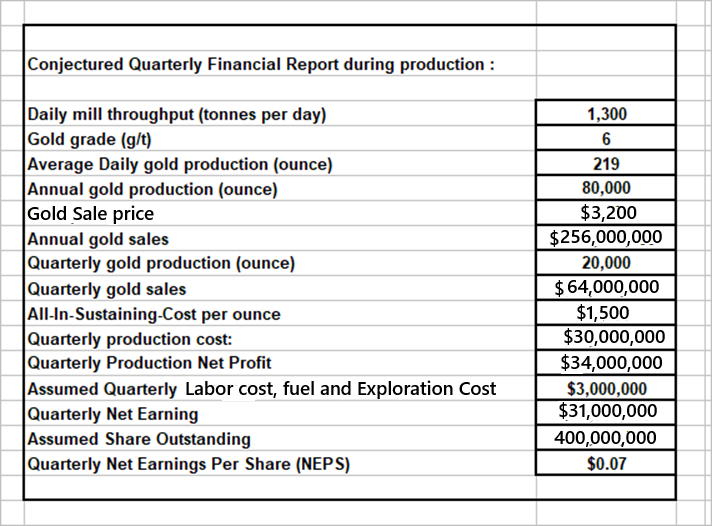

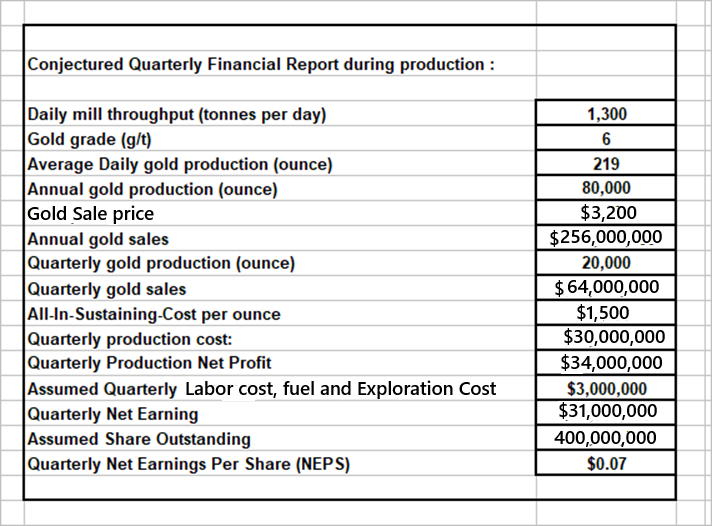

A conjectured quarterly financial report during initial production

=================================================

https://investorshangout.com/images/MYImages/...ancial.png

Future share price = P/E ratio x Earnings Per Share

About P/E ratio:

https://www.google.ca/search?q=P%2FE+ratio+fo...CwfCtLKIl-

===============================

All-In-Sustaining-Cost of gold producers

===============================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

======================

Potential future share price

======================

With annual production of 80,000 ounces and at gold price of US$3200, annual sales will be US$256 million. At the industry's average All-In-Sustaining-Cost (AISC) of $1500 per ounce, profit will be US$1,700 per ounce, it translates into net profit of US$3400 million (CAN$4760 million) over the 10 years of mine life, producing in excess of 2 million ounces of gold Future share price is projected to be CAN$4760 million / 400 million shares = CAN$12 per share, a 4700% return from current price of 25 cents, assuming future share outstanding will be at 400 million shares.

Since share price is forward looking, with consistent positive earnings, especially increasing earning, the P/E ratio can accelerate and share price could hit $12 long before the company's peak resource potential is achieved by the end of the mine life.

Gold price

https://investorshangout.com/images/MYImages/...onthly.gif

==========================

Potential return on investment

==========================

Junior Mining companies that billionaire Eric Sprott invests in:

https://www.juniorminingnetwork.com/mining-st...prott.html

At share price of $12, billionaire Eric Sprott's holding of 42 million shares will return him $1/2 Billion. Also Director Blair Schultz and CEO Shaun Heinrichs will be $54 million and $46 million richer respectively. 1911 Gold will also create many millionaires / multi-millionaires among patient loyal long term shareholders, not from the pockets of other investors, but from the wealth of Mother Nature. Even for small retail investors, a $20K investment could buy them a million dollar house or condo in a few years, no more stress from perpetual rent hike.

=====================================

1911 Gold - Net Asset Value per Share (NAVPS)

=====================================

The ore processing mill with a replacement value of $300 million + 2 million ounces of gold resource at minimum Enterprise Value of $50 per ounce contributes to the company's NAVPS of US$1.60 per share (CAN$2.20) at fully diluted basis.

1911 Gold had generated cashflow from historic tailings, producing between 5,000 and 5,500 ounces of gold annually to support the exploration effort and to maintain the existing facilities.

.jpg)

https://investorshangout.com/images/MYImages/...arged).jpg

==================================================

Government extending support for mineral exploration in Canada

==================================================

https://www.canada.ca/en/department-finance/n...anada.html

Evolution versus Creation

Evolution - Instantaneous erratic development with an uncertain future.

Creation - An ingenious and systematic contrivance with a certain ending.

There is significant difference between gambling and investing.

and the 1911 Gold potential.

It is the best of times, it is the worst of times. It is the best of times in delineating 2 million ounces of gold resources in underground drilling before production begins while gold price is in an eternal rise. It is the worst of times that some impatient 6-cents financiers are taking their profits while looking for other elusive overnight tenbaggers and in the process, hindering the upward momentum of share price. But they don't have unlimited number of shares to sell, when selling dries up, share price will accelerate upward as demands are strong. Somehow there is a silver lining in the selling, it increases liquidity and eliminates ugly bashing among late comers whose motive is to shake shares off the weak hands amid supply shortage. But when the selling is gone so will the buying opportunity for cheap shares.

