(Total Views: 1311)

Posted On: 02/06/2022 11:56:19 PM

Post# of 157549

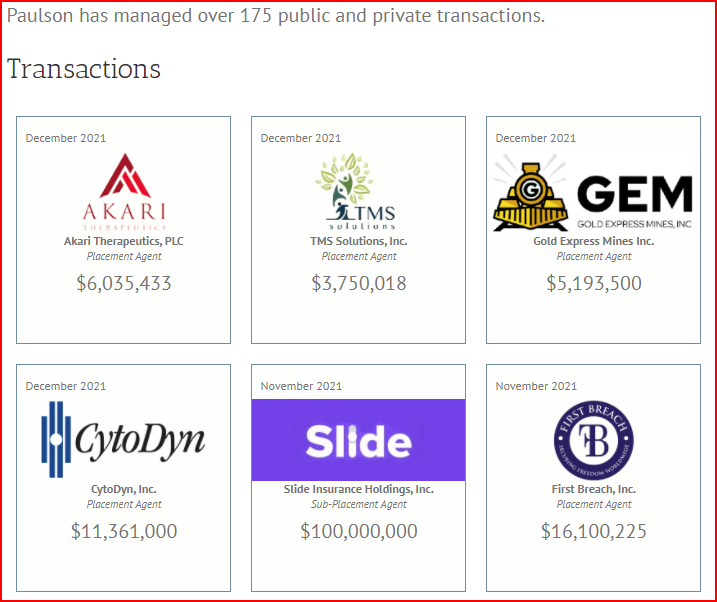

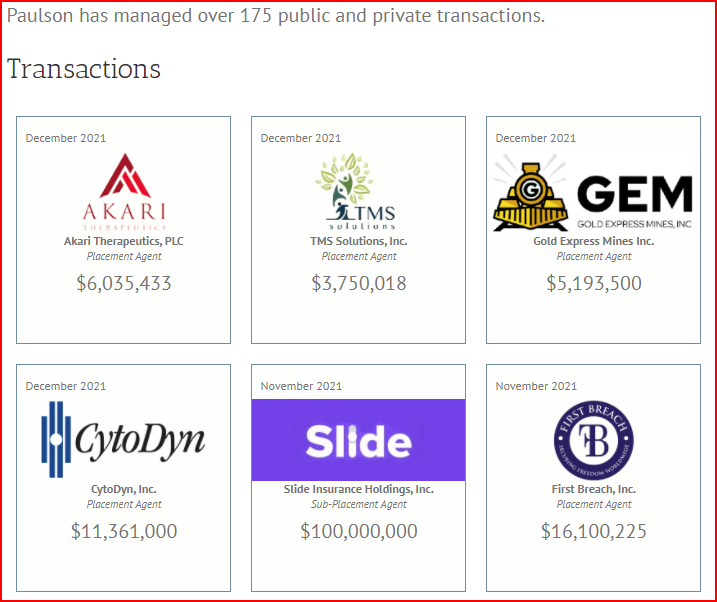

This post is to summarize what I found out about the placement work Paulson has done for CYDY. I noticed on Paulson’s website page for transactions that they were the placement agent for $11,361,000 for CYDY in December 2021.

https://paulsoninvestment.com/transactions/?f...9goqlcJITI

CYDY filed a Form D (Notice of Exempt Offering of Securities) on 12/3/21. I thought the following lines on the Form D were particularly interesting:

6. Rule 506(b) exemption

7. It is a “New Notice” with date of first sale 11-17-21

9. Type of securities offered: equity, option, warrant or other right to acquire another security

12. Sales compensation – recipient – Paulson Investment Company

13. Total offering amount $53,593,700

Total amount sold $11,361,000 (same amount shown on Paulson’s

website)

Total remaining to be sold $42,232,700

14. Number of investors who have invested in the offering = 118

15. Sales commission is estimated to be $6,481,244 assuming maximum commissions and excluding warrants. (This is just over 12% based on the entire $53M placement.)

https://www.sec.gov/Archives/edgar/data/11756...ry_doc.xml

The following applies to Form D and 506(b):

Companies that qualify for rule 506 b are not required to report to the Securities Exchange Commission (SEC) and also will not need to register their securities. However, after their first securities have been sold, these companies are required to file Form D. This form is used to list basic information about the company:

• The addresses of the company's owners.

• Names of the company's owners.

• Names of the stock promoters.

Under rule 506 b, issuers of securities are exempt from the registration requirements of the Securities Act for unlimited size offerings. However, to qualify under this rule, the securities that are being offered can

only be bought by accredited investors and no more than thirty-five unaccredited investors. These unaccredited investors must also meet certain requirements.

In addition, the issuer is not allowed to solicit the securities, and they must reasonably believe that the investors purchasing the securities are accredited or are unaccredited investors who meet sophistication requirements.

I think the above information applies to some recent discussions.

• It is rumored that the $6M Amarex bond has been paid. The $11M placement is more than adequate for that.

• It appears that only the first security sales have to be reported, so there may have been more sales since then that have not been reported. Also, with over $42M ready to be sold, it should not take long to secure operating funds for CYDY after good news and subsequent stock price increase.

• There have been discussions about Paulson not being able to discuss CYDY. That could be due to the pending placement.

The above are just my assumptions, but it does seem pretty certain that sufficient funds have been raised for the bond.

https://paulsoninvestment.com/transactions/?f...9goqlcJITI

CYDY filed a Form D (Notice of Exempt Offering of Securities) on 12/3/21. I thought the following lines on the Form D were particularly interesting:

6. Rule 506(b) exemption

7. It is a “New Notice” with date of first sale 11-17-21

9. Type of securities offered: equity, option, warrant or other right to acquire another security

12. Sales compensation – recipient – Paulson Investment Company

13. Total offering amount $53,593,700

Total amount sold $11,361,000 (same amount shown on Paulson’s

website)

Total remaining to be sold $42,232,700

14. Number of investors who have invested in the offering = 118

15. Sales commission is estimated to be $6,481,244 assuming maximum commissions and excluding warrants. (This is just over 12% based on the entire $53M placement.)

https://www.sec.gov/Archives/edgar/data/11756...ry_doc.xml

The following applies to Form D and 506(b):

Companies that qualify for rule 506 b are not required to report to the Securities Exchange Commission (SEC) and also will not need to register their securities. However, after their first securities have been sold, these companies are required to file Form D. This form is used to list basic information about the company:

• The addresses of the company's owners.

• Names of the company's owners.

• Names of the stock promoters.

Under rule 506 b, issuers of securities are exempt from the registration requirements of the Securities Act for unlimited size offerings. However, to qualify under this rule, the securities that are being offered can

only be bought by accredited investors and no more than thirty-five unaccredited investors. These unaccredited investors must also meet certain requirements.

In addition, the issuer is not allowed to solicit the securities, and they must reasonably believe that the investors purchasing the securities are accredited or are unaccredited investors who meet sophistication requirements.

I think the above information applies to some recent discussions.

• It is rumored that the $6M Amarex bond has been paid. The $11M placement is more than adequate for that.

• It appears that only the first security sales have to be reported, so there may have been more sales since then that have not been reported. Also, with over $42M ready to be sold, it should not take long to secure operating funds for CYDY after good news and subsequent stock price increase.

• There have been discussions about Paulson not being able to discuss CYDY. That could be due to the pending placement.

The above are just my assumptions, but it does seem pretty certain that sufficient funds have been raised for the bond.