(Total Views: 631)

Posted On: 06/17/2023 12:17:13 PM

Post# of 6857

UNVC: The TA DOES NOT have council with the SEC to remove the Legend From Restricted Shares Period.

What did Dalton File when he got the shares NOTHING, UNVC is deregistered from the SEC.

Removal of a legend is a matter solely in the discretion of the issuer of the securities. State law, not federal law, covers disputes.

QUOTE The TA move required SEC council and I'm sure it took some time. Does anyone honestly think doc would waste money for no reason?)

The TA move required SEC council and I'm sure it took some time. Does anyone honestly think doc would waste money for no reason?)

He never wasted money he can sell as many shares anytime he wants because they are EXEMPT from any Regulatory FILING. Plus the Issuer (Univec Inc.) pays for it. Basic Cost of $425.00, week to 10 days time frame after the holding period ends, according to the Securities Attorney, Dalton uses his Buddy, it could be a little less or more.

Rule 144 under the Securities Act of 1933 provides the most commonly used exemption for holders to sell restricted securities. To take advantage of this rule, you must meet several conditions, including a six-month or one-year holding period

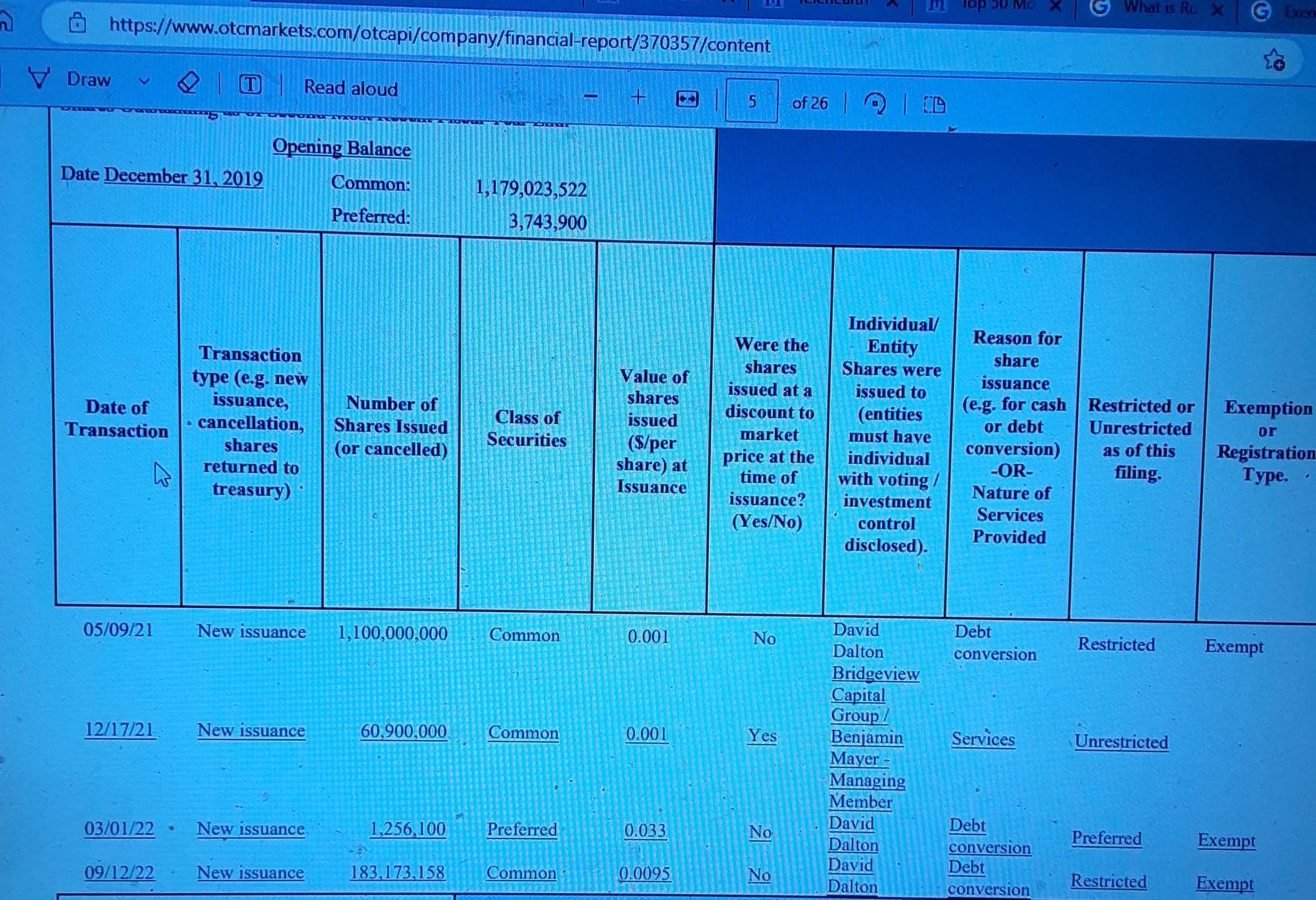

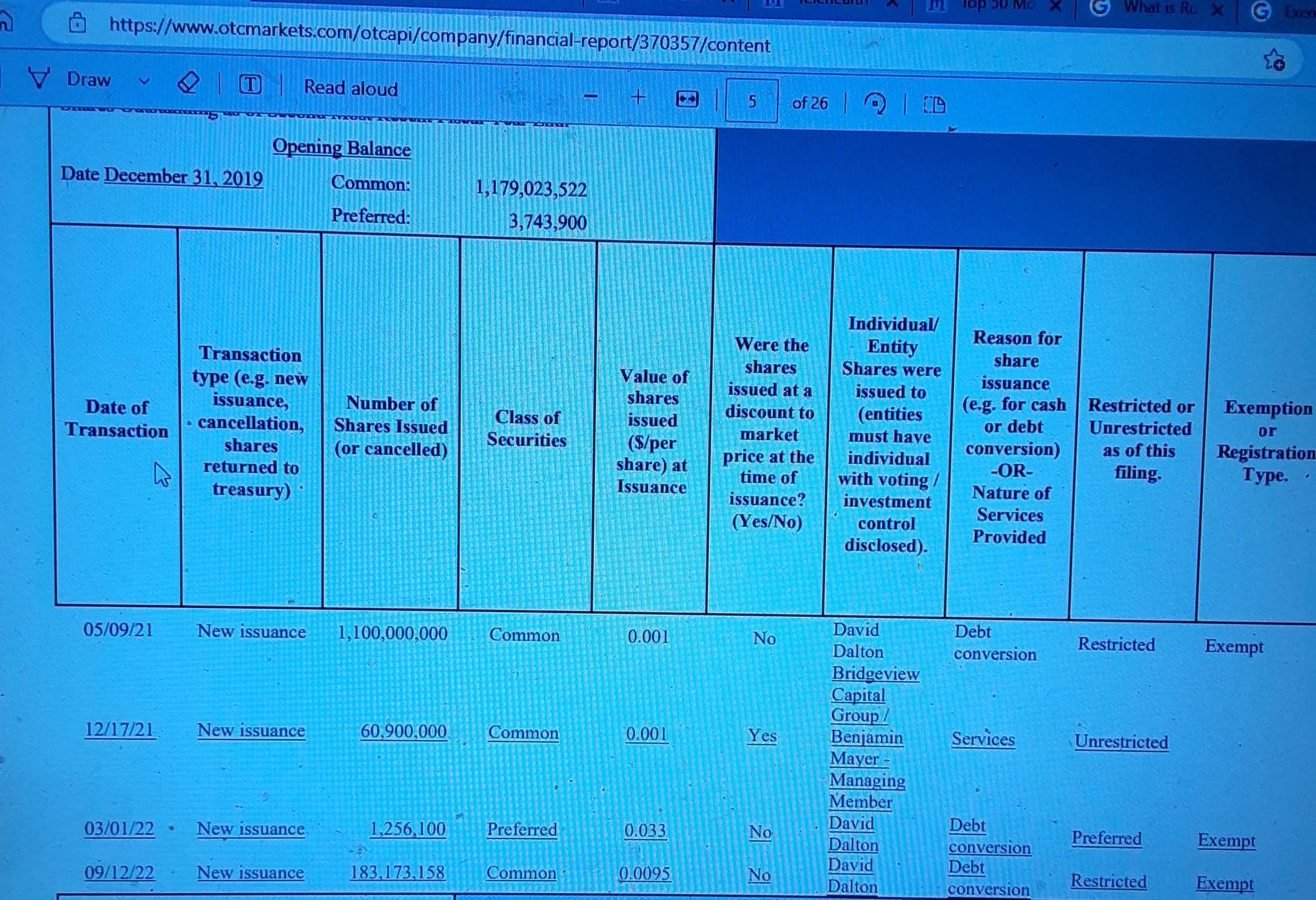

The CONDITIONS for EXEMPTION were met for them when he got them 1.1 billion, also the 183,173,158 Plus there was another 119,949,379 ??? shares added totaling 1,403,122,537 TRANSFERED TO THE FLOAT

If you are eligible to sell your shares, the law firm will issue the appropriate opinion letter, deliver the opinion letter and attachments to your broker and send a copy of the opinion letter and attachments to the Company that issued the shares to you for review.