In April, in response to my inquiry about the relentless selling by an anonymous seller at 20 cents level, hitting as low as 15 cents, Shaun Heinrich said: "There is something working against us, a fund manager has exercised his warrants, he never intends to hold the shares for long term investment, I will never do such financing again". Subsequently share price rose to 28 cents after the selling dried up but another exercising of warrant was mentioned in the 2025 Q2 financial report ( https://1911gold.com/investors/financial-reports/ ).

Excerpt from Page 18 of 2025 Q2 Management Discussion and Analysis with typo corrected:

https://1911gold.com/_resources/financials/19...f?v=083003

Issuance of common shares from the exercise of warrants

9,284,133 common shares from the exercise of share purchase warrants for a value of $928K.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

1911 Gold - AUMB.V

.jpg)

Weekly chart

https://stockcharts.com/h-sc/ui?s=AUMB.V&...2963243620

News Release

https://1911gold.com/news/press-releases/

Daily Trading

https://www.stockwatch.com/Quote/Detail.aspx?C:AUMB.V

Statistics

https://ca.finance.yahoo.com/quote/AUMB.V/key-statistics/

Share Outstanding as of August 29: 257,122,285

Market Capitalization as of August 29: $75,851,075

~~~~~~~~~~~~~~~~~~

Blue Lagoon Resources - BLLG.CA

Weekly chart ( This will happen when gold production is imminent )

https://stockcharts.com/h-sc/ui?s=BLLG.CA&...5028404030

News Release

https://bluelagoonresources.com/

Daily Trading

https://www.stockwatch.com/Quote/Detail.aspx?C:BLLG

Statistics

https://ca.finance.yahoo.com/quote/BLLG.CN/key-statistics/

Share Outstanding as of August 29: 117,585,244

Market Capitalization as of August 29: $81,133,819

But AUMB is more superior in having its own ore processing mill having a replacement value of $300 million. With high grade gold in the assays, with multi-million ounces of historical gold production, with potential of more gold discoveries in many unexplored areas in the immense 630 square kilometers property, 1911 Gold's future growth potential is limited only by imagination, especially when the company "steps out of the regional footprint for accretive acquisition in North America" as pledged by the management.

AUMB.V monthly - future scenario

https://investorshangout.com/images/MYImages/...enario.jpg

AUMB.V weekly - future scenario

https://investorshangout.com/images/MYImages/...enario.png

BLLG.CA weekly - Technical Analysis

https://investorshangout.com/images/MYImages/...3yr-TA.png

Do you know that it takes only 2 tenbaggers to turn $10K investment into $1 million? The first one turns $10K into $100K, the second one turns the $100K into $1 million. But if you are married to deadwood stocks, your $10K investment will turn into $0.00000001 So do your own diligent stoical research first before committing your hard earned money.

=================================================

A conjectured quarterly financial report during initial production

=================================================

https://investorshangout.com/images/MYImages/...ancial.png

Future share price = P/E ratio x Earnings Per Share

About P/E ratio:

https://www.google.ca/search?q=P%2FE+ratio+fo...CwfCtLKIl-

===============================

All-In-Sustaining-Cost of gold producers

===============================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

======================

Potential future share price

======================

With annual production of 80,000 ounces and at gold price of US$3200, annual sales will be US$256 million. At the industry's average All-In-Sustaining-Cost (AISC) of $1500 per ounce, profit will be US$1,700 per ounce, it translates into net profit of US$3400 million (CAN$4760 million) over the 10 years of mine life, producing in excess of 2 million ounces of gold Future share price is projected to be CAN$4760 million / 400 million shares = CAN$12 per share, a 4700% return from current price of 25 cents, assuming future share outstanding will be at 400 million shares.

Since share price is forward looking, with consistent positive earnings, especially increasing earning, the P/E ratio can accelerate and share price could hit $12 long before the company's peak resource potential is achieved by the end of the mine life.

Gold price

https://investorshangout.com/images/MYImages/...onthly.gif

==========================

Potential return on investment

==========================

Junior Mining companies that billionaire Eric Sprott invests in:

https://www.juniorminingnetwork.com/mining-st...prott.html

At share price of $12, billionaire Eric Sprott's holding of 42 million shares will return him $1/2 Billion. Also Director Blair Schultz and CEO Shaun Heinrichs will be $54 million and $46 million richer respectively. 1911 Gold will also create many millionaires / multi-millionaires among patient loyal long term shareholders, not from the pockets of other investors, but from the wealth of Mother Nature. Even for small retail investors, a $20K investment could buy them a million dollar house or condo in a few years, no more stress from perpetual rent hike.

=====================================

1911 Gold - Net Asset Value per Share (NAVPS)

=====================================

The ore processing mill with a replacement value of $300 million + 2 million ounces of gold resource at minimum Enterprise Value of $50 per ounce contributes to the company's NAVPS of US$1.60 per share (CAN$2.20) at fully diluted basis.

1911 Gold had generated cashflow from historic tailings, producing between 5,000 and 5,500 ounces of gold annually to support the exploration effort and to maintain the existing facilities.

.jpg)

https://investorshangout.com/images/MYImages/...arged).jpg

==================================================

Government extending support for mineral exploration in Canada

==================================================

https://www.canada.ca/en/department-finance/n...anada.html

Evolution versus Creation

Evolution - Instantaneous erratic development with an uncertain future.

Creation - An ingenious and systematic contrivance with a certain ending.

There is significant difference between gambling and investing.