(Total Views: 484)

Posted On: 06/21/2023 5:46:33 PM

Post# of 6857

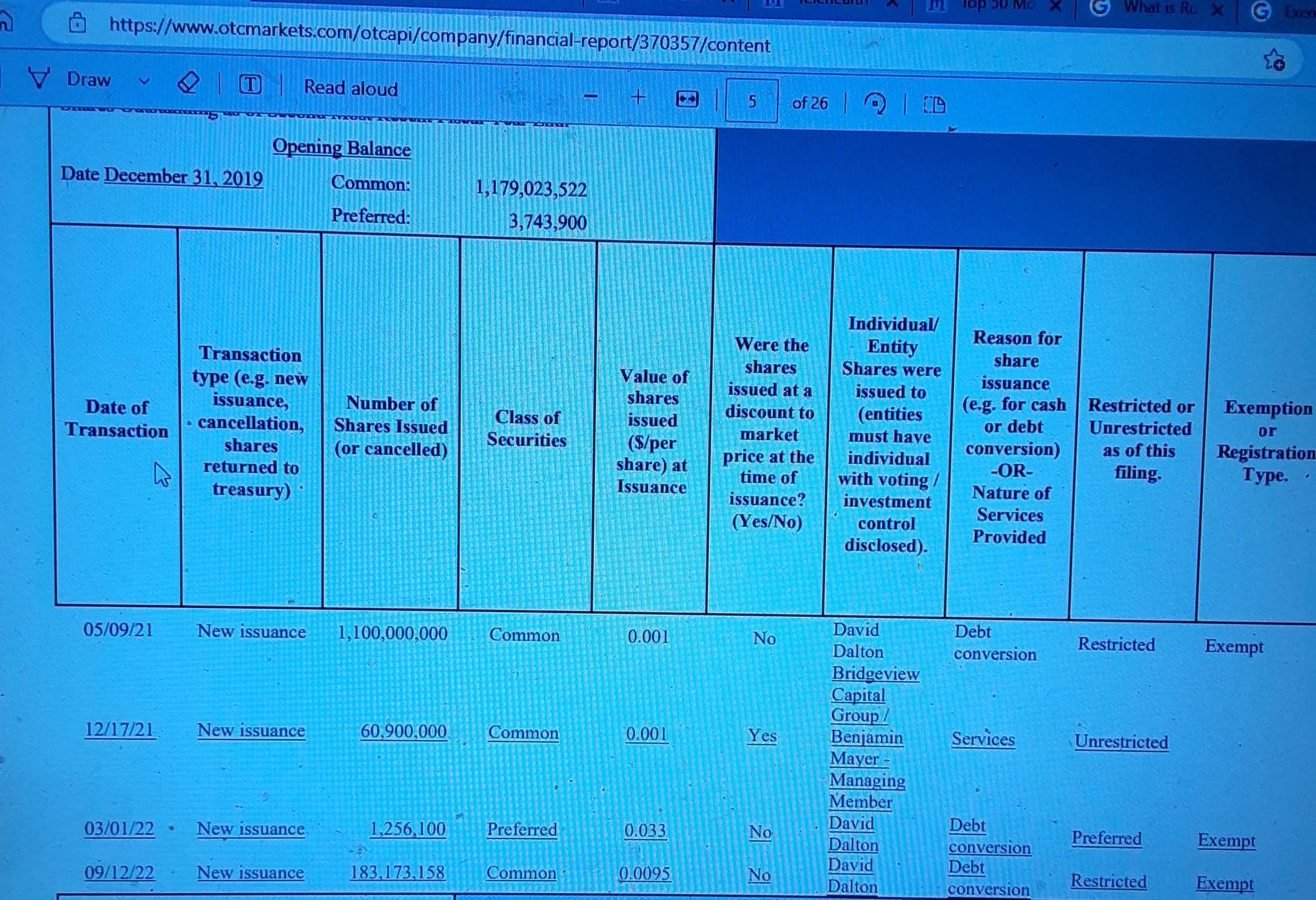

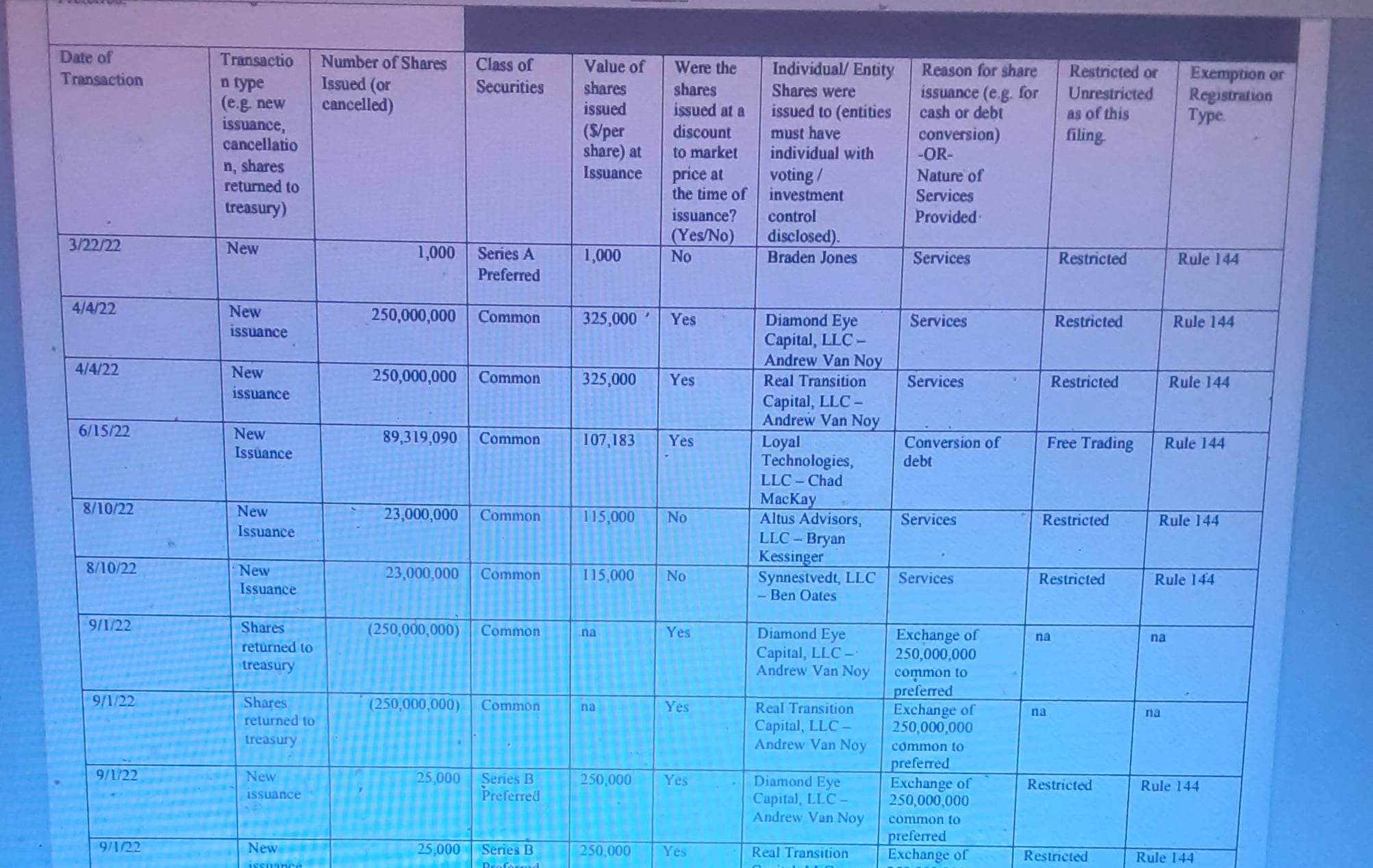

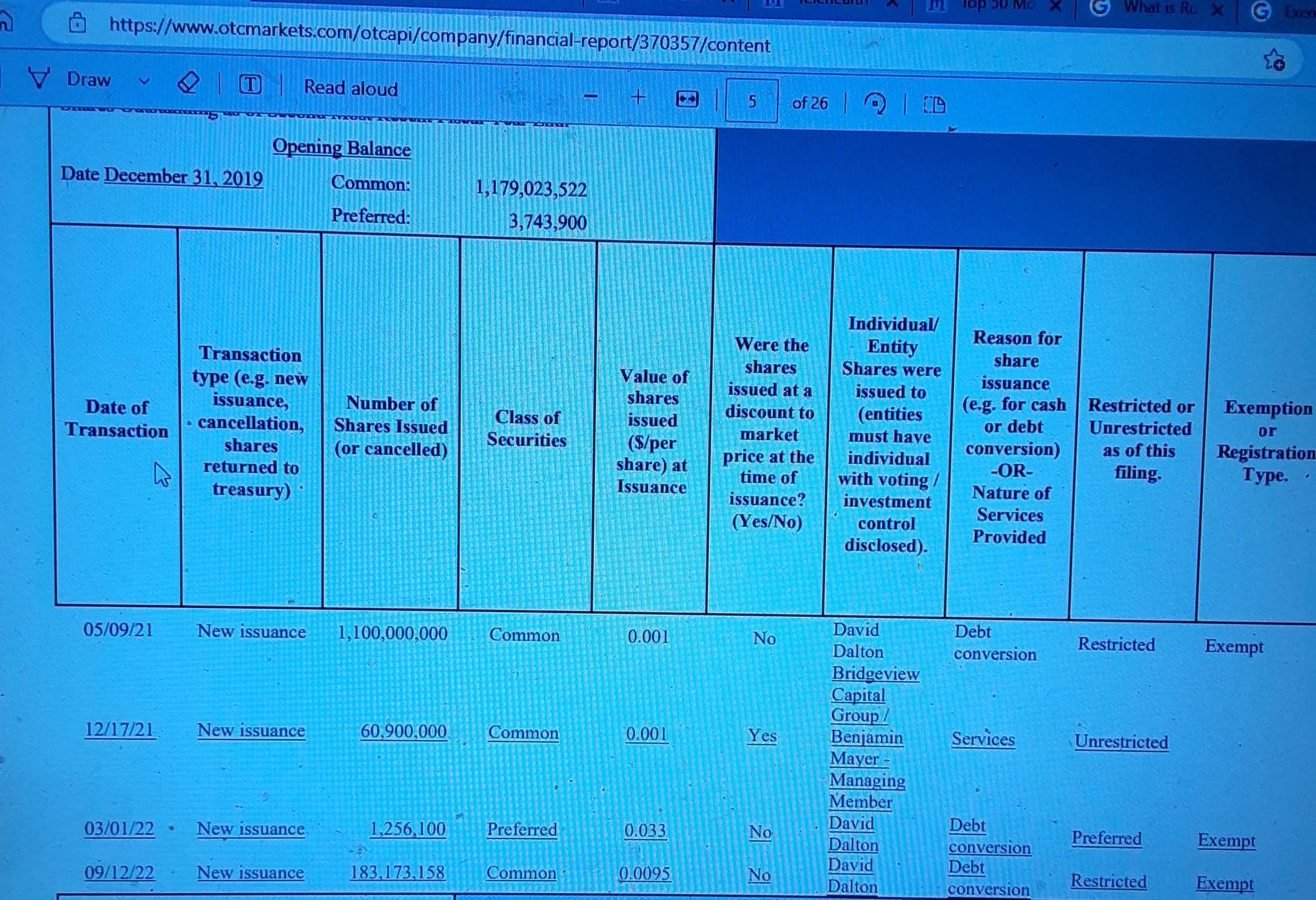

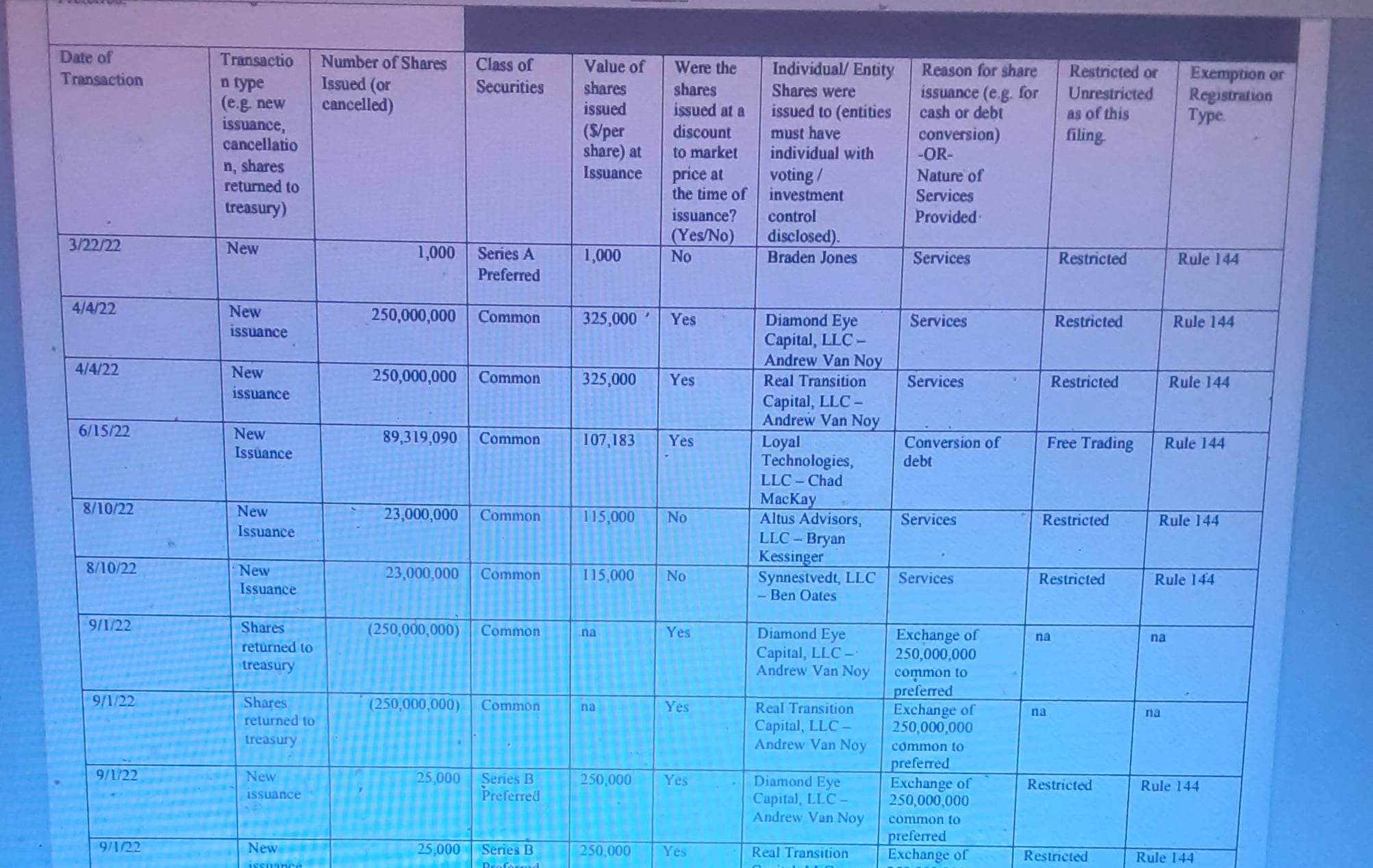

UNVC: In reference to the 1.283.173.150 exempt shares being added to the open market float, there was 119. 949.387 shares added to the float with the exempt shares. Total of 1.403.122.537.

I talked with Michael at

Customer Communications Manager

P: 800.509.5586 E: cstmail@continentalstock.com A: 1 State Street 30th Floor

New York, NY 10004-156 W: www.continentalstock.com

They do not provide information regarding a specific shareholder's account to anyone. They do not require SEC council to remove the legend, it is a matter solely in the discretion of the issuer of the securities. State law, not federal law, the SEC doesn't even get involved if there is a dispute.

