(Total Views: 432)

Posted On: 02/19/2021 11:11:37 AM

Post# of 33181

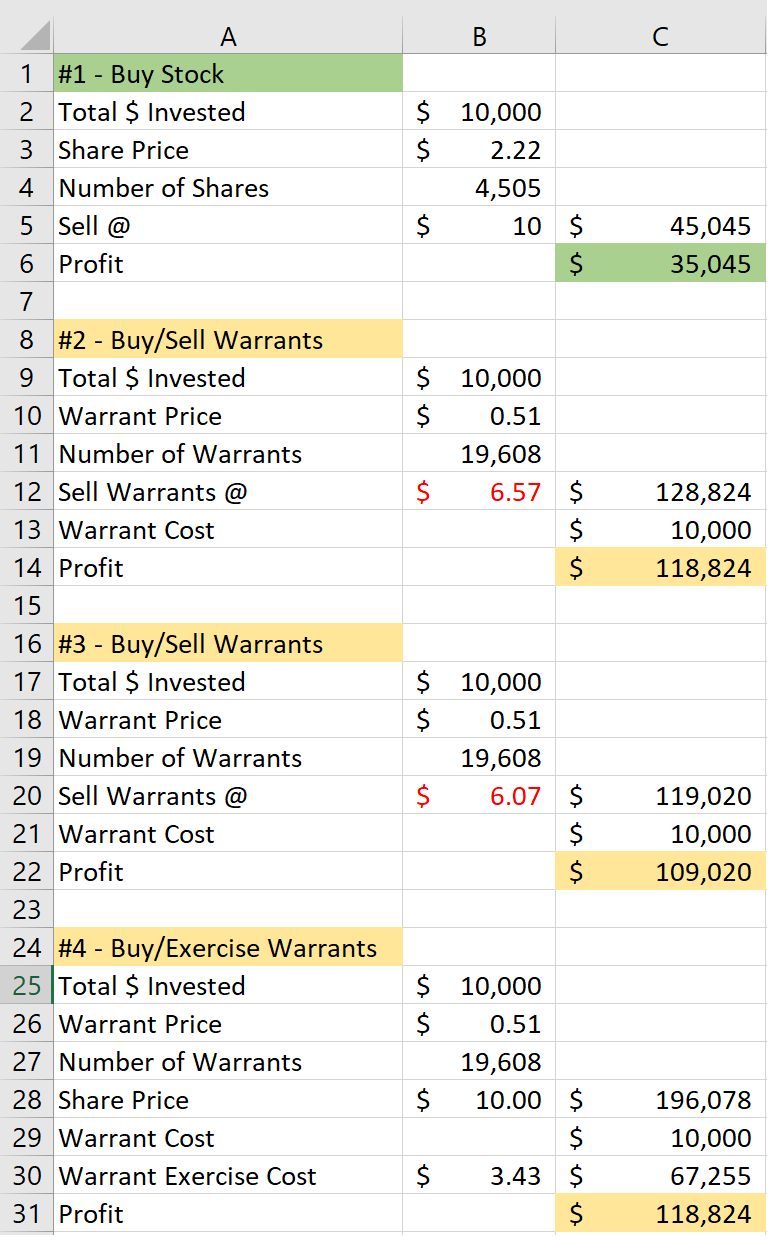

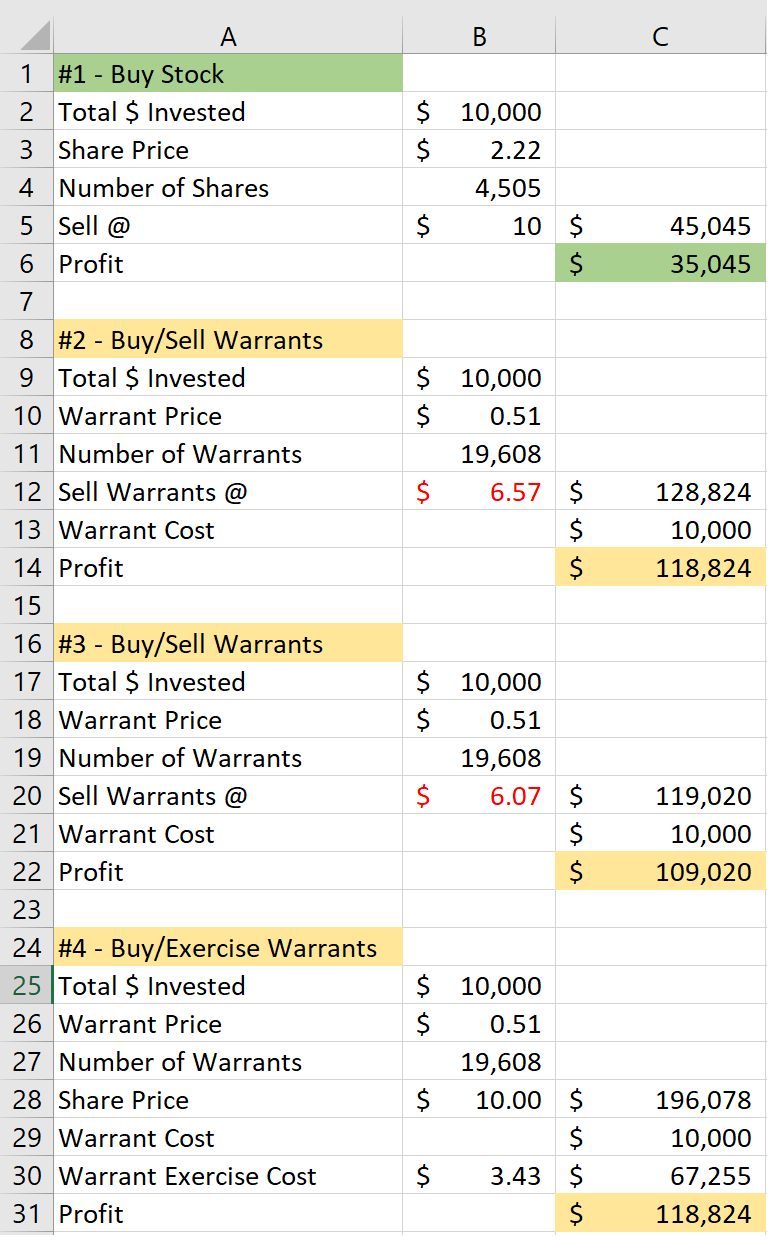

In examples #2 & #3 your stock would be worth $10, but you warrants wouldn't. #4 is what you are talking about. Examples #2 & #3 were meant to show if you just bought and sold warrants without exercising them, but then I had the selling in there so I took it out as it was confusing.

The warrant price, when in the money wouldn't' be exactly the sp - the strike price, but if you say it's a few percentage off, that makes sense. I don't know how fast you can exercise them but if it's same day then it would be close.

In the update example #2 is no difference and #3 is .50 so it would be somewhere in-between.

Now who wants to put together a model is you bought only stock investing $10K and borrowing the rest to get the me kind of return as warrants and then articulate the risk of each?

Remember, this is IF the stock is $10. For extra credit, do the same calculations when the stock is at $3, $4, $5.

The warrant price, when in the money wouldn't' be exactly the sp - the strike price, but if you say it's a few percentage off, that makes sense. I don't know how fast you can exercise them but if it's same day then it would be close.

In the update example #2 is no difference and #3 is .50 so it would be somewhere in-between.

Now who wants to put together a model is you bought only stock investing $10K and borrowing the rest to get the me kind of return as warrants and then articulate the risk of each?

Remember, this is IF the stock is $10. For extra credit, do the same calculations when the stock is at $3, $4, $5.