(Total Views: 1340)

Posted On: 08/24/2025 12:17:38 PM

Post# of 264

Check the Tape!

Something’s Not Normal

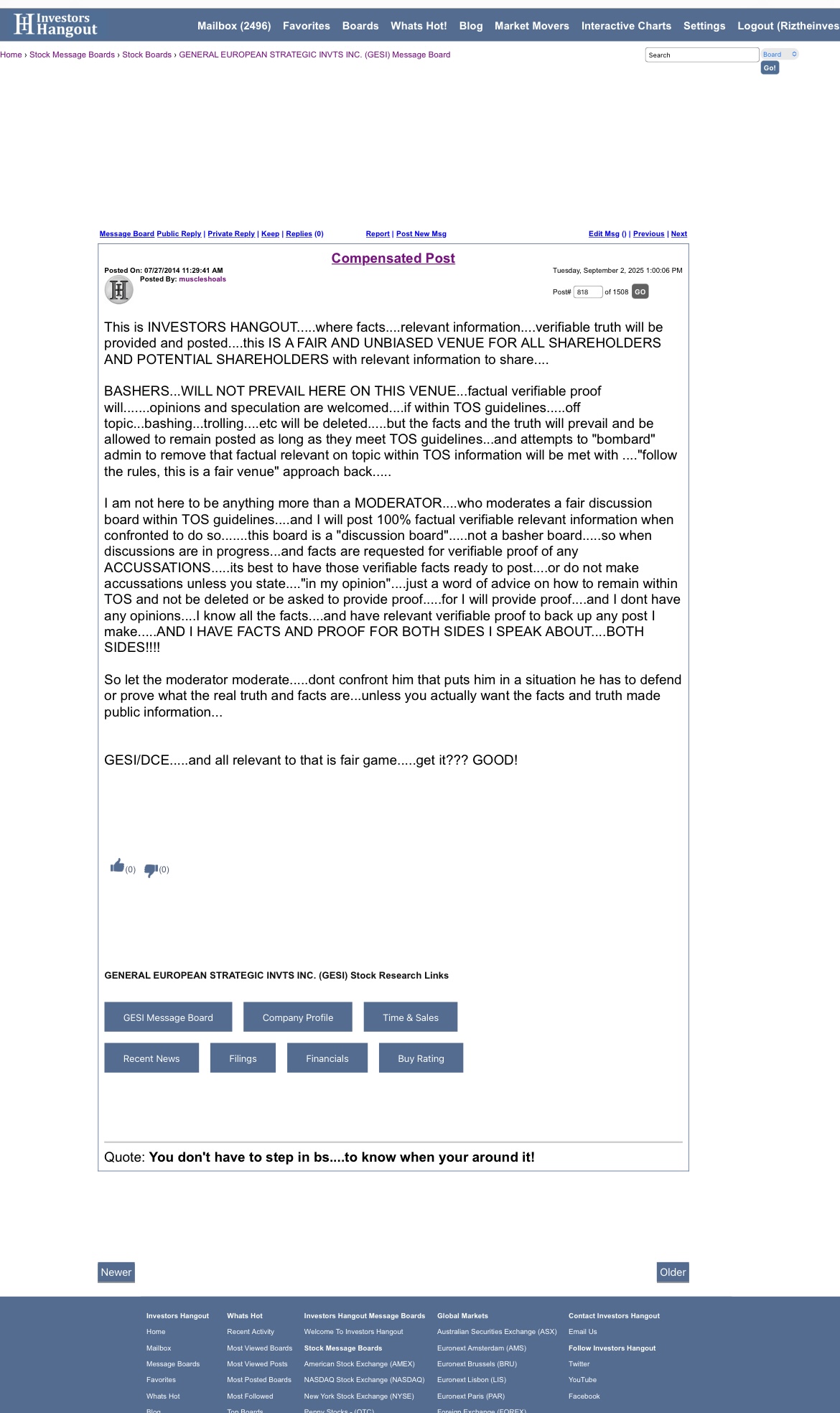

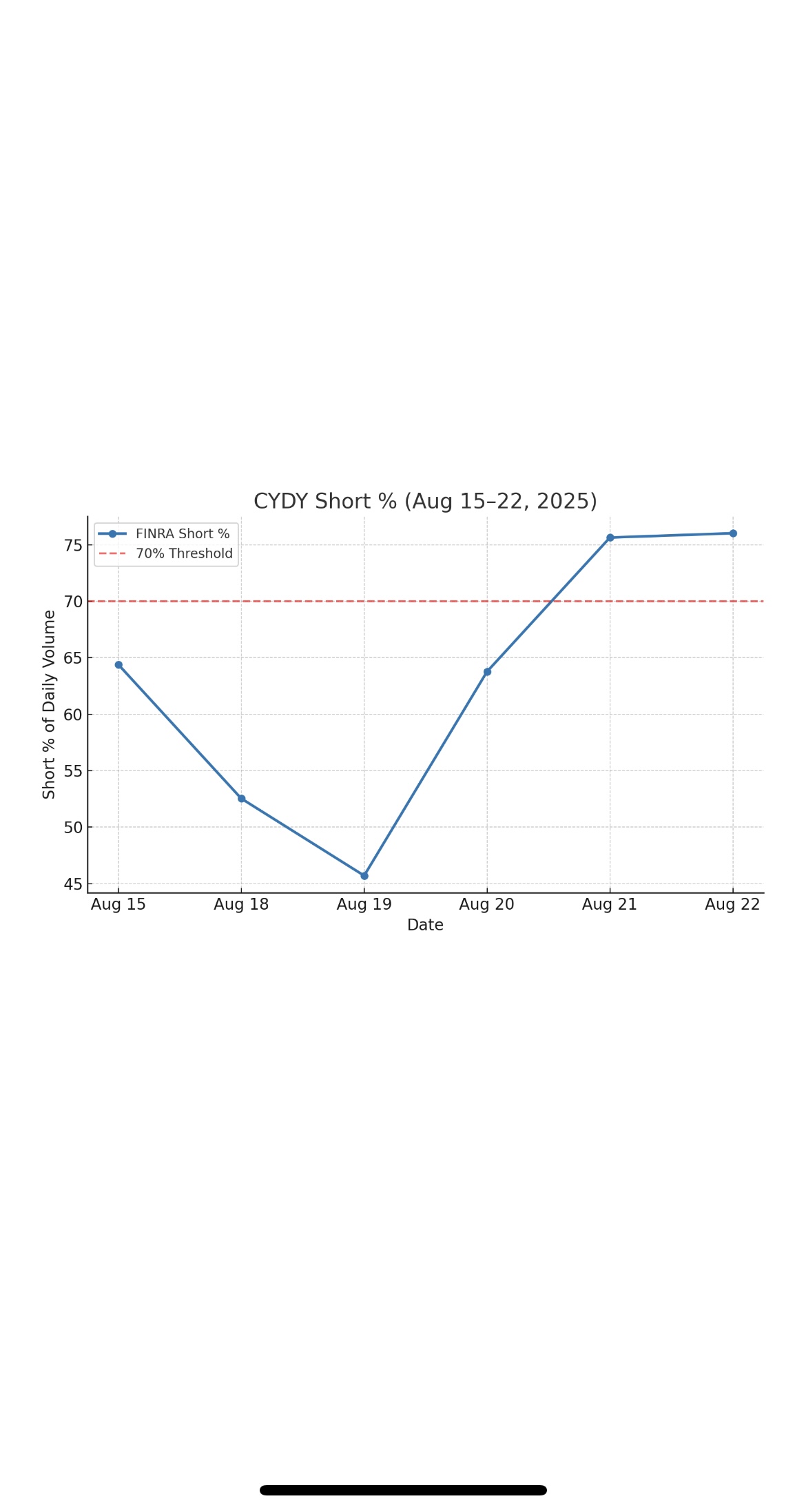

For the week of Aug 15–22, CYDY printed 70–76% short volume every single day (FINRA TRF). That’s millions of shares being hammered into the market. Normally, a microcap biotech under that level of pressure would be bleeding red candles.

But here’s the kicker:

