(Total Views: 234)

Posted On: 08/15/2025 6:18:45 PM

Post# of 1032

1911 Gold - Operation Update August 15 ............................................................

.jpg)

==================

Recent news release

==================

August 7, 2025 - 1911 Gold Intersects 5.52 g/t Au over 6.50 m and 54.00 g/t Au over 0.50 m on SAM Southeast Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

July 17, 2025 - 1911 Gold Closes C$13.2 Million “Bought Deal” Life Offering Including Increased Investment by Eric Sprott

https://1911gold.com/news/press-releases/1911...ric-sprott

June 10, 2025 - 1911 Gold Intersects up to 58.66 g/t Gold over 1.40 m on San Antonio West Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

April 30, 2025 - 1911 Gold Intersects 62.40 g/t Au over 1.00 m on San Antonio West Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

=================================

Current event and timeline of future events

=================================

- 2025 Q2 financial report will be out in 2 weeks before Friday, August 29

- With a team of mining experts having successful track record and strong credentials in engineering, ore mining and gold production, Shaun Heinrichs scheduled to delineate at least 2 million ounces of high grade gold resource first before starting gold production. Underground mining will exploit "narrow vein" drilling technique which will yield high grade gold while mitigating waste rocks. Helped by high gold price over $3,000, 1911 Gold's operation will be highly profitable.

- The company has completed 62 surface drill holes for a total of 14,974.40 meters in the current drilling program. The exploration drilling plan includes up to 30,000 meters of drilling by the end of 2025.

- Drilling in the Cohiba area is put on hold as the management is busy preparing for underground drilling which will begin in early September. The underground drilling data will provide the basis for the Preliminary Economic Assessment (PEA) towards the end of 2025.

- The True North Gold Mine has seen various gold grades in underground drilling, with historical data showing an average grade of 9.33 g/t Au from the San Antonio zone. Recent drilling by 1911 Gold has identified high-grade intercepts, including 62.40 g/t Au over 1.00 meter, 58.66 g/t Gold over 1.40 meter on the San Antonio West zone and 54.00 g/t Au over 0.50 meter on SAM Southeast zone.

- "Property Wide" new Mineral Resource Estimate (MRE) will be released in April, 2026.

- The $13.2 million financing has closed (no warrants are issued). Additional $3.7 million will be added to the coffer before December 22, 2025 from the exercising of the remaining 37 million 10-cents warrants, but Shaun Heinrichs does not expect selling of the warrant converted shares as all of the financiers' investment is for long term holding. Shaun said the $17 million cash in the coffer will be sufficient to cover PEA and will last to the bulk sample stage (Test Mining Stage) in 2026 and that it will be exciting times for shareholders. Test Mining is the final exploration stage before production.

- After replenishing mining equipment that Klondex took away during its acquisition by Hecla, ore mining will begin in the second half of 2026.

- Gold pouring is scheduled to commence towards end of 2026, hopefully in time for Christmas as "delay" is always normal in the mining business. But it could also accelerate depending on market conditions.

- Shortly into the production phase Ogama-Rockland and Central Manitoba projects will join in, feeding high grade gold ores to the mill.

- Shaun Heinrichs reckons that the company can initially produce 50,000 to 80,000 ounces gold annually at mill throughput of 1,300 tonnes per day, ramping up to 150,000 ounces annually at throughput of 3,000 tonnes per day with additional portable ore crushing circuitry which will cost about $3 million. Mine life is projected to be 10 years, producing in excess of 2 million ounces of gold.

- The management's future plan is continue to grow the company organically by "stepping out of the regional footprint for accretive acquisition in North America".

