(Total Views: 322)

Posted On: 03/20/2019 10:41:40 PM

Post# of 157511

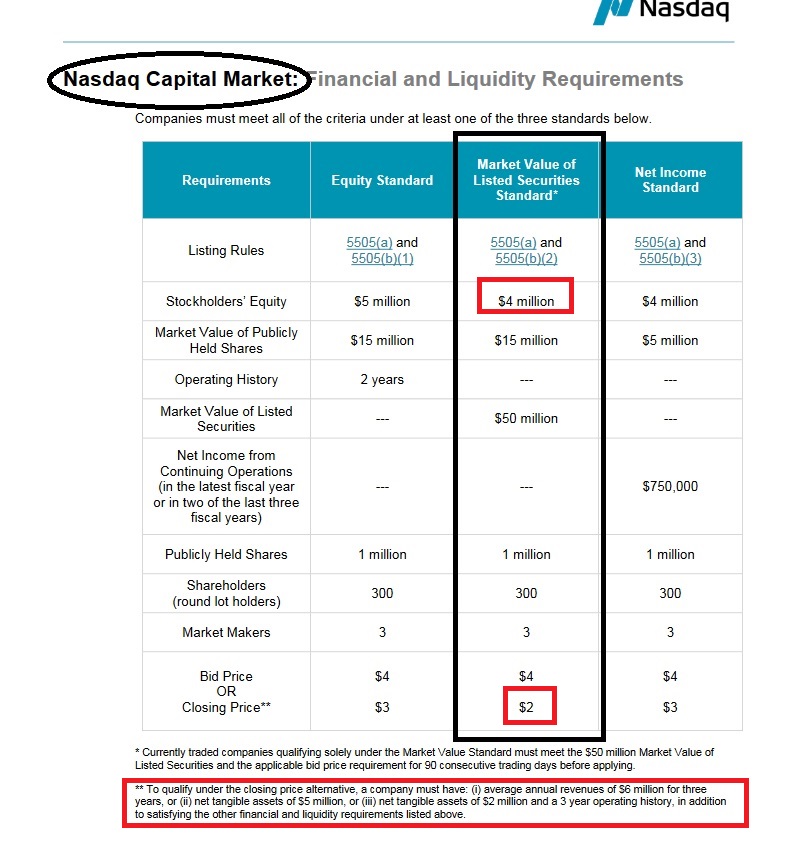

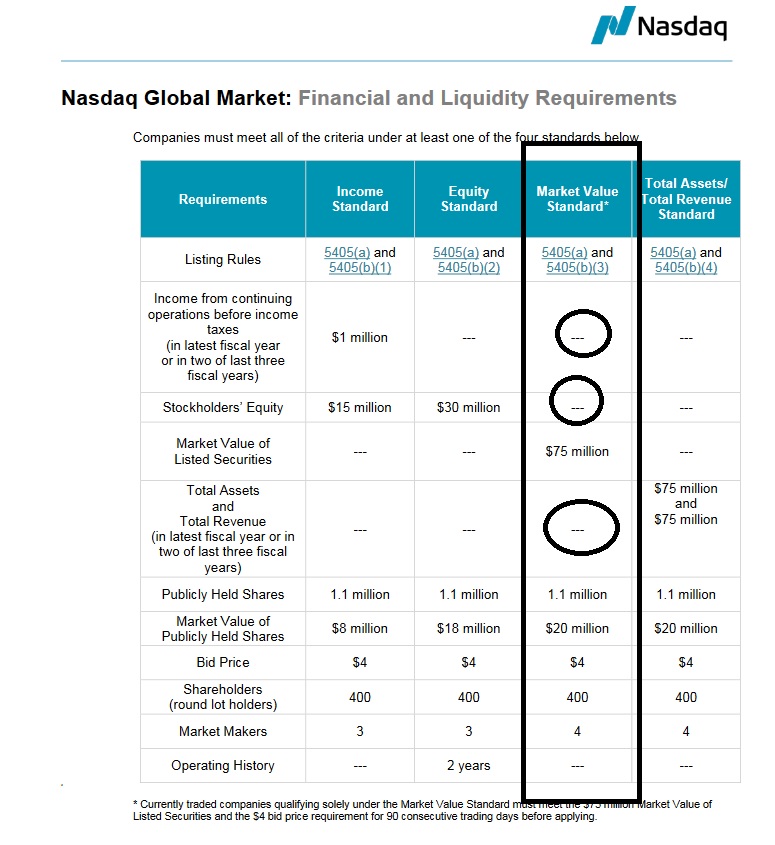

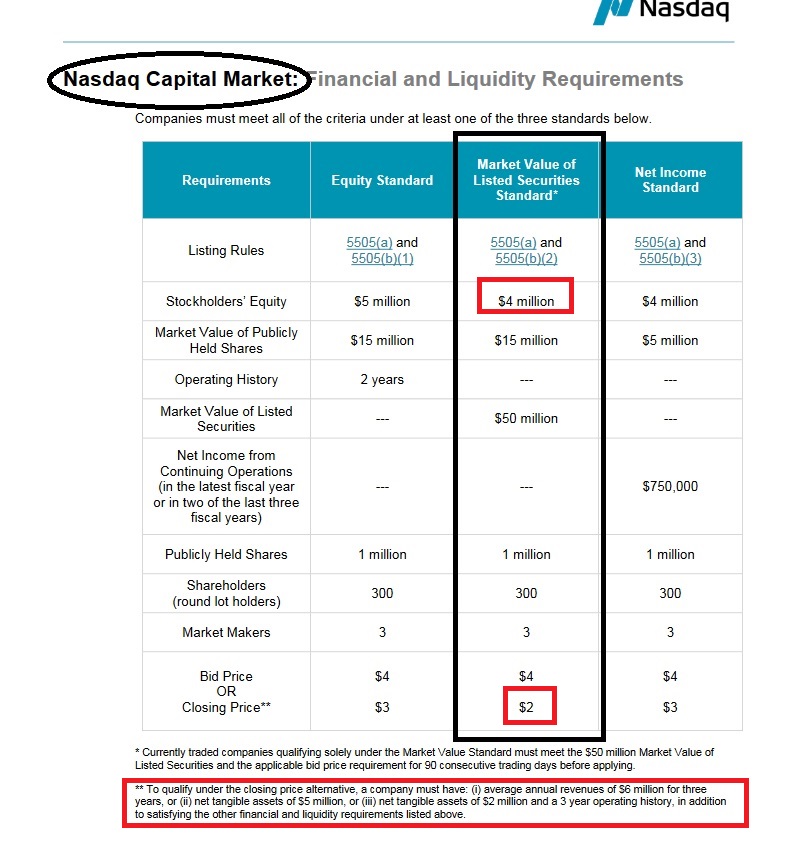

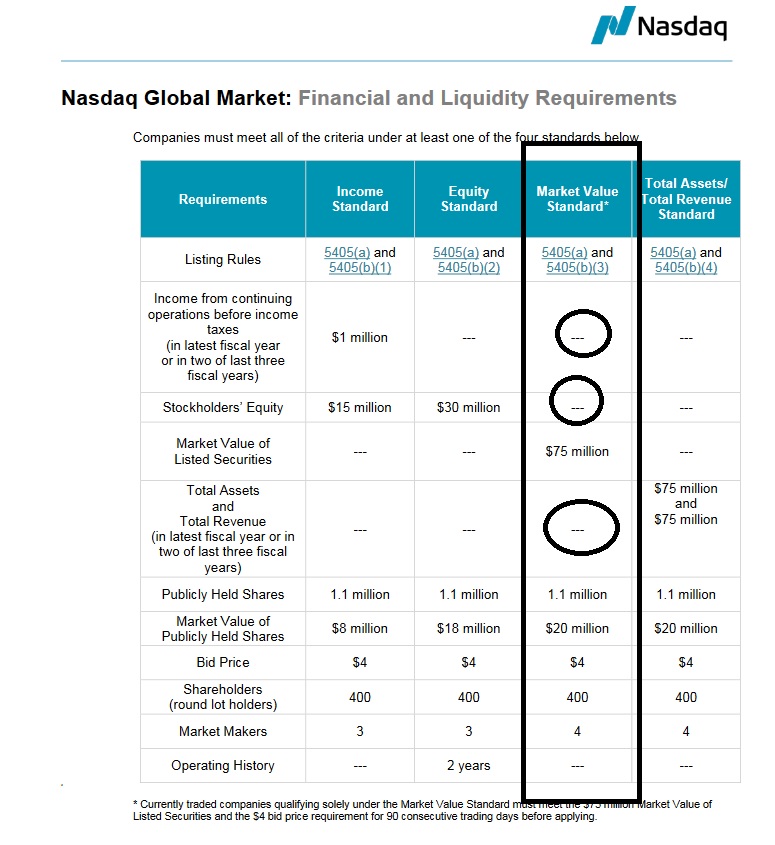

The easiest category to uplist to NASDAQ would be Global Market under the Market Value standard, requires no shareholder equity, no revenue or income, but would need a $4 share price for 90 days before using that standard.

