Posted On: 02/05/2016 3:29:30 AM

Post# of 65629

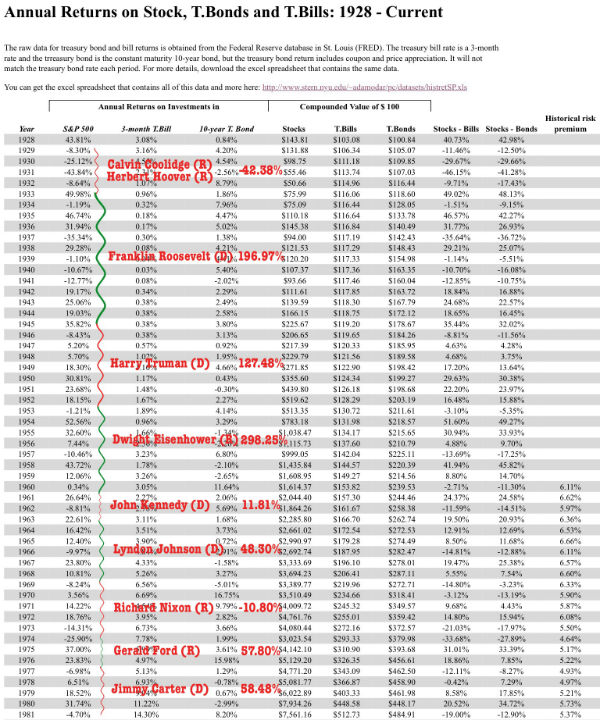

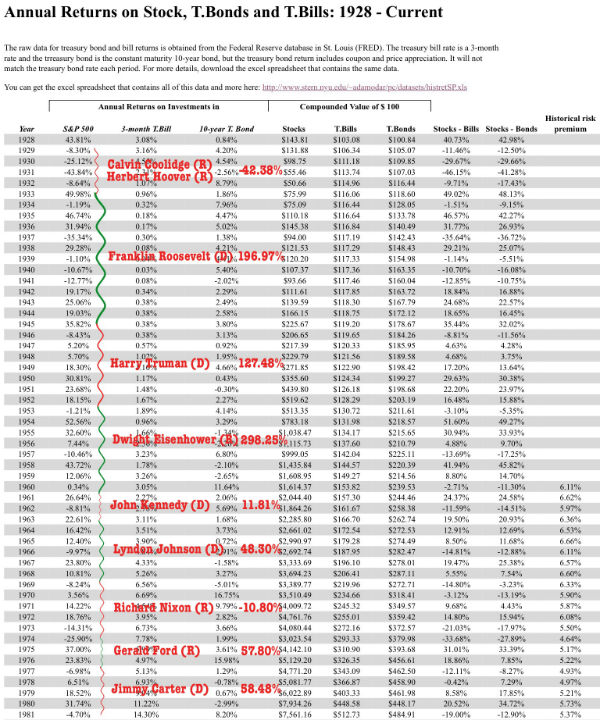

Here is the first one I compiled. out of the 52 years analyzed, a Democrat was in office for 34 of them. The largest gain happened during Eisenhower's tenure.

In aggregate, the S&P 500 advanced 302.87% (40.60% of the total) while a Republican was in office and 443.04% (59.39% of the total) while a Democrat was in office.

An argument could definitely be made that had the Republics been allocated the same amount of time in office, the weighted return of the market might have produced better result for them as they were able to produce 40.60% of the total having only served in office 34.61% of the time.

In any event, this matters very little to me as I am neither nor do I gauge my investing habits by how well the economy is doing or not doing. The best return I ever experienced was from November of 2007 to February of 2009 while the market was traveling downward. I earned over 7,000% on my money during that period.

In aggregate, the S&P 500 advanced 302.87% (40.60% of the total) while a Republican was in office and 443.04% (59.39% of the total) while a Democrat was in office.

An argument could definitely be made that had the Republics been allocated the same amount of time in office, the weighted return of the market might have produced better result for them as they were able to produce 40.60% of the total having only served in office 34.61% of the time.

In any event, this matters very little to me as I am neither nor do I gauge my investing habits by how well the economy is doing or not doing. The best return I ever experienced was from November of 2007 to February of 2009 while the market was traveling downward. I earned over 7,000% on my money during that period.

"The more numerous any assembly may be, of whatever characters composed, the greater is known to be the ascendancy of passion over reason." - Federalist no. 58