===========

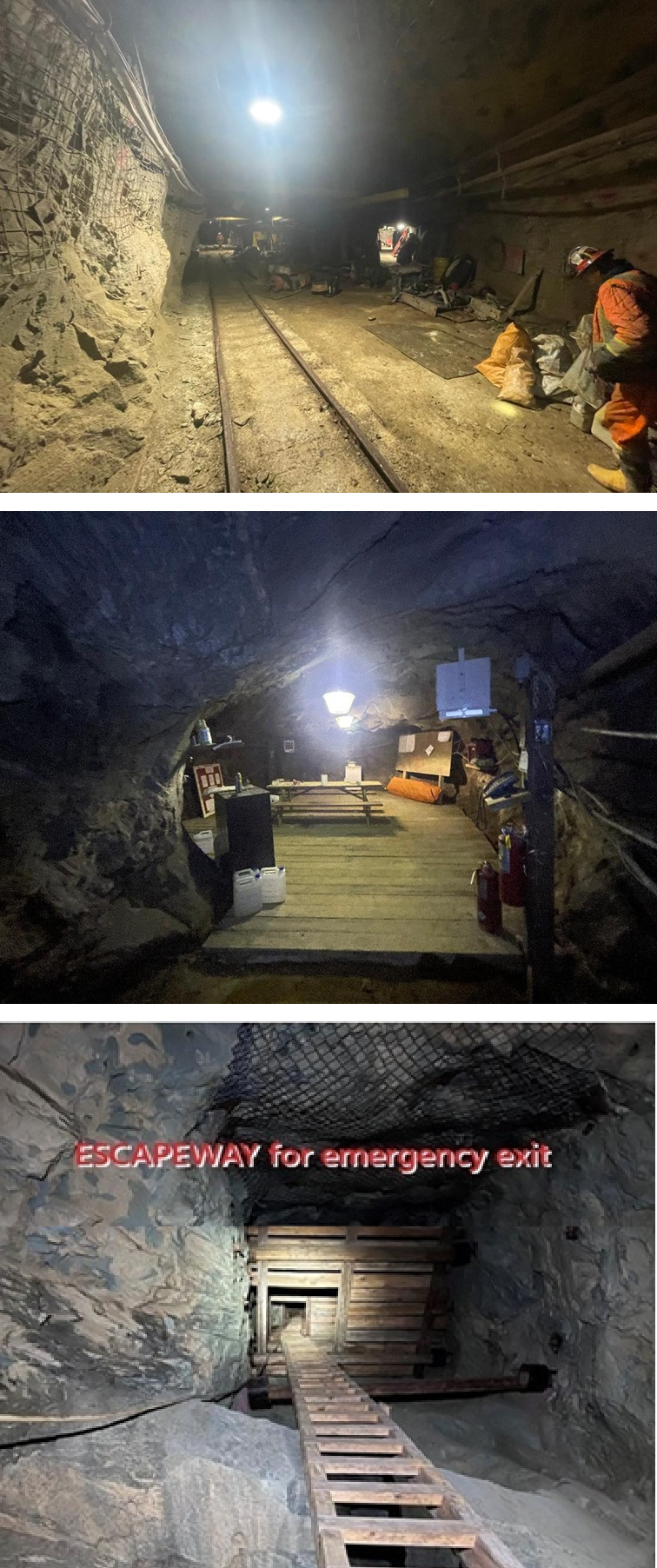

Photo gallery

===========

360 degree view of the True North gold mine as viewed at the junction of San Antonio Street and Ross Avenue .....................................