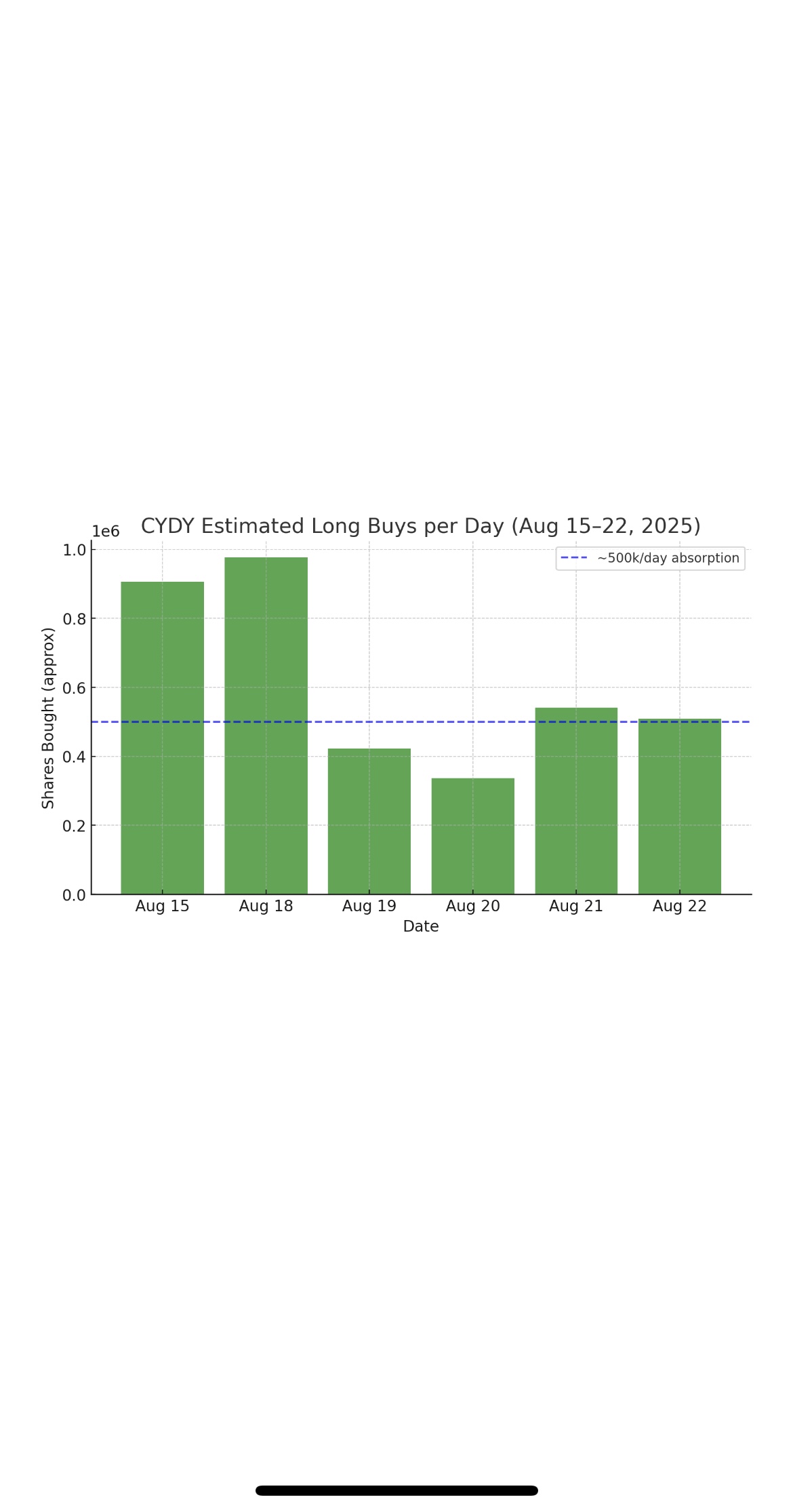

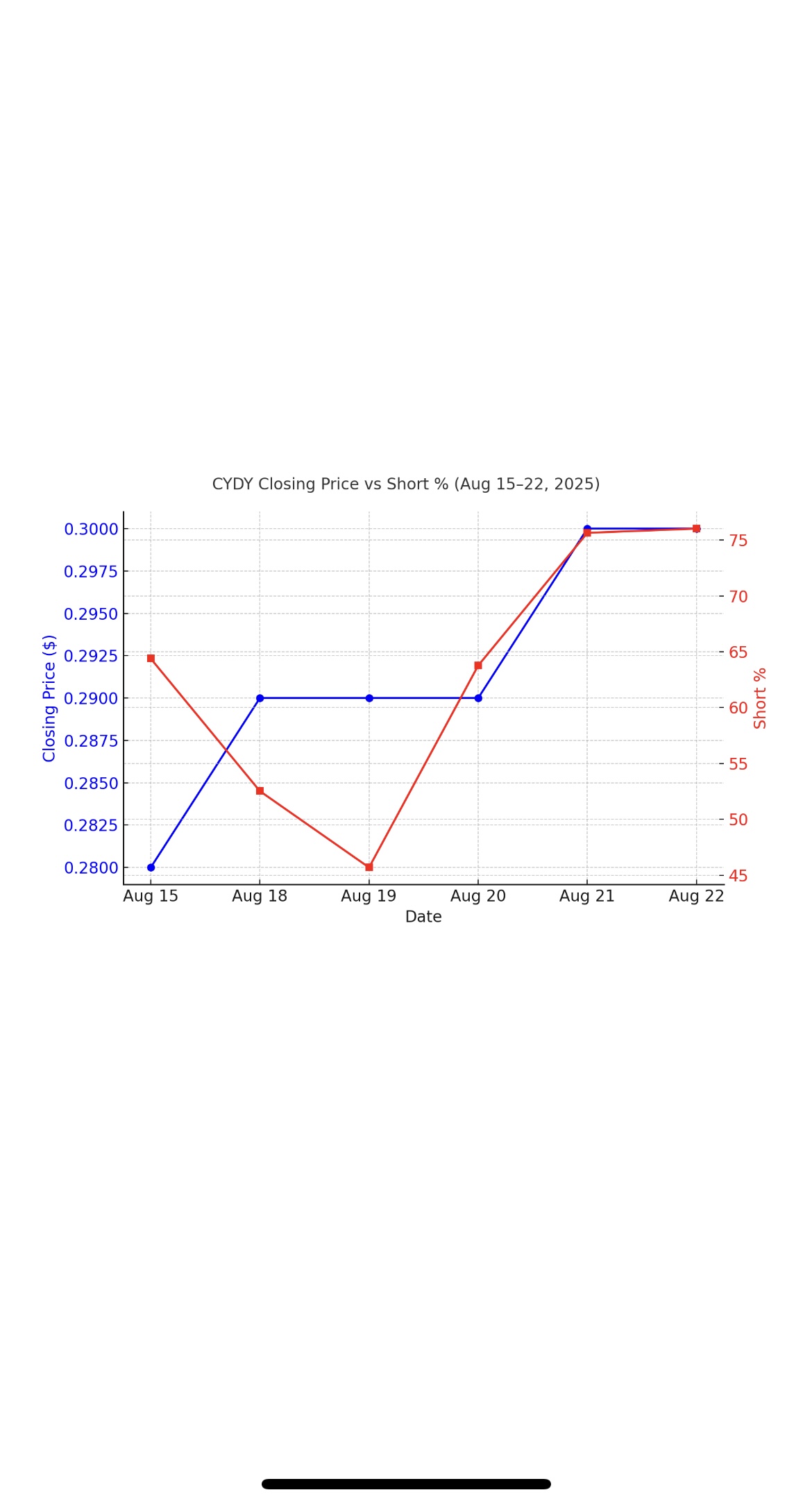

• Price held flat-to-green around $0.30.

