Posted On: 10/29/2014 5:49:11 PM

Post# of 123

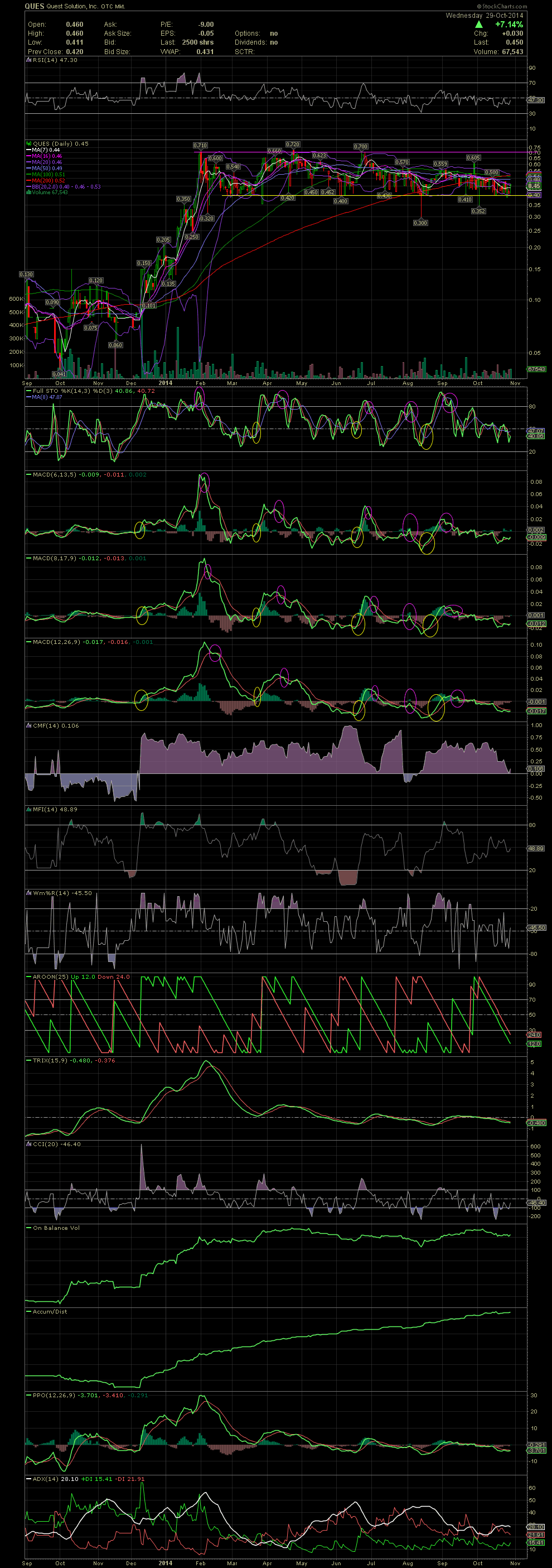

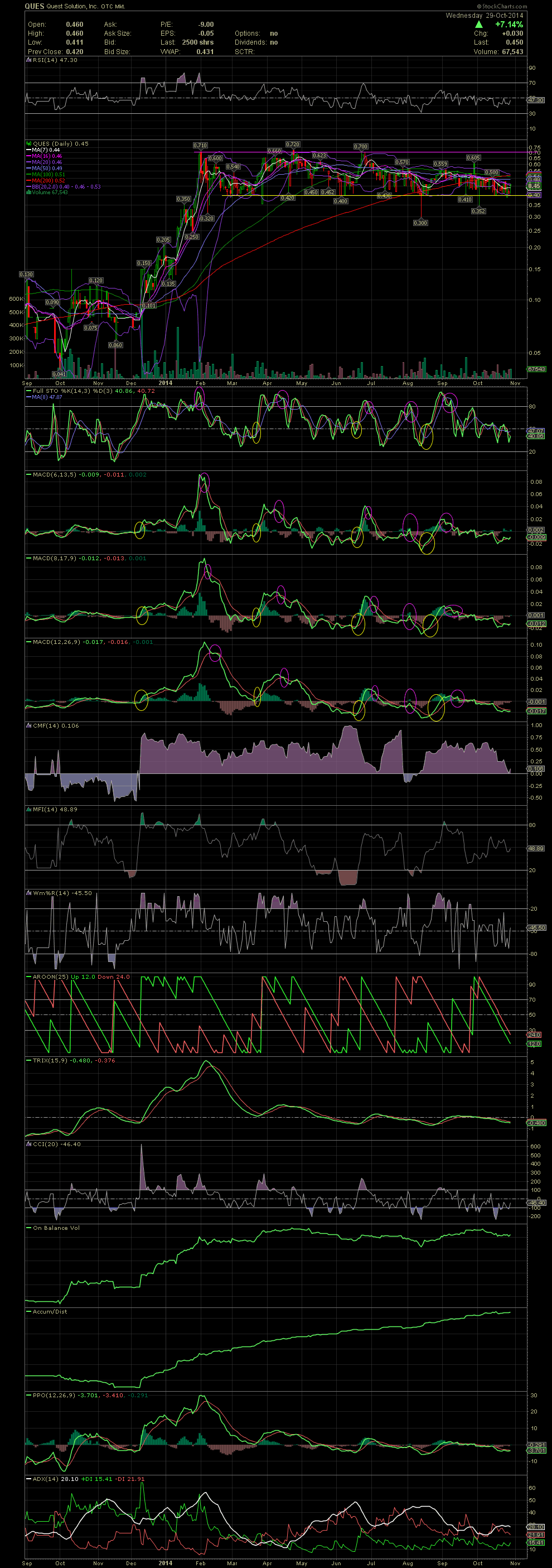

QUES Daily Chart ~ Holding Well During the OTC Bear Market

As one can see on the chart below, there has been tremendous support at the .40 level after the stock ran from a low of .04 to a high of .72. During the channeling on the chart, the OTC stocks have seen one of the worst bear markets that I've ever seen. Can't complain about a stock that has held a 1000% return since its move while the rest of the OTC has collapsed.

Looking at the chart, I'm beginning to see a setup for a move to new highs. Keep an eye on the FullSto, MACDs and a break above 50 on the RSI. My guess is once the 10Q is out, QUES will probably begin a move to the $1.50 level before the year is up. Next year I'm hoping for $5+. In the meantime, the accumulation period of sub .50s is running out of time. GLTA

As one can see on the chart below, there has been tremendous support at the .40 level after the stock ran from a low of .04 to a high of .72. During the channeling on the chart, the OTC stocks have seen one of the worst bear markets that I've ever seen. Can't complain about a stock that has held a 1000% return since its move while the rest of the OTC has collapsed.

Looking at the chart, I'm beginning to see a setup for a move to new highs. Keep an eye on the FullSto, MACDs and a break above 50 on the RSI. My guess is once the 10Q is out, QUES will probably begin a move to the $1.50 level before the year is up. Next year I'm hoping for $5+. In the meantime, the accumulation period of sub .50s is running out of time. GLTA