Your broker will send the opinion and attachments, the original certificate(s) and stock power(s), a check for the fees of the Company’s stock transfer agent and a letter of instruction to the stock transfer agent.

The stock transfer agent will contact the issuer of the securities and ask if there is any lawful reason why the Rule 144 legend should not be removed. The issuer must consent to the removal unless there are factual or legal reasons why the legend should not be removed. There are state laws that must be followed. Any issuer or transfer agent that ignores these laws and refuses to remove the restrictive legend is subject to substantial liability.

Assuming that there are no valid reasons why the Rule 144 legend should not be removed, the issuer will inform the stock transfer agent that the restrictive legend may be removed. The stock transfer agent will return the cleared shares to your broker by the method requested by the broker. Your broker may then sell the number of shares that you have authorized to be sold.

The same way any of us put in our SELL ORDERS.

Going to be a lot of disappointed Shareholders when they find out Dalton isn't on the same page as they are, if the shares were to benefit UNVC it could have been done with the restriction on them.

What did Dalton File when he got the shares NOTHING, UNVC is deregistered from the SEC.

Removal of a legend is a matter solely in the discretion of the issuer of the securities. State law, not federal law, covers disputes.

QUOTE

He never wasted money he can sell as many shares anytime he wants because they are EXEMPT from any Regulatory FILING. Plus the Issuer (Univec Inc.) pays for it. Basic Cost of $425.00, week to 10 days time frame after the holding period ends, according to the Securities Attorney, Dalton uses his Buddy, it could be a little less or more.

