(Total Views: 356)

Posted On: 04/02/2019 1:09:44 PM

Post# of 157019

Re: ClosetInvestor #1628

There is a lot of assumptions to calculate such especially before a licensing deal is inked as the royalty payments can vary significantly. But I'll attempt to provide some example calculations or you can look at Fine's evaluation model noted on ihub for another reference.

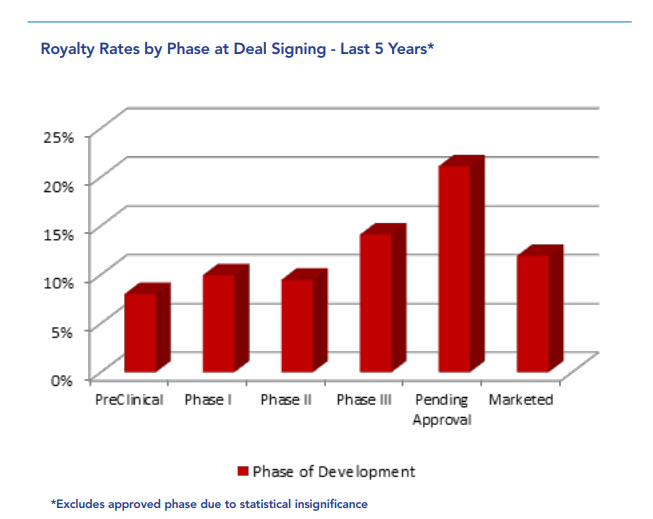

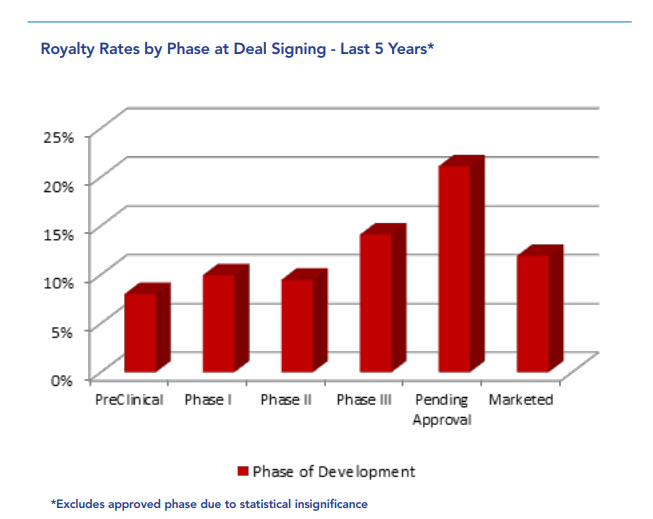

I'll stick to your $1B revenue number in the question instead of trying to guess another number with a lot of additional variables such as FDA approval time frame, market penetration, drug costs, etc. At this stage in the trial and FDA approval, IMO 18% is a conservative / reasonable / fair royalty rate for combo HIV (this varies by up-front/milestone payments, how far along in the trials the drug is, etc.).