https://www.google.ca/maps/place/Nopiming+Pro...FQAw%3D%3D

Miners at work in underground Level 16

Video Presentation on underground operation in the Truth North mine complex

https://www.youtube.com/watch?v=XOmEYouBqMU

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Corporate Presentation

https://1911gold.com/investors/presentations/

Board of Directors

https://www.1911gold.com/corporate/board-of-directors/

Financial Reports

https://1911gold.com/investors/financial-reports/

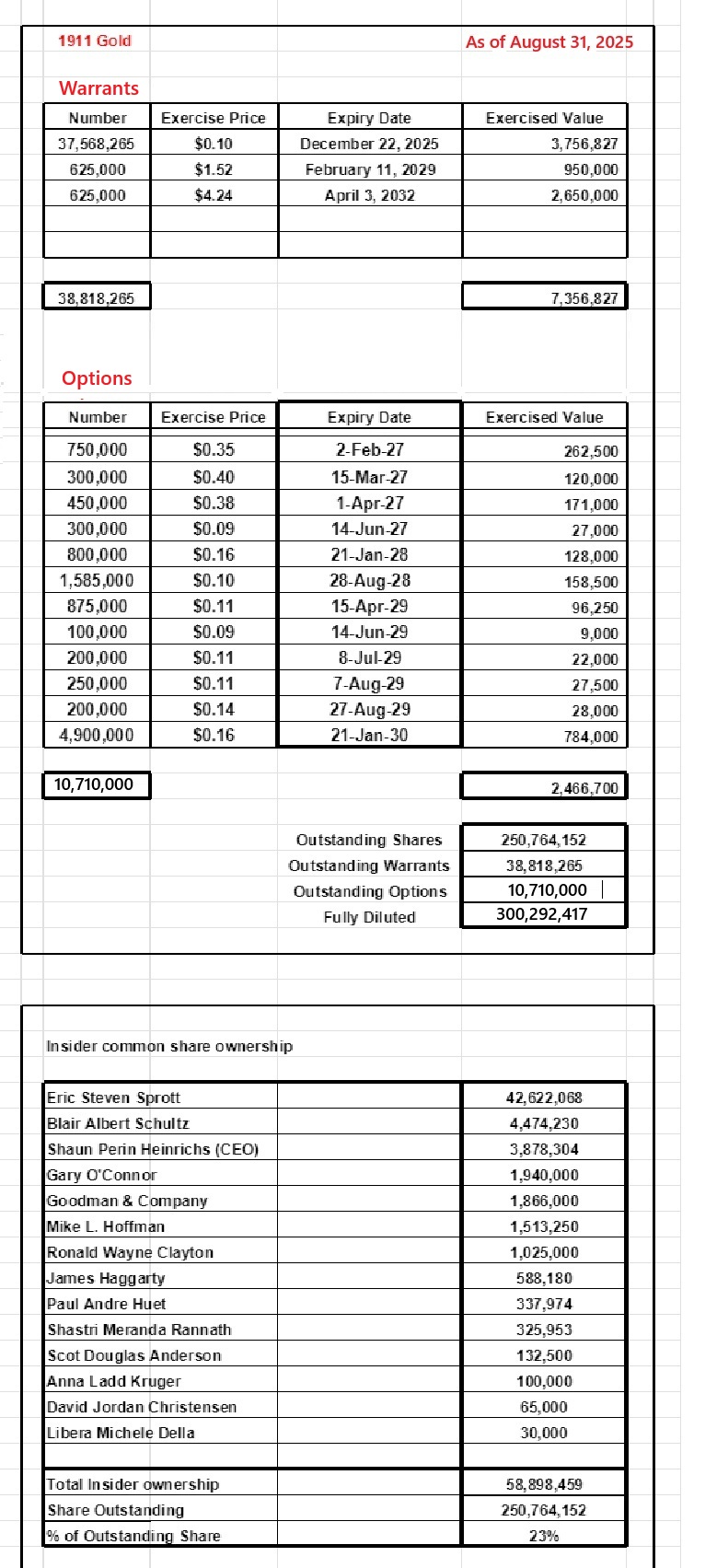

Warrants, Options, Insider Share Ownership

https://investorshangout.com/images/MYImages/...1,2025.jpg

Insider Trading Record

https://www.barchart.com/stocks/quotes/AUMB.V...der-trades

=================================================================

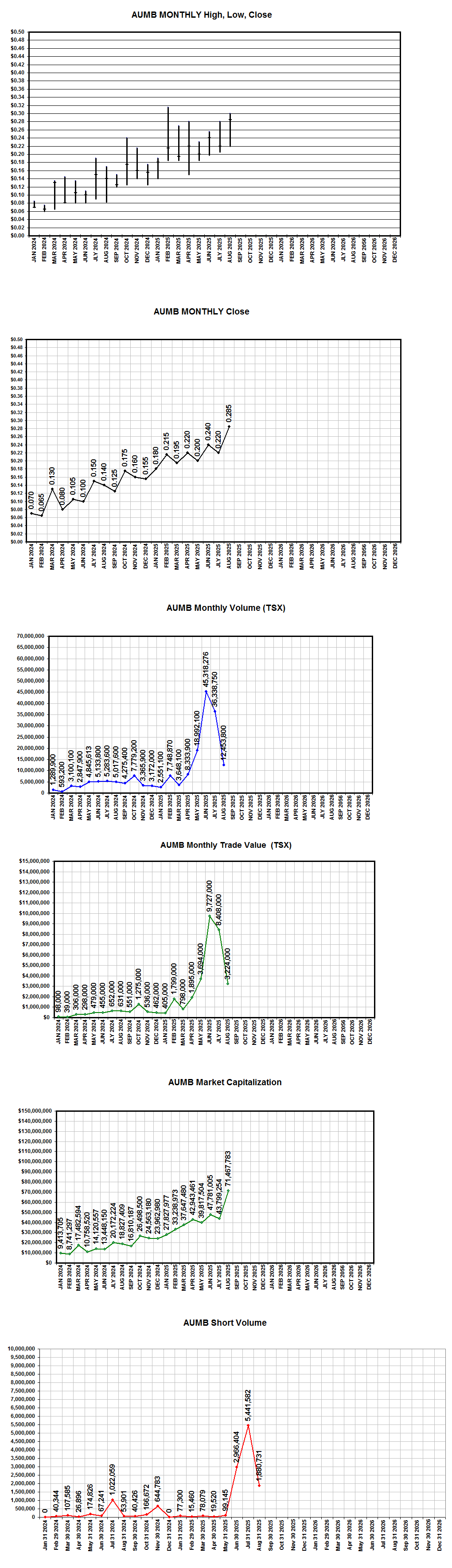

Monthly High, Low, Close, Volume, Trade Value, Market Capitalization, Short Volume

