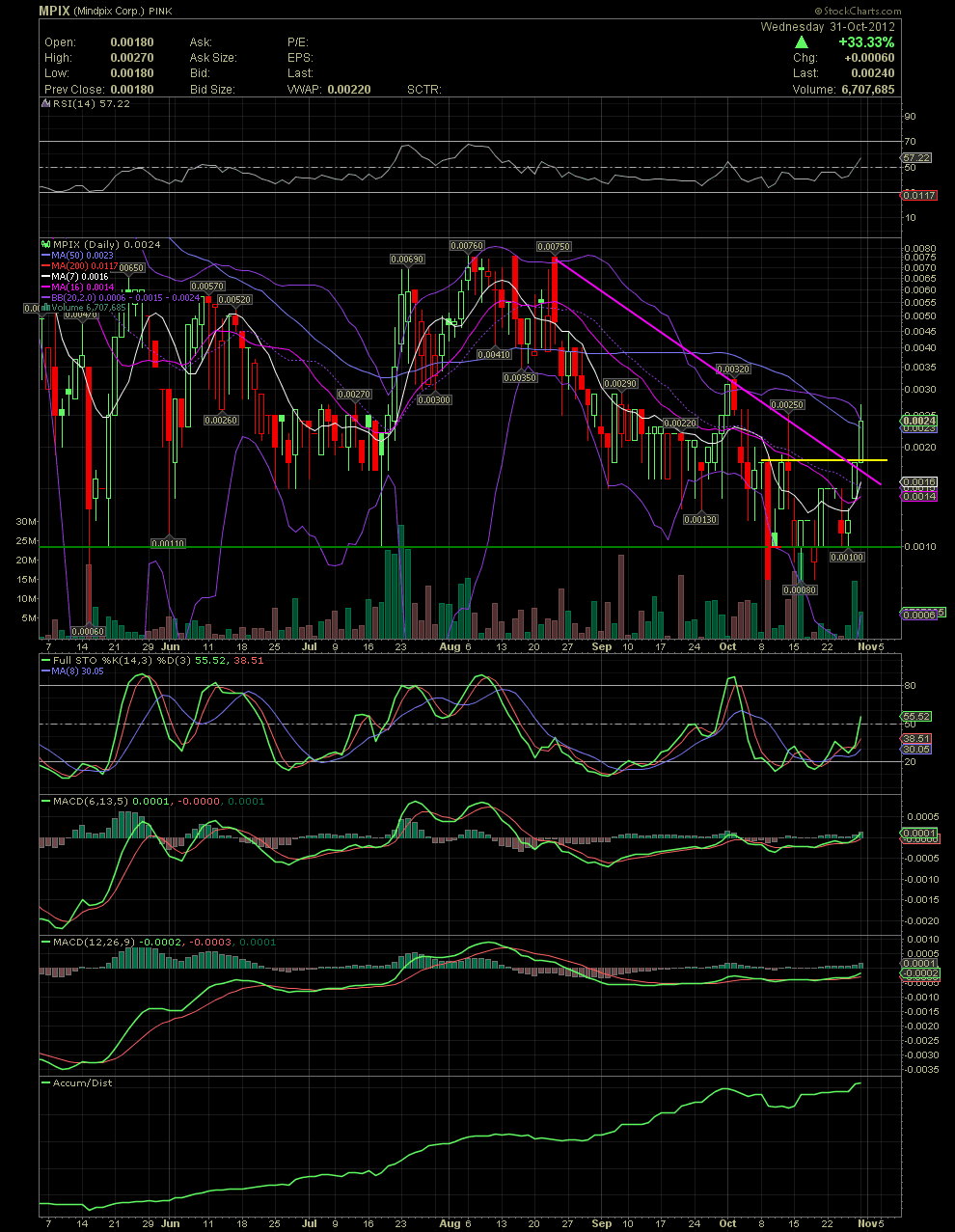

MPIX Daily Chart.................

Although the decline for many of us was tough to hold thru, those that continued to accumulate during the slide saw a sharp move in share price from .0008 to .0027 over the last two weeks. While the bashing clowns continue to spew their garbage on other sites, many here have been accumulating a boatload of shares since mid July. While some are screaming about daily dilution, not all dilution is bad. Should management be using the increase in the OS actually execute their business plan to build the company, I'll be saying thanks for all the .0008s and sub pennies for a long time into the future.

Although I thought the .001 would hold, the share price did dip below .001 four times in October but only closed under .001 once. As I mentioned over the last couple of weeks, the stock needs to recapture a few of the moving averages, especially the MA20 (middle bollie) which got down to just under .0014 last week. Once the share price closed over that MA, we saw a fairly sharp move within two trading days to tap the .0027s yesterday. At today's opening we find ourselves just over the MA50 but also against the upper bollie. I wouldn't be surprised to see a day or two of consolidation after the 3 bagger from the .0008s in ten days. Both MACDs below are wanting to break to the upside confirming a new uptrend after months of declines. The A/D line continued its accent in mid October showing continued strong accumulation which began in May. For the very short term, I would look for a close at .0032 or higher would more than likely bring into play a move to the highs of July and August at the .0069-.0076 level. News of a funding commitment by MPIX's newly engaged Investment Banking firm would probably take the stock price into the .01-.02 imo, as I'm thinking immediate announcements of a few projects would be released once management has the necessary captial. It's all about the money people. GLTA