Rule 144 under the Securities Act of 1933 provides the most commonly used exemption for holders to sell restricted securities. To take advantage of this rule, you must meet several conditions, including a six-month or one-year holding period

The CONDITIONS for EXEMPTION were met for them when he got them 1.1 billion, also the 183,173,158 Plus there was another 119,949,379 ??? shares added totaling 1,403,122,537 TRANSFERED TO THE FLOAT

If you are eligible to sell your shares, the law firm will issue the appropriate opinion letter, deliver the opinion letter and attachments to your broker and send a copy of the opinion letter and attachments to the Company that issued the shares to you for review.

Your broker will send the opinion and attachments, the original certificate(s) and stock power(s), a check for the fees of the Company’s stock transfer agent and a letter of instruction to the stock transfer agent.

The stock transfer agent will contact the issuer of the securities and ask if there is any lawful reason why the Rule 144 legend should not be removed. The issuer must consent to the removal unless there are factual or legal reasons why the legend should not be removed. There are state laws that must be followed. Any issuer or transfer agent that ignores these laws and refuses to remove the restrictive legend is subject to substantial liability.

Assuming that there are no valid reasons why the Rule 144 legend should not be removed, the issuer will inform the stock transfer agent that the restrictive legend may be removed. The stock transfer agent will return the cleared shares to your broker by the method requested by the broker. Your broker may then sell the number of shares that you have authorized to be sold.

The same way any of us put in our SELL ORDERS.

Going to be a lot of disappointed Shareholders when they find out Dalton isn't on the same page as they are, if the shares were to benefit UNVC it could have been done with the restriction on them.