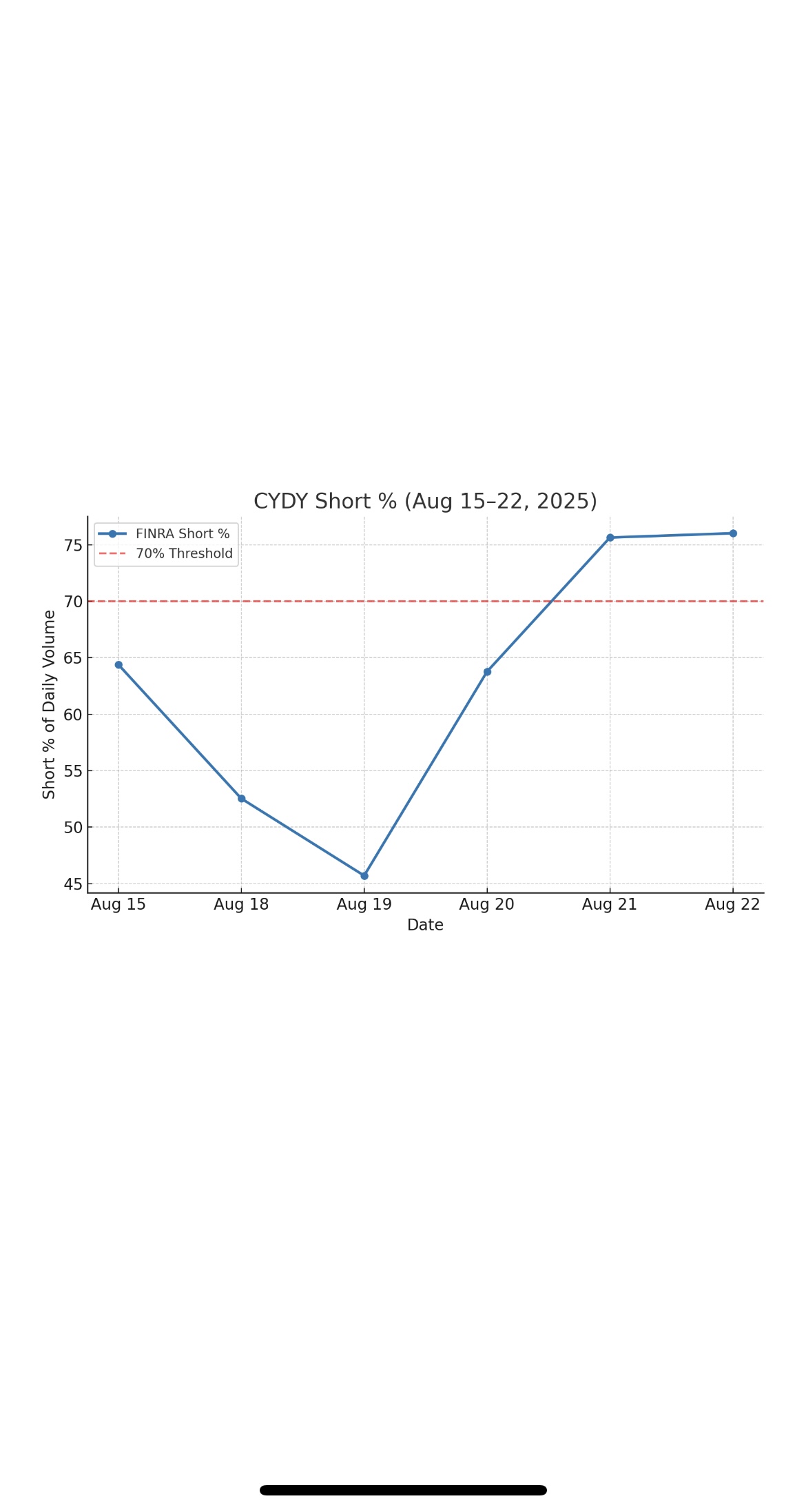

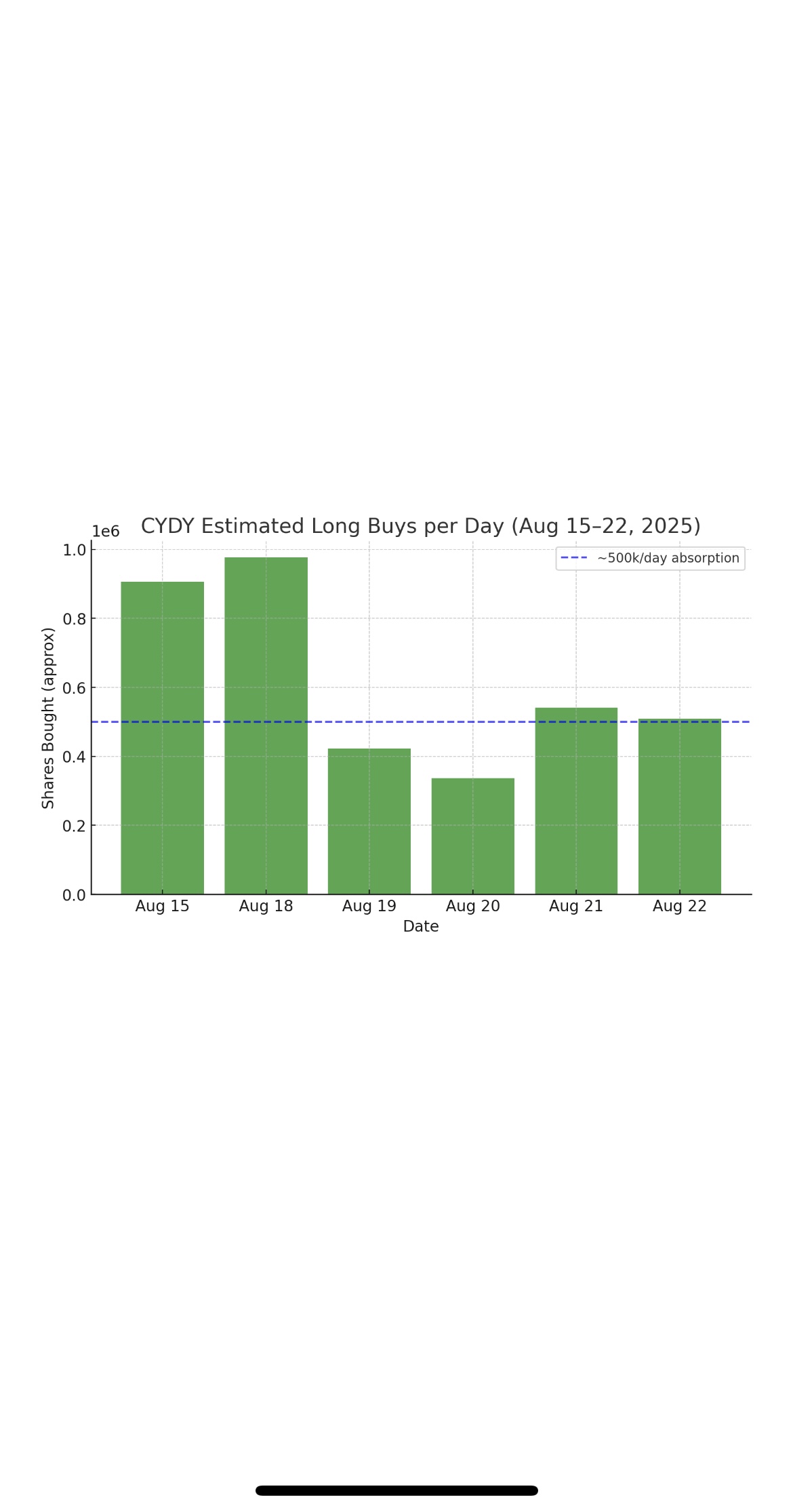

• ~500k long shares per day kept soaking supply.

• Even on Aug 21–22, with shorts throwing everything at the close, the stock still closed green.

That isn’t “random retail.” That’s what the street calls a creeper buyer…someone with deep pockets quietly accumulating day after day, letting shorts do the dirty work, and scooping shares at their set level.