=================================================================

As of August 15, 2025

https://investorshangout.com/images/MYImages/..._Aug15.png

Source of information for short volume

https://money.tmx.com/en/quote/AUMB

Share outstanding: 250 million shares

Insiders share ownership: 58 million shares (23% of outstanding shares)

Float = 250 million - 58 million = 192 million shares

===============

Technical Analysis

===============

Gold, XAU, AUMB weekly juxtaposition

https://investorshangout.com/images/MYImages/...weekly.gif

Gold weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...=2&tim

Gold MONTHLY (live chart) Gold will break above $3500, next psychological resistance is $4000

https://bigcharts.marketwatch.com/advchart/fr...320&si

XAU weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...amp;size=2

XAU MONTHLY (live chart) The Mining Index has made new historical high into uncharted territory

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB MONTHLY (live chart) AUMB will break out from the Q2 convergence, next resistance 40 cents

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB weekly ( Gearing up for a breakout in anticipation of underground drilling in early September )

https://investorshangout.com/images/MYImages/..._AUMBW.png

AUMB monthly

https://investorshangout.com/images/MYImages/...MBM4yr.gif

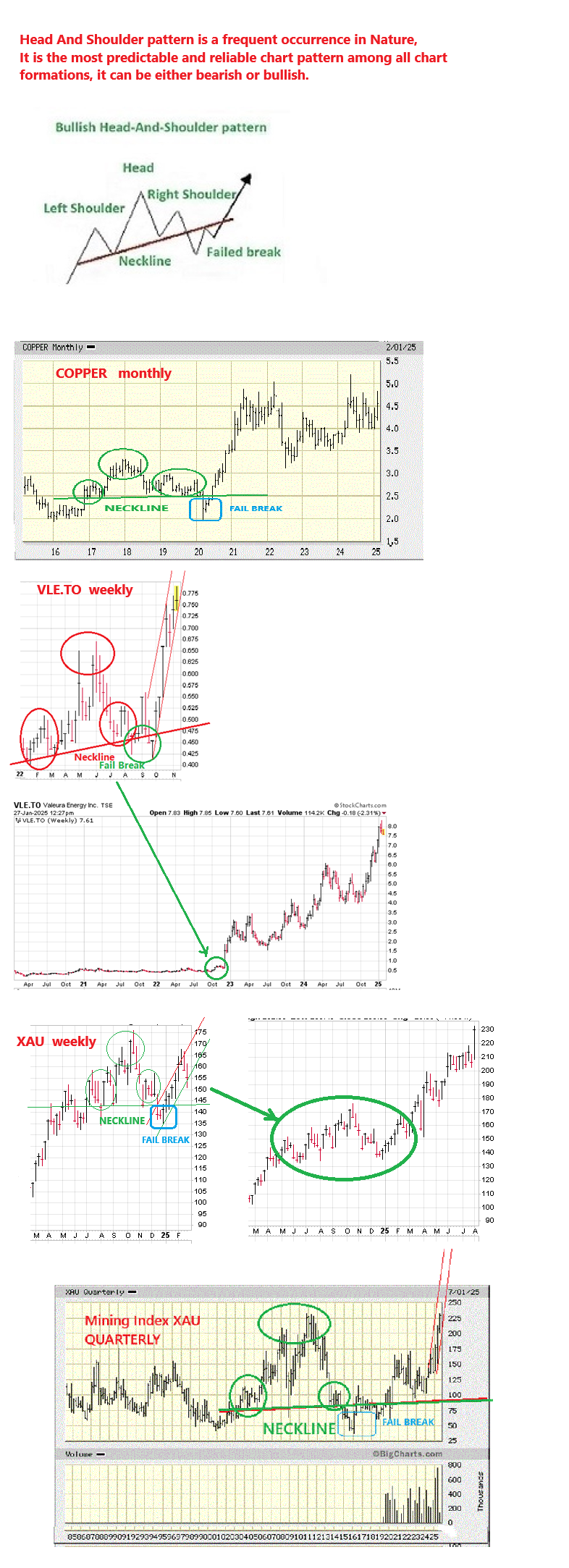

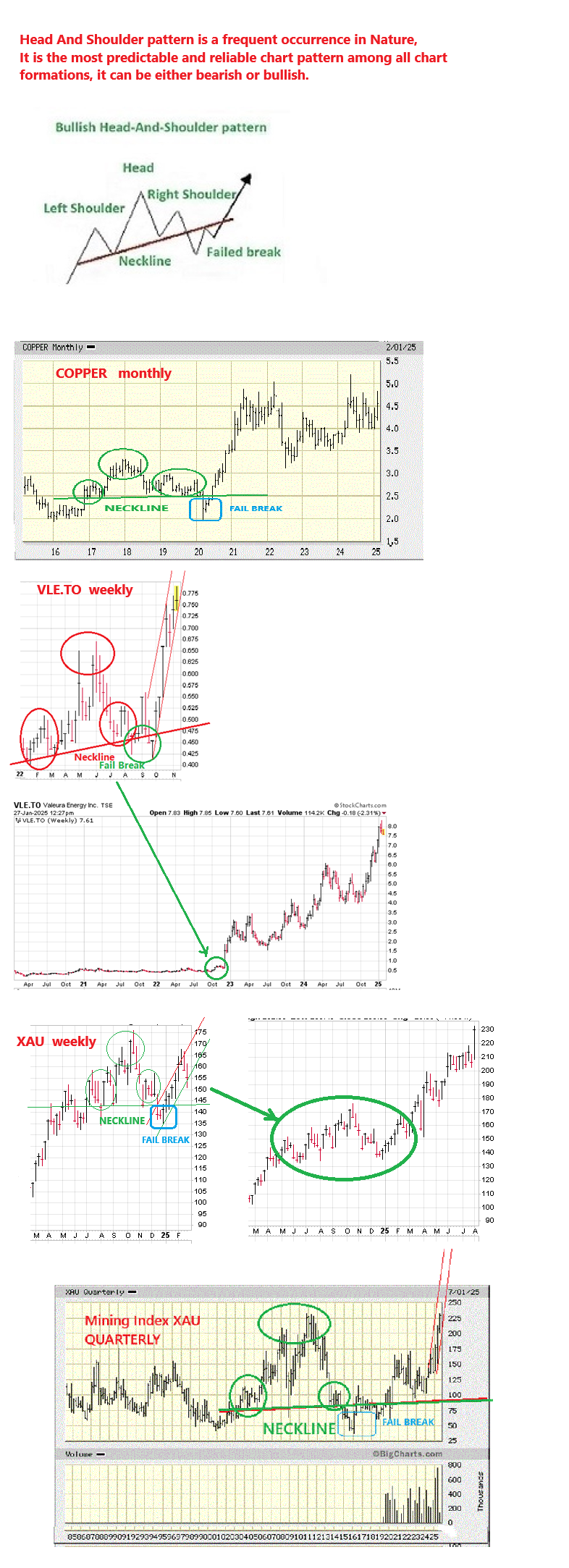

Rising Neckline with the Right Shoulder higher then the Left Shoulder indicates a strong bullish Head & Shoulder and vise versa.

AUMB monthly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

Bullish Head & Shoulder pattern - Case history

https://investorshangout.com/images/MYImages/...tterns.png

What is the long term bullish chart pattern in XAU telling us?

It forecasts gold price will continue to rise amid inevitable global hyperinflation in the coming decades, so will share price of mining companies having proven gold reserves.

