(Total Views: 174)

Posted On: 10/13/2022 6:06:28 PM

Post# of 827

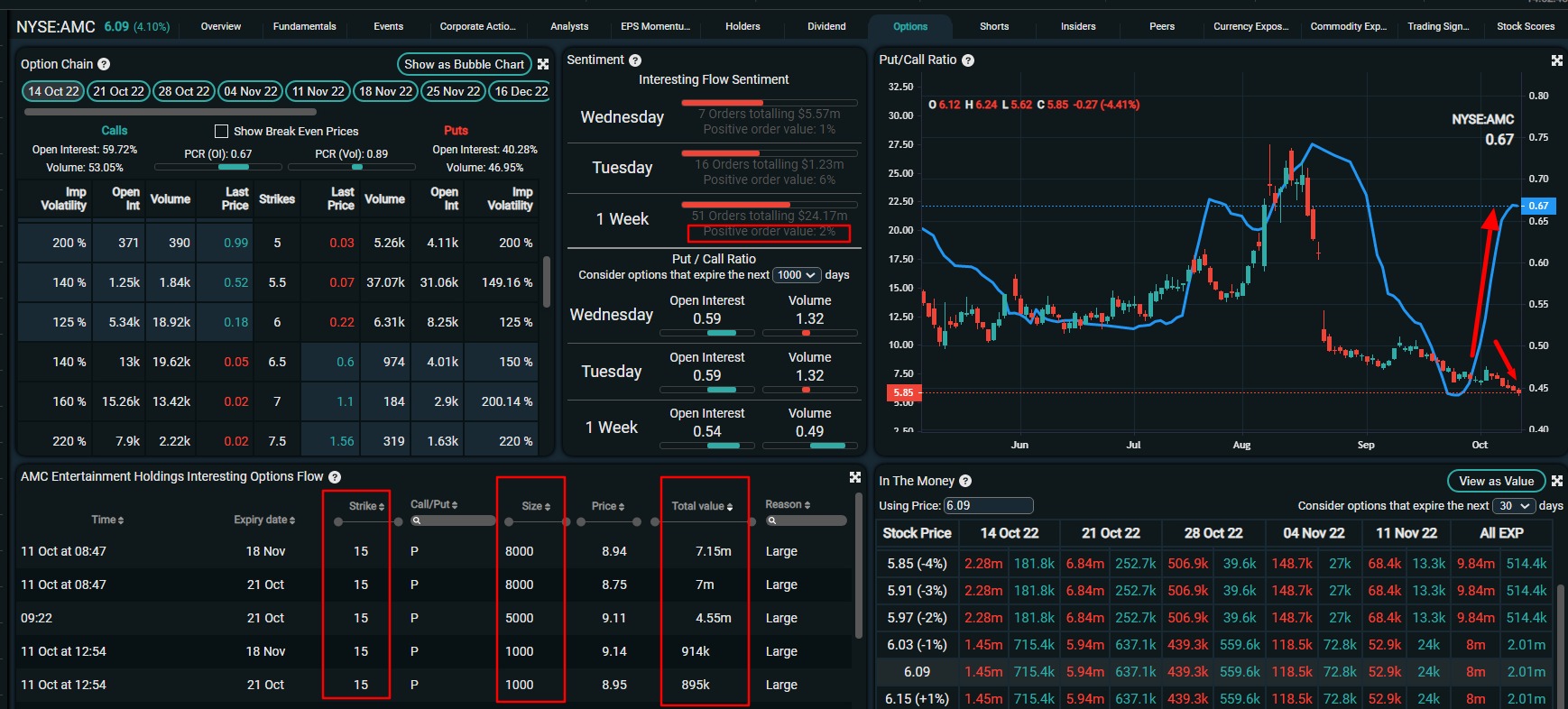

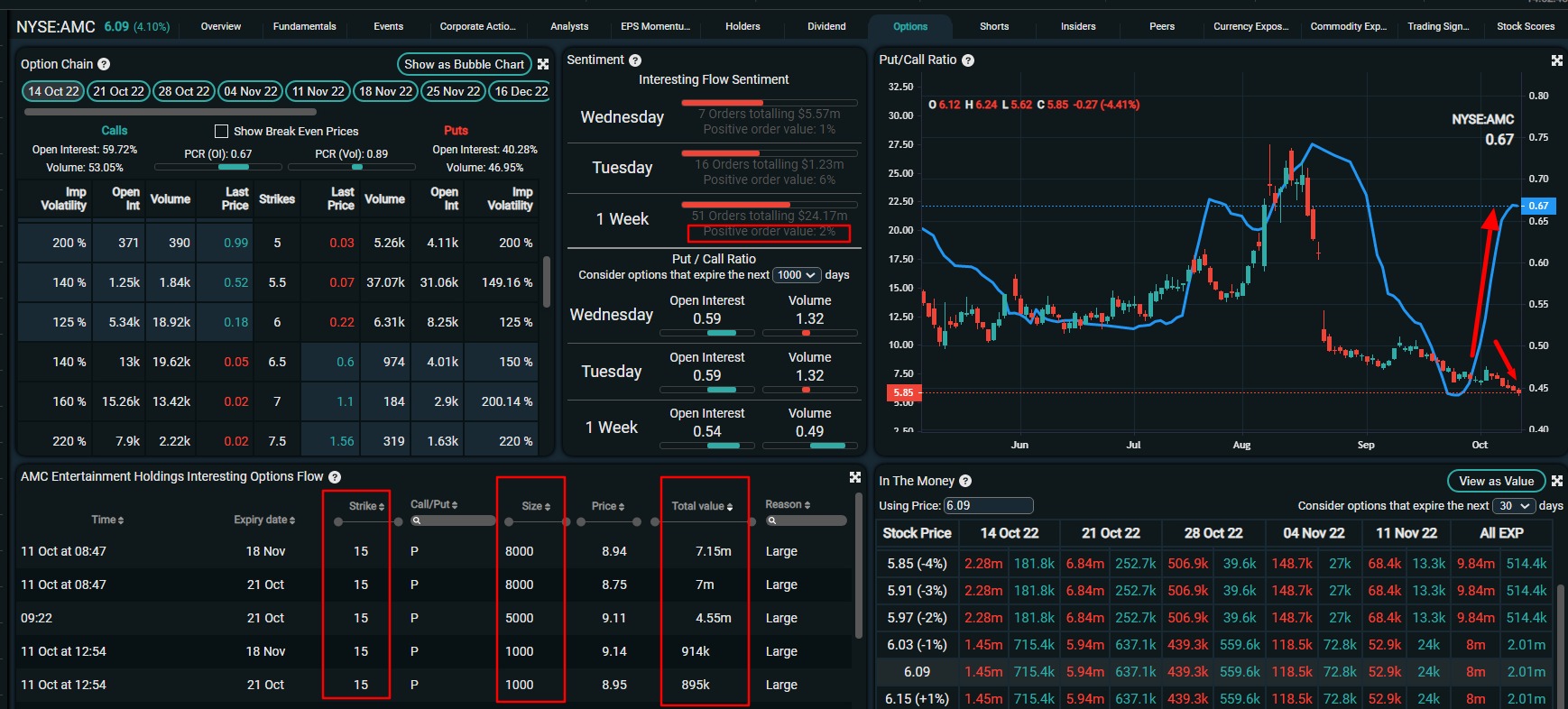

About $22 Million in-the-money puts have been purchased this past week to suppress $AMC price.

This tactic is very costly and is done when there are no shares to short and you create synthetic shorts and mark them long. OBV + turnover rate + volume = Retail not selling.

https://twitter.com/userofintellect/status/15...8988101632

This is done to by pass reporting of SI and take advantage of infinity loops and settlement gaps a true violation of bona fide market making duty.

https://twitter.com/userofintellect/status/15...8988101632

This tactic is very costly and is done when there are no shares to short and you create synthetic shorts and mark them long. OBV + turnover rate + volume = Retail not selling.

https://twitter.com/userofintellect/status/15...8988101632

This is done to by pass reporting of SI and take advantage of infinity loops and settlement gaps a true violation of bona fide market making duty.

https://twitter.com/userofintellect/status/15...8988101632