Shorts think they’re in control because they can walk it down in the last seconds. But if there’s a disciplined accumulator on the other side, every short share dumped is one more bullet handed over to the enemy.

We won’t know the name until filings force disclosure (13D/13G or a partnership announcement). But the pattern screams accumulation. And the more shorts lean, the faster this counter-force builds its position.

Be careful of the gallows you build…you might just be building them for yourself.

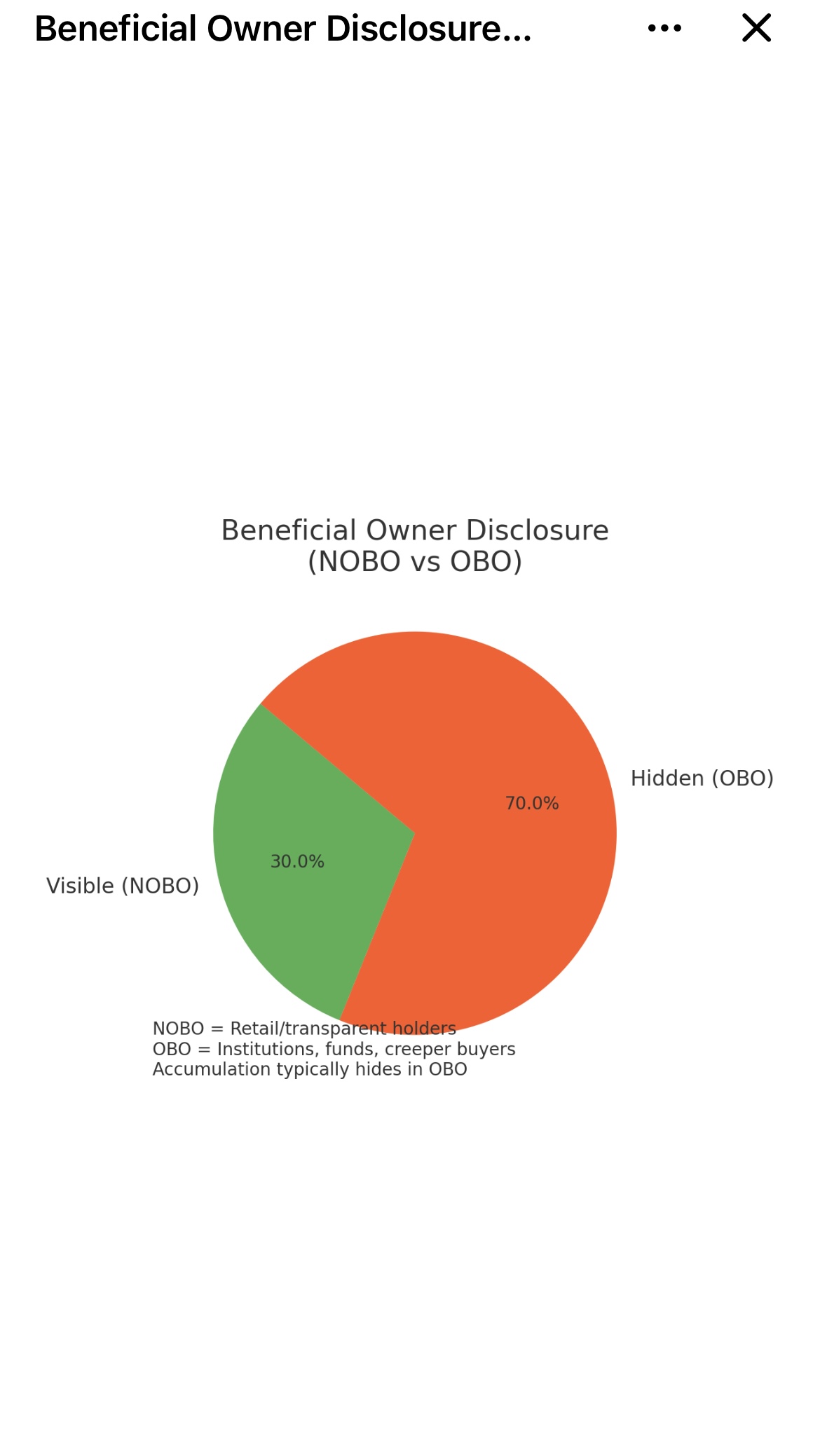

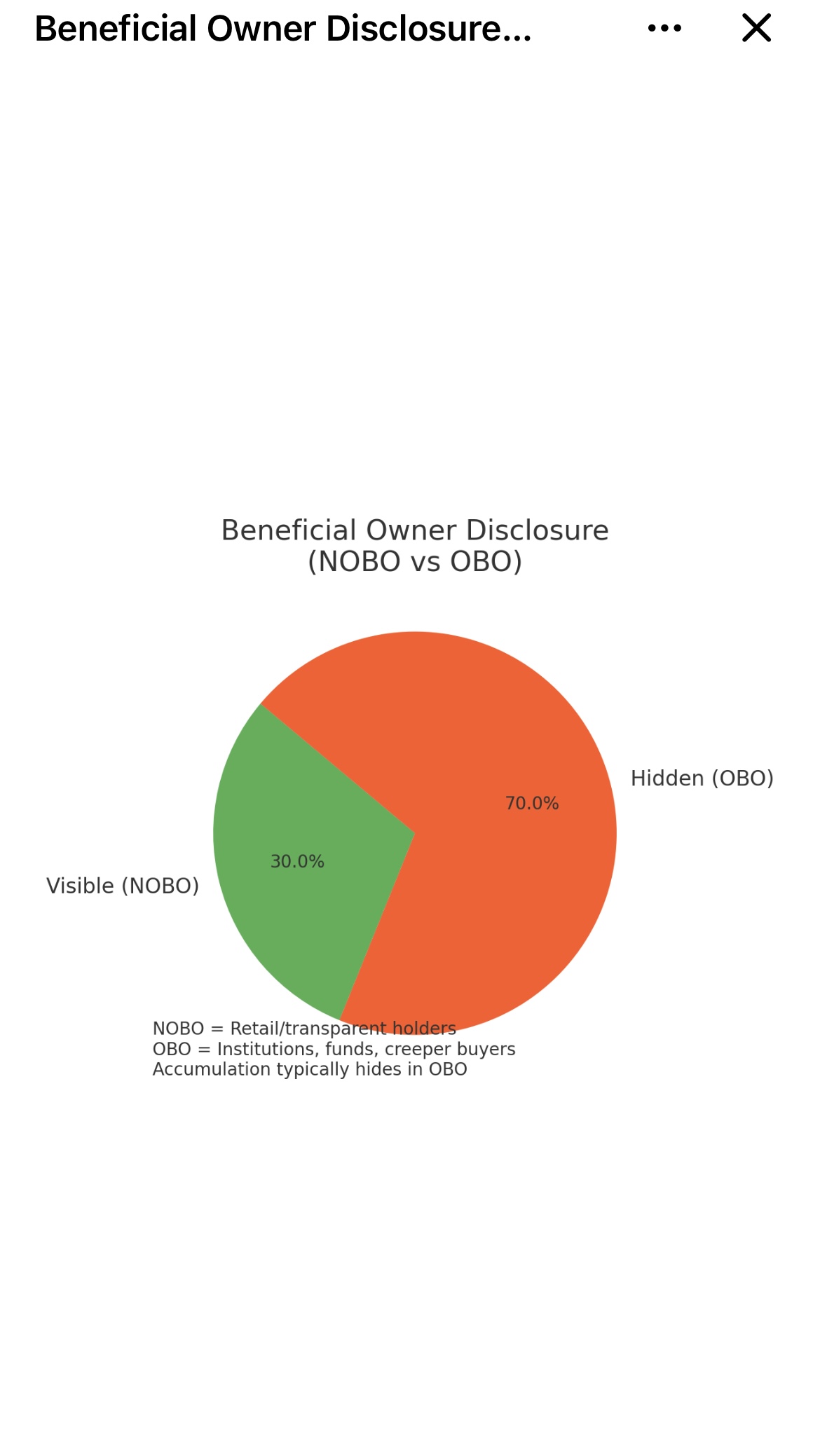

Check the FINRA tape 70%+ of CYDY’s daily volume is short. Yet ~500k shares/day are being soaked up, keeping us flat-to-green. If you’re only looking at the NOBO list, you’ll miss it. Creeper accumulation doesn’t show on NOBO, it hides in OBO. That’s where the real counter-force lives.

1. Short % per day

You can see how the last two sessions (Aug 21–22) spiked into the ~76% range, way above normal trading behavior.

⸻

2. Estimated long buys/day

Even under all that pressure, ~500k+ shares/day were being absorbed — consistent with a counter-force.

⸻

3. Closing Price vs Short %

Notice how the closing price stayed flat-to-green at $0.30 while short % surged. That divergence is the smoking gun…normally that much short pressure = price collaps

Sources:

- Aug 15, 2025 FINRA Daily Short Volume (Consolidated TRF/ADF): https://www.finra.org/finra-data/browse-catal...lume-files

- Aug 18, 2025 FINRA Daily Short Volume: (same link)

- Aug 19, 2025 FINRA Daily Short Volume: (same link)

- Aug 21, 2025 FINRA Daily Short Volume: (same link)

- Aug 22, 2025 FINRA Daily Short Volume: (same link)

- S-3 Notice of Effectiveness (Aug 21, 2025): https://investorshangout.com/post/view?id=6783864

They thought an S-3 would buy them time.

They thought 500k blocks would go unnoticed.