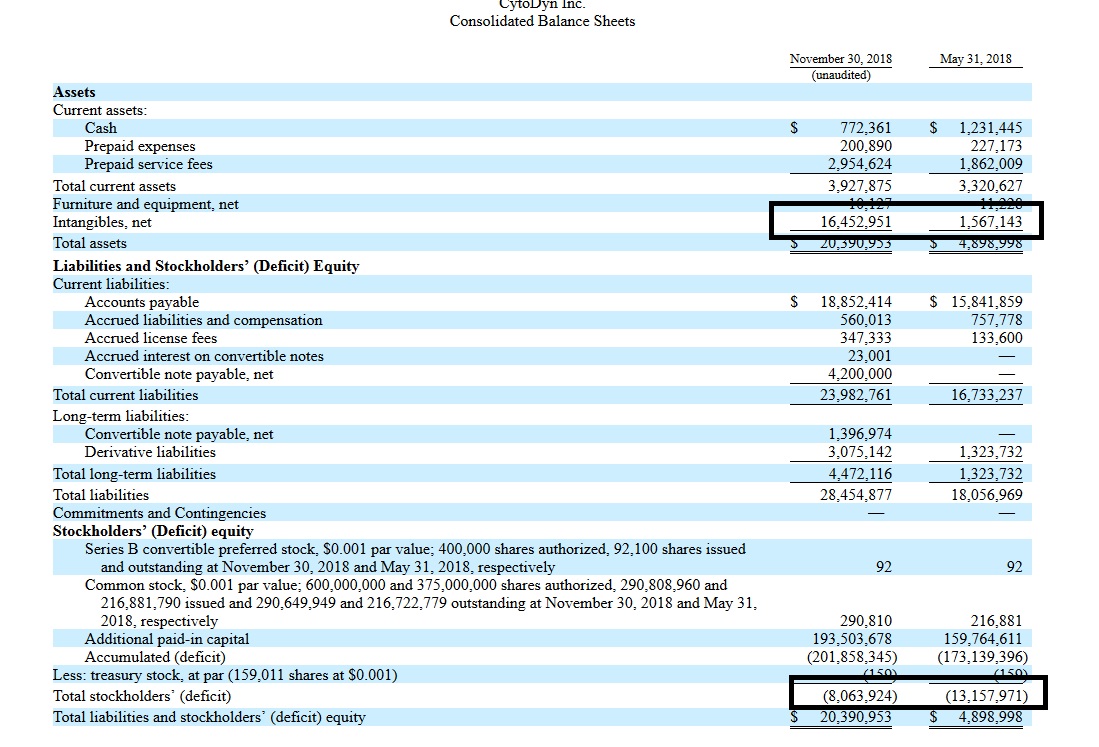

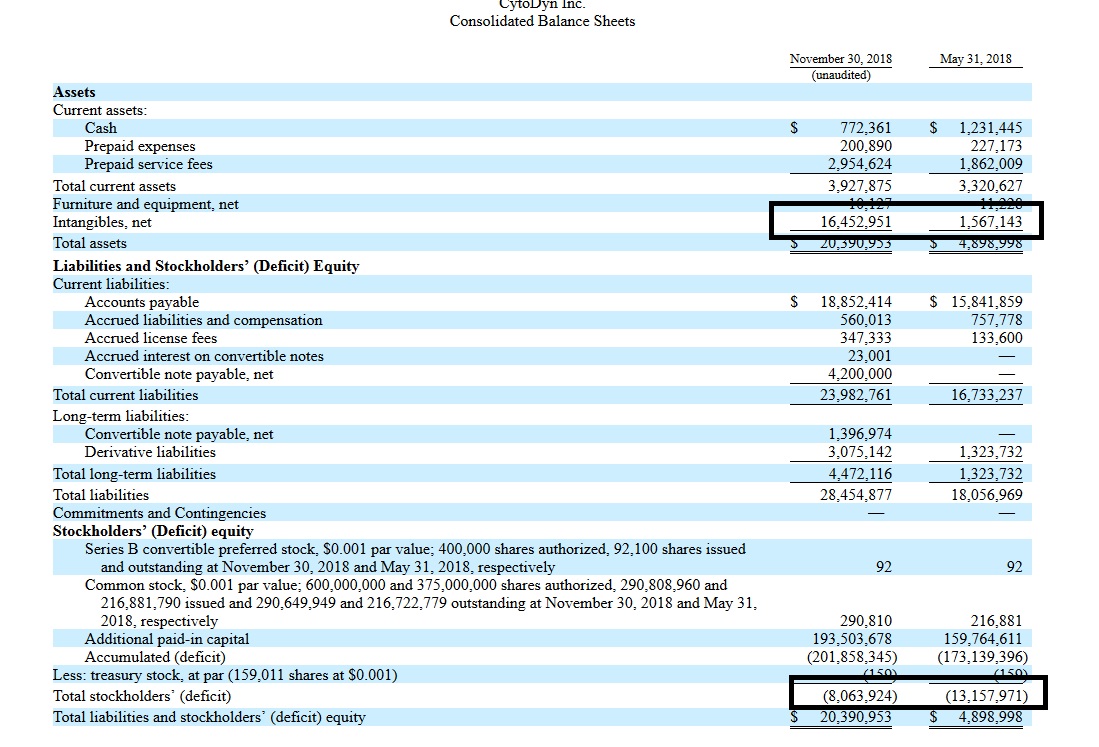

The best IMO would be the Capital Market, Market value. The share price needs to be above $2 for 90 days, but it needs 4M in shareholder equity. The shareholder’s equity went from -13M last may to -8M in November, I assume from the pre-inventory build-up. Once the drug is approved, I believe from looking at GILD for example, but I’m not 100% sure, this the will show up as inventory at market value, i.e, 200M, which should push the shareholder equity way above the needed requirement.

The best IMO would be the Capital Market, Market value. The share price needs to be above $2 for 90 days, but it needs 4M in shareholder equity. The shareholder’s equity went from -13M last may to -8M in November, I assume from the pre-inventory build-up. Once the drug is approved, I believe from looking at GILD for example, but I’m not 100% sure, this the will show up as inventory at market value, i.e, 200M, which should push the shareholder equity way above the needed requirement.