AUMB quarterly

https://investorshangout.com/images/MYImages/..._AUMBQ.gif

AUMB quarterly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...e=320&

AUMB weekly future scenario based on past characteristic

https://investorshangout.com/images/MYImages/...ection.jpg

AUMB monthly future scenario based on past characteristic

https://investorshangout.com/images/MYImages/...ection.jpg

=================================================

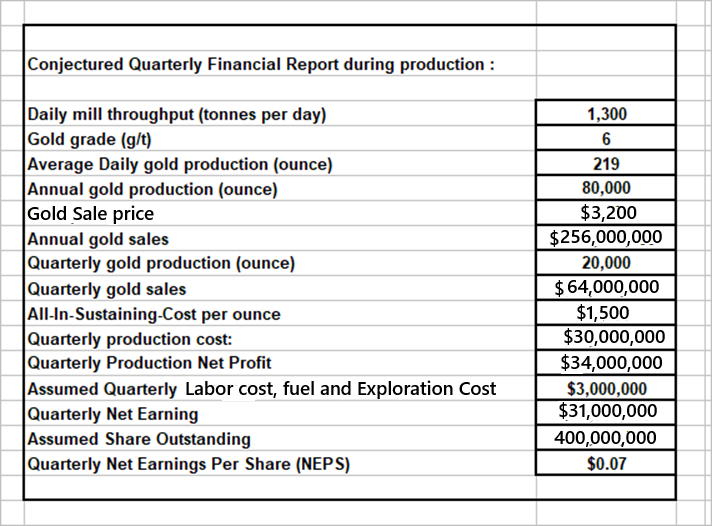

A conjectured quarterly financial report during initial production

=================================================

https://investorshangout.com/images/MYImages/...ancial.png

Future share price = P/E ratio x Earnings Per Share

About P/E ratio:

https://www.google.ca/search?q=P%2FE+ratio+fo...CwfCtLKIl-

===============================

All-In-Sustaining-Cost of gold producers

===============================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

======================

Potential future share price

======================

With annual production of 80,000 ounces and at gold price of US$3200, annual sales will be US$256 million. At the industry's average All-In-Sustaining-Cost (AISC) of $1500 per ounce, profit will be US$1,700 per ounce, it translates into net profit of US$3400 million (CAN$4760 million) over the 10 years of mine life, producing in excess of 2 million ounces of gold Future share price is projected to be CAN$4760 million / 400 million shares = CAN$12 per share, a 4700% return from current price of 25 cents, assuming future share outstanding will be at 400 million shares.

Since share price is forward looking, with consistent positive earnings, especially increasing earning, the P/E ratio can accelerate and share price could hit $12 long before the company's peak resource potential is achieved by the end of the mine life.

Gold price

https://investorshangout.com/images/MYImages/...onthly.gif

https://bigcharts.marketwatch.com/advchart/fr...320&si

==========================

Potential return on investment

==========================

Junior Mining companies that billionaire Eric Sprott invests in:

https://www.juniorminingnetwork.com/mining-st...prott.html

At share price of $12, billionaire Eric Sprott's holding of 42 million shares will return him $1/2 Billion. Also Director Blair Schultz and CEO Shaun Heinrichs will be $54 million and $46 million richer respectively. 1911 Gold will also create many millionaires / multi-millionaires among patient loyal long term shareholders, not from the pockets of other investors, but from the wealth of Mother Nature. Even for small retail investors, a $20K investment could buy them a million dollar house or condo in a few years, no more stress from perpetual rent hike.

=====================================

1911 Gold - Net Asset Value per Share (NAVPS)

=====================================

The ore processing mill with a replacement value of $300 million + 2 million ounces of gold resource at minimum Enterprise Value of $50 per ounce contributes to the company's NAVPS of US$1.60 per share (CAN$2.20) at fully diluted basis.

1911 Gold had generated cashflow from historic tailings, producing between 5,000 and 5,500 ounces of gold annually to support the exploration effort and to maintain the existing facilities.

.jpg)

https://investorshangout.com/images/MYImages/...arged).jpg

==================================================

Government extending support for mineral exploration in Canada

==================================================

https://www.canada.ca/en/department-finance/n...anada.html

.jpg)

==================

Recent news release

==================

August 7, 2025 - 1911 Gold Intersects 5.52 g/t Au over 6.50 m and 54.00 g/t Au over 0.50 m on SAM Southeast Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

July 17, 2025 - 1911 Gold Closes C$13.2 Million “Bought Deal” Life Offering Including Increased Investment by Eric Sprott

https://1911gold.com/news/press-releases/1911...ric-sprott

June 10, 2025 - 1911 Gold Intersects up to 58.66 g/t Gold over 1.40 m on San Antonio West Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

April 30, 2025 - 1911 Gold Intersects 62.40 g/t Au over 1.00 m on San Antonio West Zone at True North

https://1911gold.com/news/press-releases/1911...true-north

=================================

Current event and timeline of future events

=================================

- 2025 Q2 financial report will be out in 2 weeks before Friday, August 29

- With a team of mining experts having successful track record and strong credentials in engineering, ore mining and gold production, Shaun Heinrichs scheduled to delineate at least 2 million ounces of high grade gold resource first before starting gold production. Underground mining will exploit "narrow vein" drilling technique which will yield high grade gold while mitigating waste rocks. Helped by high gold price over $3,000, 1911 Gold's operation will be highly profitable.