They thought “routine effectiveness” would slip by quiet.

Now it’s timestamped. ******. Exhibit F.

This doesn’t end with a squeeze.

It ends with collapse… and when it does, it’s not CYDY on trial.

It’s the SEC.

• OBO lists hide who’s really buying → only insiders at brokers, transfer agents, and CYDY management can see the real flow.

• 500k block prints → retail can’t trace the counterparty, but insiders know if it’s a short swap, a placement, or a creeper buyer.

• SEC effectiveness process → the public just sees “effective 9:00am.” Insiders know the back-and-forth comment letters, who pushed, and who lined up for the raise.

Why the Patents Matter in That S-3

• CYDY slipped IP into the risk section / disclosures → that’s not filler. That’s them saying: “Hey market, we still own something valuable here.”

• By doing that, they effectively flag to potential partners (MRK, GILD, etc.) that the shelf isn’t just a survival raise… it’s a bridge tied to underlying IP.

• To shorts, that’s poison: patents extend the “optionality” window, meaning their trade isn’t against a dying shell but against a drug/platform still in play.

Who’s forcing it…

Something’s Not Normal

For the week of Aug 15–22, CYDY printed 70–76% short volume every single day (FINRA TRF). That’s millions of shares being hammered into the market. Normally, a microcap biotech under that level of pressure would be bleeding red candles.

But here’s the kicker:

• Price held flat-to-green around $0.30.

• ~500k long shares per day kept soaking supply.

• Even on Aug 21–22, with shorts throwing everything at the close, the stock still closed green.

That isn’t “random retail.” That’s what the street calls a creeper buyer…someone with deep pockets quietly accumulating day after day, letting shorts do the dirty work, and scooping shares at their set level.

Shorts think they’re in control because they can walk it down in the last seconds. But if there’s a disciplined accumulator on the other side, every short share dumped is one more bullet handed over to the enemy.

We won’t know the name until filings force disclosure (13D/13G or a partnership announcement). But the pattern screams accumulation. And the more shorts lean, the faster this counter-force builds its position.

Be careful of the gallows you build…you might just be building them for yourself.

Check the FINRA tape 70%+ of CYDY’s daily volume is short. Yet ~500k shares/day are being soaked up, keeping us flat-to-green. If you’re only looking at the NOBO list, you’ll miss it. Creeper accumulation doesn’t show on NOBO, it hides in OBO. That’s where the real counter-force lives.

1. Short % per day

You can see how the last two sessions (Aug 21–22) spiked into the ~76% range, way above normal trading behavior.

⸻

2. Estimated long buys/day

Even under all that pressure, ~500k+ shares/day were being absorbed — consistent with a counter-force.

⸻

3. Closing Price vs Short %

Notice how the closing price stayed flat-to-green at $0.30 while short % surged. That divergence is the smoking gun…normally that much short pressure = price collaps

Sources:

- Aug 15, 2025 FINRA Daily Short Volume (Consolidated TRF/ADF): https://www.finra.org/finra-data/browse-catal...lume-files

- Aug 18, 2025 FINRA Daily Short Volume: (same link)

- Aug 19, 2025 FINRA Daily Short Volume: (same link)

- Aug 21, 2025 FINRA Daily Short Volume: (same link)

- Aug 22, 2025 FINRA Daily Short Volume: (same link)

- S-3 Notice of Effectiveness (Aug 21, 2025): https://investorshangout.com/post/view?id=6783864

They thought an S-3 would buy them time.

They thought 500k blocks would go unnoticed.

They thought “routine effectiveness” would slip by quiet.

Now it’s timestamped. ******. Exhibit F.

This doesn’t end with a squeeze.

It ends with collapse… and when it does, it’s not CYDY on trial.

It’s the SEC.

• OBO lists hide who’s really buying → only insiders at brokers, transfer agents, and CYDY management can see the real flow.

• 500k block prints → retail can’t trace the counterparty, but insiders know if it’s a short swap, a placement, or a creeper buyer.

• SEC effectiveness process → the public just sees “effective 9:00am.” Insiders know the back-and-forth comment letters, who pushed, and who lined up for the raise.

Why the Patents Matter in That S-3

• CYDY slipped IP into the risk section / disclosures → that’s not filler. That’s them saying: “Hey market, we still own something valuable here.”

• By doing that, they effectively flag to potential partners (MRK, GILD, etc.) that the shelf isn’t just a survival raise… it’s a bridge tied to underlying IP.

• To shorts, that’s poison: patents extend the “optionality” window, meaning their trade isn’t against a dying shell but against a drug/platform still in play.

Who’s forcing it…

WIRETAP LOG // MINIMIZE…

EXHIBIT E: 500k BLOCKS MONDAY

SHORTS ARE FUCKED

5.95???

EXHIBIT E: 500k BLOCKS MONDAY

SHORTS ARE FUCKED

5.95???