https://pharmaintelligence.informa.com/~/medi...report.pdf

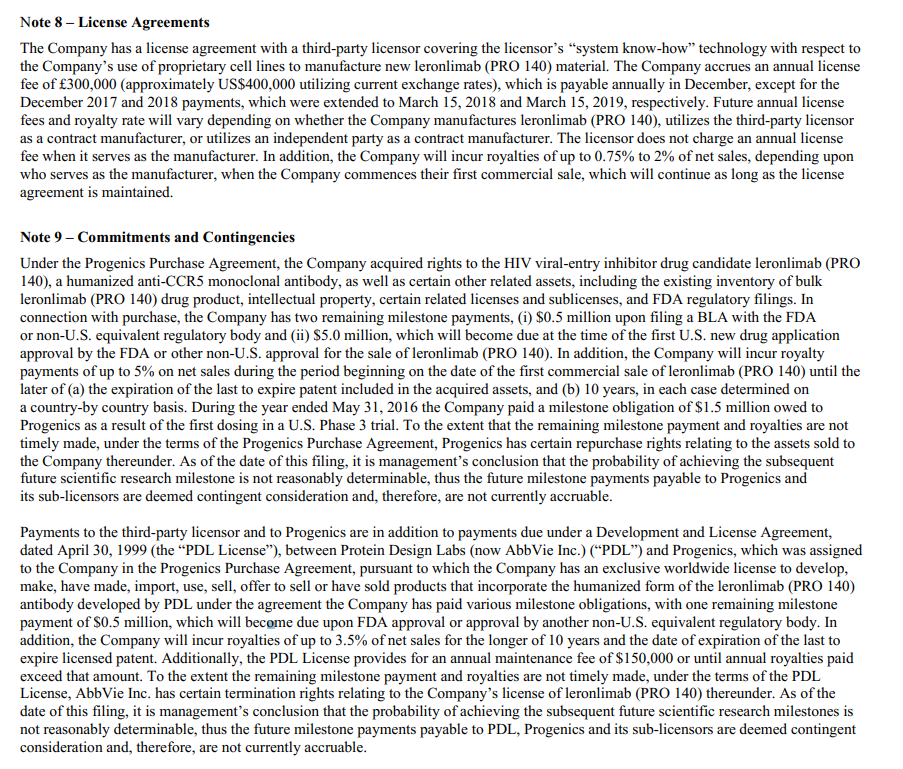

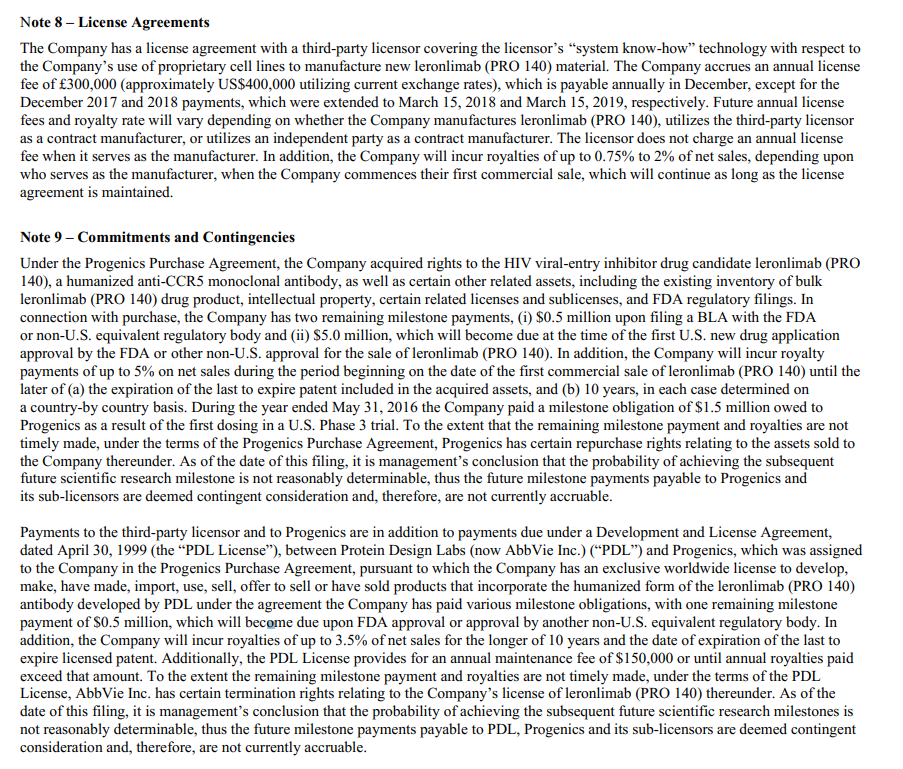

We don't know the terms and revenue threshold limits, but they owe up to 10.5% to other companies (5% to Progenics, 3.5% to PDL/AbbVie, and 2% third-party licencor....see Note 8 & 9 in the Jan 9, 2019 10-Q).

https://ir.cytodyn.com/all-sec-filings/conten...005378.pdf

Based on 18% royalty deal, this leaves CYDY with 7.5% for their revenue (IMO the above percentages are conservative, so the final rates could be higher). 7.5% of $1B = $75M. Valuation on companies can be done multiple ways, but one of the most common is price to earnings ratio (P/E)......pre-revenue companies use price to sales (expected sales) and 4-1 is in the range for biotechs based on my previous research. Since we are talking revenue, I will use P/E of 15 (which is also conservative as this website has biotech P/E at 22.74 and historically has been much higher in the 30+ range).

https://csimarket.com/Industry/industry_valua...mp;ind=801

$75M revenue assuming 75% profit margin = $56.25M Earnings

assuming outstanding shares equals fully diluted shares or authorized shares of 600M

Earnings Per Share = ~$.094

multiply by 15 P/E = $1.41 Share Price

Market cap is determined by multiplying the current share price times the number of outstanding shares. So in this case $1.41 share price times 600M outstanding shares = $846M Market Cap.

I'll stick to your $1B revenue number in the question instead of trying to guess another number with a lot of additional variables such as FDA approval time frame, market penetration, drug costs, etc. At this stage in the trial and FDA approval, IMO 18% is a conservative / reasonable / fair royalty rate for combo HIV (this varies by up-front/milestone payments, how far along in the trials the drug is, etc.).

https://pharmaintelligence.informa.com/~/medi...report.pdf

We don't know the terms and revenue threshold limits, but they owe up to 10.5% to other companies (5% to Progenics, 3.5% to PDL/AbbVie, and 2% third-party licencor....see Note 8 & 9 in the Jan 9, 2019 10-Q).

https://ir.cytodyn.com/all-sec-filings/conten...005378.pdf

Based on 18% royalty deal, this leaves CYDY with 7.5% for their revenue (IMO the above percentages are conservative, so the final rates could be higher). 7.5% of $1B = $75M. Valuation on companies can be done multiple ways, but one of the most common is price to earnings ratio (P/E)......pre-revenue companies use price to sales (expected sales) and 4-1 is in the range for biotechs based on my previous research. Since we are talking revenue, I will use P/E of 15 (which is also conservative as this website has biotech P/E at 22.74 and historically has been much higher in the 30+ range).

https://csimarket.com/Industry/industry_valua...mp;ind=801

$75M revenue assuming 75% profit margin = $56.25M Earnings

assuming outstanding shares equals fully diluted shares or authorized shares of 600M

Earnings Per Share = ~$.094

multiply by 15 P/E = $1.41 Share Price

Market cap is determined by multiplying the current share price times the number of outstanding shares. So in this case $1.41 share price times 600M outstanding shares = $846M Market Cap.

Please do your own due diligence. All my posts and comments are not to be considered investment advice.