Rule 144 under the Securities Act of 1933 provides the most commonly used exemption for holders to sell restricted securities. To take advantage of this rule, you must meet several conditions, including a six-month or one-year holding period

The CONDITIONS for EXEMPTION were met for them the day he got them.

This is what it would look like if they weren't exempt from the very beginning.

From a Securities Attorney who helps get the legend removed from shareholders of restricted shares this is basically what MLR posted, he can make a joke of it and claim I twisted words all he wants these are just the facts.

It doesn't matter what I believe this just all facts. Anyone else can believe anything they want that's their privilege to do so.

Daltons are exempt from any regulatory filings; all he had to do was get the legend removed. They doubled the float and he can sell any anytime at his discretion. Plus, he's also got the 119.949.387 shares to sell.

Securities Attorney

If you are eligible to sell your shares, the law firm will issue the appropriate opinion letter, deliver the opinion letter and attachments to your broker and send a copy of the opinion letter and attachments to the Company that issued the shares to you for review.

Your broker will send the opinion and attachments, the original certificate(s) and stock power(s), a check for the fees of the Company’s stock transfer agent and a letter of instruction to the stock transfer agent.

The stock transfer agent will contact the issuer of the securities and ask if there is any lawful reason why the Rule 144 legend should not be removed. The issuer must consent to the removal unless there are factual or legal reasons why the legend should not be removed. There are state laws that must be followed. Any issuer or transfer agent that ignores these laws and refuses to remove the restrictive legend is subject to substantial liability.

Assuming that there are no valid reasons why the Rule 144 legend should not be removed, the issuer will inform the stock transfer agent that the restrictive legend may be removed. The stock transfer agent will return the cleared shares to your broker by the method requested by the broker. Your broker may then sell the number of shares that you have authorized to be sold.

I talked with Michael at

Customer Communications Manager

P: 800.509.5586 E: cstmail@continentalstock.com A: 1 State Street 30th Floor

New York, NY 10004-156 W: www.continentalstock.com

They do not provide information regarding a specific shareholder's account to anyone. They do not require SEC council to remove the legend, it is a matter solely in the discretion of the issuer of the securities. State law, not federal law, the SEC doesn't even get involved if there is a dispute.

Rule 144 under the Securities Act of 1933 provides the most commonly used exemption for holders to sell restricted securities. To take advantage of this rule, you must meet several conditions, including a six-month or one-year holding period

The CONDITIONS for EXEMPTION were met for them the day he got them.

This is what it would look like if they weren't exempt from the very beginning.

From a Securities Attorney who helps get the legend removed from shareholders of restricted shares this is basically what MLR posted, he can make a joke of it and claim I twisted words all he wants these are just the facts.

It doesn't matter what I believe this just all facts. Anyone else can believe anything they want that's their privilege to do so.

Daltons are exempt from any regulatory filings; all he had to do was get the legend removed. They doubled the float and he can sell any anytime at his discretion. Plus, he's also got the 119.949.387 shares to sell.

Securities Attorney

If you are eligible to sell your shares, the law firm will issue the appropriate opinion letter, deliver the opinion letter and attachments to your broker and send a copy of the opinion letter and attachments to the Company that issued the shares to you for review.

Your broker will send the opinion and attachments, the original certificate(s) and stock power(s), a check for the fees of the Company’s stock transfer agent and a letter of instruction to the stock transfer agent.

The stock transfer agent will contact the issuer of the securities and ask if there is any lawful reason why the Rule 144 legend should not be removed. The issuer must consent to the removal unless there are factual or legal reasons why the legend should not be removed. There are state laws that must be followed. Any issuer or transfer agent that ignores these laws and refuses to remove the restrictive legend is subject to substantial liability.

Assuming that there are no valid reasons why the Rule 144 legend should not be removed, the issuer will inform the stock transfer agent that the restrictive legend may be removed. The stock transfer agent will return the cleared shares to your broker by the method requested by the broker. Your broker may then sell the number of shares that you have authorized to be sold.