- The company has completed 62 surface drill holes for a total of 14,974.40 meters in the current drilling program. The exploration drilling plan includes up to 30,000 meters of drilling by the end of 2025.

- Drilling in the Cohiba area is put on hold as the management is busy preparing for underground drilling which will begin in early September. The underground drilling data will provide the basis for the Preliminary Economic Assessment (PEA) towards the end of 2025.

- The True North Gold Mine has seen various gold grades in underground drilling, with historical data showing an average grade of 9.33 g/t Au from the San Antonio zone. Recent drilling by 1911 Gold has identified high-grade intercepts, including 62.40 g/t Au over 1.00 meter, 58.66 g/t Gold over 1.40 meter on the San Antonio West zone and 54.00 g/t Au over 0.50 meter on SAM Southeast zone.

- "Property Wide" new Mineral Resource Estimate (MRE) will be released in April, 2026.

- The $13.2 million financing has closed (no warrants are issued). Additional $3.7 million will be added to the coffer before December 22, 2025 from the exercising of the remaining 37 million 10-cents warrants, but Shaun Heinrichs does not expect selling of the warrant converted shares as all of the financiers' investment is for long term holding. Shaun said the $17 million cash in the coffer will be sufficient to cover PEA and will last to the bulk sample stage (Test Mining Stage) in 2026 and that it will be exciting times for shareholders. Test Mining is the final exploration stage before production.

- After replenishing mining equipment that Klondex took away during its acquisition by Hecla, ore mining will begin in the second half of 2026.

- Gold pouring is scheduled to commence towards end of 2026, hopefully in time for Christmas as "delay" is always normal in the mining business. But it could also accelerate depending on market conditions.

- Shortly into the production phase Ogama-Rockland and Central Manitoba projects will join in, feeding high grade gold ores to the mill.

- Shaun Heinrichs reckons that the company can initially produce 50,000 to 80,000 ounces gold annually at mill throughput of 1,300 tonnes per day, ramping up to 150,000 ounces annually at throughput of 3,000 tonnes per day with additional portable ore crushing circuitry which will cost about $3 million. Mine life is projected to be 10 years, producing in excess of 2 million ounces of gold.

- The management's future plan is continue to grow the company organically by "stepping out of the regional footprint for accretive acquisition in North America".

===========

Photo gallery

===========

360 degree view of the True North gold mine as viewed at the junction of San Antonio Street and Ross Avenue .....................................

https://www.google.ca/maps/place/Nopiming+Pro...FQAw%3D%3D

Miners at work in underground Level 16

Video Presentation on underground operation in the Truth North mine complex

https://www.youtube.com/watch?v=XOmEYouBqMU

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Corporate Presentation

https://1911gold.com/investors/presentations/

Board of Directors

https://www.1911gold.com/corporate/board-of-directors/

Financial Reports

https://1911gold.com/investors/financial-reports/

Warrants, Options, Insider Share Ownership

https://investorshangout.com/images/MYImages/...1,2025.jpg

Insider Trading Record

https://www.barchart.com/stocks/quotes/AUMB.V...der-trades

=================================================================

Monthly High, Low, Close, Volume, Trade Value, Market Capitalization, Short Volume

=================================================================

As of August 15, 2025

https://investorshangout.com/images/MYImages/..._Aug15.png

Source of information for short volume

https://money.tmx.com/en/quote/AUMB

Share outstanding: 250 million shares

Insiders share ownership: 58 million shares (23% of outstanding shares)

Float = 250 million - 58 million = 192 million shares

===============

Technical Analysis

===============

Gold, XAU, AUMB weekly juxtaposition

https://investorshangout.com/images/MYImages/...weekly.gif

Gold weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...=2&tim

Gold MONTHLY (live chart) Gold will break above $3500, next psychological resistance is $4000

https://bigcharts.marketwatch.com/advchart/fr...320&si

XAU weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...amp;size=2

XAU MONTHLY (live chart) The Mining Index has made new historical high into uncharted territory

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB weekly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB MONTHLY (live chart) AUMB will break out from the Q2 convergence, next resistance 40 cents

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

AUMB weekly ( Gearing up for a breakout in anticipation of underground drilling in early September )

https://investorshangout.com/images/MYImages/..._AUMBW.png

AUMB monthly

https://investorshangout.com/images/MYImages/...MBM4yr.gif

Rising Neckline with the Right Shoulder higher then the Left Shoulder indicates a strong bullish Head & Shoulder and vise versa.

AUMB monthly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...mp;state=8

Bullish Head & Shoulder pattern - Case history

https://investorshangout.com/images/MYImages/...tterns.png

What is the long term bullish chart pattern in XAU telling us?

It forecasts gold price will continue to rise amid inevitable global hyperinflation in the coming decades, so will share price of mining companies having proven gold reserves.

AUMB quarterly

https://investorshangout.com/images/MYImages/..._AUMBQ.gif

AUMB quarterly (live chart)

https://bigcharts.marketwatch.com/advchart/fr...e=320&

AUMB weekly future scenario based on past characteristic

https://investorshangout.com/images/MYImages/...ection.jpg

AUMB monthly future scenario based on past characteristic

https://investorshangout.com/images/MYImages/...ection.jpg

=================================================

A conjectured quarterly financial report during initial production

=================================================

https://investorshangout.com/images/MYImages/...ancial.png

Future share price = P/E ratio x Earnings Per Share

About P/E ratio:

https://www.google.ca/search?q=P%2FE+ratio+fo...CwfCtLKIl-

===============================

All-In-Sustaining-Cost of gold producers

===============================

https://www.mining.com/wp-content/uploads/202...31425A.gif

What is All In Sustaining Costs (AISC)

All-in Sustaining Costs (AISC) in the mining industry, particularly for gold, includes all operating costs, sustaining capital expenditures, and other costs associated with maintaining current production. This includes cash costs, sustaining capital expenditures, general and administrative (G&A) expenses, and environmental and closure costs.

Breakdown on AISC:

Cash Costs:

These are the direct costs of mining and processing, including labor, energy, consumables, and royalties (net of by-product credits).

Sustaining Capital Expenditures:

These are investments required to maintain current production levels, such as equipment replacement, mine development, and other costs to keep the mine operating at its current capacity.

General and Administrative (G&A) Expenses:

These are the costs associated with running the corporate office and other administrative functions that support the mine's operations.

Environmental and Closure Costs:

These include costs related to environmental remediation and mine closure, such as reclamation and decommissioning.

Exploration Expenses (Sustaining):

These are exploration costs that are needed to maintain current production levels and replace depleted resources.

AISC is a comprehensive metric designed to provide a more complete picture of the total cost of mining an ounce of gold, beyond just the direct cash costs.

======================

Potential future share price

======================

With annual production of 80,000 ounces and at gold price of US$3200, annual sales will be US$256 million. At the industry's average All-In-Sustaining-Cost (AISC) of $1500 per ounce, profit will be US$1,700 per ounce, it translates into net profit of US$3400 million (CAN$4760 million) over the 10 years of mine life, producing in excess of 2 million ounces of gold Future share price is projected to be CAN$4760 million / 400 million shares = CAN$12 per share, a 4700% return from current price of 25 cents, assuming future share outstanding will be at 400 million shares.

Since share price is forward looking, with consistent positive earnings, especially increasing earning, the P/E ratio can accelerate and share price could hit $12 long before the company's peak resource potential is achieved by the end of the mine life.

Gold price

https://investorshangout.com/images/MYImages/...onthly.gif

https://bigcharts.marketwatch.com/advchart/fr...320&si

==========================

Potential return on investment

==========================

Junior Mining companies that billionaire Eric Sprott invests in:

https://www.juniorminingnetwork.com/mining-st...prott.html

At share price of $12, billionaire Eric Sprott's holding of 42 million shares will return him $1/2 Billion. Also Director Blair Schultz and CEO Shaun Heinrichs will be $54 million and $46 million richer respectively. 1911 Gold will also create many millionaires / multi-millionaires among patient loyal long term shareholders, not from the pockets of other investors, but from the wealth of Mother Nature. Even for small retail investors, a $20K investment could buy them a million dollar house or condo in a few years, no more stress from perpetual rent hike.

=====================================

1911 Gold - Net Asset Value per Share (NAVPS)

=====================================

The ore processing mill with a replacement value of $300 million + 2 million ounces of gold resource at minimum Enterprise Value of $50 per ounce contributes to the company's NAVPS of US$1.60 per share (CAN$2.20) at fully diluted basis.

1911 Gold had generated cashflow from historic tailings, producing between 5,000 and 5,500 ounces of gold annually to support the exploration effort and to maintain the existing facilities.

.jpg)

https://investorshangout.com/images/MYImages/...arged).jpg

==================================================

Government extending support for mineral exploration in Canada

==================================================

https://www.canada.ca/en/department-finance/n...anada.html